2:30 pm

NDX has declined through its Cycle Top at 17252.00, putting it on an aggressive sell signal.

ZeroHedge remarks, “Since The Fed’s (uber dovish) last meeting on December 13th, the dollar is down, bonds and gold are up, and bitcoin and big-tech are surging… in other words – the QE-trade or ‘buy all the things’…”

10:12 am

BKX may have made its Master Cycle high yesterday on day 271. This morning it declined beneath its Cycle Top support at 97.24, creating an aggressive sell signal. Further confirmation may happen with a decline beneath its Intermediate support at 95.27. The most recognized support is the 50-day Moving Average at 91.62. The Cycles Model infers a possible 30-day decline to follow. The decline may be of a greater magnitude than the decline of last March. It would be beneficial to take heed of this warning.

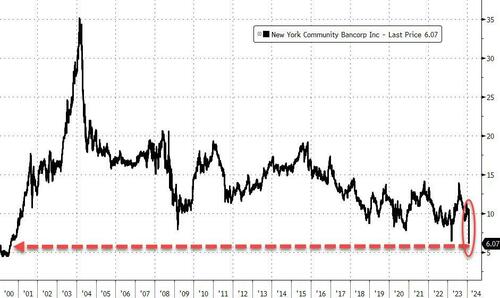

ZeroHedge reports, “The price of shares in New York Community Bancorp – the regional bank that purchased deposits from Signature Bank last year – are crashing this morning, below SVB crisis lows, after reporting a surprise loss for the fourth quarter and a cut to its dividend.”

8:15 am

Good Morning!

NDX futures declined to 17227.00 this morning before a bounce, challenging the Cycle Top support at 17234.88. An aggressive sell signal may be made, should NDX decline beneath that level. A confirmed sell signal may be made beneath the Ending Diagonal trendline and Intermediate support at 16847.76. Most analysts may assume that the uptrend is intact, which, in fact, it is. The 50-day Moving Average at 16530.52 is the most commonly used level that supports the uptrend. However, the Master Cycle high at 17665.26 indicate that the NDX is finished with its uptrend, giving us additional guidance that one may be more aggressive than the majority of players.

Today’s options chain shows Maximum Investor Pain at 17400.00. Long gamma may begin at 17425.00. Short gamma starts at 17350.00-17375.00.

ZeroHedge remarks, “Many different shades of overshoot

That stocks lead and actually overshoot various fundamental macro indicators in a bull market is nothing new. To observe this provides neither great market insight nor any tool for money making opportunities. Nevertheless, we wanted to present you with a number of different current overshoots just because it is important to know where we are in general in the overall tactical macro analysis AND we have to say that these overshoots are starting to look a little extreme.”

SPX futures have declined to 4898.40, remaining above the Cycle Top support at 4848.30 with no given signal. The Cycle Top allows an aggressive sell signal while a decline beneath the Ending Diagonal trendline and Intermediate support at 4772.91 confirms a sell signal. Most analysts agree that a sell signal may be given beneath the 50-day Moving Average at 4696.07, nearly 5% beneath the all-time high.

Today’s options chain shows a large contingent of calls at 4875.00 and a large wall of puts at 4850.00, with Max Pain lying between the two. While the SPX remains in long gamma, it may not take long to turn the table.

ZeroHedge reports, “US equity futures slumped after earnings from tech giants GOOGL, MSFT and AMD fell short of Wall Street’s lofty expectations and as investors prepared for the first interest-rate decision of the year from the Fed (full preview here).

As of 7:45am ET, contracts on the Nasdaq 100 slid 1.1%, while those on the S&P 500 retreated 0.5% with Microsoft, Alphabet and Advanced Micro Devices all sliding in premarket after their updates failed to match the market hype around tech megacaps and artificial intelligence that has helped drive the recent record-setting rally in US stocks. The balance of MegaCaps are also lower as we await the Fed. Bond yields are modestly lower as part of a bull steepening; the US dollar is stronger despite consensus expecting more dovish signaling from Powell, and commodities are mixed. JPM asks if with Russell futs positive, will we see the pain trade (+Value/-Growth with MegaCap underperformance) come to fruition near-term? The macro data focus is on ADP, ECI (Fed’s preferred measure of wage inflation), Chicago PMIs, Trsy Refunding Announcement, and then Fed meeting later today.”

VIX futures have fallen to 13.18, just above the 50-day Moving Average at 13.06. While the VIX is near a significant low, it is still on a buy signal. It appears that there may be political reasons for keeping the VIX suppressed at least until the end of the month. Today is day 252 of the Master Cycle, suggesting a possible new low in the making.

Today’s op-ex shows a possible Max Pain at 145.00, but with no short gamma beneath it. Long gamma may begin at 17.00.

ZeroHedge wishfully projects, “Let the last phase of the melt-up begin

BlackRock has upgraded U.S. stocks to overweight and believes the AI-Driven rally could expand within the next 6 to 12 months.

“The stock market’s tech-driven rally, fueled by investor excitement over artificial intelligence, should “broaden out as inflation falls further, the Fed starts to cut rates, and the market sticks to its rosy macro outlook,” said a team of strategists led by Jean Boivin, head of the BlackRock Investment Institute, in their weekly commentary research note on Monday.”

The Shanghai Composite Index has fallen to 2782.59 this morning. The analysts have gone quiet as motivated sellers have taken over. The Cycles Model calls for an end to the decline in the next week, but the additional damage may be staggering. The Model suggests a possible target near 2650.00 but. as usual, when emotions are involved the market tends to overshoot.

TNX opened lower this morning, having declined to 39.63, beneath its target at Intermediate support at 40.06. However, the corrective decline may be nearing completion, as TNX may be making a (lesser) one-half Trading Cycle low. We have just learned this morning that the current Treasury offering has been expanded already, voiding the earlier announcement of a reduced Treasury offering. While today’s offering of $60 billion 17-week notes may not roil the market, next week’s offerings may shatter expectations of a calm Treasury market.

ZeroHedge reports, “As highlighted in our preview, and as the Treasury itself noted in its last refunding announcement, moments ago the latest Treasury Quarterly Refunding announcement confirmed that it is indeed boosting the size of its quarterly issuance of long-term debt for a third straight time – rising to $121 billion, just as consensus expected – and said that it “does not anticipate needing to make any further increases in nominal coupon or FRN auction sizes, beyond those being announced today, for at least the next several quarters.”

USD futures have declined to 102.86 thus far as it makes a (lesser) Trading Cycle low. Potential targets are the 50-day Moving Average at 102.75 and Intermediate suport at 102.33.

Crude Oil futures have slipped beneath the mid-Cycle support at 77.83 this morning to a morning low at 76.61, putting crude on a sell signal. Should it decline beneath the trendline at 64.65, there may be a waterfall event of epic proportions. I may not divulge the outlook for a while, but suffice it to say that it may not be advisable to be long oil.