The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen

11:20 am

SPX declined beneath the trendline at 6935.00, testing short gamma beneath 6940.00…and didn’t like it. It has swung back to 6950.00 where long gamma rules. It needs to stay above the trendline to maintain its uptrend. A breakdown beneath it brings short gamma into play, setting the stage for a panic decline going into next week.

10:06 am

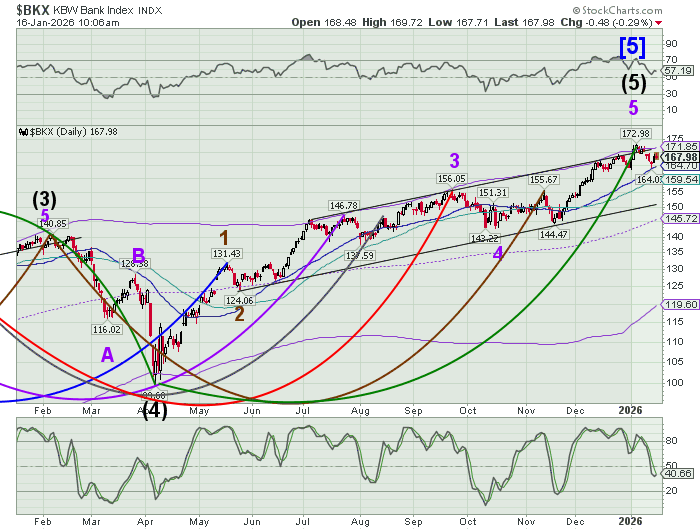

BKX has ;reversed down from its 61.8% Fibonacci retracement bounce this morning. A sell signal may be generated with a move beneath Intermediate support at 164.70. Additionally, the 52-day Moving Average lies at 159.54, beneath which another sell signal may be made. Finally, a decline beneath the trendline at 151.00 breaks the uptrend.

7:45 am

Good Morning!

SPX futures bounced off the Ending Diagonal trendline at 6935.00 in the overnight session, consolidating beneath yesterday’s high. The decline is likely to resume today, with an aggressive sell signal beneath the trendline. The sharp bounce yesterday may have been a result of pension (dumb) money, combined with buy-the-dip retail investors and dealers attempting to keep the index out of short gamma. Liquidity it thinning while the Mag 7 have been whittled down to 1…Google. How long can that last? Upward momentum has been lost. There are any number of catalysts that may weigh down on equities. Today we may expect some large moves…going nowhere.

This morning’s monthly options expiration is in. SPX may open beneath long gamma, which starts above 6950.00. Today’s closing expiration shows Max Pain at 6945.00. Long gamma begins above 6950.00 while short gamma may begin beneath 6940.00. This may be a battle royal to the close.

ZeroHedge reports, “Futures are higher, and trading near record territory, led by tech as this year’s great rotation shows no sign of slowing, broadening the base of names driving Wall Street’s push back towards all time highs. As of 8:00am, S&P 500 futures were 0.3% higher with Nasdaq 100 contracts up 0.4% as the latest wave of enthusiasm for technology stocks carried into Friday.”

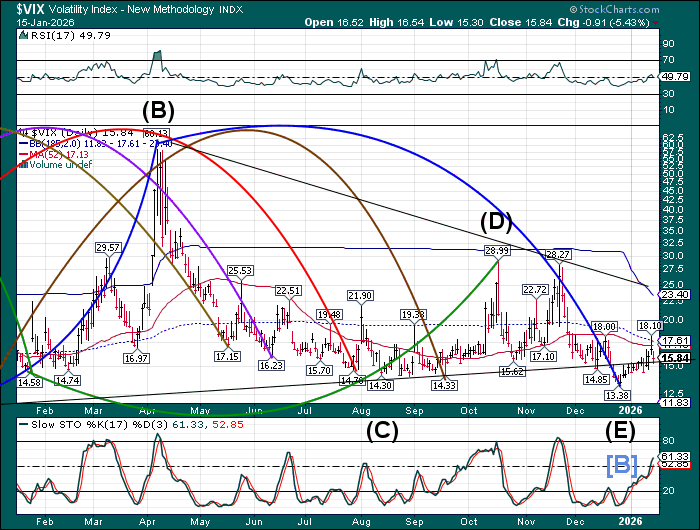

The premarket VIX has consolidated above the trendline near 15.35. The Cycles Model anticipates rising volatility with a possible panic move beginning this weekend. The next two weeks may be violent in the VIX. Low volatility does not mean low risk. The loss of momentum in the Mag 7 leaves the market more sensitive to shocks.

The January 21 options chain shows the VIX may be loaded for bear beneath 17.50 with over 850,000 put contracts. However, there are 1,580,000 call contracts between 18.00 and 30.00. Furthermore, there is a buildup of large institutional holdings of calls every 5 points up to 100. This is the first monthly options chain with a preponderance of long gamma in the VIX.

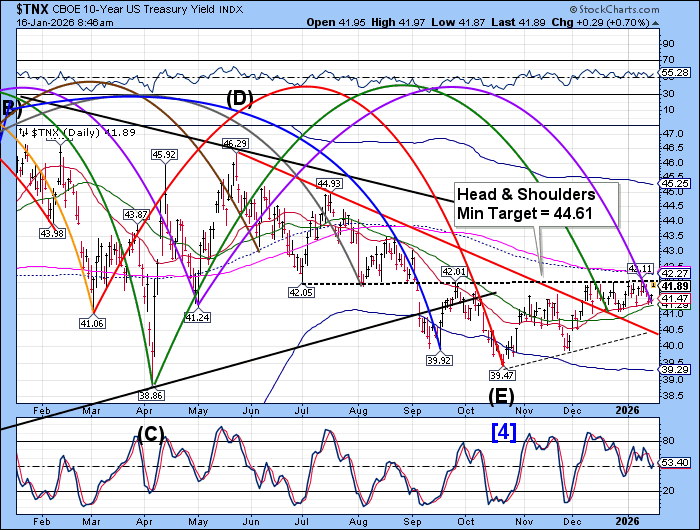

TNX leaped up to 41.97 from its Master Cycle low that bounced from the 52-day Moving Average at 41.29 on Wednesday. Signs of inflation are mounting. Trending strength is reappearing today, with a possible breakout above the neckline at 42.05. The next four weeks show multiple days of strength, suggesting a breakout may lead to a rally to the Cycle Top at 46.25.

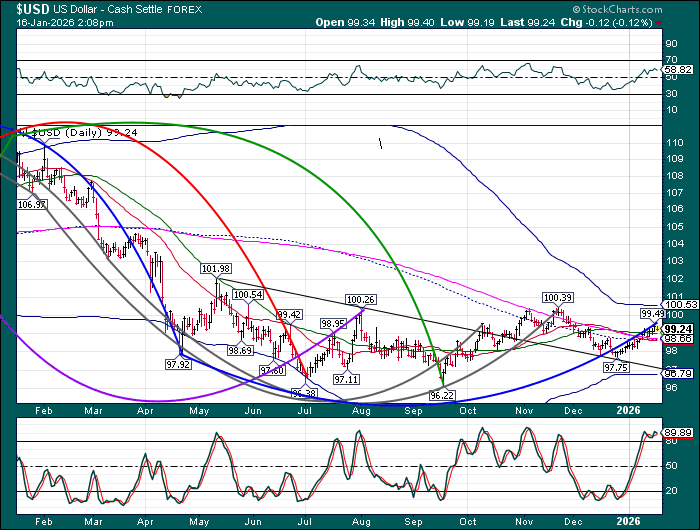

The US Dollar Index pulled back to 99.19 after making its Master Cycle high yesterday. Intermediate support and the mid-Cycle support lie at 98.66, proposing a shallow correction lasting only a few days before the trend reasserts itself. Next week may bring two panic upside days bringing possible pain to the dollar shorts. The breakout above the November high may be profound, as short covering dominates the USD.

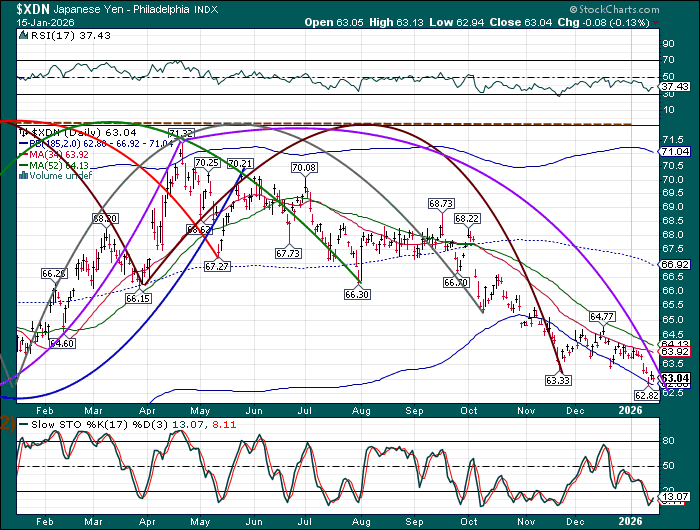

The Japanese Yen may have a final probe toward 62.00 to complete its Master Cycle. A reversal may be imminent, as the Bank of japan is conducting its monetary Policy meeting this weekend. An announcement of higher key interest rates may result, as the BOJ attempts to stem the declining Yen. A reversal of this declining 10-month trend in the Yen may result, putting pressure on the Yen carry trade, both in rising interest and rising loan principal.

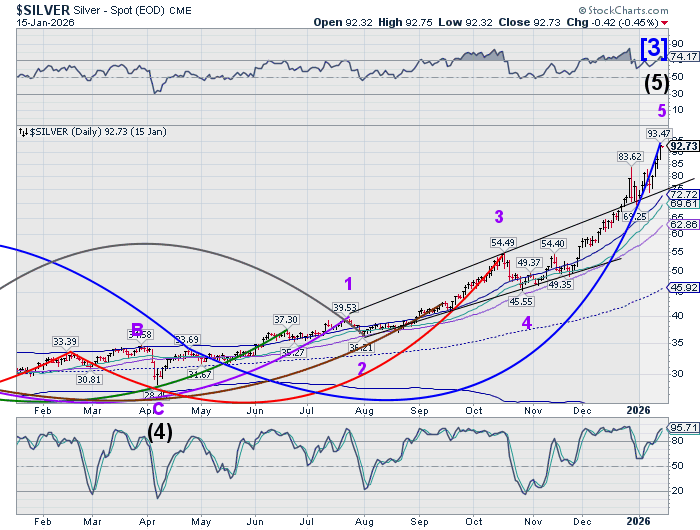

Silver futures declined to 87.38 in the overnight market, leaving the January 14 ATH intact. The down candle is the largest since 1980. The Cycles Model implies a possible two-month correction. While the word “correction” sounds mild, silver may decline to its mid-Cycle support at 46.92 – a 50% decline from the top. There is no sell signal yet. Only caution is advised.