1:00 pm

SPX has now fallen into a bear market. In addition, it is embarking on Wave [iii] of 3 of (3) of c, a lethal combination. We may expect this Wave alone to reach 3000.00. Most analysts are reading this formation as a Head & Shoulders with a minimum target of 3400.00. The Cup with Handle is much more bearish. Short gamma is in full force and may intensify over the next couple of weeks and may last as long as mid-June.

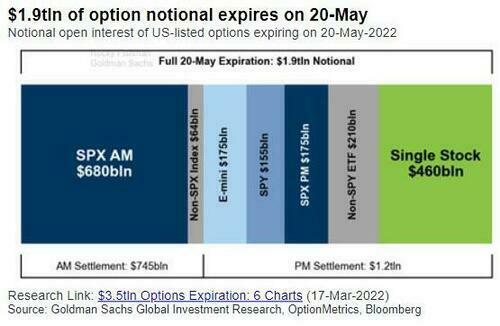

ZeroHedge remarks, “Traders will close old positions for an estimated $1.9 trillion of derivatives while rolling out new exposures on Friday. This time round, $460 billion of derivatives across single stocks is scheduled to expire, and $855 billion of S&P 500-linked contracts will expire according to Goldman.

As SpotGamma notes, this expiration is not particularly large for SPX or QQQ with our models showing ~15% of delta & gamma expiring, but sizeable for SPY (37% of gamma, 20% of delta).

The impact of the sizable 3900 strike gamma exposure cannot be understated however…

Most of this position expires today, as does a large percentage of the at-the-money SPX/SPY/QQQ options position (seen in light grey). The expiration of these positions reads as less support for next week.”

8:00 am

Good Morning!

SPX futures reached a morning high of 3952.20, under the 38.2% (cash) Fibonacci level of 3958.38. SPX is still deep within short gamma territory beneath 3975.00 in the morning options. Oddly enough, a huge put holding at 4000.00 has been removed, easing the downward pressure. Both am and pm options are positive above 4000.00, with Index options lighter in the pm.

SPY (close: 389.46) options, which close this afternoon, favor puts at 412 and below, with short gamma starting at 400.00. Should the SPX open lower, a firestorm of volatility may ensue.

ZeroHedge reports, “Contracts on the S&P 500 advanced 1.1% as of 7:15a.m. in New York suggesting the index may be able to avoid entering a bear market (which would be triggered by spoos sliding below 3,855) at least for now, although today’s $1.9 trillion Option Expiration will likely lead to substantial volatility, potentially to the downside.

Even with a solid jump today, should it not reverse as most ramps in recent days, the index – which is down almost 19% from its January record – is on track for a seventh week of losses, the longest such streak since March 2001. Futures on the Nasdaq 100 and Dow Jones indexes also gained. 10Y TSY yields rebounded from yesterday’s tumble while the dollar was modestly lower. Gold and bitcoin were flat.”

NDX futures rose to 12094.00 in the overnight market and has eased lower It’s 38.2% retracement value is 12092.69. This morning puts are favored beneath 12150.00 with short gamma at 12100.00. An open beneath that level may cause increased volatility.

In tonight’s expiration, QQQ (289.58) is loaded with puts beneath 300.00, with short gamma starting at 290.00.

ZeroHedge remarks, “An interesting way to exercise the brain is to imagine what some of us might consider the unimaginable. That is what I ask you to do now. Many investors continue to believe that even if the stock market drops they will be smart enough to get out after taking only a minor hit. Others simply think no way exists for these markets to fall sighting a lack of investment alternatives and what they see as the Fed put having their back.

After the financial crisis in 2008 when the market took nasty and violent swings many investors came away with the feeling they learned a few things that will enable them to leap to safety before it is too late. That brings us to today.

Almost everyone agrees that after years of moving ever upward this bull market is long in the tooth. Today with the economy rapidly slowing and debt across the world having exploded it seems any opportunity to panic the bears should not go unexploited. It is against this backdrop that one allows optimist fellas to think, this time is different.”

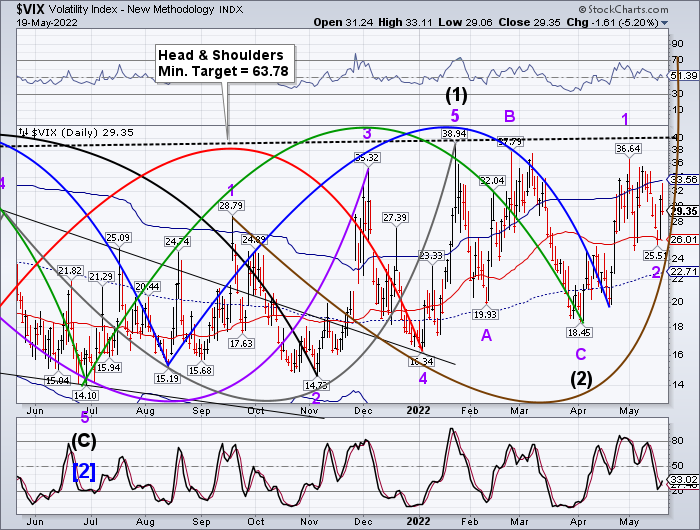

VIX futures reached a low of 28.41 this morning, but has regained some of its losses. Most analysts watch the top of the chart and observe that VIX is no higher than it was in January. However, they fail to observe the rising lows, adding upward pressure on the VIX. A breakout may be explosive.

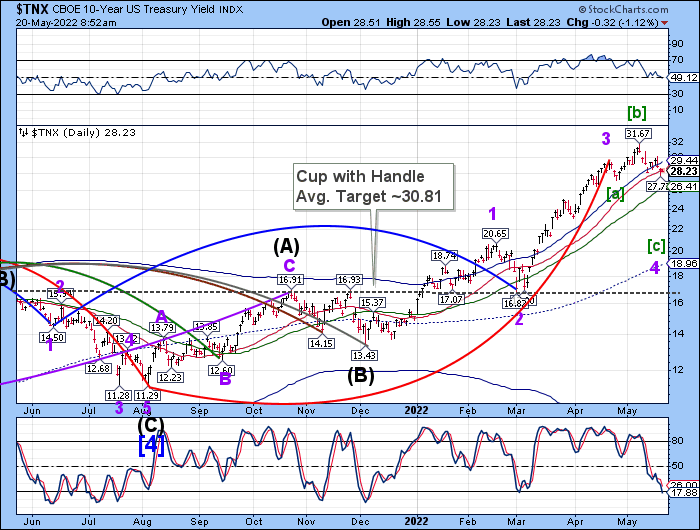

TNX is retesting Intermediate-term resistance at 28.47 this morning prior to heading lower. The Cycles Model is warning that a very large surge of liquidity may be heading into Treasury notes as it leaves equities through the end of the month. Let me warn that a Wave 4 may descend to the top of Wave 1, should the conditions be met.

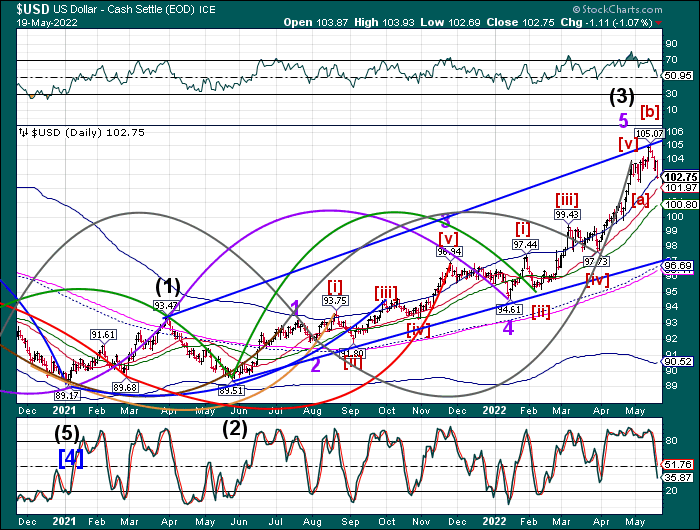

USD futures may be bouncing off its Cycle Top support at 102.87 as it consolidates beneath its high. The Cycles Model has USD declining through mid-June.