The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen

8:00 am

Good Morning!

SPX futures rose to 6956.20 this morning, above the Ending Diagonal trendline at 6927.00. A decline back beneath it may send the SPX to test the 52-day Moving Average at 6825.00 before another, larger bounce. Amplitude is increasing, but not to the level of panic. The Cycles Model suggests that panic days may arrive next week and repeat into the first week of February. Analysts suggest that stocks remain in the primary trend with bounces appearing to make stocks bulletproof. However it is clear that the degree of difficulty is rising. This is only the opening act.

Today’s options chain shows Max Pain at 6935.00. Long gamma may strengthen above 6950.00 while short gamma rises to 6930.00. This morning’s rally may have been a dealers’ move to rise out of short gamma. It may not last.

ZeroHedge reports, “US equity futures are higher led by Tech stocks which bounced back on Thursday after chipmaker TSMC revived confidence in the durability of artificial-intelligence demand, as signalling a strong outlook with $56BN in CapEx spending in 2026 (a 25% increase), restoring confidence in global AI growth and sending Europe’s ASML to a record high.”

NDX futures bounced after piercing its 52-day Moving Average at 25345.00, rising to 25755.70. It must rise above 25 873.00 to have any chance of a new ATH. Currently the all-time high remains at October 29 at 26182.00.

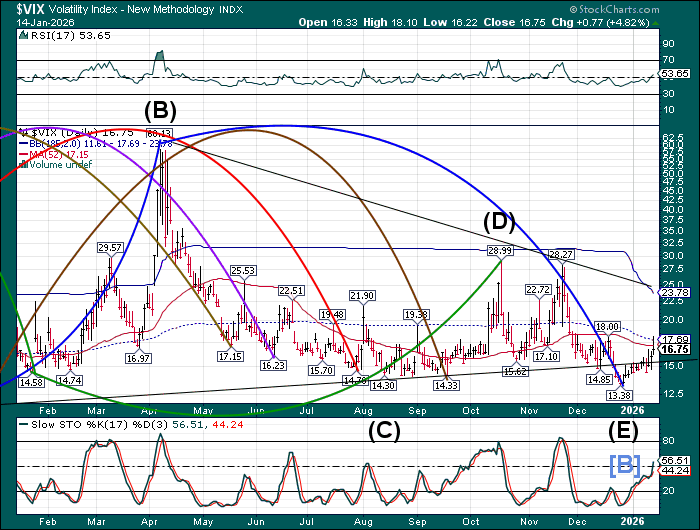

The VIX pre-market dropped to 16.02 this morning, remaining above the trendline after breaking above its December high. The 52-day Moving Average was exceeded, giving a buy signal for the VIX. The next couple of moves may elevate the VIX to the Cycle Top before a retracement. The Cycles Model suggests a panic move may begin this weekend.

The January 21 (monthly) options chain shows Max Pain at 19.00. Short gamma is very crowded between 14.00 an 18.00. Long gamma may begin at 20. There is large institutional presence up to 110.00. Do they know something that we don’t?

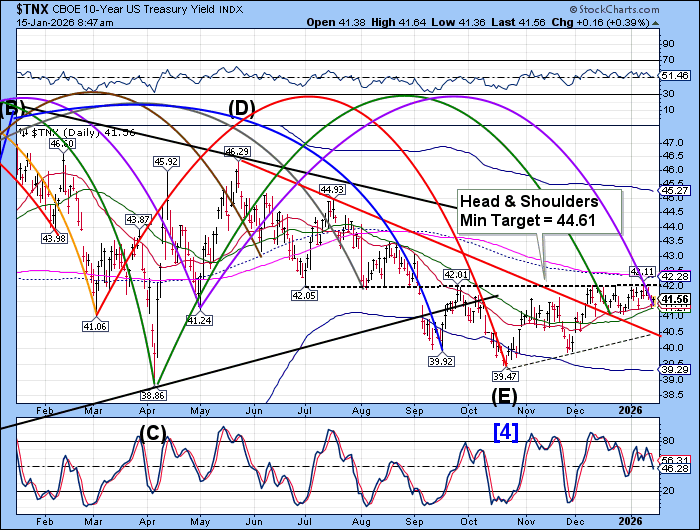

TNX bounced from the 52-day Moving Average yesterday at 41.32, Making a Master Cycle low on its due date. Bond volatility has crashed since last April, but is starting to show some life again. A breakout above the Head & Shoulders neckline at 42.05 may create a panic Cycle, sending the TNX toward its Cycle Top at 46.27. The Cycles Model infers potential panic days starting as early as tomorrow with subsequent recurrences through mid-February.

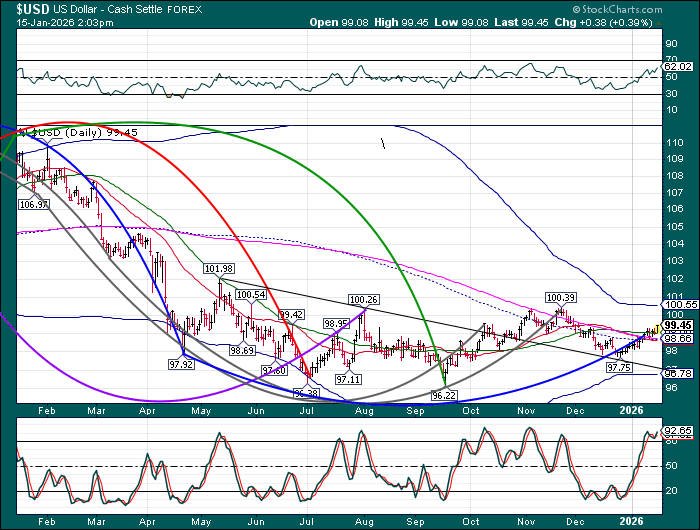

USD rose above its 52-day Moving Average at 98.99 this morning, confirming its buy signal. The January 9 high at 99.16 may have been the terminus of its Master Cycle. If so, the USD may phase-shift into a new Master Cycle that has a potential to extend to mid-March. A breakout above the November high at 100.39 may erupt into massive short covering, fueling the continuation of the rally.

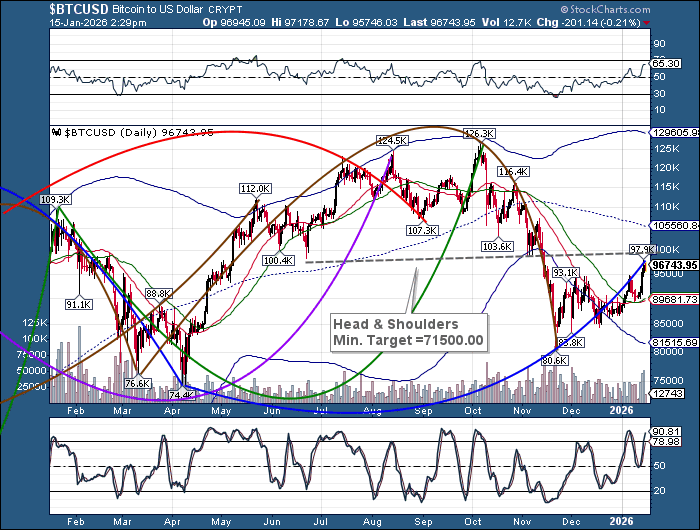

Bitcoin may be reversing from its Master Cycle high made yesterday at 97943.00. Tis is an example where the Cycle time was stretched to meet the Cycle price beneath the neckline of the Head & Shoulders formation. The reversal may turn into a sharp decline to the Head & Shoulders target in early February.

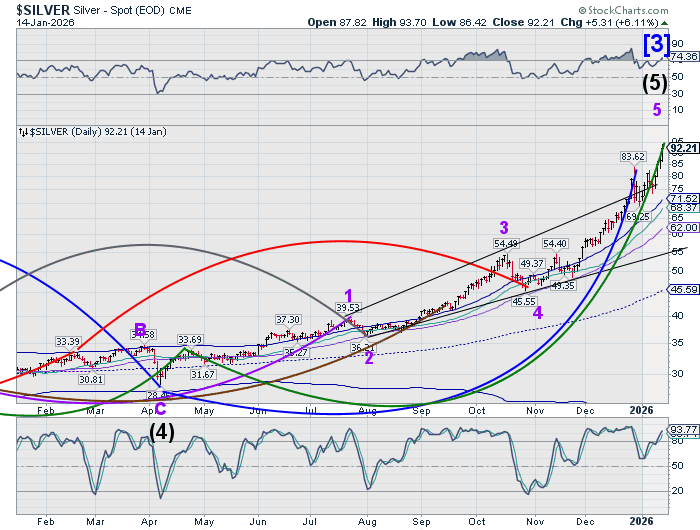

Silver futures pulled back to 86.20 from yesterday’s possible Master Cycle high at 93.70. As warned, silver may correct substantially over the next month. The amplitude of potential corrective moves may be extreme. Caution is advised, as the decline may revisit the lower trendline at 60.00. The Cycles Model suggests corrective moves may be made until early April.

ZeroHedge reports, “President Trump said on Wednesday he had opted against imposing tariffs on rare earths, lithium and other critical minerals – for now – and instead ordered his administration to seek supplies from international trading partners.”

Gold futures may also be coming off their high at 4650.00 on January 14. A decline beneath its Cycle Top at 4557.00 may give gold an aggressive sell. Gold may correct until early April as well.