1:40 pm

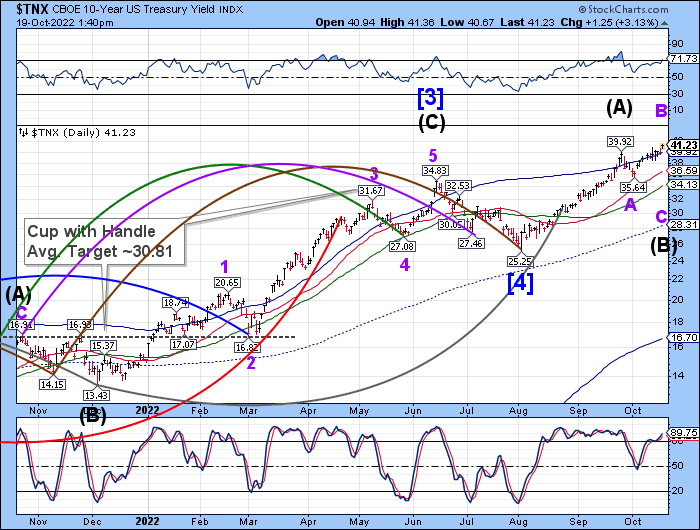

TNX has spiked higher, partially due to the Band of England putting bonds on the market in November ad partially due to the reaction the bond market in the US has received. Today’s 20-year Treasury auction is the pits.

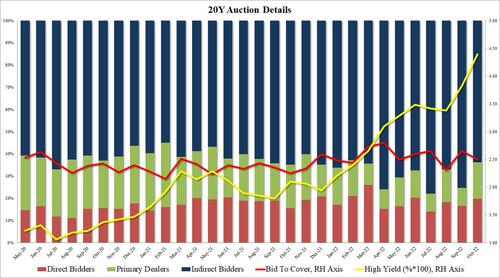

ZeroHedge remarks, “While it’s safe to say that nobody expected a solid 20Y auction today, today’s reopening of 19-year 10-month cusip TK4 was a debacle.

Pricing at a high yield of 4.395%, this was the highest yield since the 20Y tenor returned in May 2020 (and far above last month’s 3.820%). It also tailed the 4.370% when issued by 2.5bps, the biggest tail in the auction’s 2.5 year history. Ugly.

The bid to cover was 2.50, below both last month’s 2.65 and the six-auction average of 2.58. Also ugly.

But what was most notable is that while Foreign buyers took down just 63.7% of the auction, the lowest since February, and far below the 72.4% recent average – extremely ugly; and with Directs awarded 19.9% (above the recent average of 16.8%), Dealers were left holding 16.4%, far above the six-auction average of 10.8% and the highest since January. Definitely ugly.”

1:30 pm

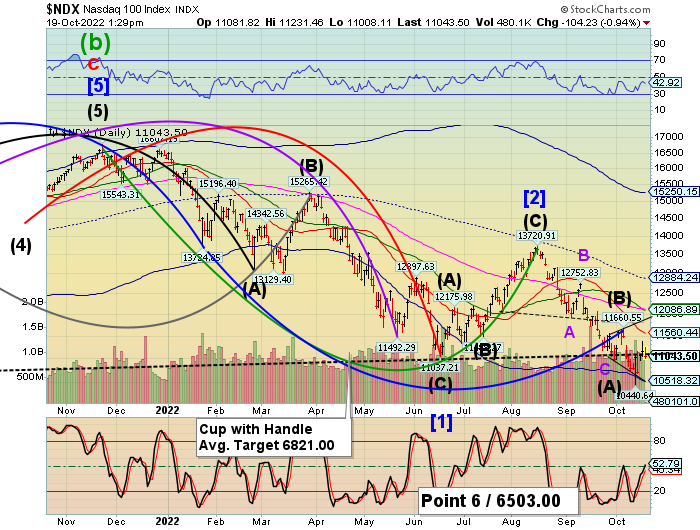

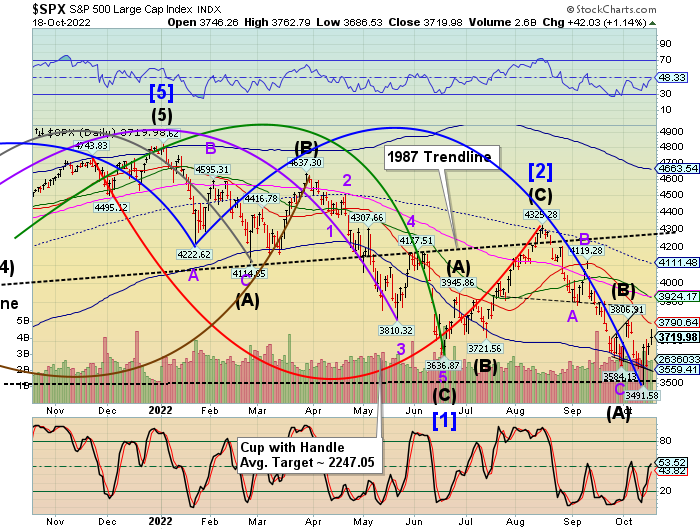

NDX has declined beneath the Lip of the Cup with Handle formation at 11100.00. This may trigger a panic decline that may last up to 16 market days (22 calendar days). The target is illustrated on the chart. Keep in mind this is an estimated target that may fall short or be exceeded. Should this be a panic decline, we may see several 10% down days. We may also see bounces that may cause people to lose their short positions.

10:08 am

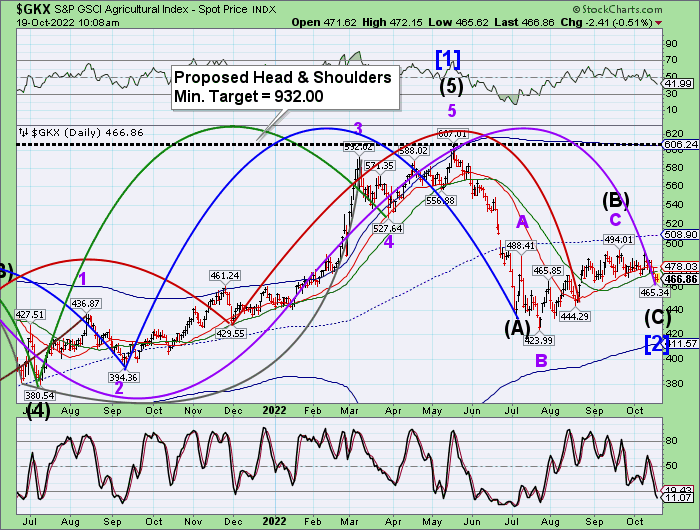

The Ag Index may be forming a Master Cycle low. Yesterday’s low was on day 259, but the correction may be missing a final probe to the low in the next few days. This may be an ideal time to accumulate shares (DBA) of the Ag Index. The rise in food prices is multi-dimensional, as discussed below.

ZeroHedge reports, “Supply chains across the Midwest face significant constraints as a portion of the Mississippi River is closed again.

Bloomberg reported a stretch of the Mississippi River, about 125 miles northeast of Memphis, near Hickman, Kentucky, closed Monday as water levels continue to plunge.

Dredging operations began in the afternoon to clear debris from the waterway. The US Coast Guard said three vessels and 51 barges were waiting in the line at Hickman.

According to the National Weather Service, waters in Memphis reached negative 10.79 feet and continue to decline, reaching record-low levels. ”

8:15 am

Good Morning!

SPX futures rose to 3761.70 in the overnight session, but declined beneath 3700.00 since then. Wild swings are still common as short gamma rules the options market. The Cycles Model shows 16 days left to the bottom of the current Cycle.

Today’s op-ex shows Max Pain at 3705.00 Long gamma starts at 3740.00, while short gamma begins at 3700.00.

ZeroHedge reports, “US stock futures erased overnight gains of over 1% as worries about the impact of scorching inflation and a looming recession took the shine off a strong start to the corporate earnings season. Contracts on the S&P 500 dropped 0.4% in an extremely illiquid session at 7:15 a.m. in New York after earlier rising as much as 1.1%. Nasdaq 100 futures were also down 0.4%, despite a boost from a better-than-expected report from Netflix which sent the stock soaring 13% in premarket trading.

Behind the sudden, violent slump is today’s renewed surge in interest rates which pushed the 10Y Yield to 4.10%, the highest level since October 2008, potentially driven by news that the BOE would launch gilt sales on Nov 1.”

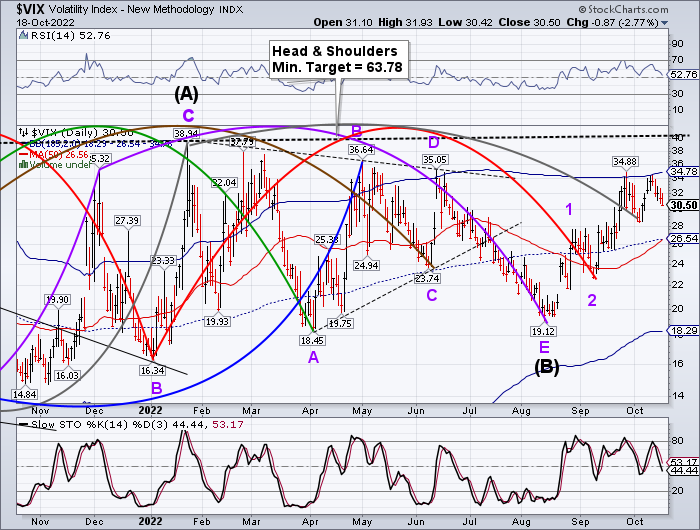

VIX futures rose to 31.50 this morning, but remained within yesterday’s trading range. VIX trading remains compressed in the upper half of its monthly trading range, The Cycles Mode suggests it may break higher.

Today’s options expiration sows Maximum pain for options investors at 30.00with Long gamma beginning at 30.00. Short gamma starts at 29.00 in a hotly contested options day. The next heavy options expiration day is November 16, with Max Pain at 30.00.

Invessting.com notes, “I’m back after a rare day taken off. Stocks finished mostly higher yesterday, with the S&P 500 rising by around 1%. The index finished at approximately 3,720, with options expiring on Friday and the big gamma level still at 3,700. I doubt we will see much and advance from here.

That gamma level should work to keep the S&P 500 index pegged at least until Friday morning, but we will see. What complicates things is that VIX options will expire today, which means we should see it begin to trade more freely and break either higher or lower from this 30 to 32 region.

TNX vaulted higher this morning on the announcement by BoE that bond sales would begin on November 1. The increased demand for US Treasuries is depressing the price of UST and increasing yields.

RealInvestmentAdvice suggests, “Last week, the FOMC published its minutes from the September meeting, confirming its recent stance that Fed rate hikes will continue until inflation is vanquished. To wit:

“Many participants noted that with inflation well above the Committee’s 2 percent objective and showing little sign so far of abating, and with supply and demand imbalances in the economy continuing, they had raised their assessment of the path of the federal funds rate that would likely be needed to achieve the Committee’s goals.”

As noted previously, the problem with this view is that the Fed is managing monetary policy based on lagging economic data.To wit:

“As the Fed continues to hike rates, each hike takes roughly 9-months to work its way through the economic system. Therefore, the rate hikes from March 2020 won’t show up in the economic data until December. Likewise, the Fed’s subsequent and more aggressive rate hikes won’t be fully reflected in the economic data until early to mid-2023. As the Fed hikes at subsequent meetings, those hikes will continue to compound their effect on a highly leveraged consumer with little savings through higher living costs.

Given the Fed manages monetary policy in the “rear view” mirror, more real-time economic data suggests the economy is rapidly moving from economic slowdown toward recession.”

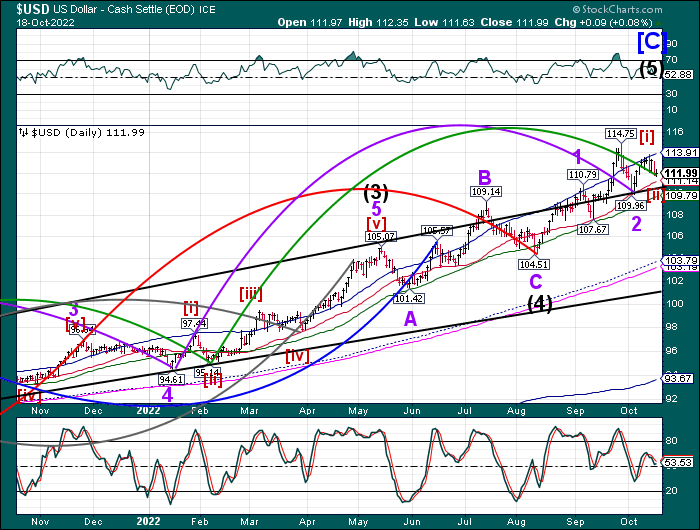

USD futures broke higher, to 112.86 this morning after a possible Master Cycle low yesterday on day 256. Another probe lower may be forthcoming in the next few days, so I may remain flexible.