9:54 am

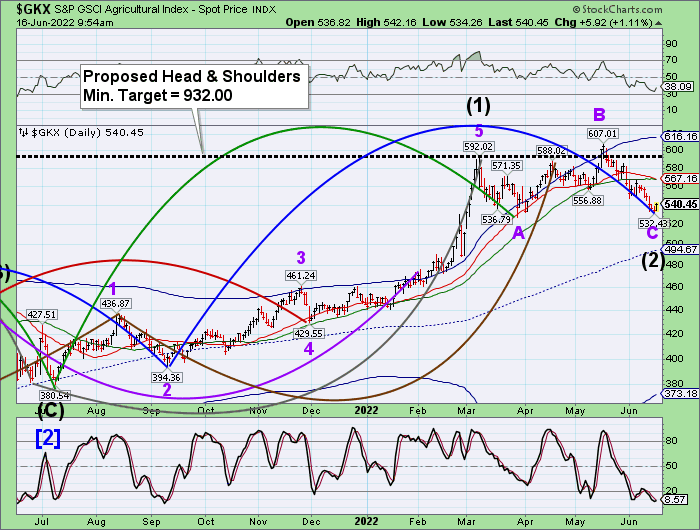

The Ag Index finally made its Master Cycle low yesterday, on day 277 of the last Cycle. This opens the door for a rally that may last until the end of July, the only long opportunity on my radar.

ZeroHedge observes, “There’s nothing like the sweet smell of Building Back Better…

Pennsylvania farmers are being “crushed” by the record cost of diesel – so much so, that questions about a food crisis are starting to loom, the Morning Call reported.

One farmer in Lehigh County is quoted as saying: “I’ve got a tractor hooked up to my corn planter out here, no diesel fuel, and I can’t afford to get any.”

The Heat Wave is taking its toll…

…as furious farmers go viral.

And food processors mysteriously go off line.

9:44 am

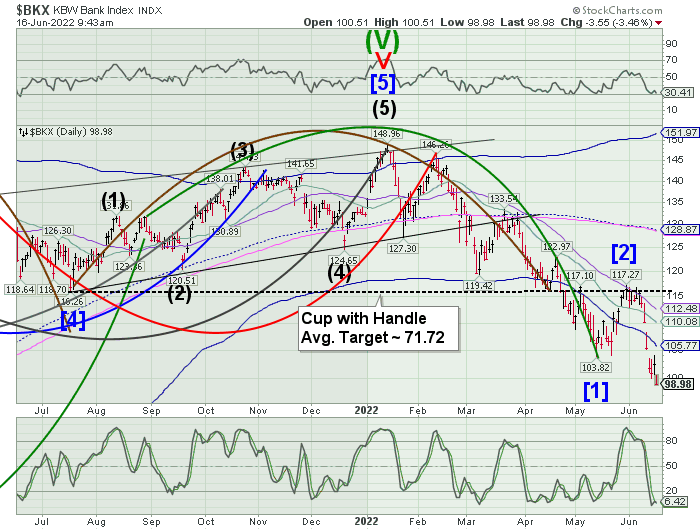

BKX, our liquidity proxy, is sinking to new lows in a Primary Wave [3]. The next Master Cycle Bottom appears in the week of July 18, post op-ex. This suggests that both June and July options expirations may be brutal for liquidity. Could we see a “no bid” market before the summer is over? A contracting economy and stock market may make banks more reluctant to loan for any reason.

Zerohedge observes, “Another day, another disappointing macro data point in the US economy. While ‘hard’ data has been tumbling, we now see the usual optimism-filled ‘soft’ survey data giving up hope as Philly Fed’s business barometer plunged into contraction in June (from +2.6 to -3.3), notably missing expectations of a small rebound to +5.0.

This is the first contraction since the COVID lockdowns of 2020…

8:05 am

Good Morning!

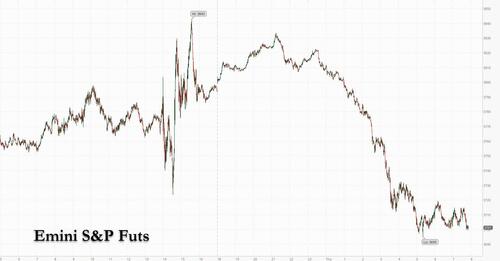

SPX futures mad a new low at 3692.30, promising more to come after a brief bounce. Equities followed their script, sucking in more bag holders prior to the close. Now they have to make a swift exit as dealers and hedge funds double down deeper into short gamma territory. Minor Wave 2 ended in an Orthodox Broadening Top, forecasting the possibility of a decline to 2300.00 in this Cycle. The Cycles Model made a small adjustment, since the 4.3-day decline previously mentioned began at yesterday’s close. There should be no respite until mid-morning on Wednesday when the SPX completes Waves 3, 4 and 5 of Intermediate Wave (3). The new bottom may give way to a 3-week rally followed by the next decline into mid-August. Another decline into mid-October. And a final decline into early November. By then investors will be so worn to a frazzle by all the false calls for a bottom, they will refuse to participate. I know. I have been there before.

Today’s options are deep into short gamma, with only 909 call contacts at 3750.00. There are pockets in the thousands of puts every 50 points down to 3000.00 today. They are lined up like dominoes. Tomorrow’s options expiration is even more dramatic, with pockets of puts in the tens of thousands. The number of put contracts at the 3000.00 strike is 55,111. This is now payback time for all the contracts that expired worthless. We may see a dealer or two fold.

ZeroHedge reports, “In our preview of how to trade the Fed’s 75bps rate hike, we said to expect a “kneejerk move higher (especially if we get an outsized hike, hinting the Fed is hoping to catch up to the curve), then a gradual drift lower” (a reco which was later echoed by Goldman). Sure enough, in the aftermath of the FOMC announcement yesterday, we got the knejerk move higher… and then overnight, the drift lower has also appeared tight on schedule, with futures tumbling in the US, undoing the entire post-FOMC move higher, and dragging global stocks lower as traders come to grips with the realization that 75bps of hikes – far from bullish – means that a recession is now on deck. As a result, S&P futures were down 2.2%, tumbling as much as 130 points from overnight session highs, while Dow futures puked a whopping 600 points as central banks lose control over markets. European stocks headed for a 16-month low and Chinese Internet shares dropped in premarket New York trading”

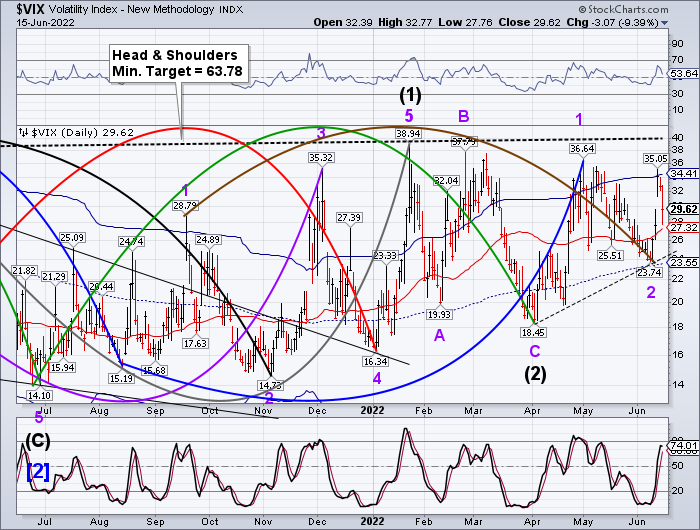

VIX futures rallied to 32.19 this morning, on its way above the Cycle Top to the Neckline at 40.00. VIX is now in long gamma with next Wednesday’s open interest at 4498 call contracts at 30.00 and 9131 call contracts at 35.00. open interest spikes every 5 points up to 50.00, where I stopped my research. This is a good point at which to buy VIX, as its peak doesn’t come until the third week of August, at options expiration. The breakout over 40.00 may cause a panic, as it hasn’t been that high since October, 2020.

As mentioned, the NYSE Hi-Lo Index opened at –35.00, but closed at -332.00 as the correction failed.

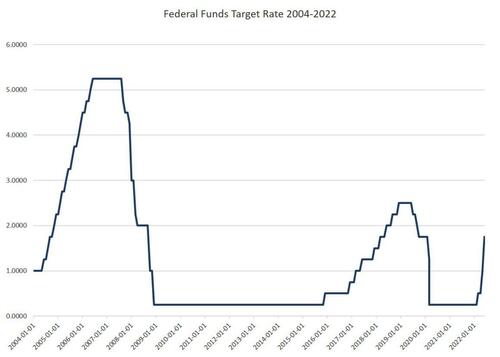

TNX made a possible new swing high at 34.95 before dropping back beneath the prior high at 34.83. In any event, TNX is due for a substantial correction lasting until the first week of July. For those of you who think the Fed is all-knowing and all-powerful, I did a study of all the FOMC moves vs the 90-day T-bill rate. The Fed never anticipated a single rate increase or decline since 1949. It has always bee late by an average of 3 months recognizing any changes in trend.

ZeroHedge opines, “The Federal Reserve’s Federal Open Market Committee (FOMC) today announced an increase of 75 basis points to the target federal funds rate, raising the rate to 1.75% from 1%. June’s meeting today was the third meeting this year at which the FOMC has raised rates. Coming into the March meeting this year, however, the FOMC had not raised the target rate since March of 2020, even though price inflation began to accelerate during the second half of 2021.”

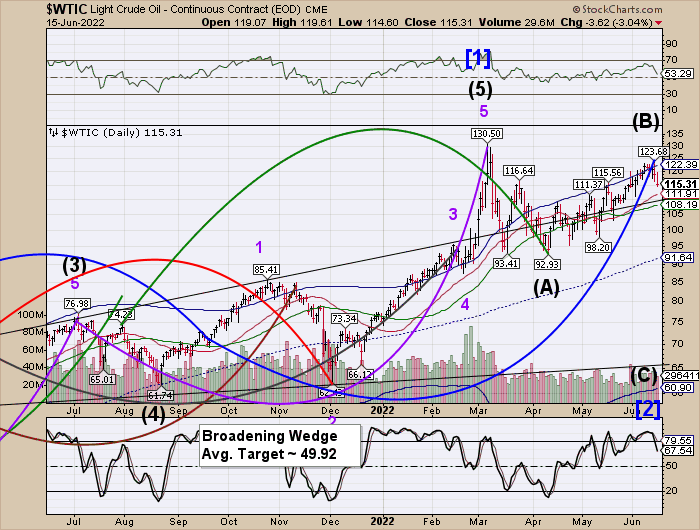

Crude oil consolidated in the overnight session, making a low of 114.76. It may now have entered a serious correction with a bottom near the end of the year. Note the Broadening Wedge formation. We may now be entering a demand destruction phase in the market as liquidity dries up. A 61.8% decline toward the April 2020 low would take crude down to 53.07,very near the Broadening Wedge target.

While the IEA sees a record demand for oil in 2023, ZeroHedge interviews Max Berman, who believes that demand destruction may be underway.