The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:00 am

Good Morning!

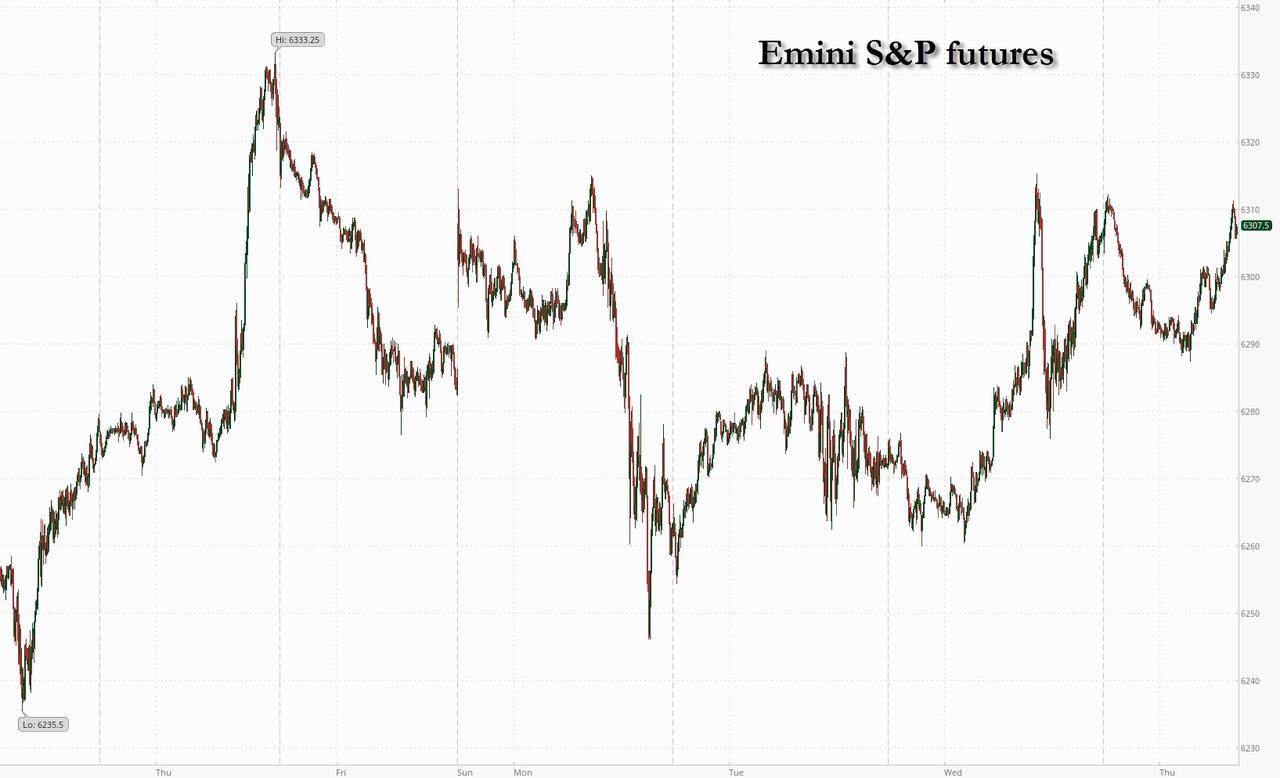

SPX futures peaked in the overnight market at 6272.10, remaining beneath the rising trendline near 6275.00. The trendline continues to rise at 10.9 points per day. Institutions have pared back their longs through quarterly rebalancing and have no incentive to increase their exposure early in the second half of the year. This leaves the mechanical buyers such as the Commercials and the retail crowd to pick up the slack. Retail activity has picked up to the highest its been since 2018. Cash levels, on the other hand, have declined beneath 4%, a critical level for market liquidity. That being said, the Cycles Model doesn’t show heightened volatility until the second week of August. That suggests the SPX may remain range-bound above the 50-day Moving Average at 5987.86 for the next couple of weeks, implying the retail longs may become even more crowded.

ZeroHedge reports, “US equity futures are flat, trading in a narrow range overnight, with SPX unchanged, while Nasdaq futs rise after TSMC beat on sales guidance. Since yesterday’s close, incremental macro headlines were muted, but earnings reports were solid (TSM, UAL). As of 8:00am ET, S&P futures are unchanged, Nasdaq futs are up 0.1% boosted by a positive outlook from TSMC, and Rusell 2000 futs are down 0.4%. European stocks also advance with the Stoxx 600 up 0.7%, led by gains in industrial, construction and auto sectors. In Pre-market trading, megacap tech is higher, with NVDA (+0.8%) leading gains, followed by META (+0.7%) and AAPL (+0.3%) as TSMC’s raised outlook is a good sign that spending on AI is holding up; on sector basis, Health Care and Real Estate are outperforming. Yields are 1-2bp higher and the dollar staged a comeback as dip-buyers stepped in, following Wednesday’s brief bout of panic over the future of Powell. Commodities are mixed, with oil and iron ore higher, while base and precious metals are lower. Today, markets will focus on Retail Sales (8:30am), Jobless Claims (8:30am), Philly Fed Business Outlook (8:30am), NAHB Housing Mkt Index (10am), Fed speakers Kugler (9:15am), Daly (12:45pm), Cook (1:30pm), Waller (6:30pm). We also get earnings from ABT, CFG, CTAS, ELV, FITB, GE, MAN, MMC, PEP, TRV, USB before the market; while after the close we get: IBKR, NFLX, SFNC, WAL.”

VIX futures remain beneath the 50-day Moving Average in a consolidation pattern. The fact that it very briefly broke above the 50-day indicates a buy signal, but most technicians may remain short or neutral pending a breakout above the declining wedge formation and mid-Cycle support/resistance at 19.66. Be aware that the current position affords an ideal condition for accumulating shares.

USD futures have risen above the 50-day Moving Average at 98.82 this morning, turning up the pain levels for the USD shorts. The Cycles Model suggests the pain levels may remain heightened for the next three weeks as short covering may rule the USD. Current positioning may have set off a buy signal for the commercials as the 50-day is a powerful trigger point for the CTAs.

TNX futures made a new high at 44.97 while the cash market topped at 44.93 as it goes into a brief consolidation. TNX may pull back to the 50-day Moving Average at 44.04. However, the Cycles Model suggests a burst of energy tomorrow may nullify the retracement.

Zerohedge observes, “Many were shocked (again) after the latest CPI and PPI data confirmed that the experts were once again dead wrong, and instead of the widely expected inflation tsunami, Trump’s tariffs have so far sparked only continued disinflation (which will only become more acute as home prices slide). And yet, anyone who read our Beige Book analysis from April (not to mention our accurate prediction from last June that “The Experts Are All Wrong About Inflation Under A Trump Presidency“) would have known just that: as we laid out, “Beige Book Finds Inflation Mentions Tumble To 3 Year Low” which was the clearest indication that despite the prevailing narrative, rising prices is simply not a thing businesses across the US are worried about. We got further confirmation of this last month, when the latest Beige Book found no runaway inflation (again) but instead that sentiment in the economy splitting along party lines.”

Bitcoin futures have fallen beneath the Cycle Top at 118154.57. While it is in the early stages of a reversal window, it may not be finished to the upside. The Cycles Model suggests rising volatility/strength over the weekend which may offer directionality for the next two weeks. Money flows suggest capital may be fleeing Europe and Japan.