The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:00 am

Good Morning!

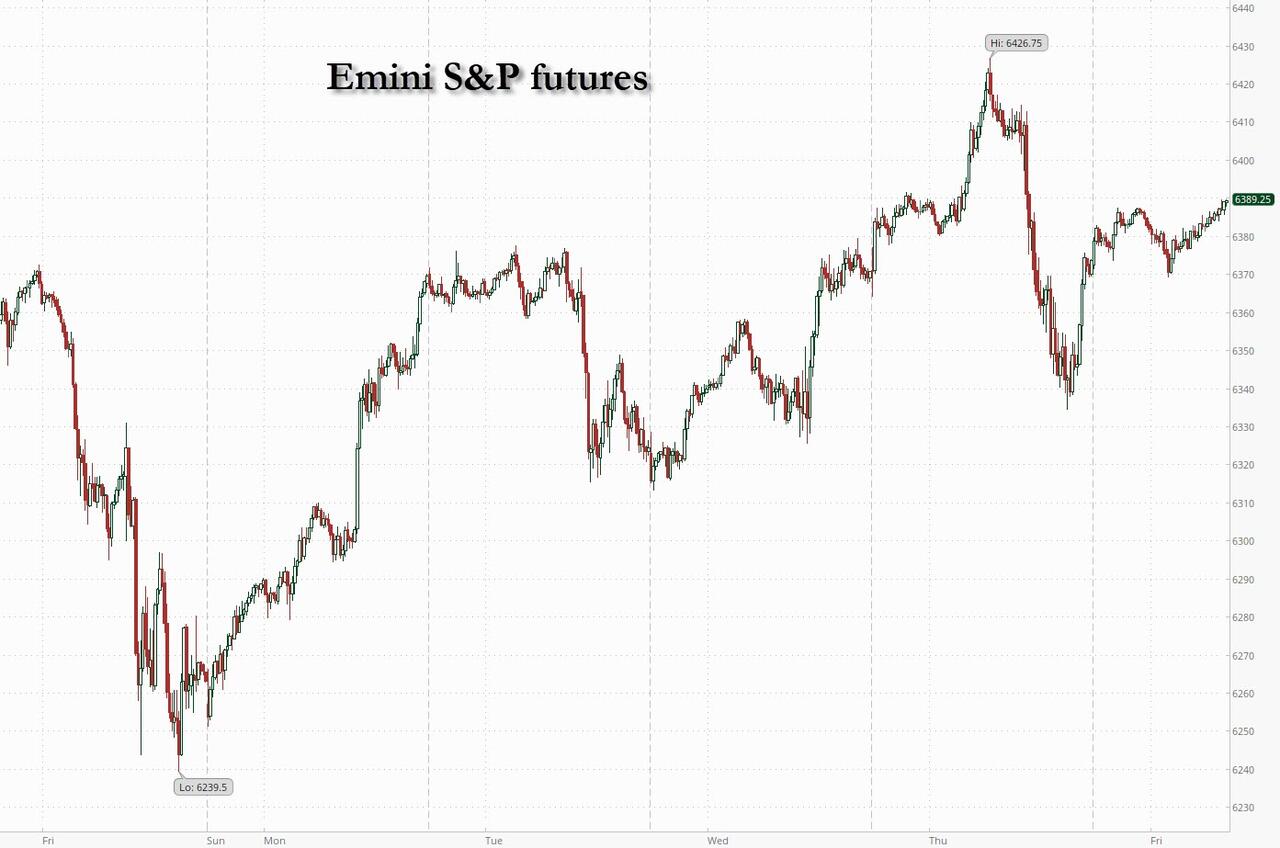

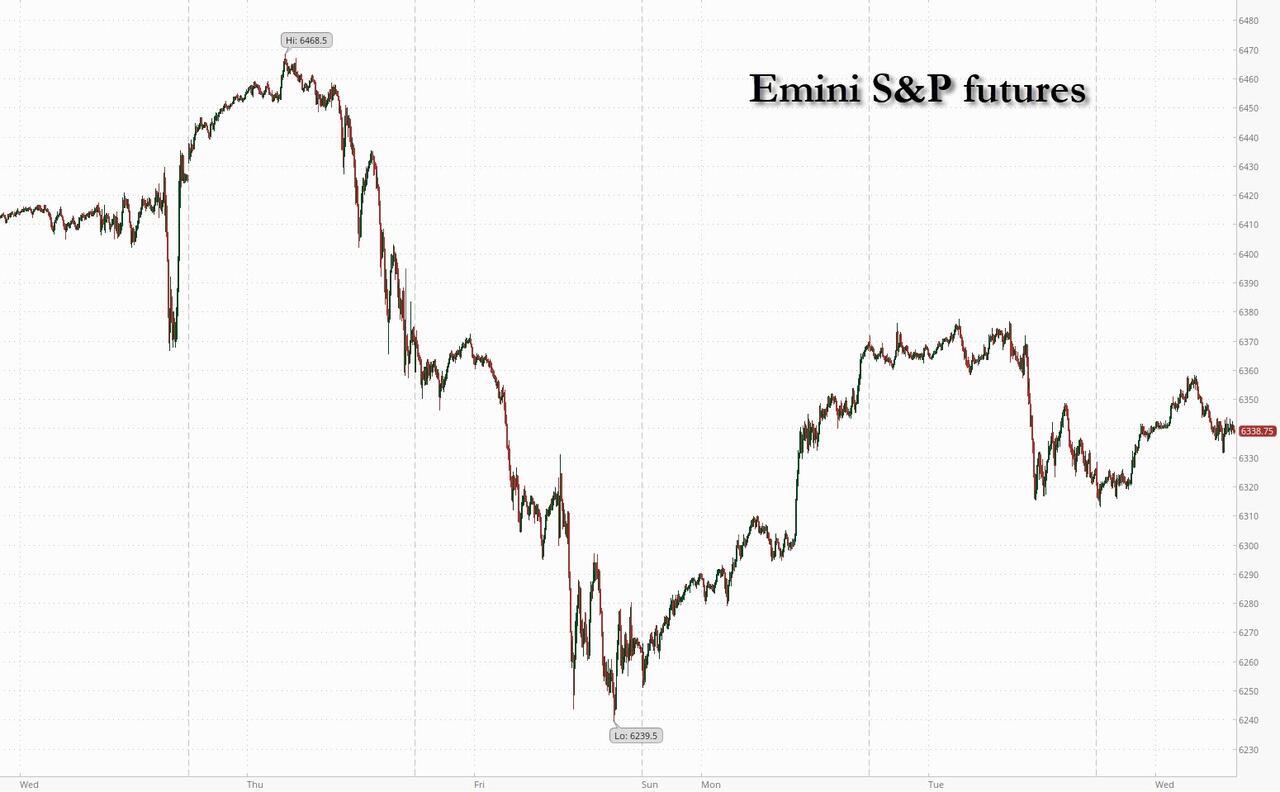

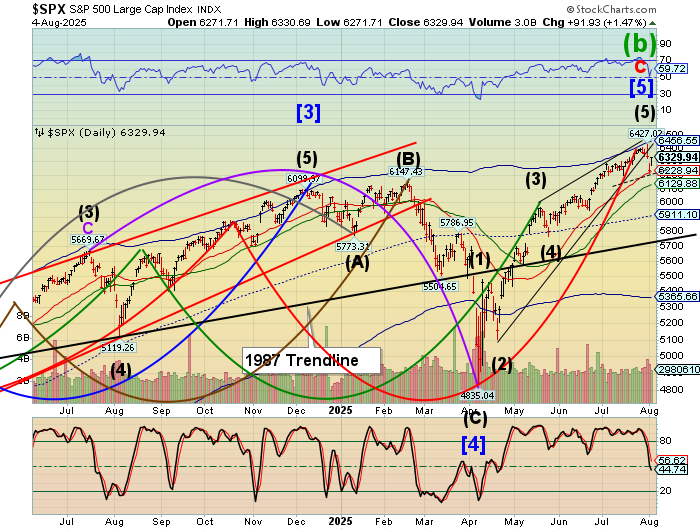

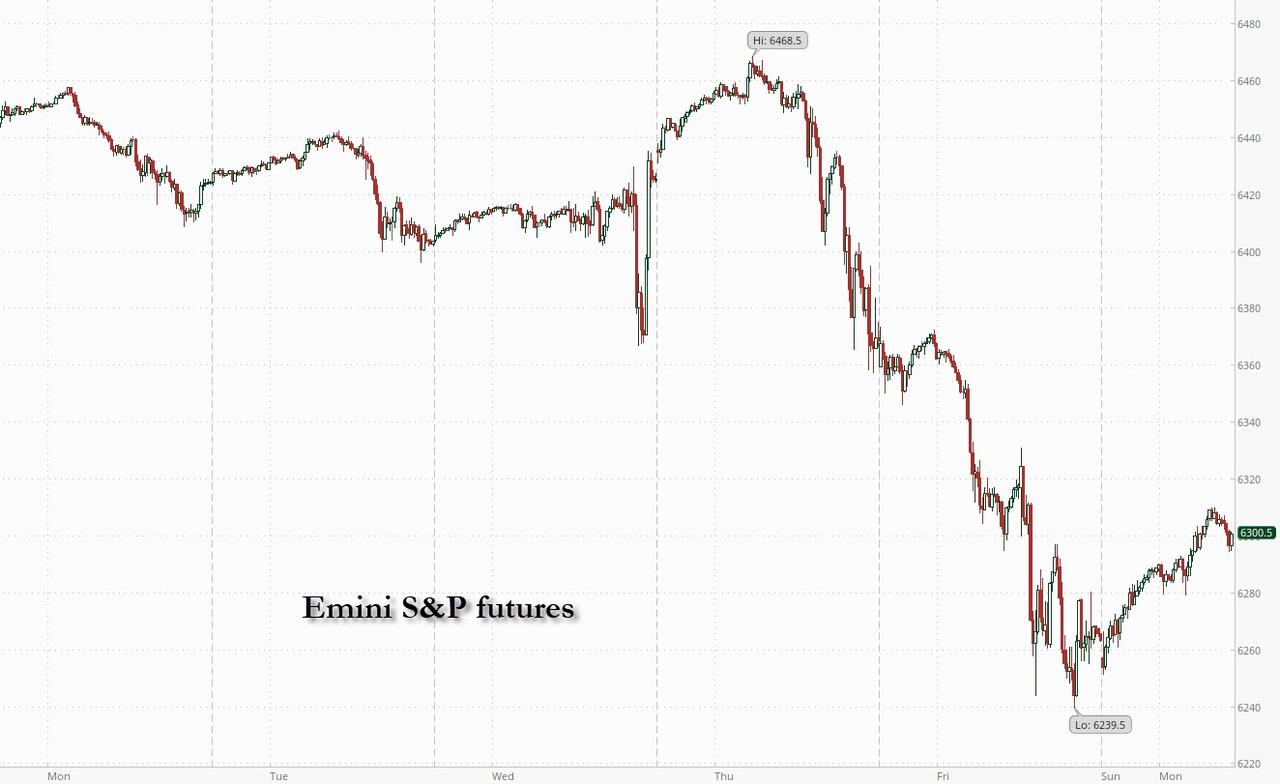

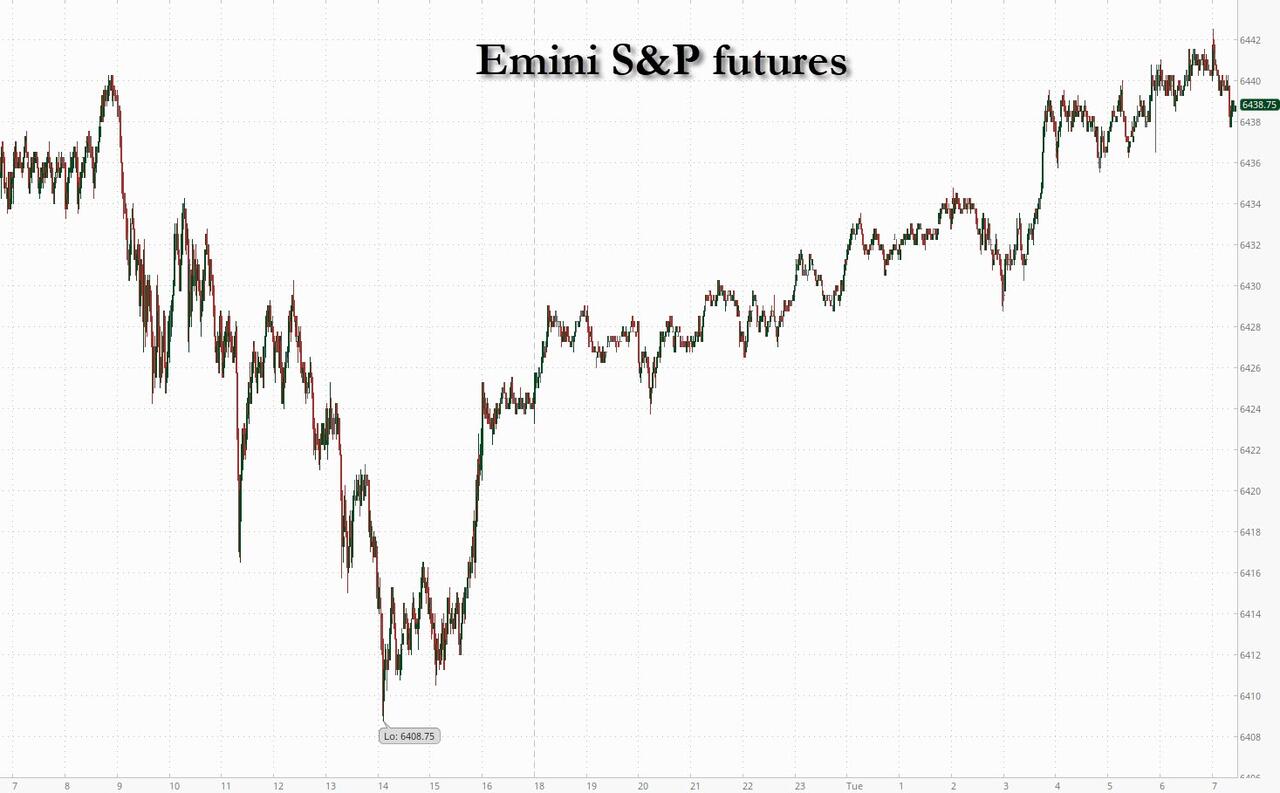

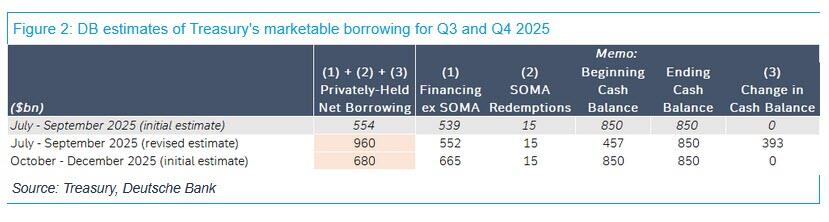

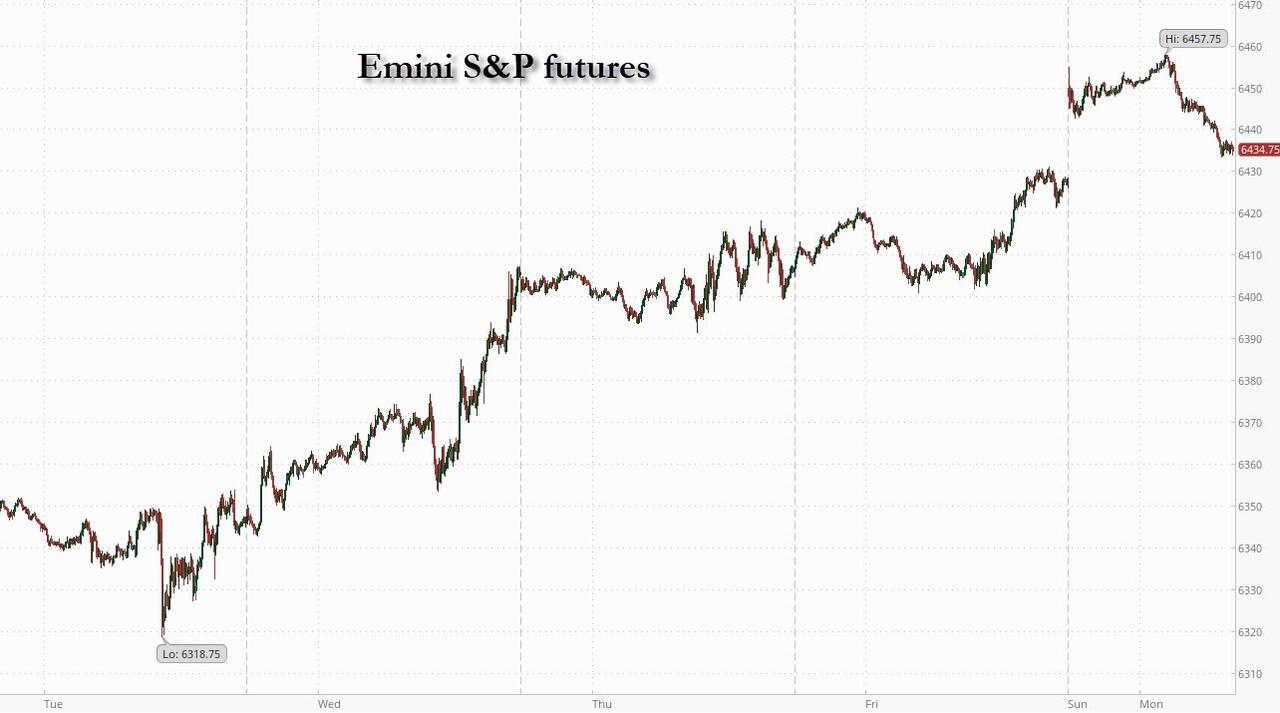

SPX futures rose to 6405.70 over the weekend and are currently stalled at round number resistance (6400.00). The Cycles Model anticipates the first possible major break in the uptrend about to occur with an acceleration of the decline by mid-week. While commercials continue to buy, hedge funds became sellers last week and retail participation has thinned.

Today’s options chain shows Max Pain at 6385.00. Long gamma comes in strong above 6400.00, while short gamma rules beneath 6350.00.

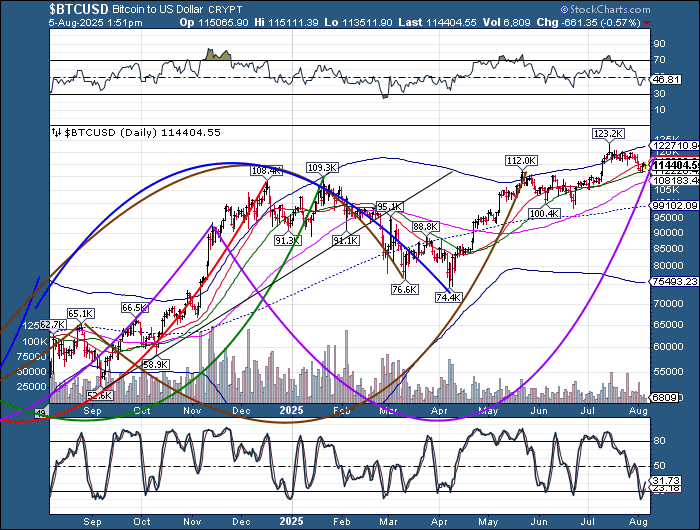

ZeroHedge reports, “US equity futures are up small with Russell/small caps outperforming, and yields dip at the start of a data-heavy week that will be pivotal for the Fed’s rate cuts later this year. As of 8:00am ET, S&P 500 contracts rose 0.2% after the index ended Friday just shy of a record high; Nasdaq futures were flat. In premarket trading, AMD fell 2.3% and NVDA was 1% lower after the chipmakers agreed to remit to the US government 15% of their revenue from AI chip sales to China in exchange for export licenses. Bond yields are lower as the curve flattens and the USD rises. Cmdtys are lower with Energy/Metals weaker but Ags stronger. Meanwhile, Trump asked China to increase soybeans purchases 4x ahead of tomorrow’s trade deadline although Lutnick last week said another extension is likely. Geopolitics is also in focus with a larger impact on EMEA and the Trump/Putin summit this Friday. Bitcoin rises back to $122K and Ethereum surge to $4350 overnight, hitting the highest since 2021. There are no major macro data prints today but market will focus on CPI on Tuesday.”

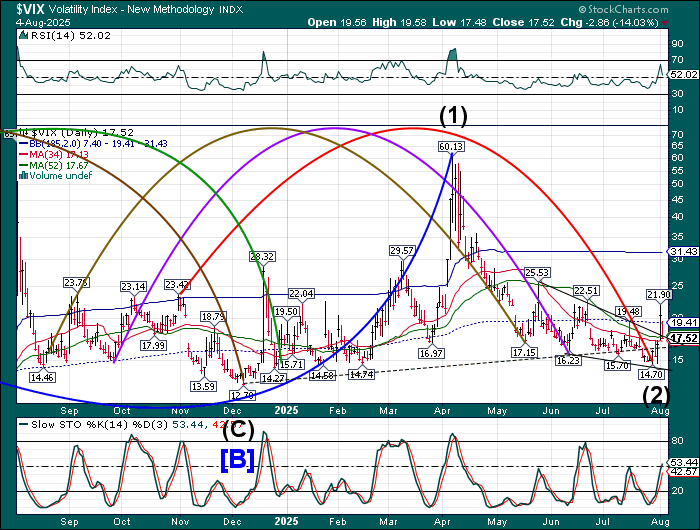

VIX futures are holding steady above Friday’s low. Overhead resistance is at 16.68. A probe above that level reinforces the buy signal. The Cycles Model agrees that the uptrend is about to resume, with strength, this week.

The August 13 options chain shows short gamma at 15.00-16.00. Long gamma begins at 17.00 and remains strong to 25.00.

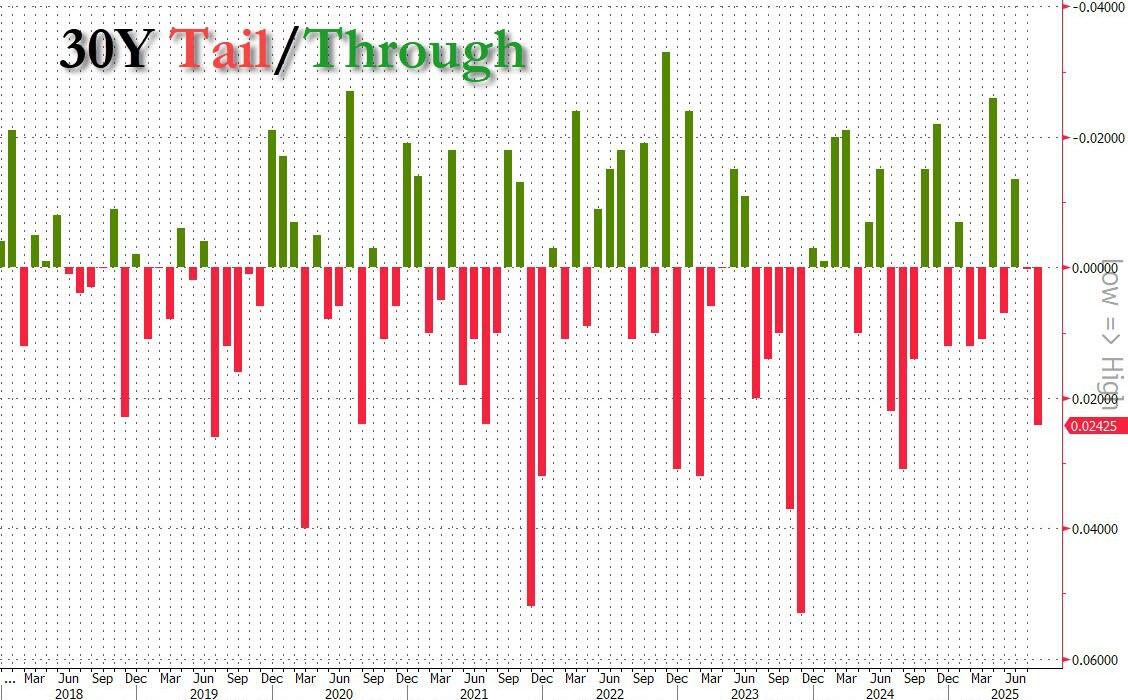

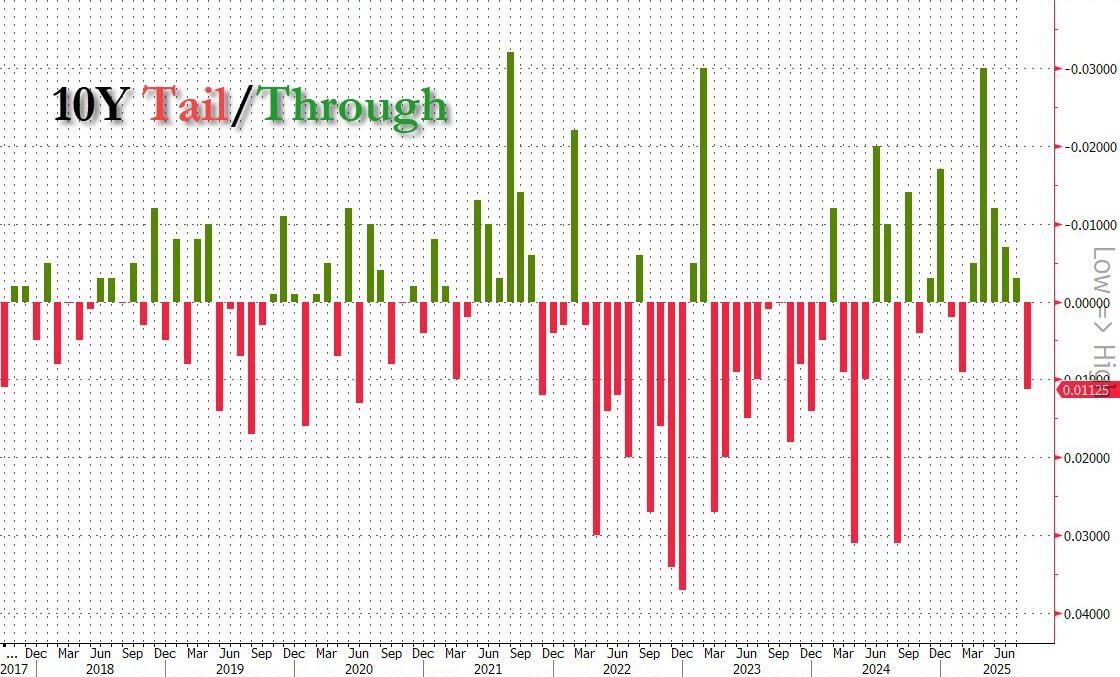

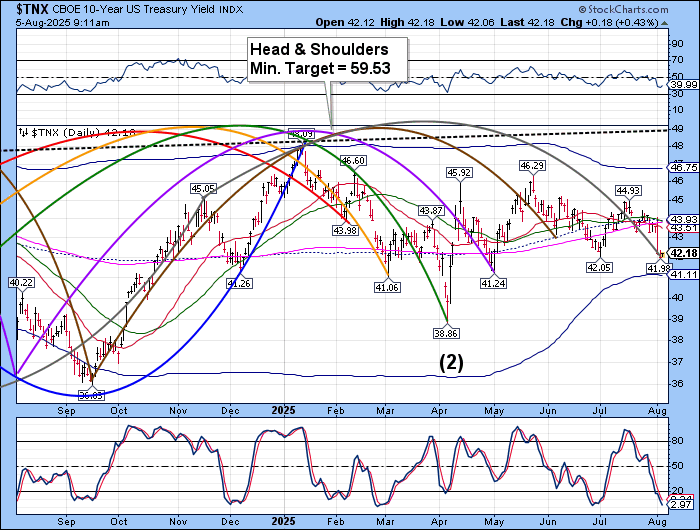

TNX is trading mid-range between its Master Cycle low, made last Monday, and Intermediate resistance at 43.37. A rise above that level gives a buy signal that may extend to late September. Note the Head & Shoulders formation that hints of higher rates ahead.

ZeroHedge remarks, “Mainstream economists were surprised last week after Donald Trump closed two massive trade and tariff deals, the first with Japan and the second with the EU. And this happened without triggering an economic crash.

The deal with Europe in particular has made a number of critics look rather foolish; there’s an army of mainstream economists who might reasonably acknowledge they misjudged the situation. But we all know that economists never admit their mistakes.”

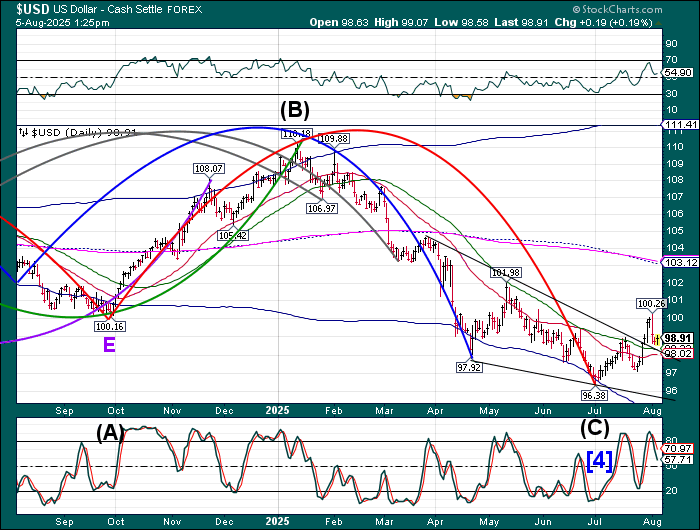

USD futures have risen above the 50-day Moving Average at 98.24 this morning, giving a very strong buy signal. There is still a massive dollar short contingent that may start feeling the pain of a squeeze. The Cycles Model indicates a possible rise in the USD to mid-September. Trending strength may appear by mid-week.

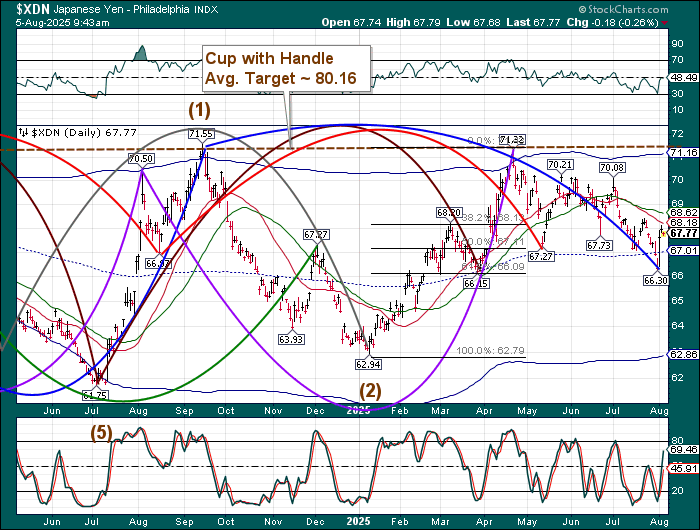

Euro futures are pulling away from being repelled from the Intermediate resistance at 116.60 and may be about to test the 50-day Moving Average at 115.84. The Euro is currently on a sell signal and a further decline beneath the 50-day Moving Average offers reinforcement to that signal. The Cycles Model suggests the Euro may decline with strength into early September as the War drums beat louder and investors flee the danger zone.

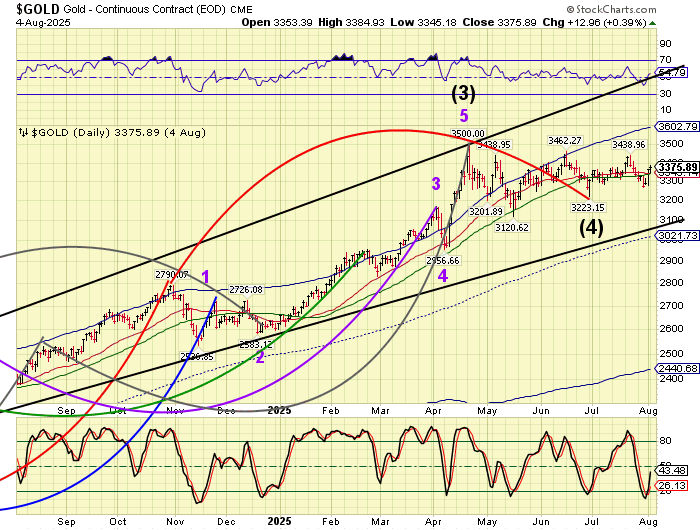

Gold futures may have declined beneath the 50-day Moving Average at 3346.56 today, creating a potential sell signal. If correct, the Cycles Model anticipates a decline until early September. A possible target may be the trendline near 33100.00. A secondary target may be near the mid-Cycle support at 3036.54.