The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

10:15 am

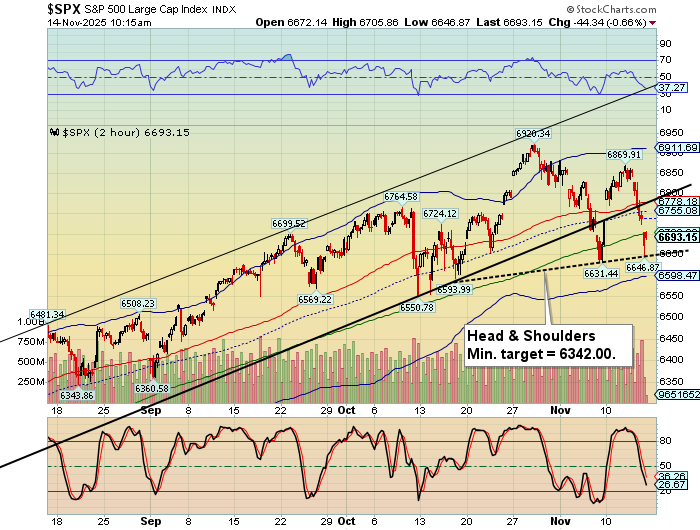

SPX has gapped down at the open and bounced at a potential Head & Shoulders neckline, testing the 52-day Moving Average at 6705.00. Should resistance hold, SPX may then resume its decline beneath the neckline with knock-on consequences. A secondary resistance may be the trendline at 6775.00.

10:30 am

NDX is also bouncing from a potential Head & Shoulders formation. Stay alert for a decline beneath the trendline at 24535.00. The down-sloped neckline may be more bearish.

7:45 am

Good Morning!

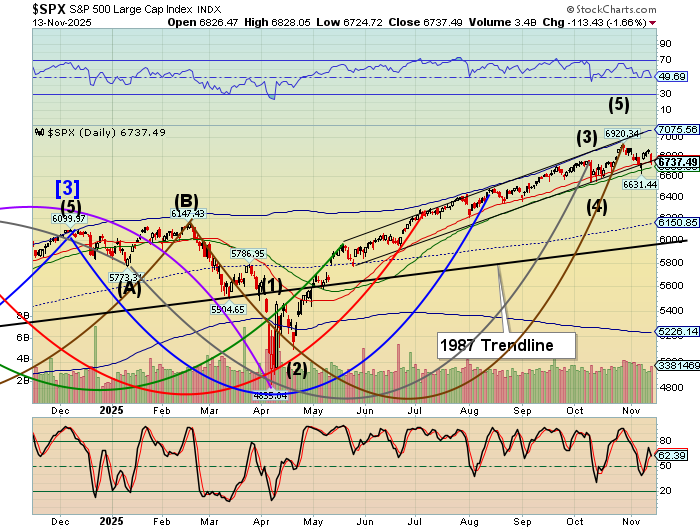

SPX futures have gapped down beneath the 52-day Moving Average at 6690.50, plummeting to 6664.00 thus far. SPX is on a confirmed sell signal since crossing the 7-month trendline yesterday. Thus far, the decline has been orderly. However, a decline beneath the November 7 low at 6631.44 opens the volatility spigots. Wall Street must defend that level. Should the breakdown occur, the minimum target may be near 6350.00. Retail investors are heavily long while street gamma is negative. A dangerous combination. The Cycles Model warns that trending strength may grow into Friday’s monthly options expiration.

Today’s options chain shows Max Pain at 6775.00. Long gamma strengthens above 6800.00. Short gamma dominates beneath 6750.00, with heavy reinforcements every 25 points lower.

ZeroHedge reports, “It’s ugly out there. Futs are sharply lower on doubts about whether the Fed will cut interest rates again in December, as fear deepens about stretched AI valuations and the debt used to fund them.”

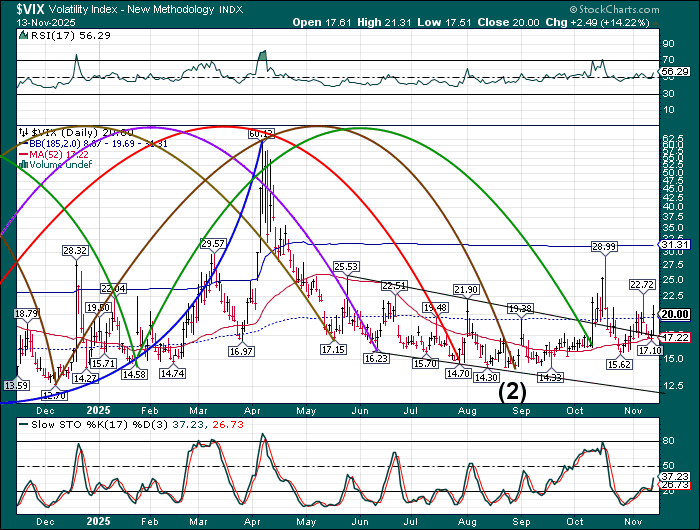

VIX futures vaulted to 22.63, short of a breakout above the November 7 high. Upside momentum appears to strengthen this week as panic may set in. The Cycles Model implies a continued rise in volatility to late December.

The November 19 options chain shows Max Pain at 20.00. Short gamma is heavily laden from 15.00 to 19.50. Long gamma begins at 22..00 and strengthens at 25.00 with institutional presence every 25 points above.

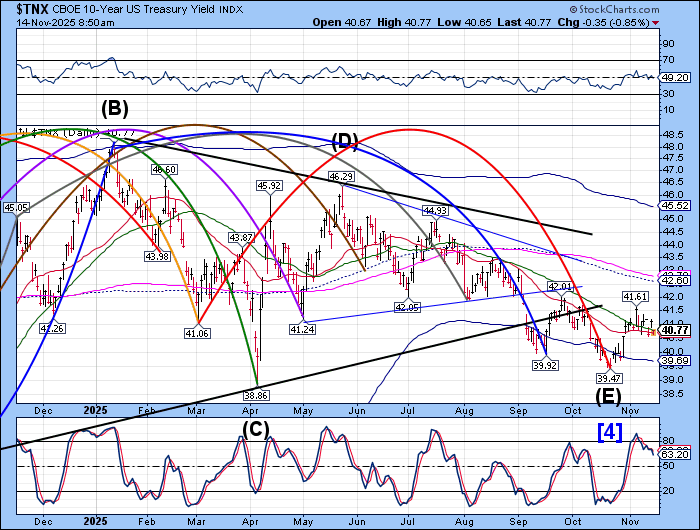

TNX has declined beneath the 52-day Moving Average at 40.79, on its way to a Trading Cycle low early next week. It remains relatively calm until monthly options expiration on Friday. From that point on, volatility may erupt into the first half of December.

ZeroHedge reports, “After yesterday’s mediocre, tailing 10Y auction, and with yields pushing higher today, prospects for the week’s final coupon auction, today’s $25BN in 30Y bonds, were not too exciting. Which is a good thing because the just concluded final refunding auction was quite disappointing.”

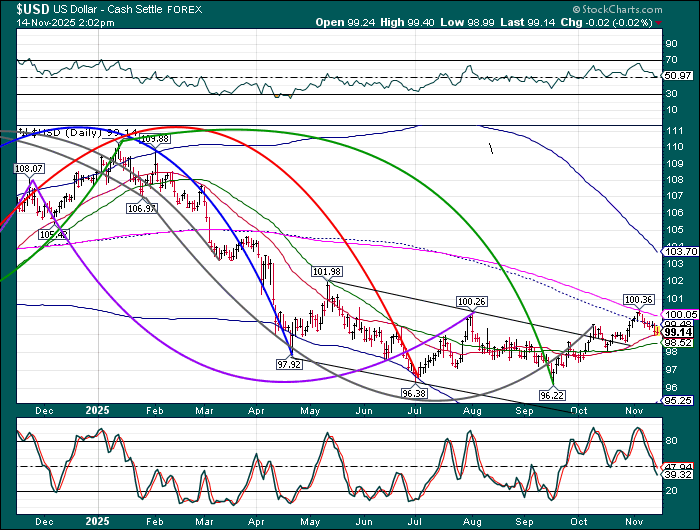

USD is testing Intermediate support at 98.98 as it descends into a Trading Cycle low early next week. The 52-day Moving Average at 98.52 is a likely target, but may go lower. Subsequently, a new surge higher, with growing strength, may emerge and continue to the first week of December.

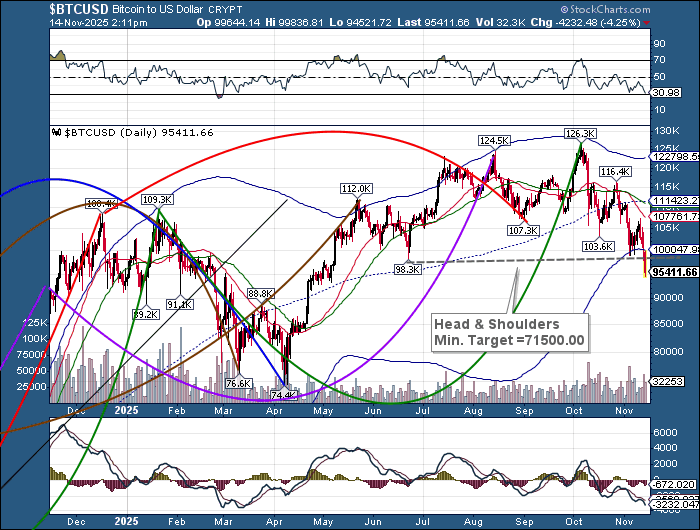

Bitcoin has broken down beneath the Head & Shoulders neckline at 98932.00 with considerable force. The formation has been activated. However, a bounce may arise, testing the neckline before trending lower. Bitcoin may be another proxy for market liquidity as there is nothing backing it but the sentiment of investors with extra cash or people wishing to seamlessly cross national boundaries. China may have outlawed the use of bitcoin and many European countries are considering banning it, which may be cutting off cross-boundary liquidity.

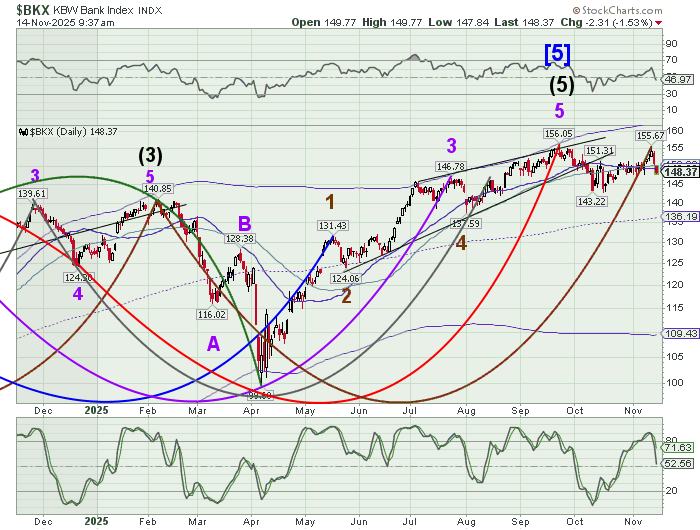

BKX has broken through the 52-day Moving Average at 150.07 this morning, placing it on a sell signal. The banking index has been heavily defended until November 12, stretching out the Master Cycle in double overtime. That support may give out at the end of November with a quadropoly indicated panic Cycle developing in December.

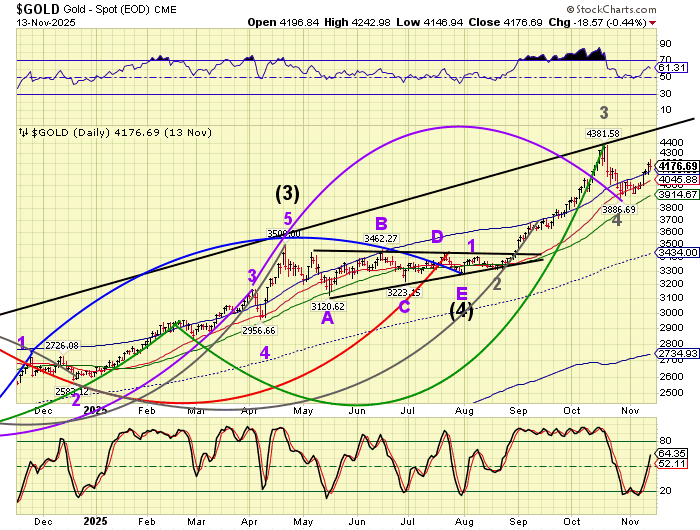

Gold futures declined to 4033.09, challenging the Cycle Top at 4133.00 and Intermediate support at 4045.88, making a Trading Cycle low that may be complete this weekend. Keep in mind that the retracement may go to the 52-day Moving Average at 3914.67 before reversing higher. These washouts may test the gumption of gold investors as they may be unable to withstand the shakeout.