12:38 pm

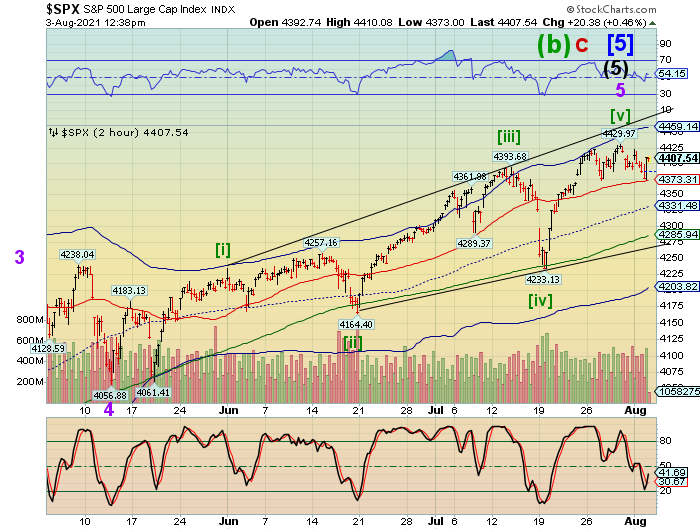

While SPX remains above 4400.00, things could go south quickly. This morning’s low at 4373.00 is testing Short-term support. Tomorrow’s options lean towarde puts beneath 4400.00 with a critical mass being reached below 4375.00. We are looking for a beakdown beneath 4373.31 to place short positions. Open Interest indicates over 500 net puts at 4400.00 and the number grows at every strike lower with 1659 net puts at 4375.00 and 3651 net puts at 4350.00. Beneath that, thing get really ugly. Our confirmed sell signal lies at 4331.49. It is amazing how the options market lines up with the Cycles Model.

ZeroHedge observes, “A choppy overnight session saw S&P futures test back up towards the key 4,400 level, which as SpotGamma notes is the major gamma strike on the board.

SpotGamma also notes that ‘The Call Wall’ has consolidated to the 4450 strike which is now the top end of our range on a larger time frame, with 4375 as intermediate support.”

8:30 am

Good Morning!

SPX futures rose to 4404.80 n th eovernight session, but have declined back beneath 4400.00. Thursday’s high at day 262 is still holding, closing the door to new highs and making the decline more imminent. Options players are getting more aggressive, with puts outnumbering calls beginning at 4415.00 for tomorrow’s expiration. Friday’s expiration becomes bearish at 4375.00. You can see Short–term support at 4370.93 which is our breakpoint to go short.

ZeroHedge reports, “US equity futures rebounded from the latest China regulatory scare which saw shares of Tencent plunge as much as 11% after Chinese state media criticized online gaming as “opium for the mind,” fueling investor concerns that the companies’ popular games could be swept up into a broader regulatory crackdown. As China watcher Victor Shih noted, this showed that “even when you comply with every party dictate, you can be labeled an ‘opium’ or ‘poison‘.” But even though Eminis dipped briefly below 4380 when the Tencent news hit overnight, they have since rebounded and were trading up 15.50 or 0.35%, rising to 4,395. Dow futures were up 160 points or 0.461% and Nasdaq futs added 0.08% or 11 points.”

The Shanghai Composite Index topped out at the Head & Shoulders neckline at 3470.66, then declined, closing in the negative.The demonization of certain tech companies has led to mixed reactions from investors.

ZeroHedge reports, “Update (0745ET): As CNBC’s Eunice Yoon reports, Beijing has now republished the original Economic Information Daily article with a much softer tone, including removing the phrase “spiritual opium”. Did Beijing perhaps underestimate how these new restrictions impacted the market?

* * *

China’s broad-based crackdown on perceived anti-social tendencies of its biggest corporations continued on Tuesday with a new industry being targeted: video games.

Beijing’s latest attempt to rein in the excesses of capitalistic development – and reassert the “primacy of socialism”, as Reuters described it – came Tuesday in the form of an article published by the Xinhua-affiliated “Economic Information Daily” which offered up a scathing critique of China’s video-game industry and its impact on minors. The article asserted (citing anecdotal reports from teenagers) are spending up to 8 hours a day playing the country’s most popular game: “Honor of Kings”.

NDX futures have been weakening, only briefly emerging above round number support/resistance at 15000.00, then declining beneath it. Short-term support is at 14887.40 and just beneath it is the Diagonal trendline that gives us a sell signal.

ZeroHedge observes, “With asset prices so frothy, it is understandable that central banks would be wary of beginning to taper monthly bond purchases before it is clear that inflation has taken off. But they would do well to recognize that prolonging quantitative easing implies significant risks, too.

Inflation readings in the United States have shot up in recent months. Labor markets are extremely tight. In one recent survey, 46% of small-business owners said they could not find workers to fill open jobs, and a net 39% reported having increased their employees’ compensation. Yet, at the time of this writing, the yield on ten-year Treasury bonds is 1.24%, well below the ten-year breakeven inflation rate of 2.4%. At the same time, stock markets are flirting with all-time highs.

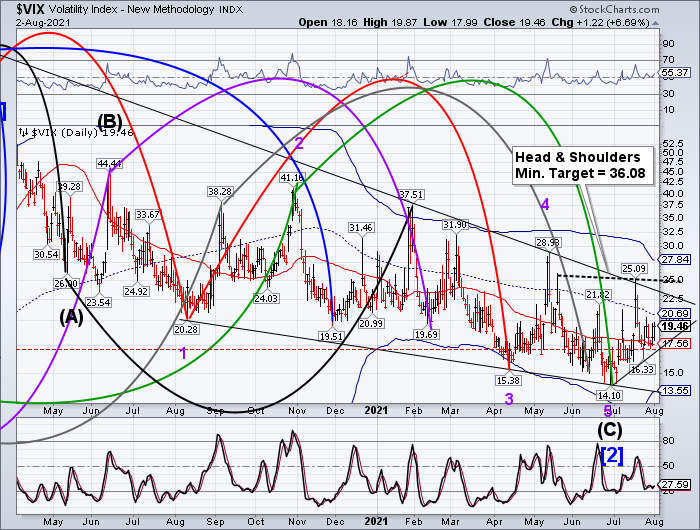

VIX futures dipped to 18.63 before rising back toward yesterday’s close. While it appears hesitant to resume new highs, it has made successively higher lows, indicating a probable change in trend. There appears to be a potential Head & Shoulders formation that gives a target well above the Ending Diagonal formation. There is a good probability of meeting that target by the end of next week.

The NYSE Hi-Lo closed at 182.00 yesterday, well above the sell signal levels.

TNX appears to be consolidating inside yesterday’s range. The Cycles Model suggests a Master Cycle low may be made by the end of the week, possibly in time to upset Friday’s options expiration in the SPX.

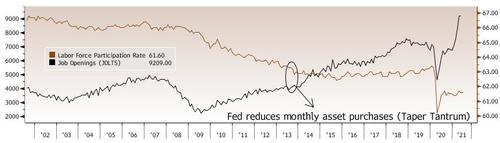

ZeroHedge observes, “Job growth at pre-pandemic levels is the key to the start of tapering, according to Fed Chair Powell. The good news for fixed income traders worried about higher rates and bond bulls is we’re not there yet.

A good gauge for when we do get there, take a look at the spread between the labor participation rate and job openings (JOLTS). It’s nowhere near pre-pandemic levels. Looking back at where labor and job openings were when the Fed announced tapering in December 2013 serves as a decent indication of what this relationship needs to look like before tapering is a more convincing option for the central bank.