The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:15 am

Good Morning!

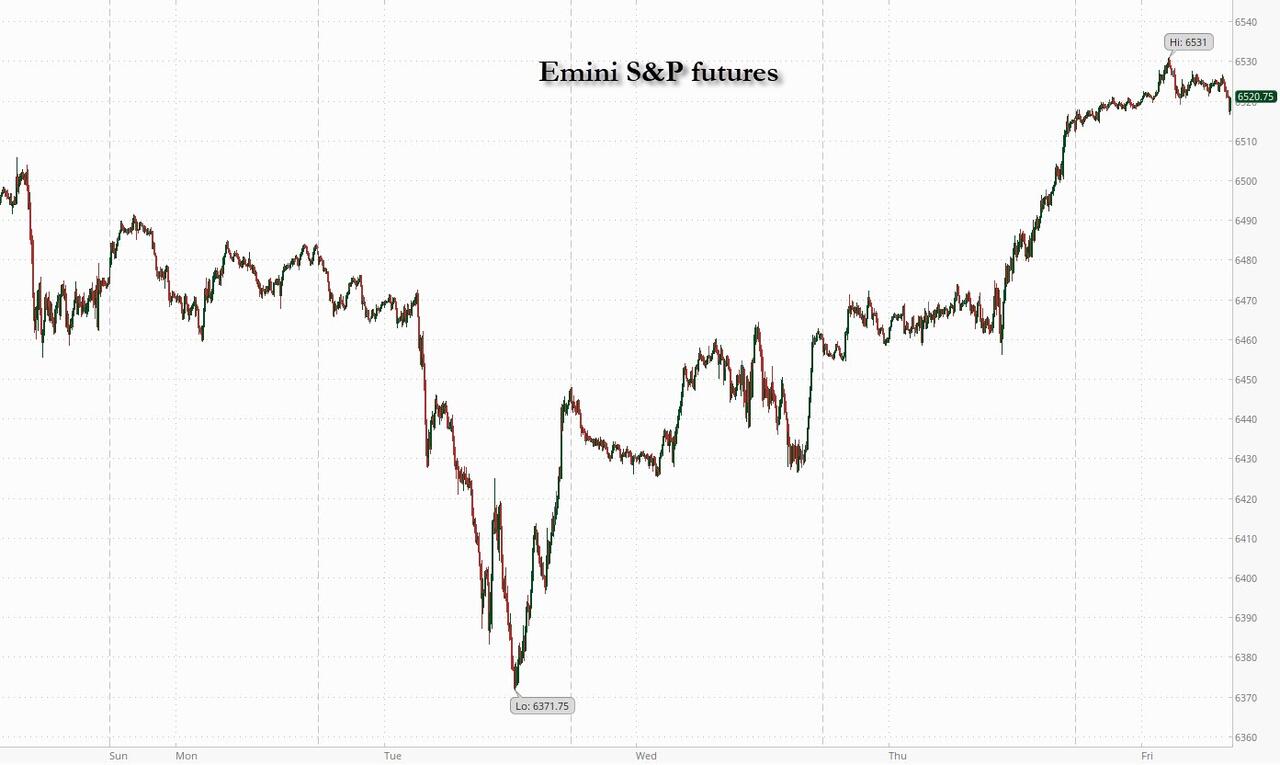

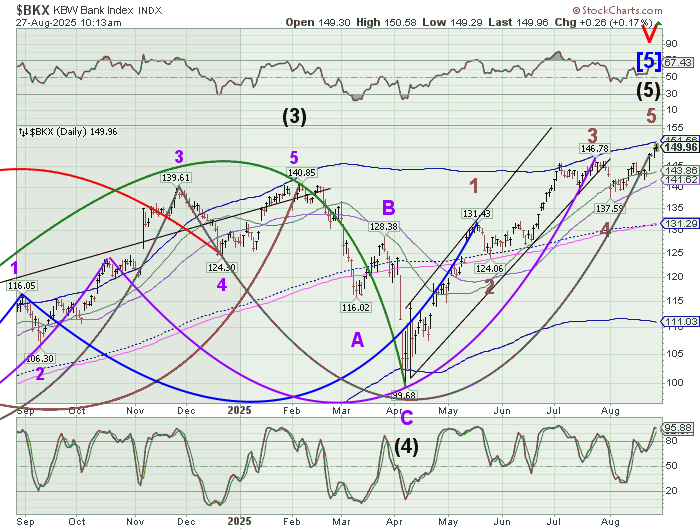

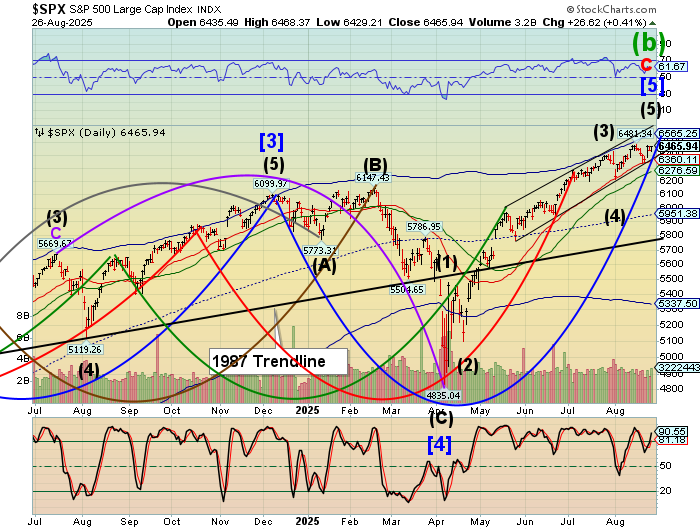

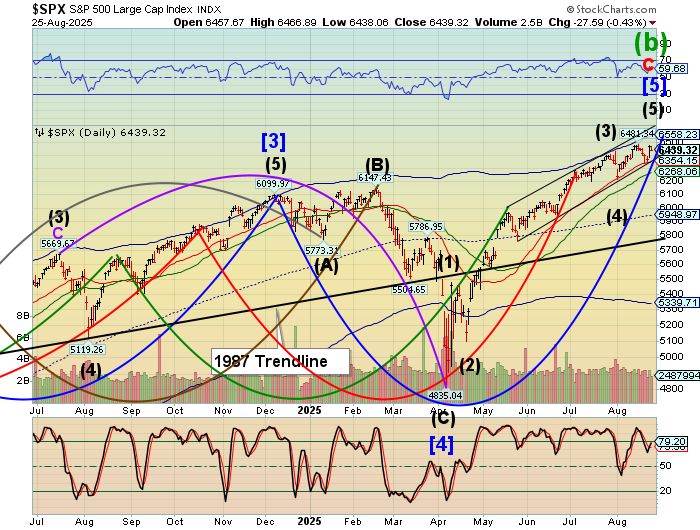

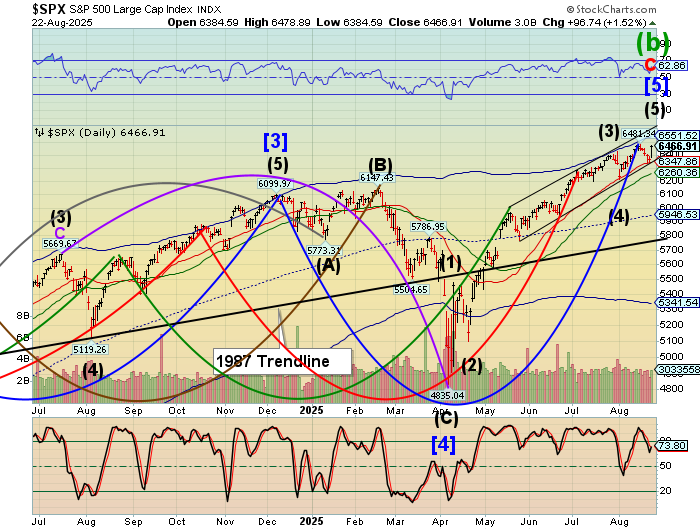

SPX futures rose to 6500.90 this morning, a 61.8% Fibonacci retracement. Market breadth is at its lowest point in years, as Commercial traders have maxed out their allocation. Retail investors are trying to ascertain whether the Fed has launched a new rate-cutting regimen or will the cut be simply a one-off phenomenon. The largest market drivers in the AI movement are in a funk. Finally, buy-backs are in a blackout period to the end of quarterly earnings season. What can possibly go wrong? The Cycles Model suggests a decline to the end of September with a possible target being the April 7 low.

Today’s options chain shows Max Pain at 6480.00. Long gamma resides aboe 6500.00 while short gamma lies beneath 6450.00.

ZeroHedge reports, “US equity futures are higher ahead of today’s French vote of confidence which should end the Bayrou government, and into major inflation updates this week. As of 8:0am ET, S&P futures are up 0.2% and on pace for another record high after Friday’s post payrolls drop; Nasdaq futures gain 0.4% with all Mag7 names higher premarket, ex-AAPL which is flat into its product event tomorrow. Large caps are higher across virtually all sectors. In overnight news, US is reportedly considering annual export approvals to chip facilities in China. The yield curve is twisting steeper and the DXY is flat as USD / JPY appreciates after PM Ishiba announced his resignation, but is well off its session highs. Commodities are stronger, led by Energy, after OPEC+ confirmed a smaller than expected production increase of 137k bpd in Oct. Gold / silver continue to run higher, with the former hitting another record high of $3622; Ags are weaker. Today’s macro data focus is on NY Fed’s 1-Yr inflation expectations and Consumer Credit.”

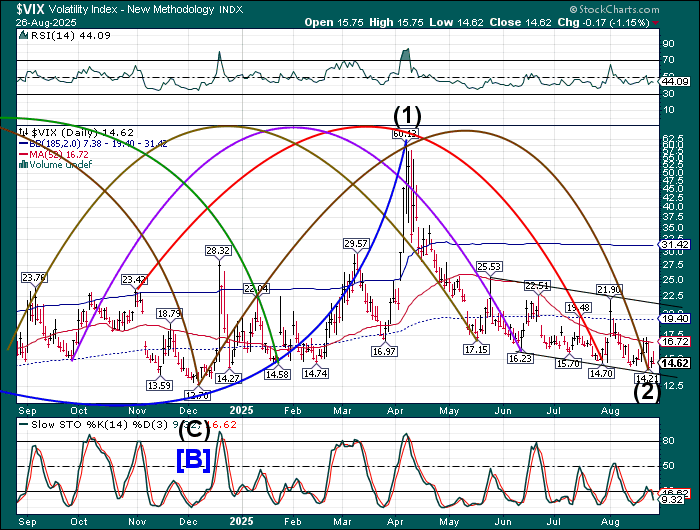

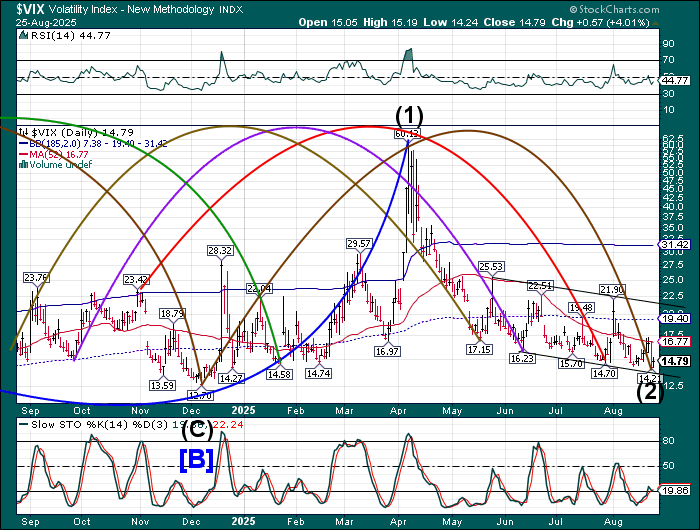

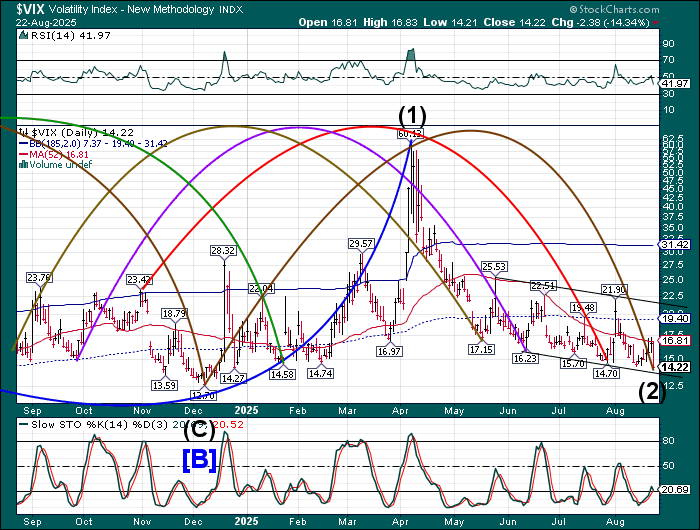

VIX futures have risen to a morning high at 15.64, hovering beneath the 50-day Moving Average at 16.11. The Cycles Model calls for increasing trending strength by the end of the week. The rally may resume to the end of September with a potential target being the April 7 high.

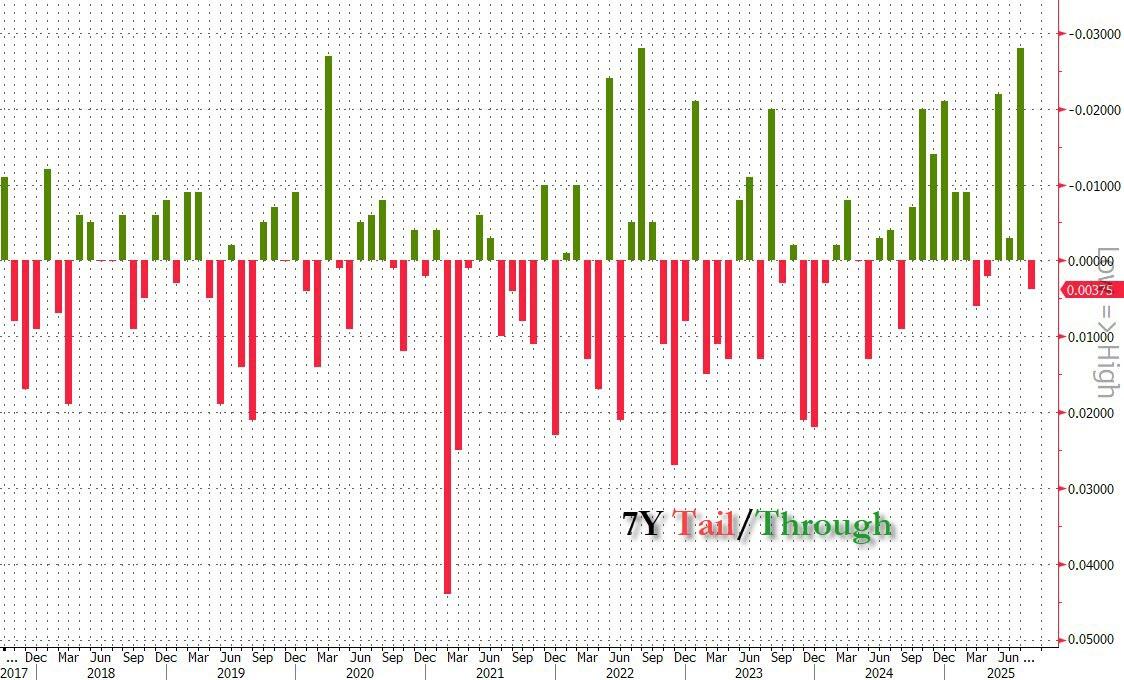

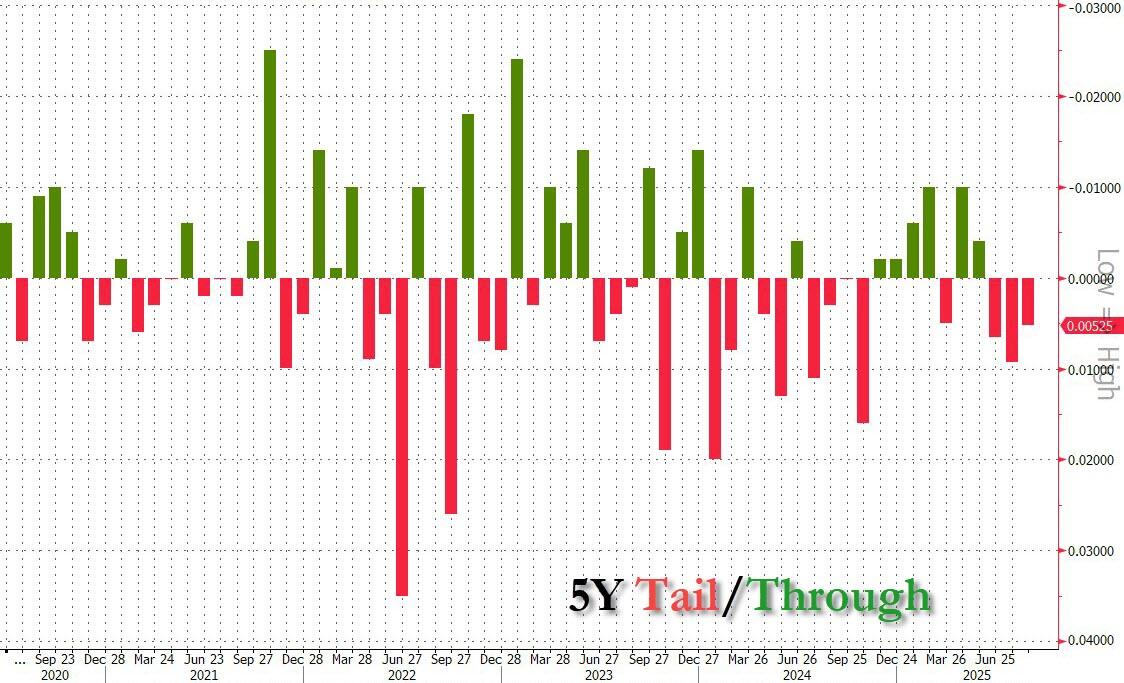

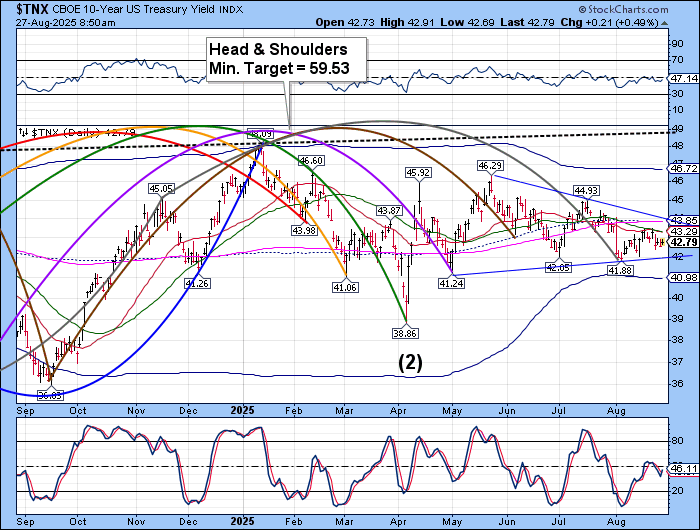

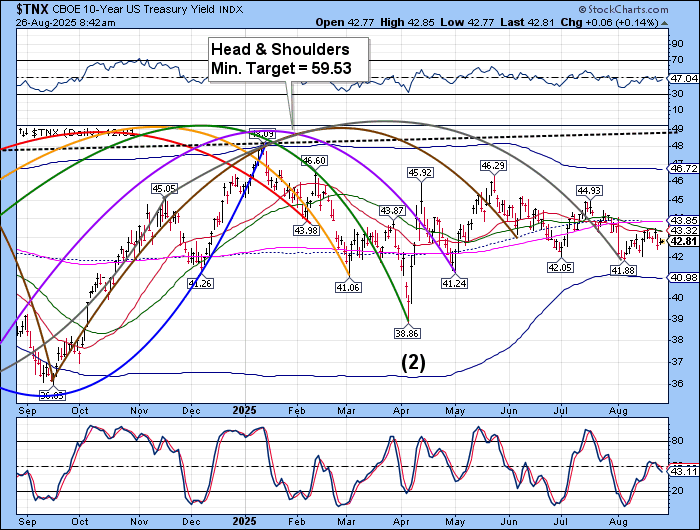

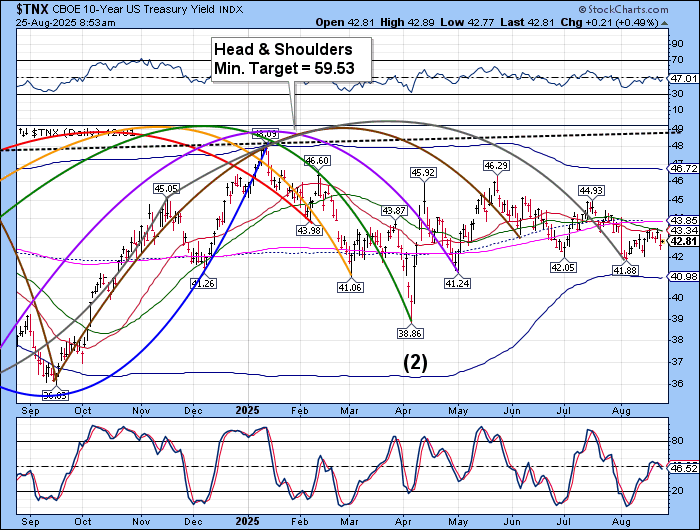

TNX futures are hovering above Friday’s low, but beneath the Cycle Bottom resistance at 40.98. The Cycles Model suggests declining 10-year rates to the end of the month. A possible target may be the April 4 low at 38.86.

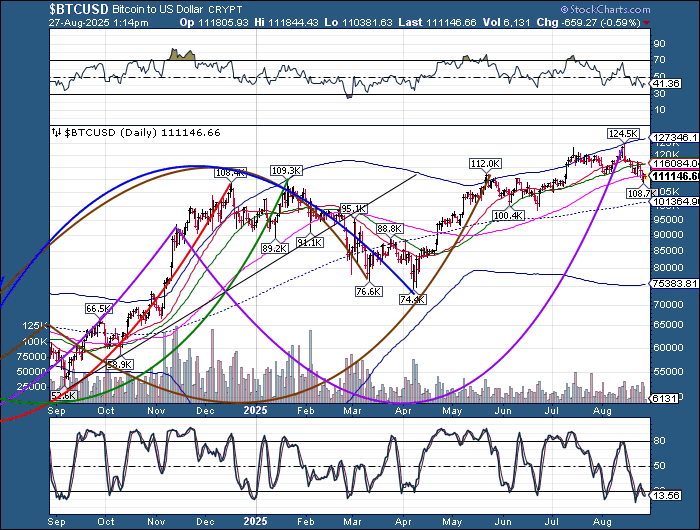

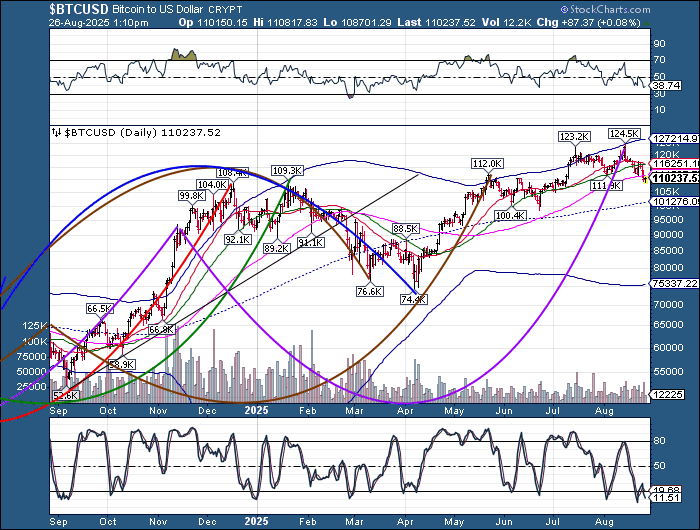

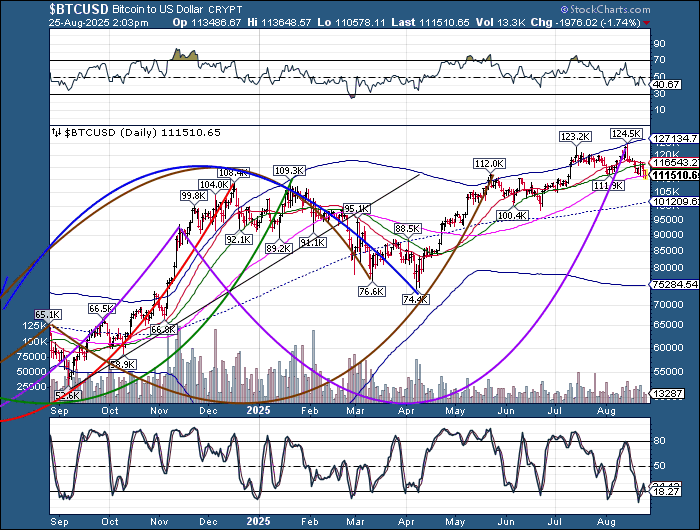

Bitcoin continues to hover near its 100-day Moving Average at 111817.00. The key observation is that it remains beneath its 50-day Moving Average at 115513.00. Should it remain so, the signal may be neutral.

The gold rally continues with new all-time highs today. However, the rally is weakening and the Cycles Model suggests the rally may end soon. While the futures may have made the Cycle Top resistance, the cash market (CME) has not.

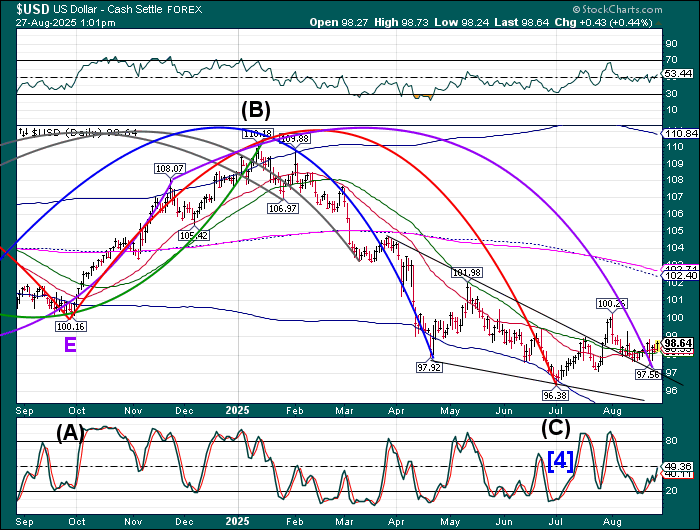

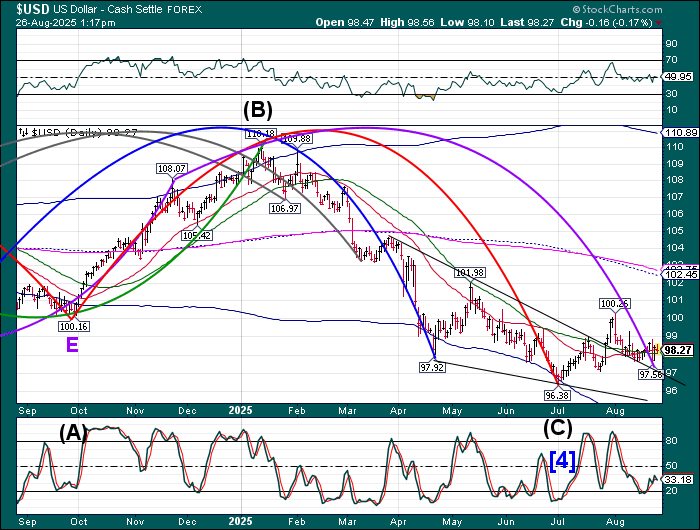

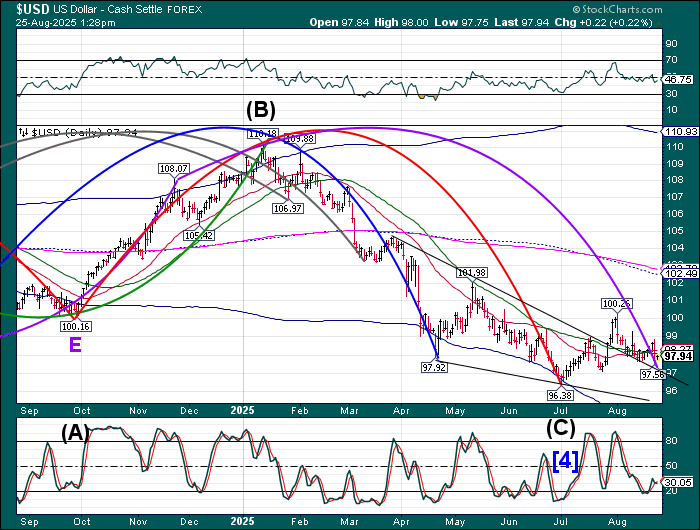

USD futures threaten new lows this morning. the decline may continue to mid-September. A possible target may be near 95.00, bringing back the USD bears.