The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen

3:50 pm

Last week SPX hit its price target. Today would have been the last day of this Cycle had it not achieved 7002.28 last Tuesday. The result was that SPX came within 10 points of the all-time high today, having met both time and price for this Master Cycle.

ZeroHedge observes, “Market cycles are once again at the center of the investment narrative as we head into 2026. The optimism is familiar as earnings held up in 2025, the economy avoided recession, and big tech lifted the indexes. However, those victories are already reflected in the price.”

8:00 am

Good Morning!

SPX futures plummeted to a weekend low at 6840.30, challenging the 52-day Moving Average and Ending Diagonal trendline at 6851.72 before regaining higher ground at 69000.00 this morning. This is the beginning of a broken market, with more selling to come. Whatever declines that are made today may be redoubled in the next few days.

Today’s options chain shows Max Pain at 694.00. Long gamma emerges above 6950.00 while short gamma dominates beneath 6925.00.

ZeroHedge reports, “Stock futures slide extending Friday’s rout, although are well off session lows, with aggressive unwinds across commodities and a crypto rout adding to the risk-off mood and sparking cross-asset margin calls.”

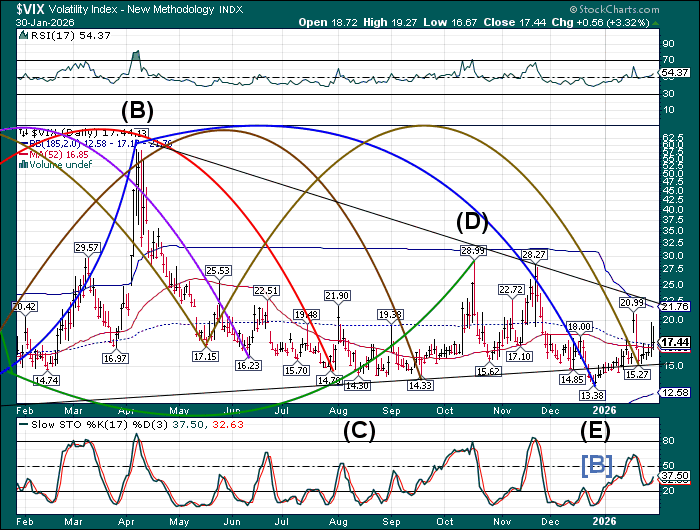

The premarket VIX rallied to 19.96 before easing back. The upper trendline and Cycle Top at 21.76 may be the next to fall.

The February 4 options chain shows short gamma occupying the range from 14.50 to 16.00. Long gamma rules above 17.00 with the largest concentration of calls beneath 25.00.

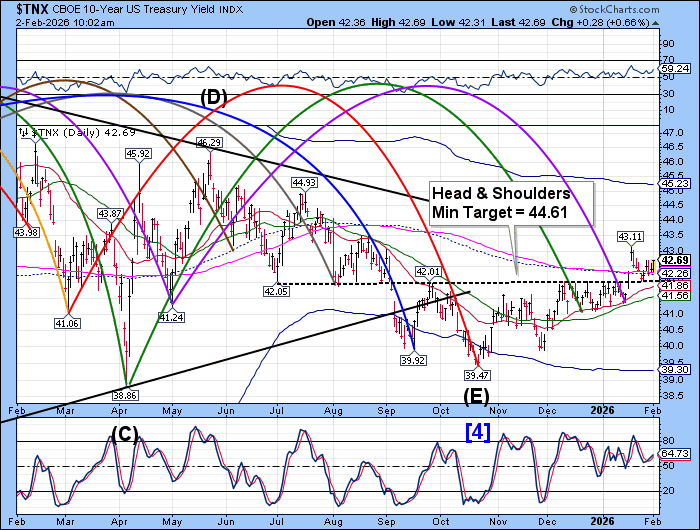

TNX may be working on a deferred period of strength as the Head & Shoulders neckline was tested and held. The Cycles Model may allow the TNX to rise to the Cycle Top at 45.23 over the next three weeks.

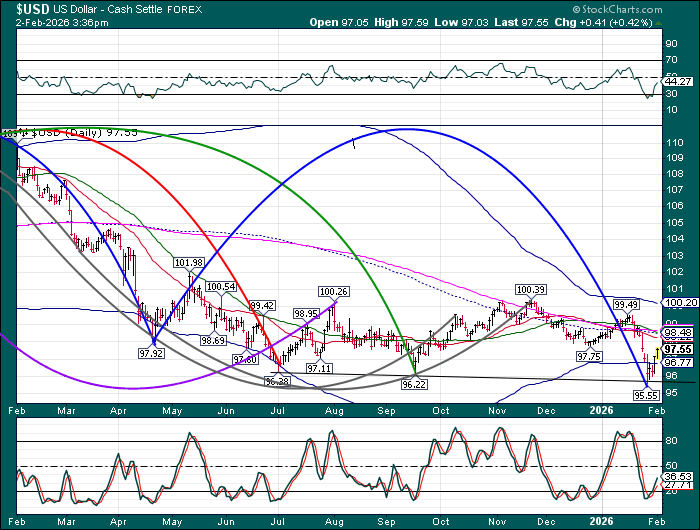

USD futures emerged above the Cycle Bottom at 96.76, creating a buy signal. This may not be recognized until it rises above its January 16 high at 99.49. The Cycles Model suggests a burst of energy may be due shortly that may challenge the resistance cluster at 98.48. The USD may continue its rally through mid-March in the current Master Cycle. The rally is not being anticipated by the majority of traders.

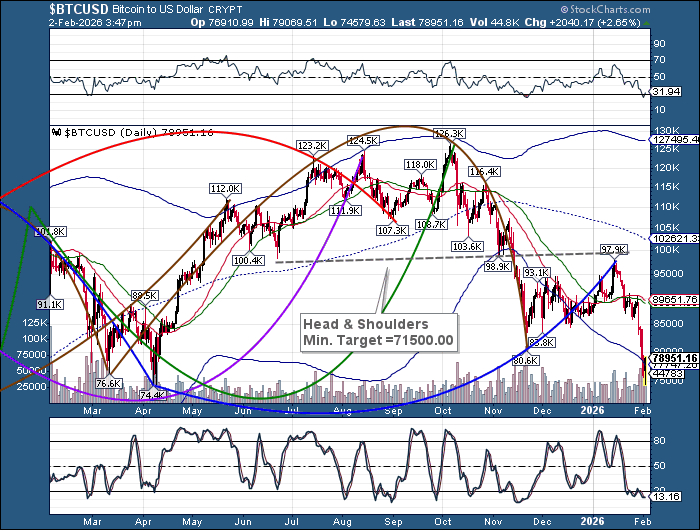

Bitcoin bounced from its weekend low at 74579.00 to test the Cycle Bottom at 77750.00. It may be due for another deep dive to its Head & Shoulders minimum target over the next few days. Once accomplished, bitcoin may be due for a relief rally that may last to the end of February.

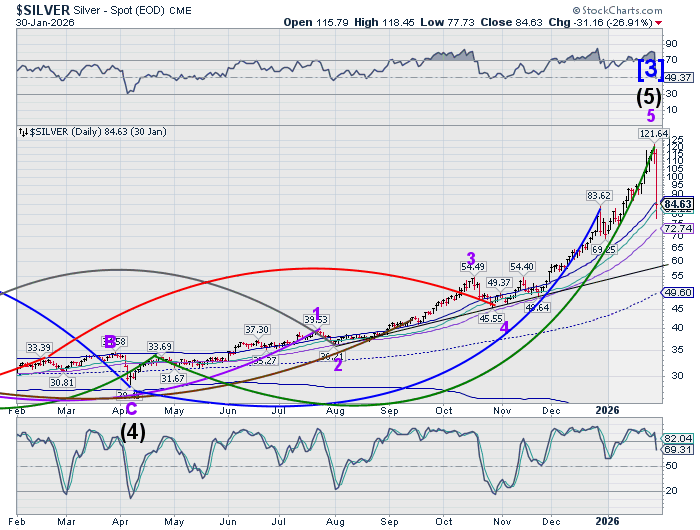

Silver futures have resumed their decline after its Friday rout, taking out the Cycle Top at 85.74, then bouncing from its low to retest it. This move has been simply too fast to trade. It may continue the decline to test the 52-day Moving Average at 72.74 in the next few days as the dust settles. The sell-off was due to a couple of large banks that had shorted silver on margin, thinking that the top was in. Friday was a margin call day, forcing the massive selling, with more to come. However, this may not be the end of the bullish Cycle, as buyers are lined up to buy the dip. In a few more days, the rally may resume to test the top again. February may be chaotic as actual profit taking may ensue as the high is being approached. The bull market isn’t over, but it may be more difficult to make money in the days to come.

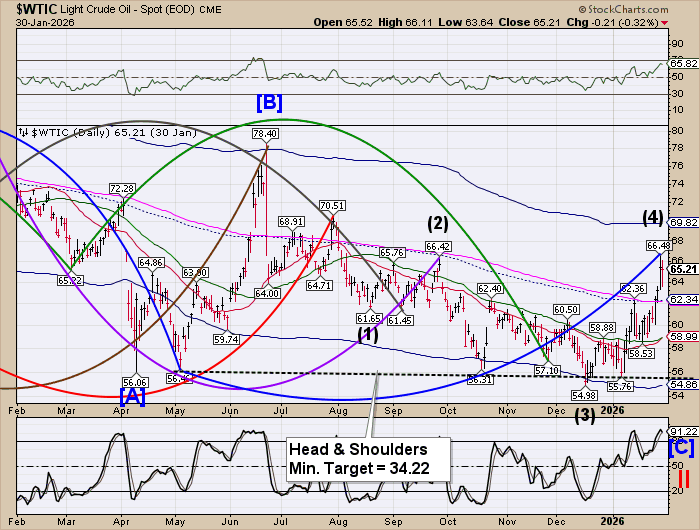

Crude oil made its Master Cycle high last Thursday with a strong reversal day on Friday. Over the weekend it plummeted to a low of 61.43 before bouncing back to the mid-Cycle support/resistance at 62.34. That movement may have precipitated a sell signal. If so, the Cycles Model infers a decline to mid-March that may fulfill the Head & Shoulders target shown in the chart.