The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen

8:20 am

Good Morning!

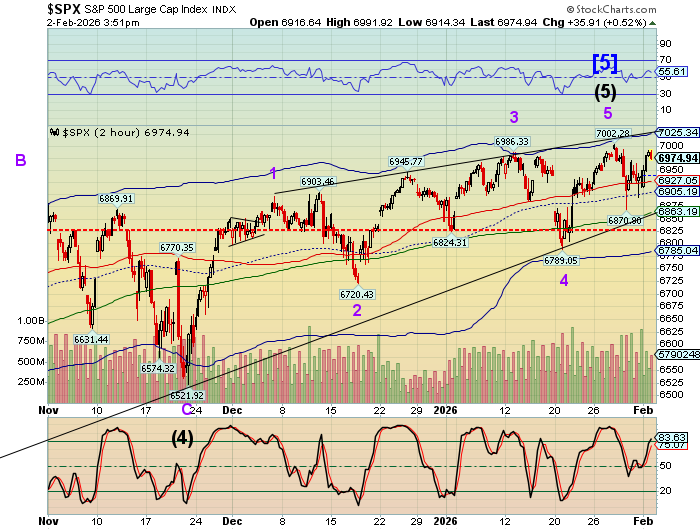

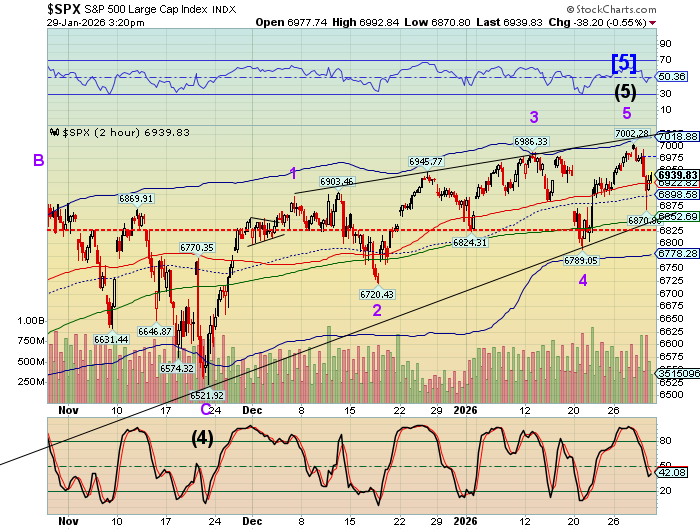

SPX futures declined to 6730.00 this morning, approximating the proposed decline at yesterday’s close. This morning’s bounce rose to 6848.10, which may allow the SPX to resume its decline to the futures low momentarily, triggering the Head & Shoulders formation. A decline beneath 6780.00 favors this view. An alternate view is that, should the bounce go above 6860.00, it may be underway to the 52-day Moving Average and trendline currently near 6877.96, a nearly 50% retracement over the next two days. In this situation, it may go even higher. The current fractal allows either of these two possibilities. Traders say a rebound is possible. Resolution may be revealed shortly.

This morning’s options chain shows Max Pain at a highly contested 6850.00. Long gamma may gain a foothold above 6875.00, while short gamma lies waiting beneath 6835.00. On balance, the options market favors a further decline.

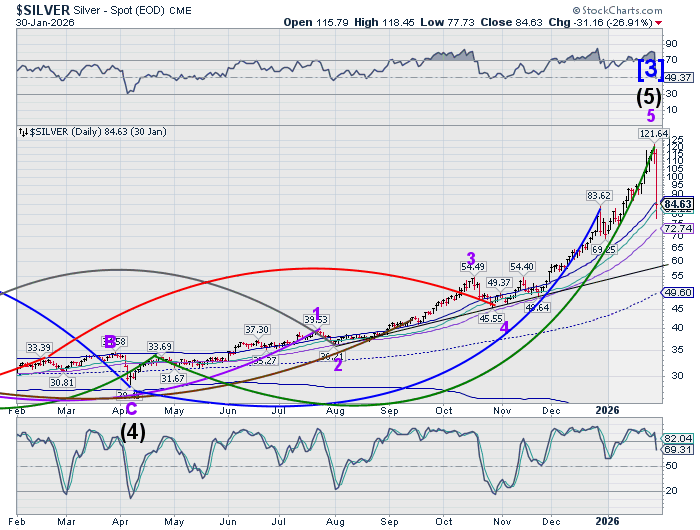

ZeroHedge reports, “US equity futures are poised to open higher with Software companies finally bouncing (as previewed here), even though Amazon continues to be deep in the red after its eye-watering capex outlook. US stocks will cap a bruising week in which a rush to unwind crowded trades – from AI shares to precious metals and crypto – triggered margin calls and amplified the market’s slide.”

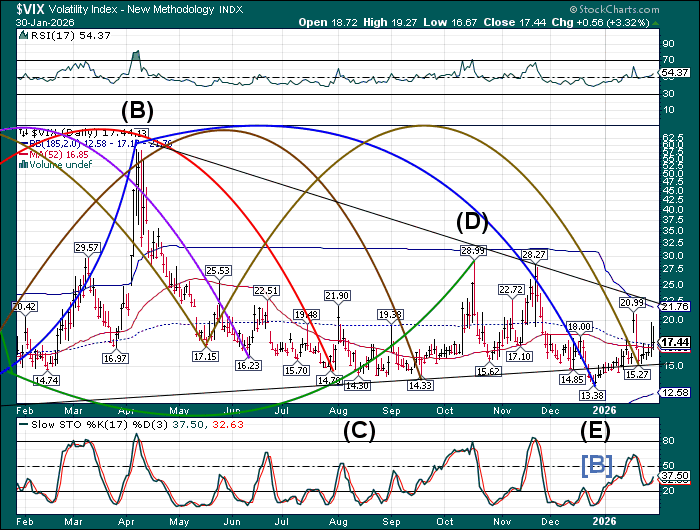

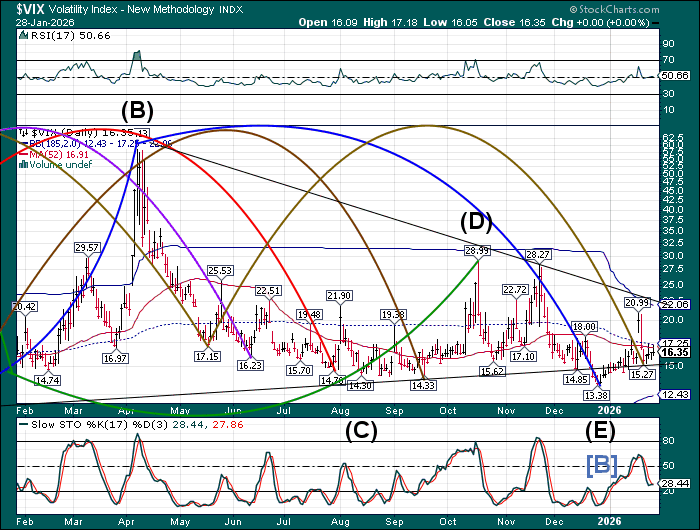

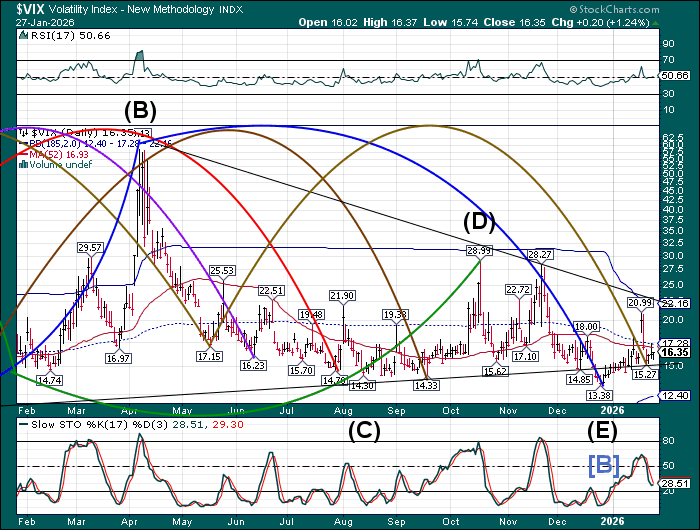

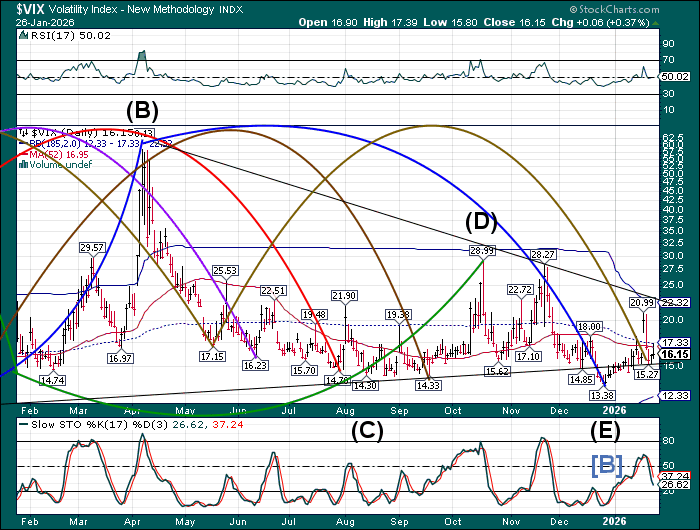

The premarket VIX tested the Cycle Top at 21.53, then declined to 19.98 thus far this morning. The rising fractal appears incomplete and may go higher today. A probe aobve the trendline at 22.00 may allow this to happen. The alternate view may be a correction to mid-Cycle support at 17.11.

The February 11 options chain shows short gamma having the upper hand between 14.00 nad 17.00. Long gamma has an even stronger presence above 18, stretching to 40.00. Hedging has begun.

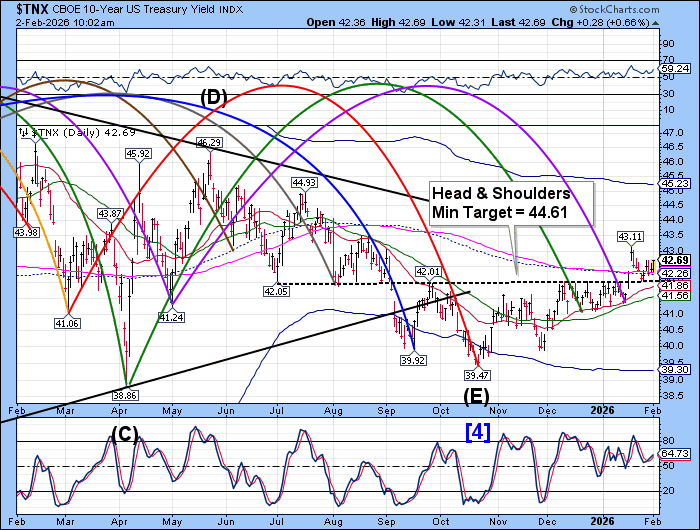

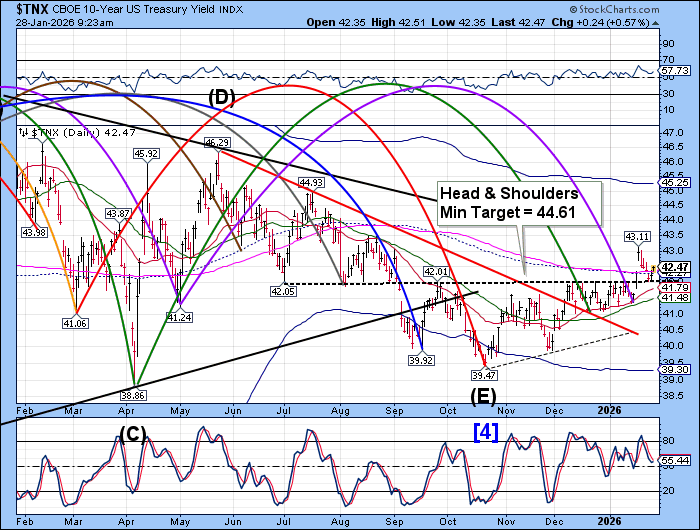

TNX rose from Intermediate support at 41.98. The correction may be over, or nearly so. The Cycles Model suggests the buy signal remains, with strength returning to the uptrend by mid-week. A rise aobve mid-Cycle resistance at 42.22 confirms the buy signal.