The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

2:12 pm

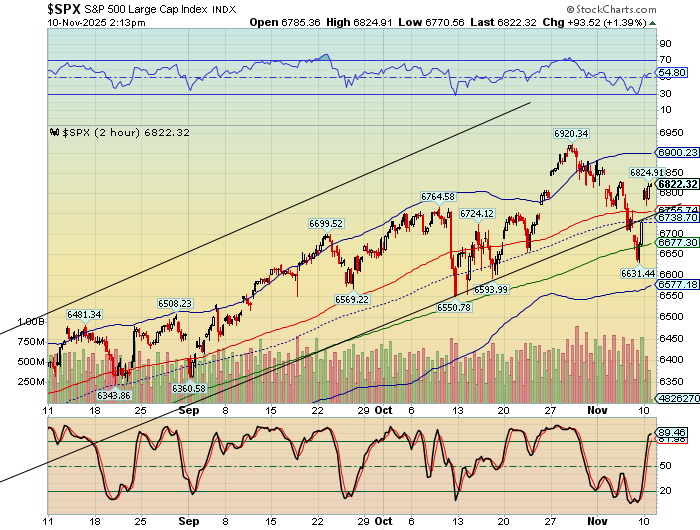

SPX may have completed its first fractal from the all-time high. It is now due for a reversal to a much lower value, possibly its September 2 low at 6360.00 or lower. The Sell signal is confirmed beneath the trendline and mid-Cycle level at 6738.70.

8:00 am

Good Morning!

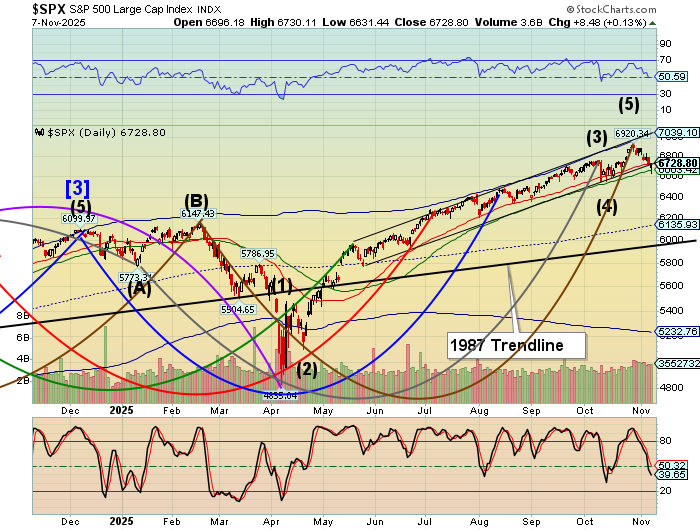

SPX futures rose to 6797.10 as a short squeeze creates a 57% retracement thus far. The 61.8% Fibonacci retracement lies at 6810.61. The Cycles Model calls for another hour or more at these or higher levels as the first bearish fractal completes in approximately 8 market days. Investors were not buying the dip. The bounce came from short covering and dealers liquidating to cover Friday’s options expiration. Hedge funds and individual speculators remain “all in” the AI darlings. The last pension contributions catch-up date happened on October 15. Note: the peak occurred two weeks later. Substantial lay-offs by corporate America have reduced the flow of contributions to 401(k) plans, reducing the flow of cash to passive index funds, further exacerbating the regular supply of new money to equities.

Today’s options chain show Max Pain at 6730.00. Long gamma may begin at 6750.00 while short gamma rules beneath 6700.00.

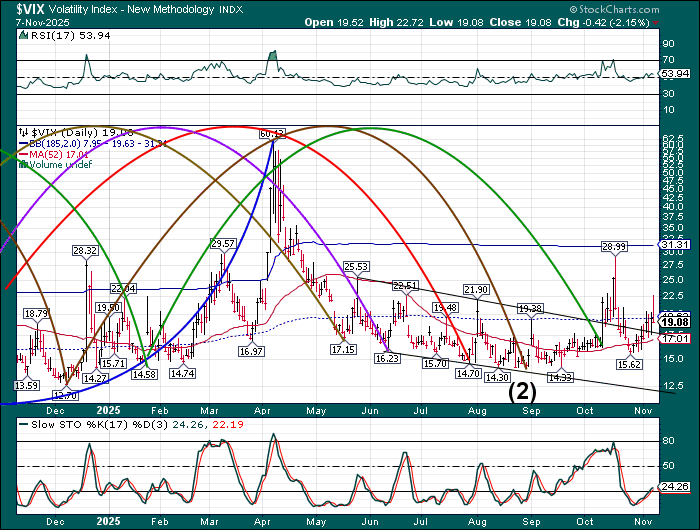

VIX futures descended to 18.40 thus far. A normal retracement may reach the trendline near 17.50 or the 52-day Moving Average at 17.01 before take-off.

The November 12 options chain shows Max Pain at 21.00. Short gamma resides at 15.00 to 20.00. Long gamma begins at 25.00. The overall sentiment is still short.

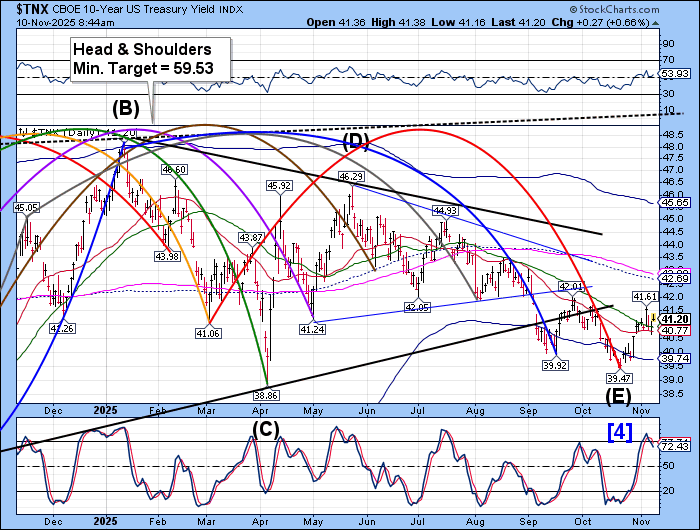

TNX has probed above the 52-day Moving Average at 40.90 this morning and may go higher, short-term. The reversal at the Intermediate support may take another day or two to completion. Subsequently, it may be due for a Trading Cycle low near mid-November.

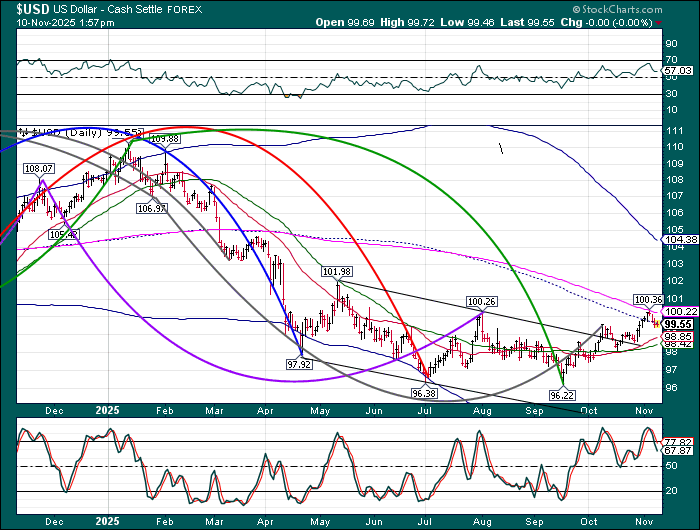

USD futures may be consolidating at mid-Cycle support at 99.54. It may resume its correction to the 52-day Moving Average at 98.42 by the week end. Trendiong strength may not appear for the next two weeks, but may revive at month-end as the current Master Cycle wraps up.

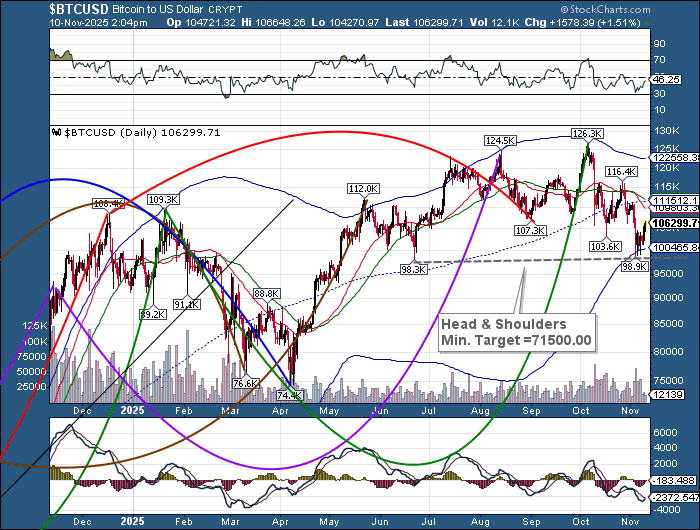

Bitcoin is continuing its retracement from its Cycle Bottom at 98932.00. A final probe higher may be made to the 50% retracement value at 107663.00 or as high as the mid-Cycle resistance at 111511.00.

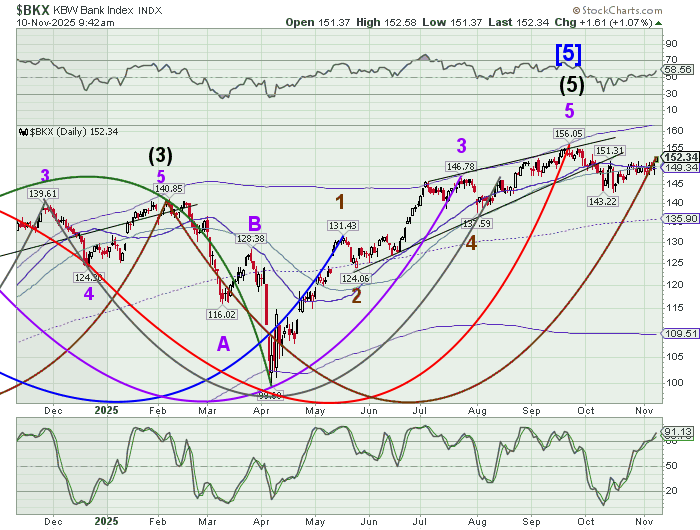

BKX may have extended its Master Cycle high to today. This has become a very stretched Cycle which may be due for a substantial decline.

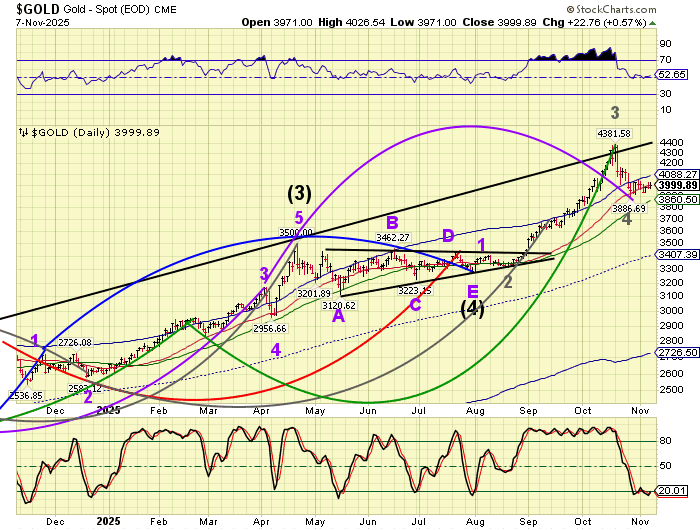

Gold futures rallied to 4114.85 the morning as it may have overcome the Cycle Top resistance. The breakout may allow gold to rally even further, as the new Master Cycle may extend to late December. The prospect of further downside may be postponed to 2026.