8:30 am

Good Morning!

SPX futures plunged beneath back beneath Intermediate-term support at 4616.50 this morning to an overnight low of 4586.10 as the bear market resumes. SPX completed a 4.3-day (top-to-top) Cycle at 1:00 pm yesterday and possibly set the pattern for the next Cycle high on Monday morning. This decline is likely to take out the 50-day Moving Average at 4626.65 and challenge the trendline just above 4400.00. Wave 3 may be a multiple the size of Wave 1. Experts are still calling for a Christmas rally later in December. However, the Cycles Model may not agree.

RealInvestmentAdvice opines, “Last week, we asked if there would be a market correction before “Santa visits Broad and Wall?”

“Investors’ ‘wish lists’ are hung by the chimney with care, hopeful the ‘Santa Claus rally’ will soon be there. While they remain ‘snug in their beds, the historical data dances in the heads.’ The chart below from @themarketear shows the annual “seasonality” from 1985 through 2019.

It certainly seems there is little to worry about. However, notice that dip at the beginning of December.“

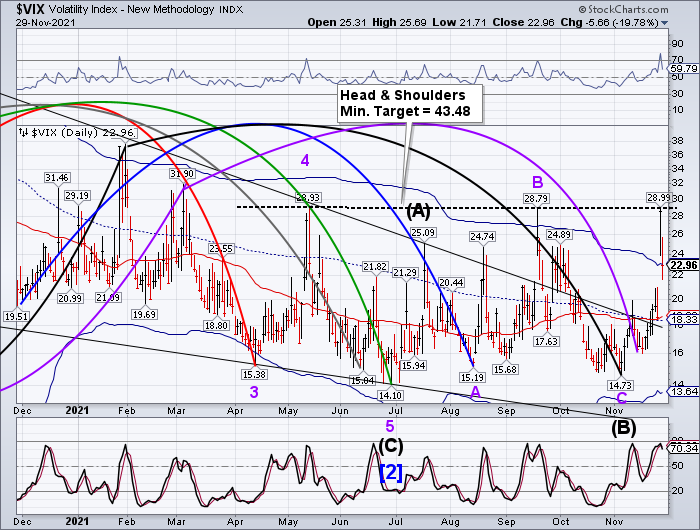

VIX futures rose to an overnight high of 27.58 as the level of fear rises again. Commentators suggest that VIX is trading more line February 2020 than a mere correction.

The NYSE Hi-Lo Index is not offering any support for the bulls. Although at a higher low, the Hi-Lo Index Cycles Model doesn’t call for a low until December 8-10. That’s nearly 2 weeks of negative market to look forward to.

TNX has declined to a morning low of 14.24. Wave (B)appears to be turning into an Expanded Flat correction that may find a bottom near 14.15. The Cycles Model suggests that the bottom is near and an abrupt reversal may be at hand.

USD futures made an overnight low at 95.65, just above Cycle Top support at 95.58. The Cycles Model also calls for a sharp reversal today in USD.