10:05 am

SPX rallied to the 50% Fib retracement level at 4396.49 in the first hour, a bit higher than expected. The Cycles Model suggests the decline resumes this morning with the largest panic-selling episode just ahead. While we may see yet another attempt at 4400.00, the worst of the retracement may be over.

ZeroHedge observes, “A dramatic rebound in stocks – off the S&P’s 100DMA – has prompted many commission-rakers and asset-gatherers today to call the end of the Evergrande event and signal the all-clear to new highs.

So what happened? What changed?

Nomura’s Charlie McElligott explains that there is simply no way to overstate the power of the “reflexive vol sellers” into another spike, as this “sell the rip (in vol)” = “buy the dip (in stocks),” particularly as it related Put sellers either directionally shorting “rich” vols yday…and “long sellers” who monetized their downside hedges by the close (a lot of that being 1d SPY Puts from Retail “day traders” which doesn’t show in OI), creating $Delta to buy and again self-fulfilling yet another “turnaround Tuesday”

Critically, that Delta buying in the late day was hugely important then in reducing the absolute $ of systematic deleveraging “accelerant” flows, because only closing down -170bps in SPX then meant a much more manageable -$24.7B of Vol Control de-allocation in coming days, as opposed to what would have been a much more challenging -$62.9B to digest which we estimate would have been triggered off of a “-3% close”…while similarly, Leveraged ETFs only needed to rebalance -$5.9B at EOD, as opposed to a hypothetical -$8.9B assumed at the low of the day.”

(Please read the whole article.)

9:45 am

The S&P GSCI Ag Index took a brief pause in its ascent. The Cycles Model infers a continued rally through mid-December as food prices skyrocket. There are no bullish formations to speak of, but should Wave [3] be equal to Wave [1], the target would be 670.00. Wave [3] may be the strongest of the series, so that would be a minimum. Since this is a Primary Wave [3], it suggests a potential target between 850.00 and 1000.00.

ZeroHedge reports, “Robusta coffee prices continued to soar to record-highs this week as concerns deepen over the outlook from Brazil, the world’s top producer.

“Cheaper robusta-coffee beans, used widely in instant-coffee beverages such as Nestle SA’s Nescafe brands, are sold out in Brazil. After drought and frost ruined crops of the higher-end arabica variety favored by cafes like Starbucks Corp., local roasters are racing for robusta replacements and driving prices to new records each day,” Bloomberg wrote.

Spot prices for Brazil robusta Espirito Santo have nearly doubled this year, up 356 reais per 60-kg bag, or about 87% to 769 reais.”

8:20 am

Good Morning!

SPX futures rose to 4406.40 before being repelled by the gap left at 4402.95. The 50% Fibonacci retracement level is at 4396.39 and futures have slid beneath that level. The 38.2 Fib level is at 4375.04 which I proposed to be the top of the retracement yesterday. It may yet open at or beneath that level. That is why I suggested that no action may be needed to take profits. The Cycles Model proposes the decline may resume in the first hour of the cash market.

ZeroHedge reports, “Even though China was closed for a second day, and even though the Evergrande drama is nowhere closer to a resolution with a bond default imminent and with Beijing mute on how it will resolve the potential “Lehman moment” even as rating agency S&P chimed in saying a default is likely and it does not expect China’s government “to provide any direct support” to the privately owned developer, overnight the BTFD crew emerged in full force, and ramped futures amid growing speculation that Beijing will rescue the troubled developer…

… pushing spoos almost 100 points higher from their Monday lows, and European stock were solidly in the green – despite Asian stocks hitting a one-month low – as investors tried to shake off fears of contagion from a potential collapse of China’s Evergrande, although gains were capped by concerns the Federal Reserve could set out a timeline to taper its stimulus at its meeting tomorrow. The dollar dropped from a one-month high, Treasury yields rose and cryptos rebounded from yesterday’s rout.”

The NYSE Hi-Lo Index closed at -73 yesterday, giving the final confirmation of the sell signal. The interesting item is that the Hi-Lo is due for a Master Cycle low as early as tomorrow, but no agreement with the SPX and VIX. This is odd, since there is another Master Cycle low in mid-October which syncs with the SPX. This suggests to me that there may be some event that may panic and close the markets, since the SPX and VIX are in mid-Cycle. The two main events that could possibly affect the markets are a government shutdown, Evergrande and the Canary Island Volcano.

VIX futures pulled back to 22.36 this morning before resuming their ascent. A move back aboe 25.00 may induce hedge funds and CTSs to resume selling, as this is considered gamma negative.

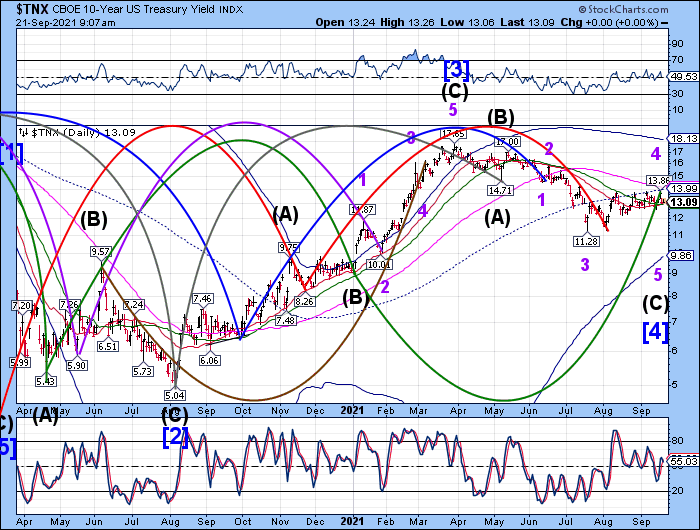

TNX is testing Intermediate-term support at 13.02 witht he 50-day Moving Average just beneath it. Should it break beneath, it may be a signal for more decline to come. The proposed Master Cycle terminus in mid-October may be the Cycle Bottom support, near 10.00. Old habits die hard and a panic sell-off in stocks may drive investors into treasuries.

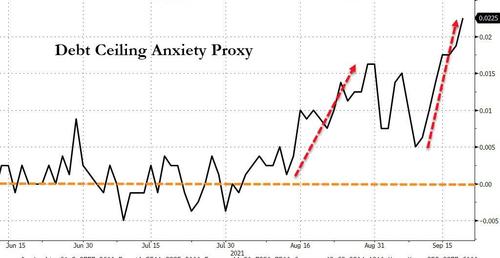

ZeroHedge observes, “In a risky move inviting a showdown with Republican lawmakers, House Democrats are linking a suspension of the US debt ceiling to a must-pass spending bill required to keep the government operating past September.

If it works, the debt ceiling – which GOP leaders have balked at raising – would be suspended through December 2022.

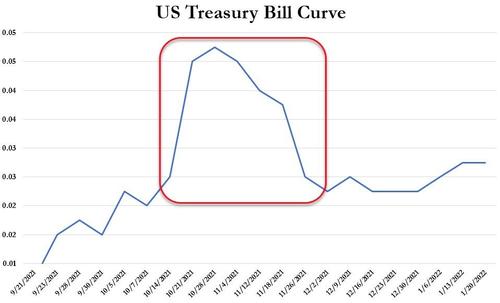

If nothing is done, the federal government will shut down and default on payments as soon as next month – a prospect which already has anxiety through the roof as measured by the spread between Oct and Nov T-bill yields.

USD futures are lower this morning, suggesting the anticipated Master Cycle may have ended yesterday, day 257 of the Master Cycle. This appears to go hand-in-hand with treasury yields. The USD may take a real beating as it is in a multi-year Orthodox Broadening Top and is targeted to land near 85.00 in the current decline.