10:58 am

SPX has bounced from its lows this morning as dealers buy back this morning’s short options after the open. Resistance is at the 50-day Moving Average at 5921.26. Thereafter, the decline may resume with a big put wall at 5800.00. Short gamma begins at 5900, so there may even be an attempt to hold SPX there.

7:45 am The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

Good Morning!

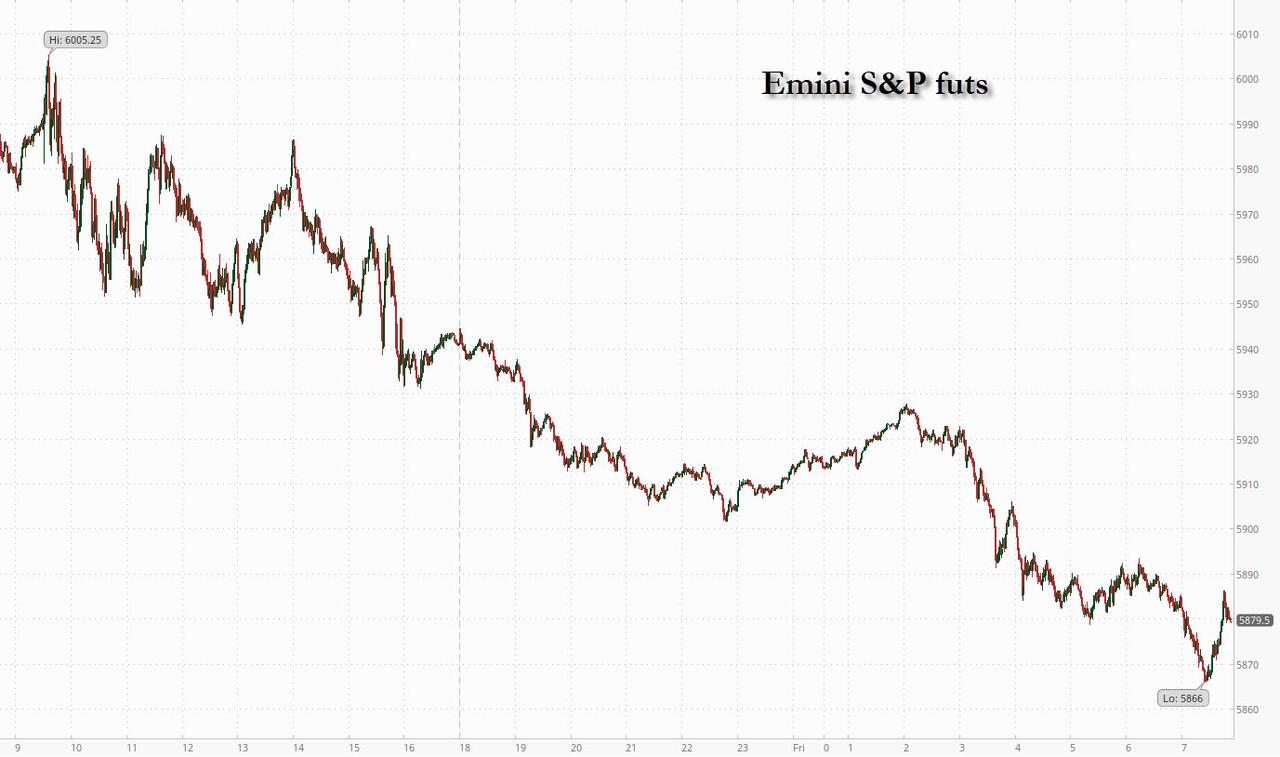

NDX futures declined to a morning low of 20744.00 thus far, crossing beneath the 50-day Moving Average at 20781.03. This is widely recognized as a confirmed sell signal. Today approximately 40% of all listed companies go into their blackout period, where stock buybacks are curtailed. In addition, hedge funds and CTAs may have hit their “sell” levels. In addition, leveraged funds must start unloading to raise collateral. Margined accounts may start getting calls on stocks that have fallen hard. The chaos may increase as the Cycles Model also suggests the decline may be strengthened today and until Christmas.

Today’s options screen appears to be closed as it is Triple Witching day.

Investopedia remarks, “The triple witching hour is the last sixty minutes of the trading day on the third Friday of March, June, September, and December, when contracts for stock index futures, stock index options, and stock options, expire simultaneously.”

SPX futures have reached a morning low of 2801.20 thus far. The Cycles Model indicates that selling may continue through the holidays as stock buybacks are being curtailed. In addition, the 50-day Moving Average at 5918.15 has been left behind. Equities ar at a “make or break” level. Analysts are holding out hope that the 100-day Moving Average at 5747.77 may provide support. With two weeks left in the current Master Cycle, the 1987 Trendline near 5300.00 may be a significant support.

The morning expiration shows Max Pain at 5910.00. Long gamma has the upper hand above 6000.00 while short gamma gains ascendancy beneath 5900.00. The afternoon expiry shows 5800.00 as the most intense battle zone where both puts and calls contracts number over 50,000. Thus we see that 5800.00 is a “must hold” level for the dealers.

ZeroHedge reports, “US equity futures and global markets are broadly risk-off to end a turbulent week after the US House rejected a temporary funding plan backed by Donald Trump (38 republicans voted against the bill) which would have avoided a gov’t shutdown that otherwise will start a midnight, with trade war concerns mounting (Trump said “I told the European Union that they must make up their tremendous deficit with the US by the large scale purchase of our oil and gas. Otherwise it is tariffs all the way!!!”). Expect elevated volumes today due to the last option expirty/quarterly rebalance of the year. As of 8:00am ET, S&P futures are down 0.8%, Nasdaq futs tumble 1.4%, with technology stalwarts such as Tesla and Nvidia sliding in early trading as momentum reversed with a bang. Europe’s Stoxx 600 weakened 1.7% as Novo Nordisk A/S fell by the most on record on the back of disappointing data from a treatment trial; the rest of the world not much better: FTSE -95bps, DAX -1.3%, CAC -1.05%, Nikkei-29bps, Hang Seng -16bps, Shanghai -6bps. 10Y treasury yields dipped a little after surging in the past three days, down 2bps to 4.54%, with the Bloomberg US dollar index also easing back a bit as both the yen and euro gain. Bitcoin tumbled amid the riskoff mood, sliding as much as 8% to a low of $92K and dragging down MicroStrategy Inc. and other crypto-related companies in premarket trading. Oil reversed earlier losses with gold also rising on expectations of aggressive Chinese stimulus. Today’s economic calendar will see the November core PCE, personal income and spending as well as the latest UMich data.”

VIX futures rose overnight making a morning high at 26.51 before pulling back thus far. The pullback may find support at the Cycle Top at 23.58. The Cycles Model suggests that trending strength may intensify today and remain strong through next week. While volatility spikes tend to fade, as it did in August, today’s backdrop is structurally different. There is much more leverage in equities and leveraged ETFs must sell in down markets regardless of liquidity. In addition, bond convexity is troublesome.

The December 24 options chain shows Max Pain at 18.00. Short gamma still dwells between 14.00 and 17.00. Long gamma may begin above 20.00, but conviction fades at 28.00. There may be some surprises over the weekend.

TNX pulled back to 44.98 this morning after breaking out of its perceived (1 year) downtrend. The fact is, TNX never lost its longer-term uptrend held since July 2020. Having noted that, the current Master Cycle still has three weeks to go. Structurally, Wave 3 cannot be the smallest Wave. By definition, the minimum rally may be to 50.00.

Bitcoin is testing its 50-day Moving Average at 91807.29 this morning. This is not good for the longs as volatility may be increasing the weekend and next week. The problem with Bitcoin investors is that the do not have a sell discipline. Today may be a pivot point where selling may become imperative.