2:30 pm

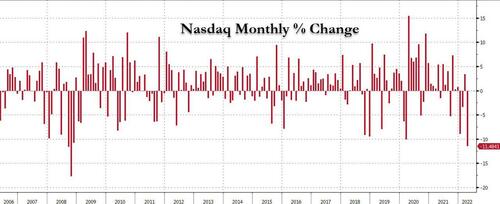

NDX is beneath the Lip of the Cup with Handle formation for the second time. There is likely to be no recovery as the mutual funds are all lined up to sell in the final hour of the day. A month ago the Cup with Handle target appeared to be dubious. Today it appears to be realistic…and that is only Wave (3)!

ZeroHedge exclaims, “Earlier today we observed that the Nasdaq was on pace for the worst month since 2008, and judging by the ongoing collapse in the tech index which is now down more than 2% and trading reading near session lows ahead of today’s margin calls that’s pretty much assured.

But thanks to Deutsche Bank we have stumbled on an even more remarkable state.

As the bank’s head of thematic research Jim Reid writes, and sparing us the obvious TS Eliot references, today is the last business day of the month and we could see something in April we’ve only seen three other times since our data starts in 1973: a month where S&P 500 returns fall more than -5% AND US Treasuries fall more than -2%.”

9:50 am

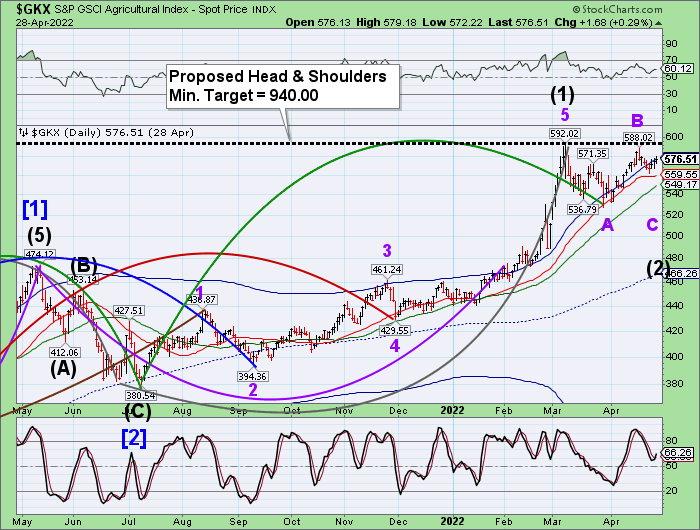

The Ag Index continues its corrective moves with a month-long decline in the works. The proposed target may be near 520.00-525.00 by the end of May. The correction is a great place to accumulate shares as the breakout may be powerful. Time to plant/expand that garden.

ZeroHedge reports, “The effects of pandemic lockdowns, related supply chain strains, and conflict in Ukraine are wreaking havoc on the world’s agricultural system. Readers have heard the likes of the UN warning that Middle Eastern countries are at “breaking points” as food prices hit record highs, and as of last week, the Rockefeller Foundation began the countdown (about six months) to a “massive, immediate food crisis.”

Now, Goya Foods CEO Bob Unanue has issued a similar warning: “We are on the precipice of a global food crisis.”

In a Wednesday interview, Unanue told Fox Business’s Maria Bartiromo, “Americans will have to tighten their belts and consume less,” in response to her question about a potential food shortage crisis.”

9:44 am

SPX is back in short gamma territory beneath 4270.00. This elevates the probability of a meltdown beginning today.

ZeroHedge notes, “As we noted yesterday, options positioning was extreme and provided a lot of fodder for a short-squeeze (which we saw in yesterday’s panic-bid in US equities). However, AAPL and AMZN stole the jam out of that donut overnight and as Nomura’s Charlie McElligott notes, the pivot level which folks will be watching is ES 4270, where the Street is short 9100x Put at that strike that expires today (as part of a customer’s monthly Put Spread Collar program – where they are long 9100 SPX 29Apr 3600 / 4270 PS vs short the 4695 calls, a ~$4B hedge), which obviously lost Delta into yesterday’s booming rally and was clearly a large part of the “Short Gamma” scramble and hedging-squeeze higher in the market yesterday (the 4270 Put went from an 80 Delta put at 10am to a 46 Delta put, so Dealers had to buy ~$1.25B in futures to remain neutral).

But as we all know, “Short Gamma” goes two ways, so as the Put has now gone from a 46 Delta to a 57 Delta with the move overnight, this has created ~$600mm+ of Incremental selling pressure as well; FWIW, the customer tends to roll to a similar Put Spread Collar in June month-end around 11am (h/t J Pierce and H Homes)”

8:00 am

Good Morning!

NDX futures slipped beneath the Cycle bottom support at 13359.51 to an overnight low of 13181.40. The retracement rally, strong as it was, is over. The question is, how long will it take to make new lows beneath the Lip of the Cup with Handle near 13030.00?

As for today’s options expiration, Max Pain is at 13460.00. However, the gamma-weary dealers and hedge funds were delivered a serious blow after hours with diminishing liquidity. Short gamma begins at 13300.00, so the battle lines have been drawn. QQQ options (closing price; $328.01) offers Max Pain at 327.50 and short gamma begins at 325.00 with reinforced selling every 5 points beneath it.

ZeroHedge observes, “Update (5:45pm EDT): Just when it seemed that AAPL stock would provide the much needed pillar of support to offset the tumbling AMZN and keep the Nasdaq from plunging tomorrow, with its stock initially jumping after hours, AAPL has since sunk, fading an $8 AH gain and dropping as much as 6% to $152, after it warned on the earnings call that supply constraints would cost the company $4 billion to $8 billion in the current quarter, casting a pall on record-setting results that the company just reported.

Covid restrictions, which have swept China in recent weeks, will take a toll on the June quarter, the company said on a conference call, and even though last quarter’s sales and profit had topped analysts’ estimates, fueled by strong demand for the iPhone and digital services, and the company announced $90 billion in new stock buybacks, the stock has staged a nearly $20 reversal lower in the after hours session.

SPX futures declined to 4240.00, threatening the Cycle Bottom support at 4215.65. Yesterday was a Cycle turn date at 30.1 days from the March 29 high at 4637.30. In today’s options expiration, Max Pain is at 4325.00. Short gamma begins at 4270.00. Short covering left the SPX near short gamma territory. Should the markets fail today, the decline may be swift and deep, regardless the oversold condition. There are 22 days left to the bottom in this Master Cycle. The entire 2020 crash only took 22 days.

ZeroHedge reports, “It has been an illiquid, rollercoaster session on the last day of the week and month, which first saw US index futures modestly rise alongside European stocks propped up by surging Chinese and Asian markets following Beijing’s latest vow to use new tools and policies to spur growth, however the initial move higher quickly faded as markets remembered that not only did Amazon report dismal earnings (with Apple also sliding on weak guidance) but the Fed is set to hike 50bps (or maybe 75bps) next week, and put a lit on any upside follow through. As a result, S&P500 futures dropped 0.9%, while Nasdaq futures retreated 1.1% on the last trading day of April, adding to their 9.3% decline so far this month and on pace for the worst monthly performance since November 2008 as fears of rising rates hurt bubbly growth shares and fuel risks for future profits. The yen snapped a slide while staying near 20-year lows. The yuan, euro, pound and commodity-linked currencies made gains while the dollar dipped. 10Y TSY yields rose, rising by about 4bps to 2.87% while gold moved back above $1900. Bitcoin tumbled as usual, and last traded back under $39,000″.

VIX futures declined to 28.62 as it consolidated within yesterday’s trading range. Normally VIX would decline to the 50-day before moving higher. However, yesterday was day 17 (a turn date) from the Wave(2) low. The possibility of fireworks today is very high.

The NYSE Hi-Lo Index closed at -501.00. This is not a time to be bullish.

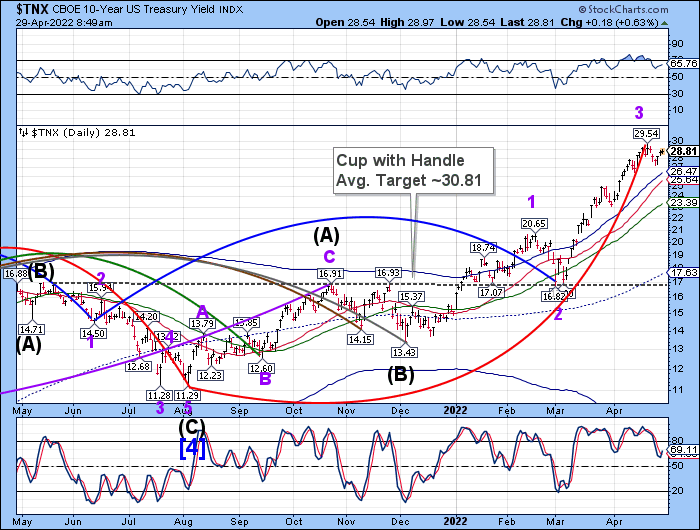

TNX is approaching its peak this morning as a brief period of strength may push it to 30.00. TNX is still in a correction phase and is likely to resume its decline next week, making this move a red herring. The Cycles Model suggests a decline may last through the end of May.

ZeroHedge reports, “After a strong 2Y, and a subpar 7Y auction earlier this week, we end the week’s coupon issuance with an auction of $44BN in 7Y paper which came in just right.

The high yield of 2.908% was a whopping 41bps higher than the March auction and was the highest since Nov 2018, just before the Fed panicked and ended its tightening (of course, inflation back then was well lower). And even though yields have been grinding higher all day, the auction tailed the 2.891% When Issued with a “decent” 1.7bps tail, the biggest since December.

The 2.41 bid to cover was in line with recent prints, and while it dipped from last month’s 2.44, it was above the 2.34 six-auction average.”

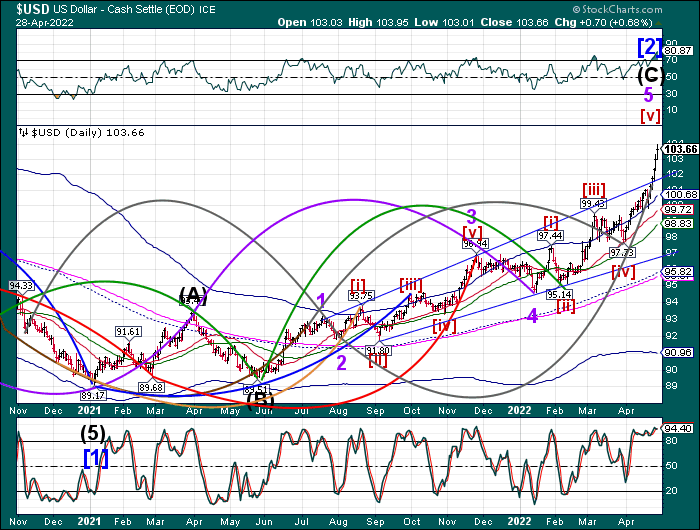

USD declined this morning, leaving the high in debate as yesterday’s close was 103.66 vs 103.61 on March 19,2020. The intraday high on March 17, 2020 was 103.98 vs 103.95 yesterday, day 272. The Cycles Model calls for a 6-week decline which may take it to the mid-Cycle support at 95.82. If it stays above that level by the end of June we may see a resumption of the uptrend through early next year.

Crude oil continues its consolidation above the trendline. It may test the Cycle Top resistance before a two-month decline. A decline beneath the 50-day Moving Average at 102.59 gives a sell signal.

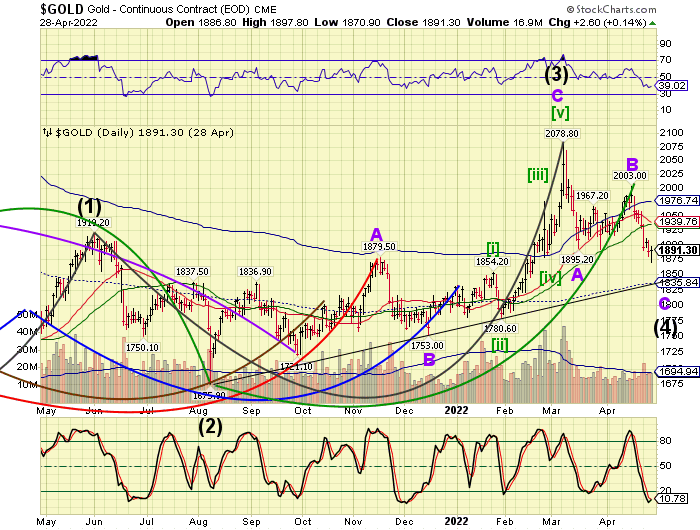

Gold futures offered some hope in the overnight market by bouncing to 1921.86. However, is is giving up that gain and may quickly slide back beneath 1900.00 as it continues its correction. The Cycles Model suggests that gold may continue its decline through mid-June. The uptrend may be preserved should it remain above the mid-Cycle support at 1635.84.