The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

9:45 am

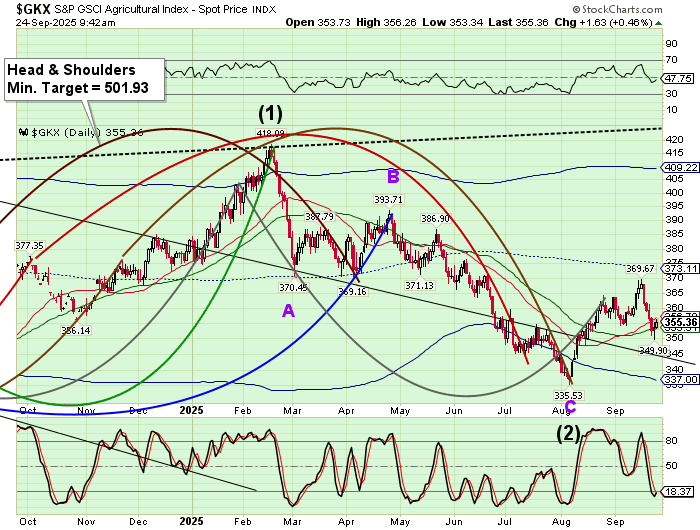

The Ag Index is correcting after its rally from its Cycle low in August. It may continue to decline to mid-October, but may provide an opportunity to “buy the dip.” The price of foodstuffs may rally dramatically due to global unrest and weather-related shortages.

ZeroHedge observes, “American farmers and ranchers who have sold or exchanged livestock due to drought conditions are eligible for tax relief, the IRS said in a Sept. 22 statement.

Generally, livestock sold due to drought must be replaced within four years. Under the latest extension, farmers and ranchers who had sold livestock due to drought, with replacement periods scheduled to expire by the end of 2025, will now have until the end of the 2026 tax year to make replacements.”

TheEpochTimes comments, “You have doubtless seen the price of beef at the store. It is shocking, outrageous really, ticking up higher and higher each week. When all this began four years ago, many people assumed that prices would settle back down after the crisis ended. That has not happened. The problem is getting worse, not better.

Checking in on the CPI for ground beef, we were shocked to see double-digit rates of inflation. The price of beef steaks in five years has gone up fully 50 percent and keeps rising.

8:00 am

Good Morning!

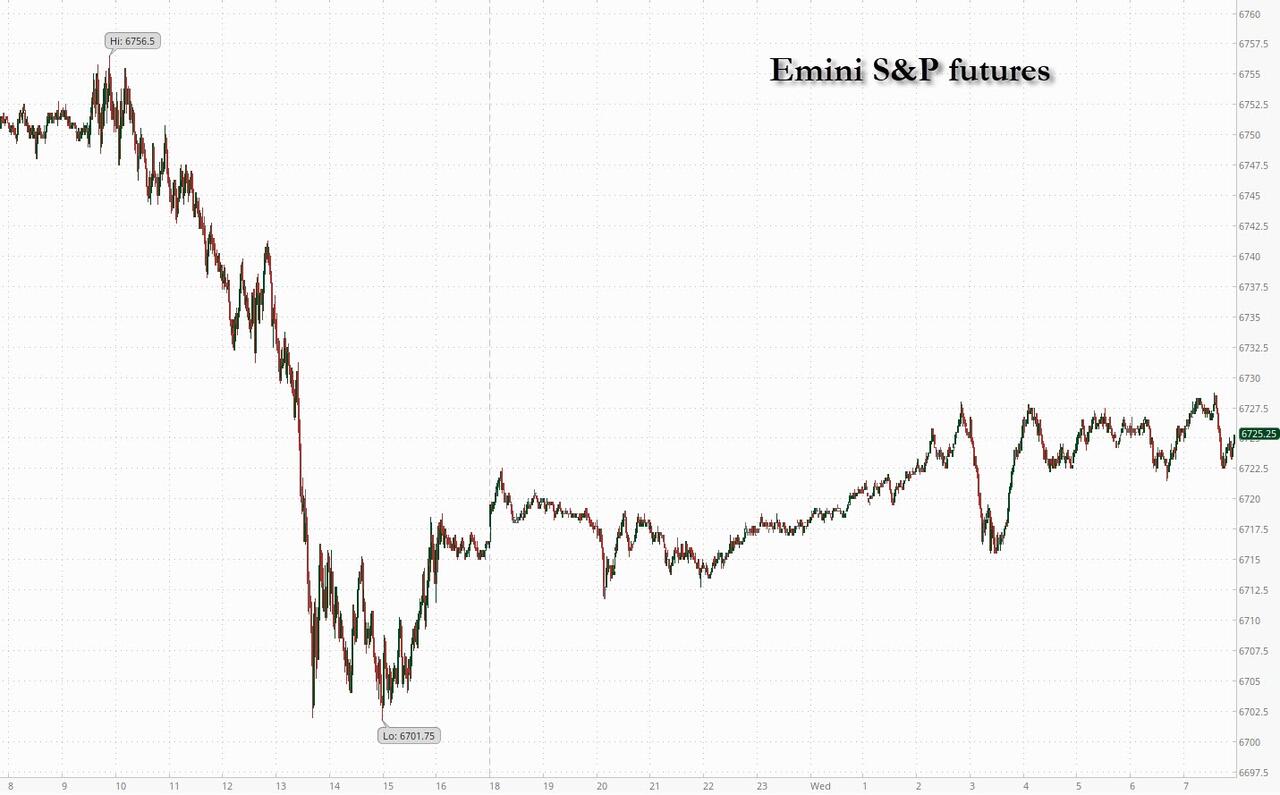

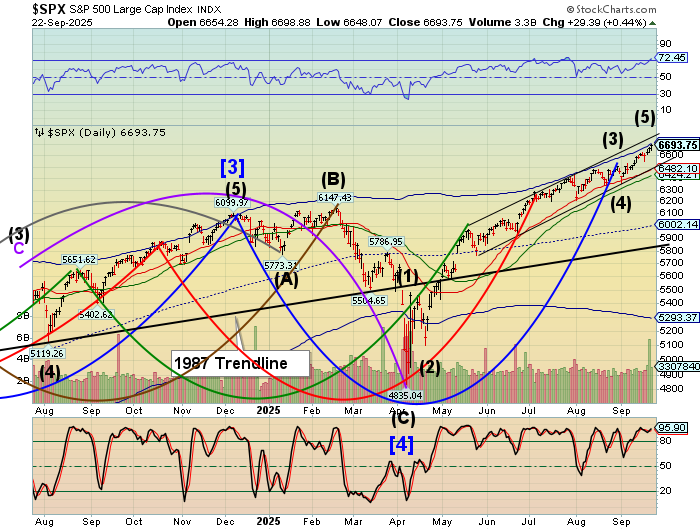

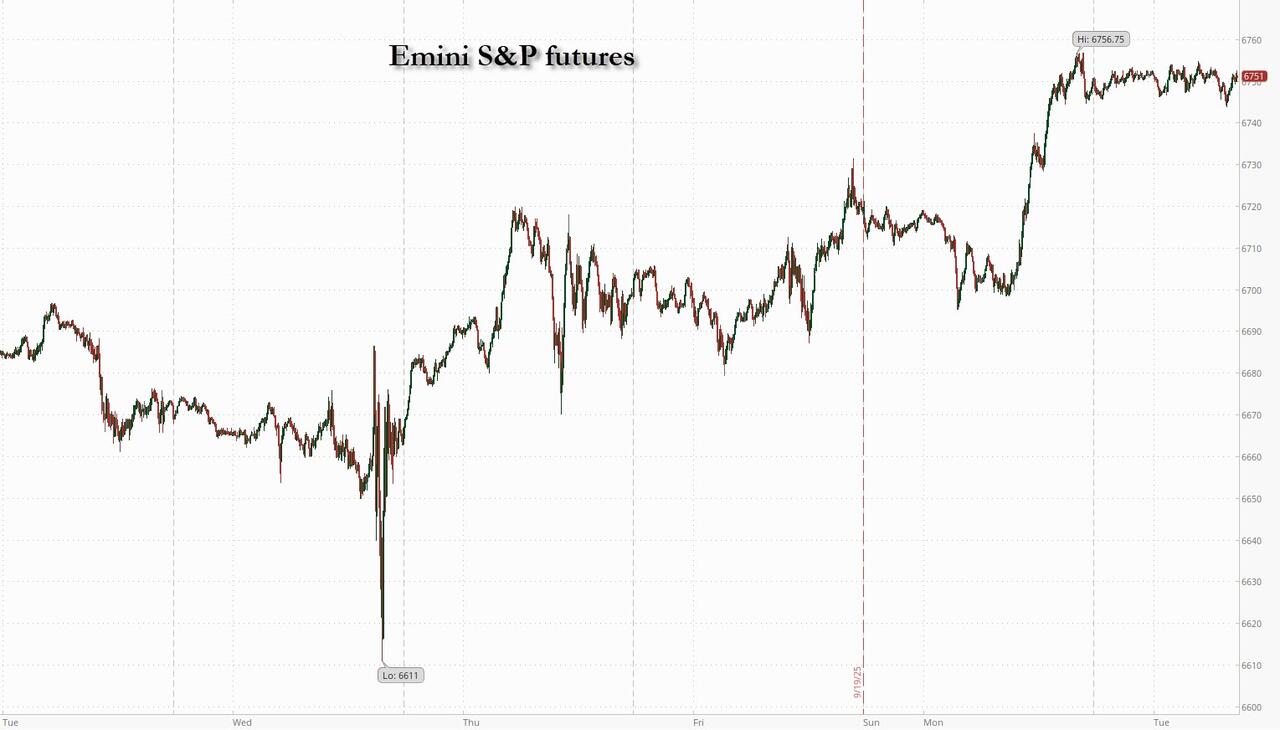

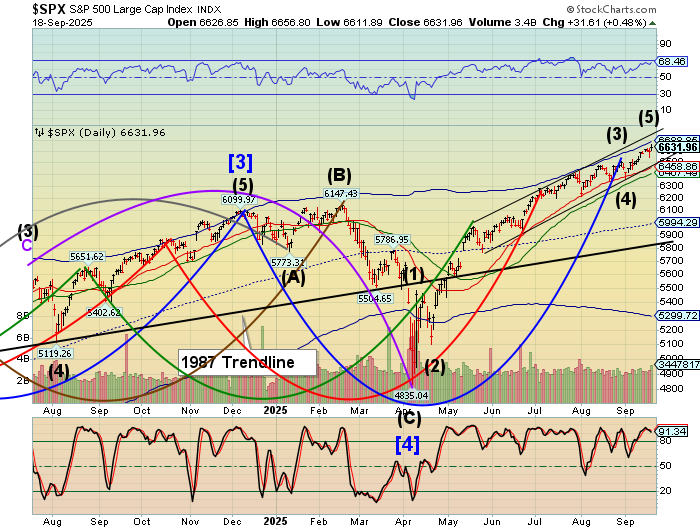

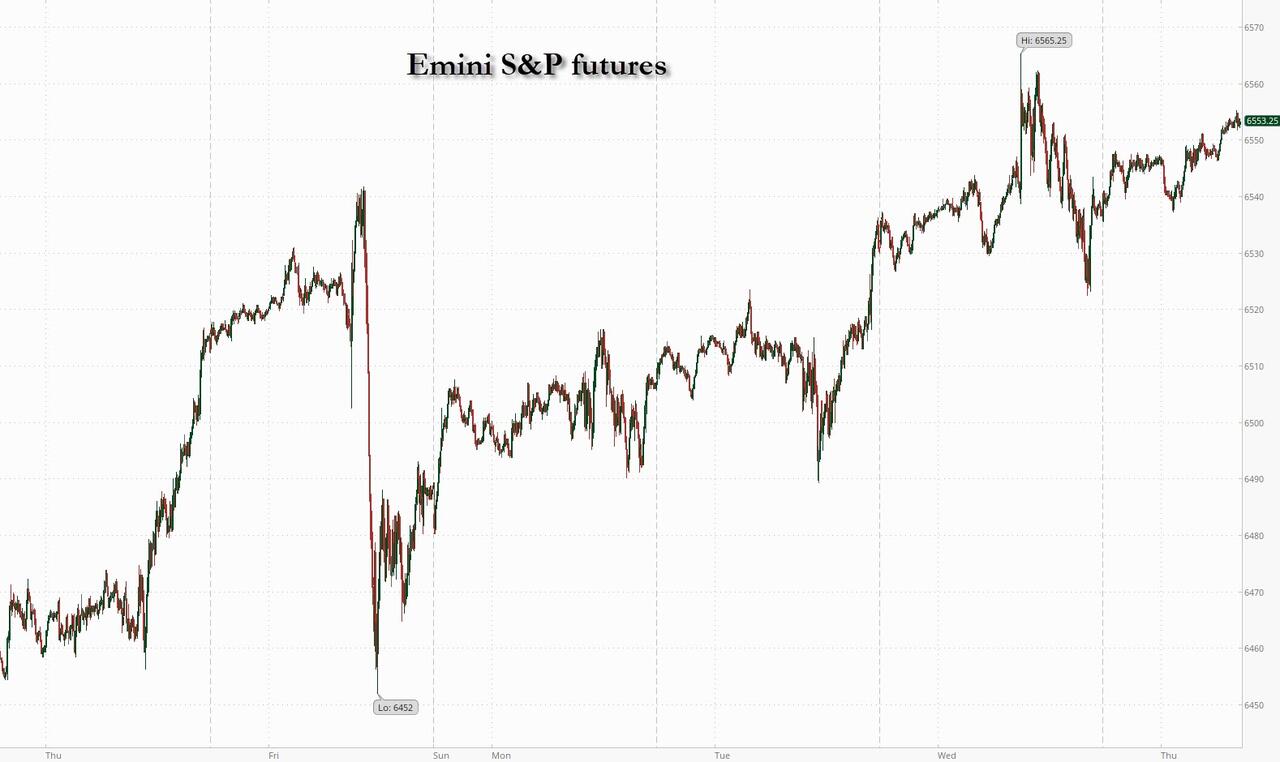

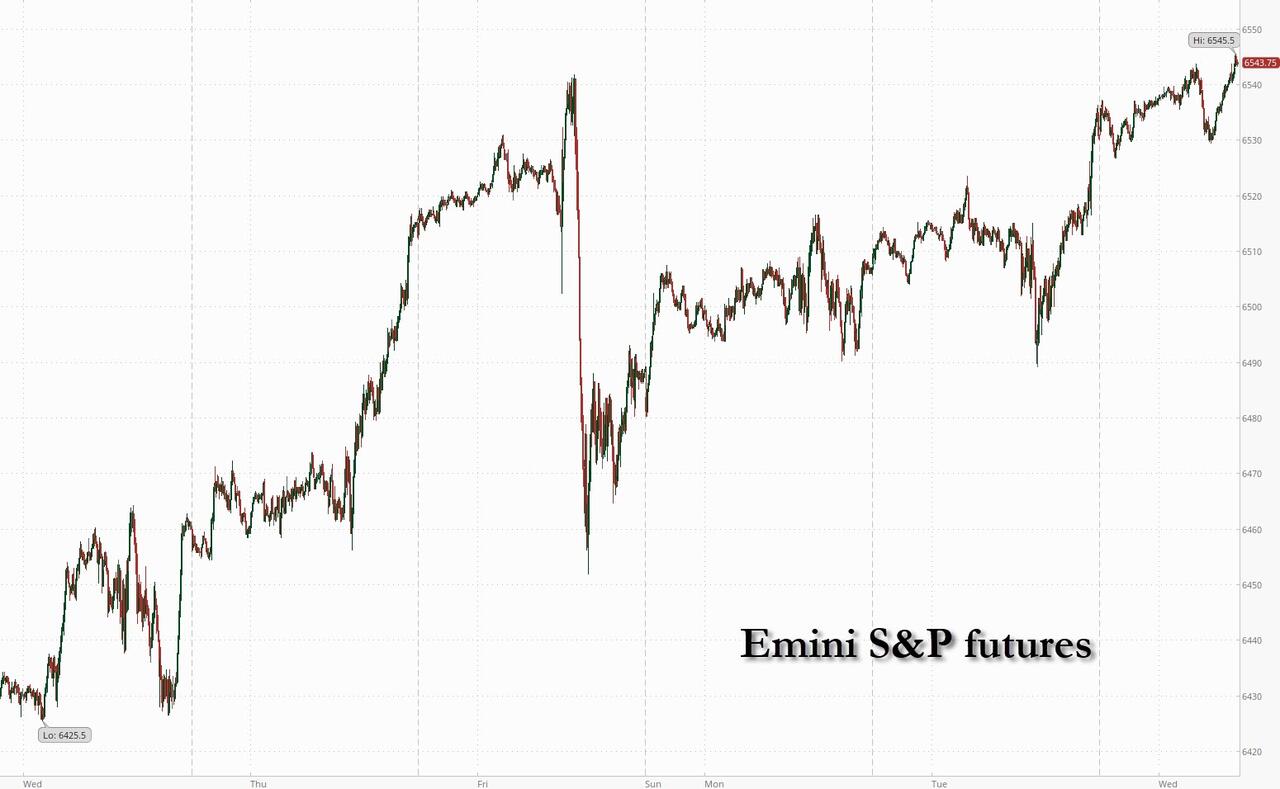

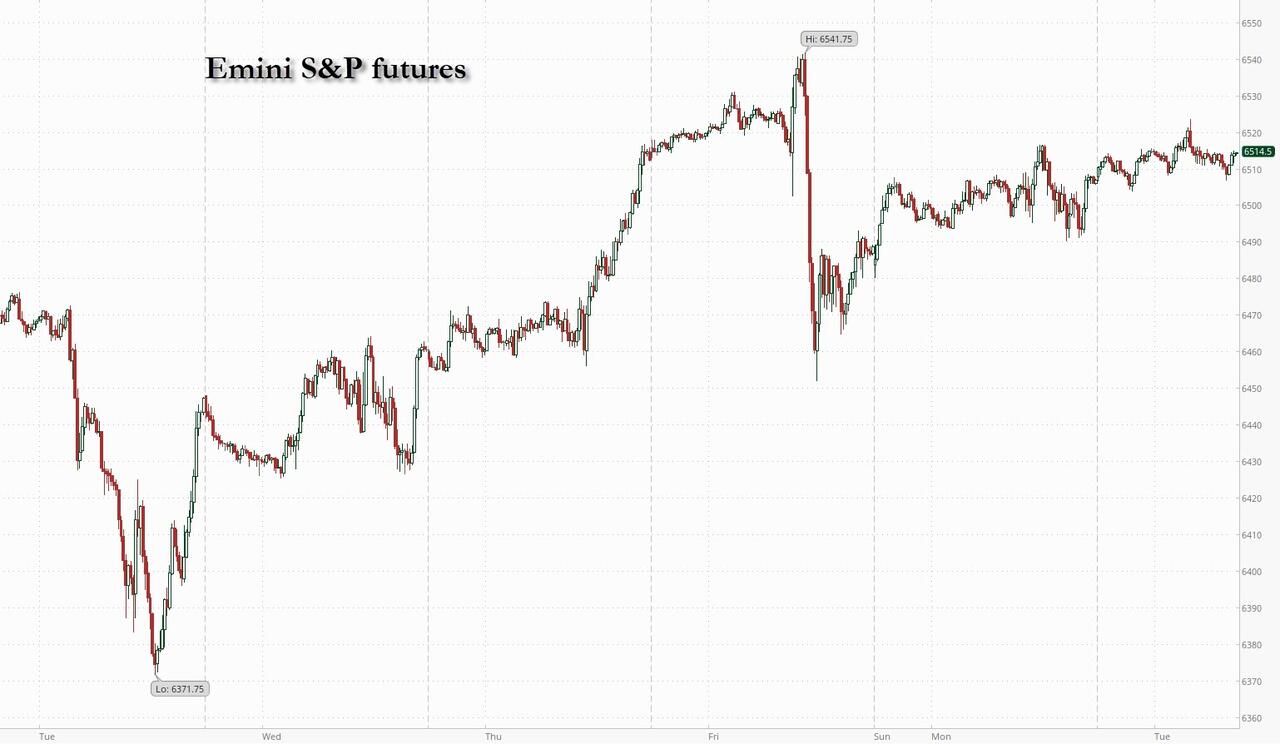

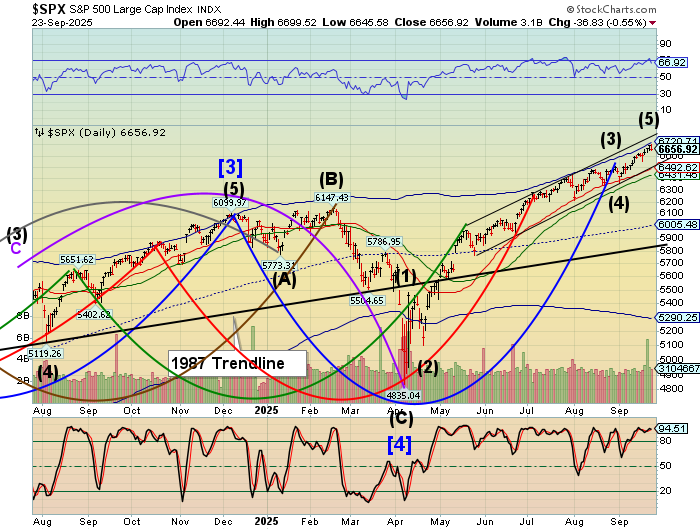

SPX futures made a 50% retracement of yesterday’s decline thus far. The absence of a new high may be an early sign that the uptrend may be over. Rejection at the Cycle Top resistance currently at 6720.21 was anticipated at this late stage in the Master Cycle. The trendline supporting the uptrend lies near 6500.00. It may be too early to call the top, but the conditions are there for a strong reversal. The Cycles Model calls for growing strength of trend for the balance of the month. Should the reversal take place, the Model infers a decline into early October. The conditions are right for a serious decline with the corporate buyback blackout and end of quarter rebalancing either selling or abstaining from new purchases during the earnings reports. Retail investors have been steadily losing confidence witnessed by the record-breaking use of call options instead of direct participation in the market. Markets thrive on confidence and decline on the fading belief that markets can be trusted.

Today’s options chain reveals Max Pain at 6670.00. Long gamma comes in above 6685.00 while short gamma rules beneath 6650.00.

ZeroHedge reports, “US futures are once again higher after taking a brief pause yesterday, led by Tech, with all of Mag7 higher pointing to a stronger open as Alibaba’s spending promise and Micron’s upbeat outlook lift sentiment on AI. Global stocks resumed their rally after a pledge by China’s Alibaba for more spending (now the mere promise of more capex is sufficient to send your stock ripping) and Micron’s upbeat forecast lifted sentiment on AI (even higher… if that’s possible). As of 8:00am ET, S&P and Nasdaq futures rose 0.2% after big tech’s slide in the prior session broke a streak of records; Mag 7 are all green led by AMZN, +1.6% while TMT is boosted by Micron rising +1.5% after strong earnings underscored the boom’s ongoing momentum. Semis were bid after Alibaba jumped 9% in typhoon-hit Hong Kong on plans to boost AI spending beyond an initial $50 billion target. According to JPM, the AI-theme should perform well today (when does it not), including Critical Metals. Cyclicals are leading Defensives. The curve is steepening as 2Y yields are -2bps and the 10Y rises 3bps to 4.13% as the USD is bid up for first time this week. Trump said that Ukraine, with NATO help, has the tools to win back all of its Russian-occupied territory, included continued US weapons sales to NATO, and should shoot down Russian planes that enter its airspace. Gold held near all-time highs. Today’s macro data focus is on Home Sales, Building Permits and Mortgage Apps.”

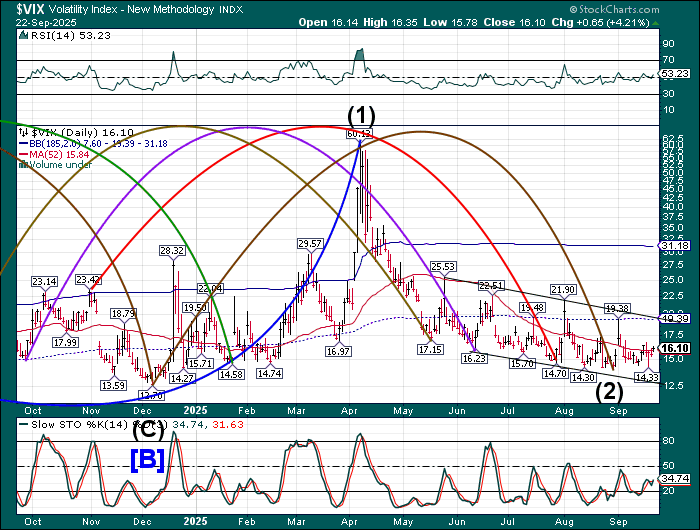

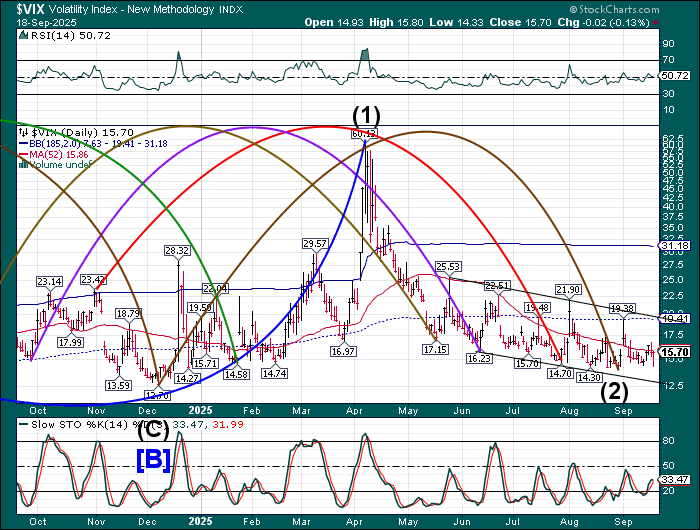

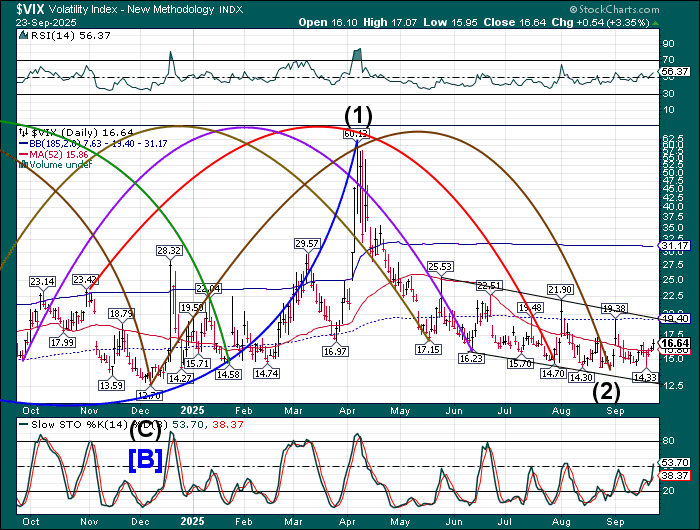

VIX futures consolidated within yesterday’s trading range, remaining above the 50-day Moving Average at 15.86. VIX gave an early buy signal which should not be ignored. Trending strength may be due for a pickup this week, which may be accompanied by a breakout above the trading channel and more substantial recognition of the new trend. The Cycles Model suggests a possible rally into early-mid October.

Today is (weekly) options expiration for the VIX, so this report is on the October 1 expiration. Max Pain resides at 17.00. Short gamma is strong at 15.00-16.00 while long gamma ig gaining adherence above 20.00 with conviction fading above 25.00.

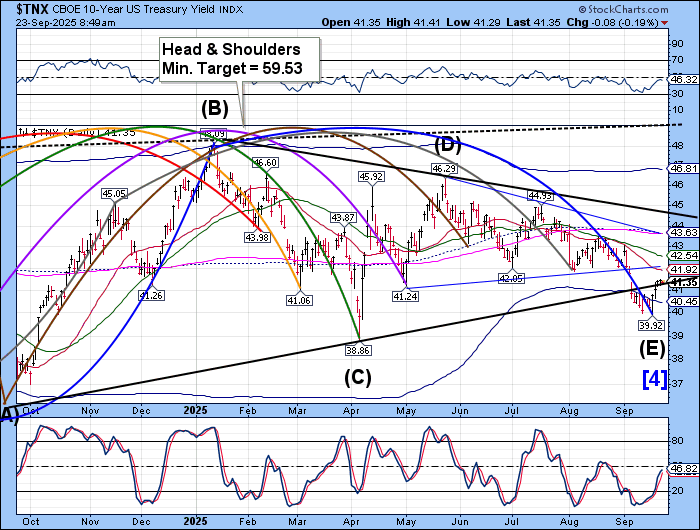

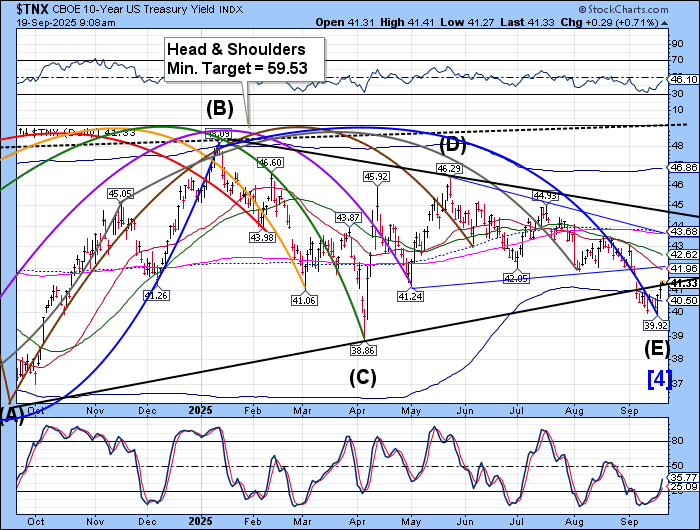

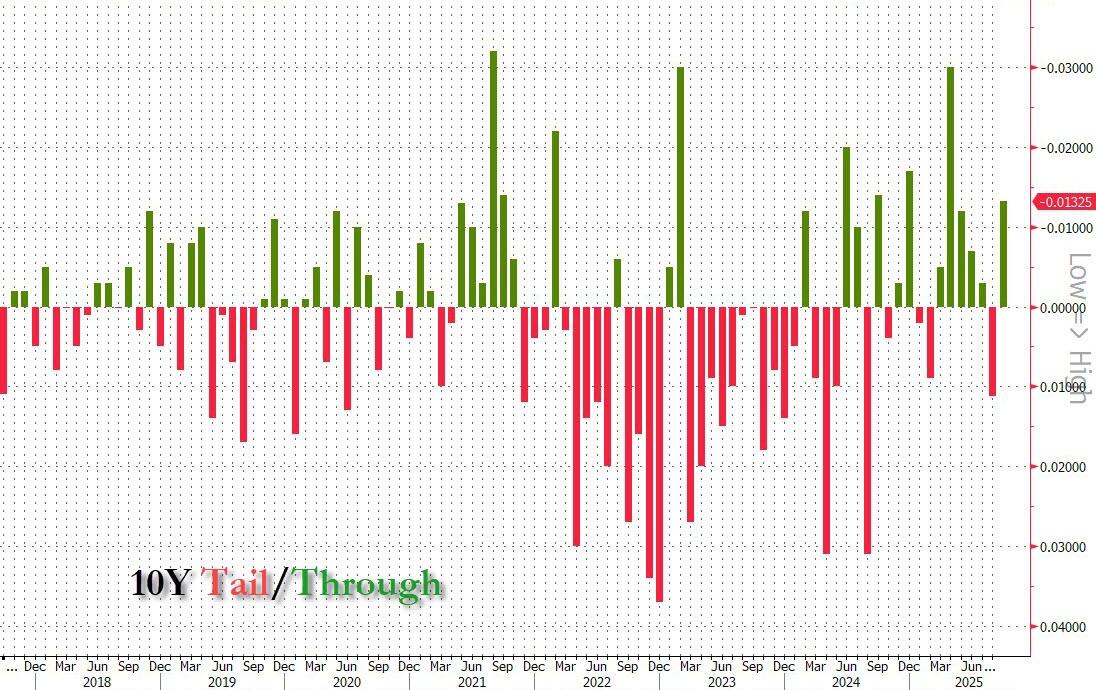

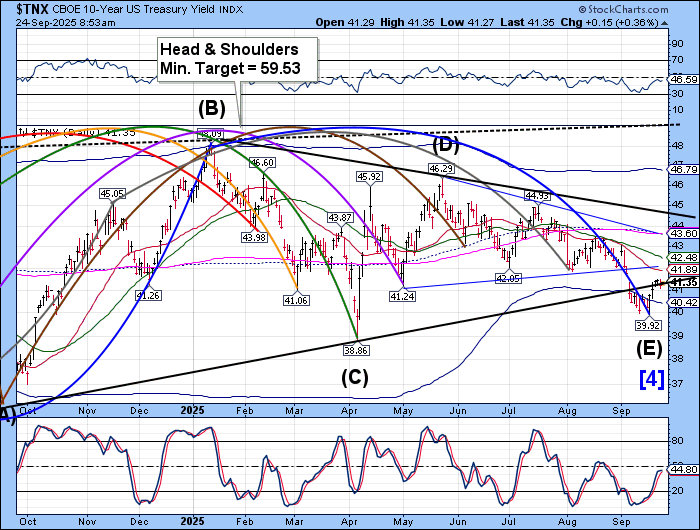

TNX has stalled near the Triangle trendline at 41.25. It may be due for a burst of energy that allows it to test the 50-day Moving Average at 42.48 in the next few days. Subsequently, it may be due for a correction lasting about 3 weeks. The recent plunge in rate volatility has been painful for institutions that have purchase hedges against rising rates. This may cause them to drop their hedges (at a loss) in time for rates to start rising again.

ZeroHedge observes, “At the start of a new week of coupon issuance, the market (the bond market at least) has been remarkably stable, with yields today barely budging and trading where they closed last Friday, just around 4.13%. Which is why the market barely moved after today’s 2Y auction passed without a glitch.”

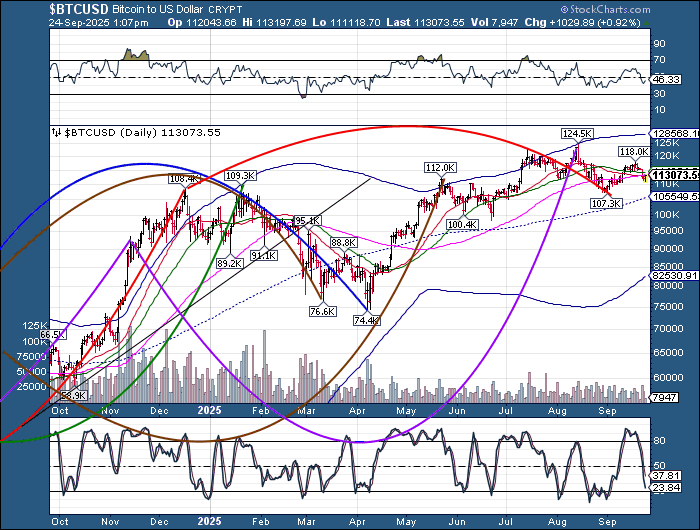

Bitcoin is consolidating beneath its 50-day Moving Average at 114254.00. The Cycles Model offers a triple dose of trending strength through the weekend, suggesting a strong decline ahead, lasting to early-to-mid-October.

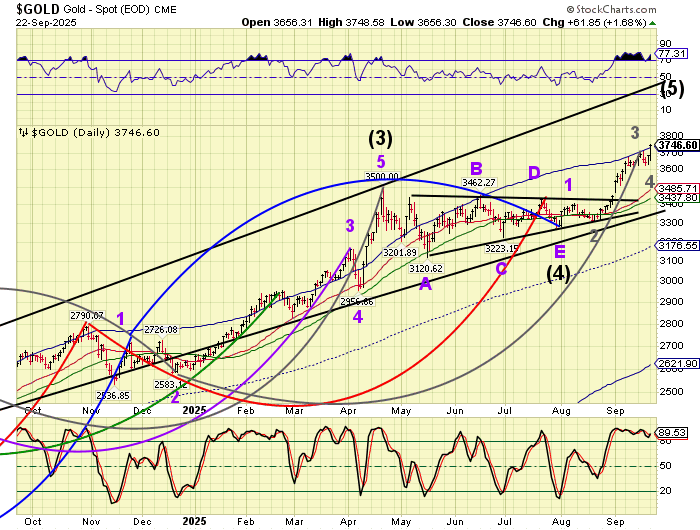

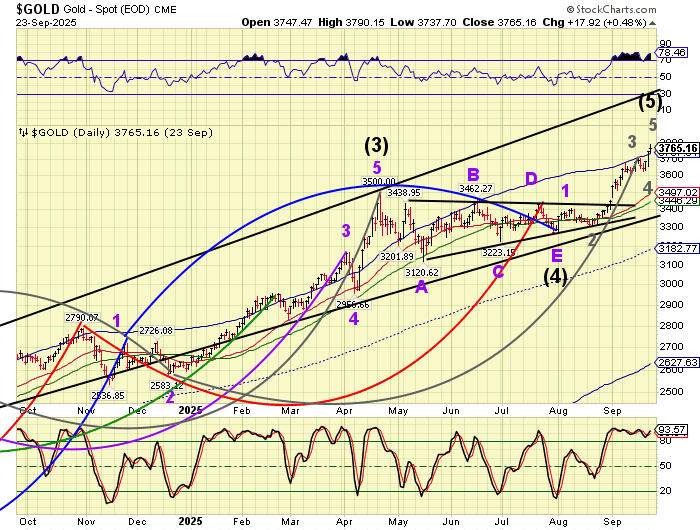

Gold futures are consolidating above the Cycle Top support/resistance at 3737.00. A decline beneath that level may precipitate a sell signal as the rally completes its final probe to an all-time high. The Cycles Model suggests that, once the reversal is made, a decline may follow to mid-November.