The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen

2:54 pm

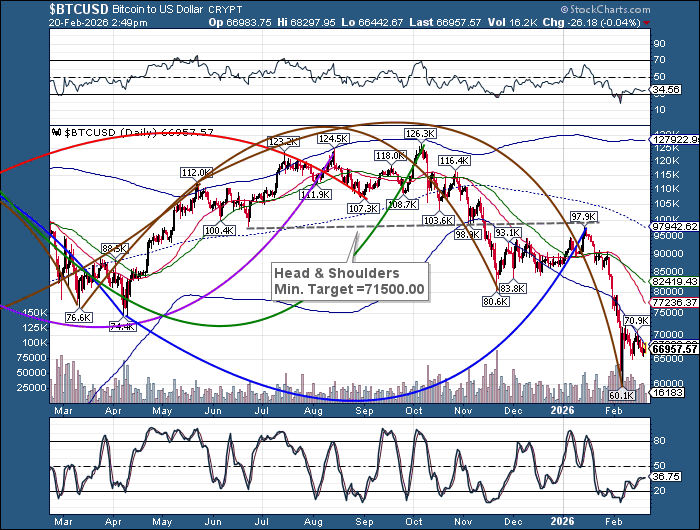

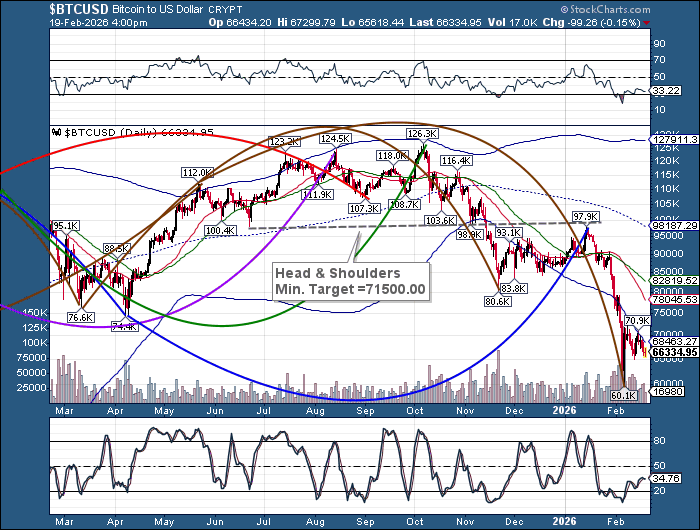

Bitcoin fractals reveal that it may decline to 64000.00 before it is finished. It may go as low as 60700.00, but the bounce from the low may be quick. Time for bitcoin lovers to load up the truck.

11:17 am

SPX declined this morning, slicing through the 52-day Moving Average at 6894.69 and the nearby Ending Diagonal trendline. Support may be found for a bounce at 6832.18 or the neckline of the Head & Shoulders formation at 6775.00. 40 S&P companies have made 3-sigma declines today,, revealing market fragility.

10:50 am

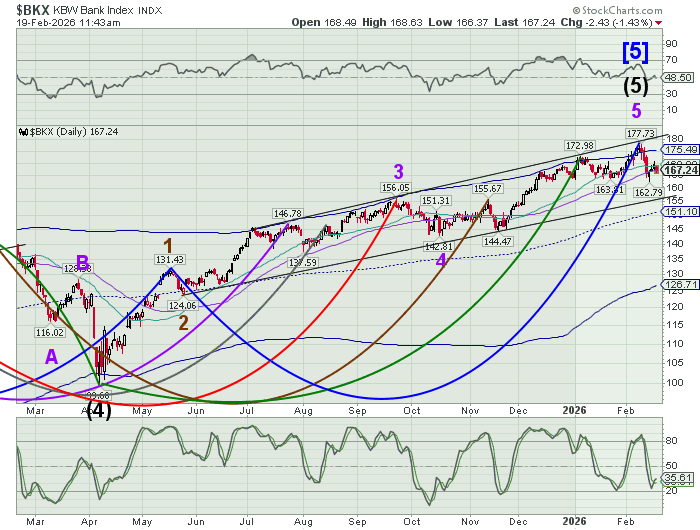

BKX may be testing Intermediate support at 169.04 this morning after declining beneath Cycle Top support at 175.18. Beneath Intermediate support the sell signal strengthens, while the 52-day Moving Average at 166.41 offers another confirmation. This is a fast moving decline with a possible panic day by mid-week.

8:30 am

Good Morning!

SPX futures declined to 6912.90 after the close yesterday, then recovered near the close this morning. Holding steady at this level is not a long-term option, since Intermediate support is at 6922.00 and rising while the 52-day Moving Average and Ending Diagonal trendline lie at 6892.00 and also rising. Support is becoming thinner, while the flat close belies the turmoil underneath the surface. The next breakdown may be the last time we see these levels. The Cycles Model suggests a 6-week decline ahead. Volatility and velocity may increase over the weekend.

Today’s option chain shows Max Pain at 6965.00. Long gamma strengthens at 6975.00 while short gamma clusters at 6940.00, then 6900.00. Short gamma may be waiting for a stumble.

ZeroHedge reports, “Futures are higher but there continues to be tangible angst below the surface as traders are aggressively shorting potential AI losers, while US stocks continue to fall behind the rest of the world.”

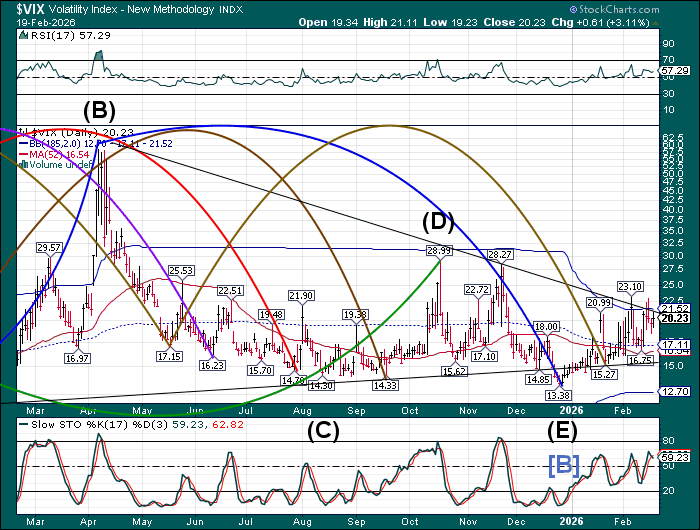

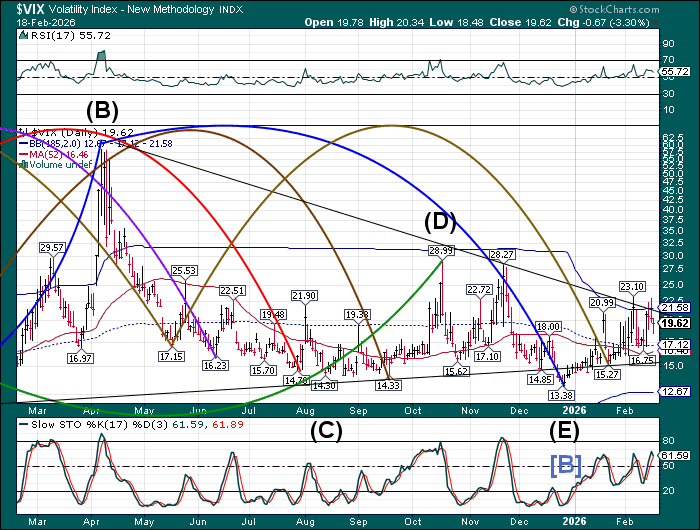

The premarket VIX is holding steady above the mid-Cycle support at 17.20. The Cycles Model suggests a rising VIX with a possible breakout by early next week. The Cycles Model shows the next 6 weeks to be complex, with the first possible peak at the end of February.

The February 18 (monthly) options chain shows Max Pain at 19.00. Short gamma is strongly clustered between 15.00 and 18.50 as VIX launches into positive seasonality. Long gamma begins at 20.00 and runs strongly to 70.00, with an outlier call wall (129,000 contracts) at 100.00.

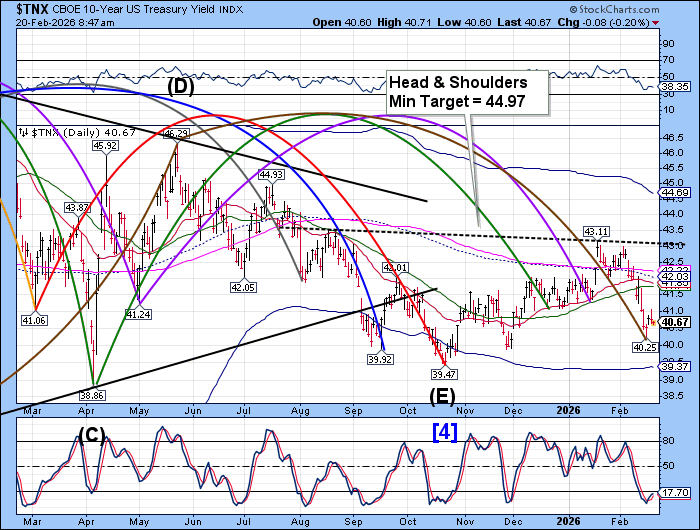

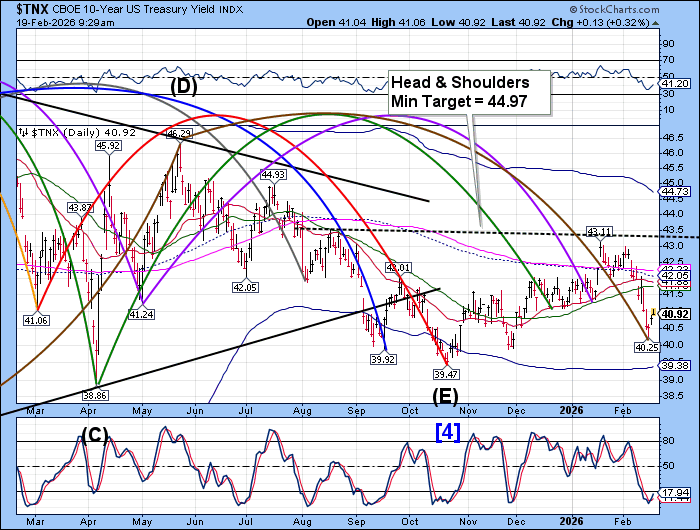

TNX may have completed its correction at 41.25 yesterday. It may test the 52-day Moving Avergae at 41.76. Above it the buy signal is reiterated. The inverted Head & Shoulders formation has been revised, with a higher target than first projected. This new target actually matches the Cycles Model projection.

ZeroHedge reports, “After yesterday’s mediocre 3Y auction (which saw a drop in foreign demand offset by record direct bid), moments ago the Treasury concluded the sale of 10Y benchmark paper, and despite a cheerful preview by the Bloomberg MLIV team (which appears to be wrong every time it tries to handicap the outcome), today’s auction was absolutely dreadful.”

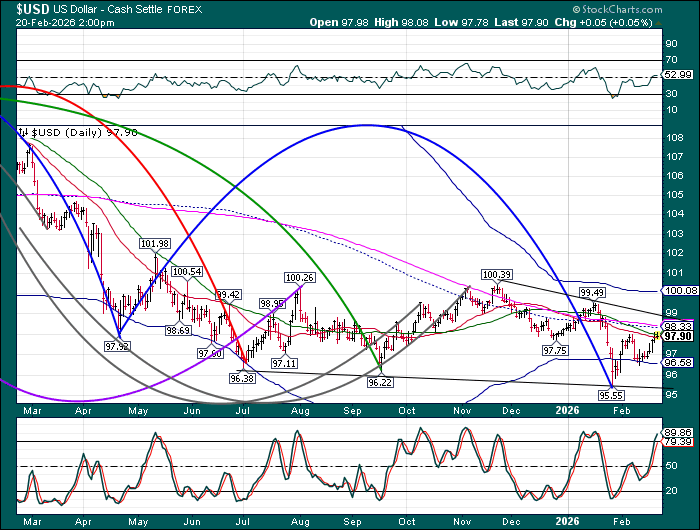

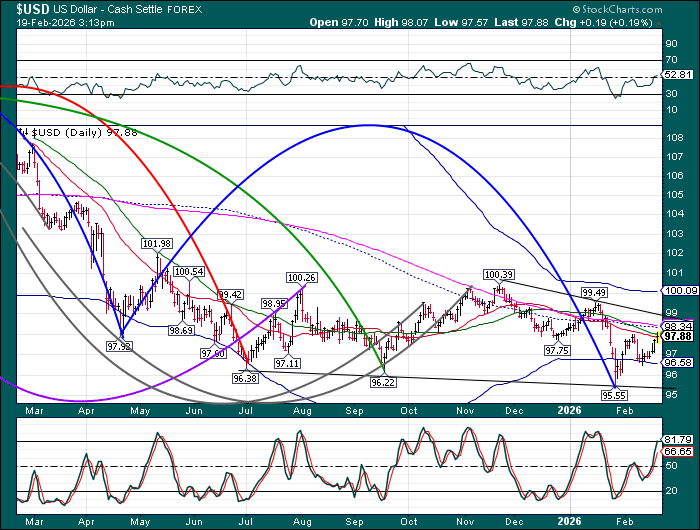

USD may finish its correction beneath the Cycle Bottom at 96.65 with a probe lower in the next couple of days. The Cycles Model suggests a mighty surge out of the low beginning over the weekend with the knock-on rally extending to mid-March. Dollar shorts may be squeezed, providing more fuel for the rally.

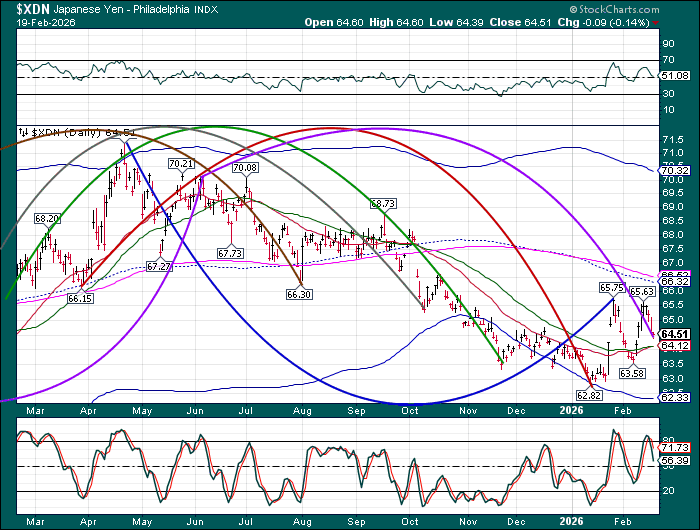

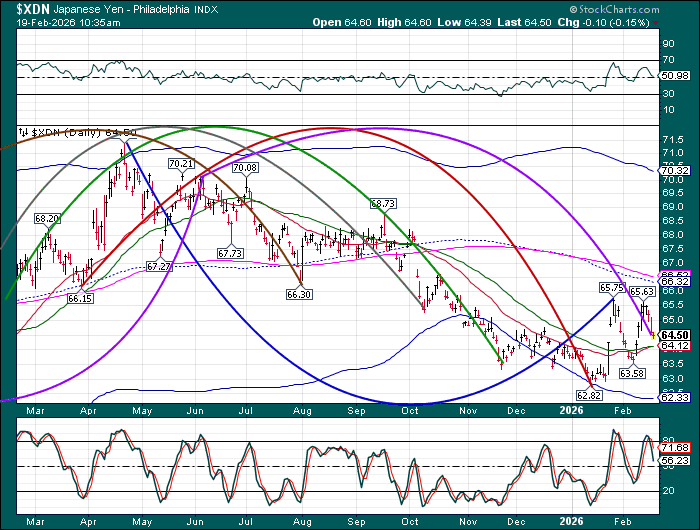

The Japanese Yen is consolidating this morning after testing its February 5 high at 65.75. A breakout may be imminent. The Cycles Model shows a massive chaotic move over the weekend that may either cut this rally short, or segue into a massive move higher. The Bank of Japan raised its key interest rate to .75% in January. Recent developments suggest another rate hike is possible. Such a move may destroy the Yen carry trade, as those firms that borrow from the Bank of Japan are shorting the Yen. A short squeeze may be imminent, forcing the bailout of several major American hedge funds and banks.

Reuters reports, “The Bank of Japan must raise interest rates in a timely fashion to prevent underlying inflation from surpassing its 2% target, central bank board member Kazuyuki Masu said on Friday, keeping alive the chance of a near-term rate hike.”

Bitcoin found support at 65725.00.but still has a way to decline. Today is a double trending strength day, suggesting a possible bottom test over the next two days.

Gold is testing the trendline near 5100.00. There appears to be little to no strength in this rally. Should it not exceed the trendline, the next move may be a decline to a lower level. The Cycles Model suggests a possible downside target near the mid-Cycle support at 3884.08, a reversion to the Cyclical mean. The long-term trend is still “higher,” but with some pain ahead of the next push to higher levels.

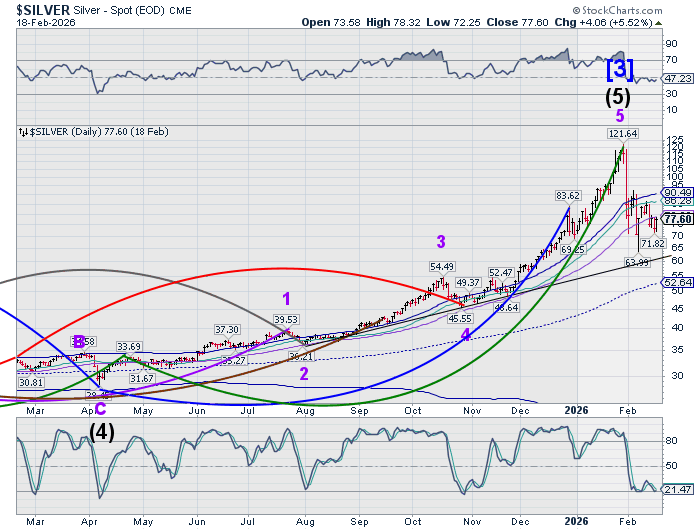

Silver futures dipped to 81.28 this morning, indicating the rebound may be running out of fuel. Should it catch support at the 52-day Moving Average at 77.42, it may bounce higher. It may be on a different Cycle than gold. The Cycles Model proposes a possible sideways consolidation that may last another month.

Crude oil has dipped below 63.50 this morning, with a possible decline to its Head & Shoulders neckline near 55.50. The Cycles Model suggests a sharp decline that may trigger the Head & Shoulders formation.