The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

2:16 pm

SPX plunged beneath the 52-day Moving Average at 6670.00, then bounced above it. It may rebound to an afternoon high at 6696.00 or the trendline at 6732.00. This sets up for an even larger panic decline this weekend.

11:10 am

SPX has declined beneath the 52-day Moving Average at 6661.88. The sell signal is now doubly indicated and the decline continues. Take appropriate action.

7:30 am

Good Morning!

SPX futures declined to 6691.00 this morning after having declined through the trendline at 6720.00, then closing at trendline resistance. A sell signal has been triggered, offering an exit for longs and the opportunity for hedging/shorting. The next lower support is the 52-day Moving Average at 6658.36, which commonly elicits a bounce. Should that occur today, a vigorous bounce to 6800.00-6850.00 may ensue. The alternate view allows the SPX to decline through the 52-day followed by fractal expansion (panic decline). The Cycles Model reveals heightened volatility (a possible panic Cycle) starting today and continuing through the weekend into next week. A large factor in the decline is the heightened layoffs. The immediate result is the cessation of contributions to 401(k) plans which are passively invested into ETFs and mutual funds.

Today’s options chain shows Max Pain at 6760.00. Long gamma may begin at 6775.00 while short gamma strengthened at 6750.00. Options are tightly wound and may move explosively.

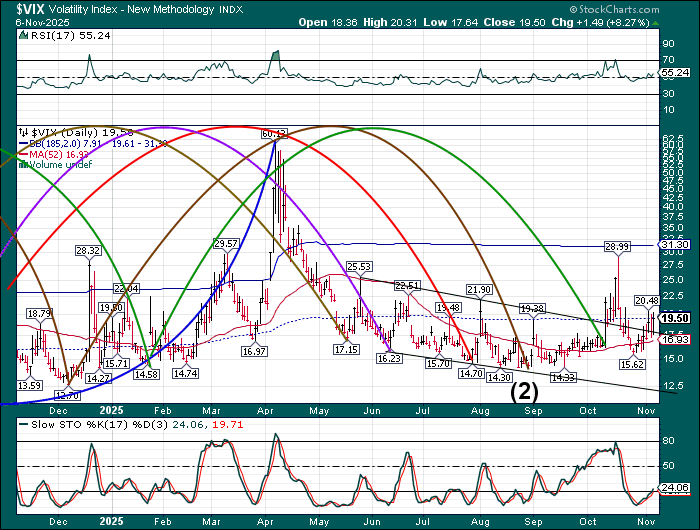

VIX futures rose to 20.87 this morning the SPX loses its grip on the 6-month trendline. The Cycles Model reveals the VIX may be poised for a substantial move this weekend. VIX continues on a buy signal that may last through late December.

The November 12 options chain shows Max Pain at 20.00. Short gamma resides between 16.00 and 18.00, while long gamma strengthens above 23.00 and shows institutional involvement up to 55.00.

ZeroHedge remarks, “Markets have been whipping around more violently than usual over the last several weeks, a reminder that volatility is the natural habitat of a late-cycle market.”

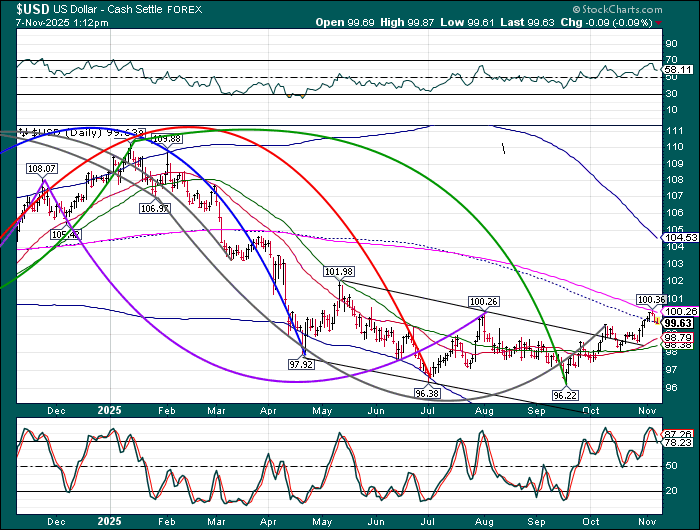

USD is pulling back after being resisted at the 200-day Moving Average. The Cycles Model reveals today is a day of trending strength which may propel the USD to a breakout above the 200-day. This is the last bastion for the dollar shorts, who may be forced to liquidate en masse, creating a strong surge.

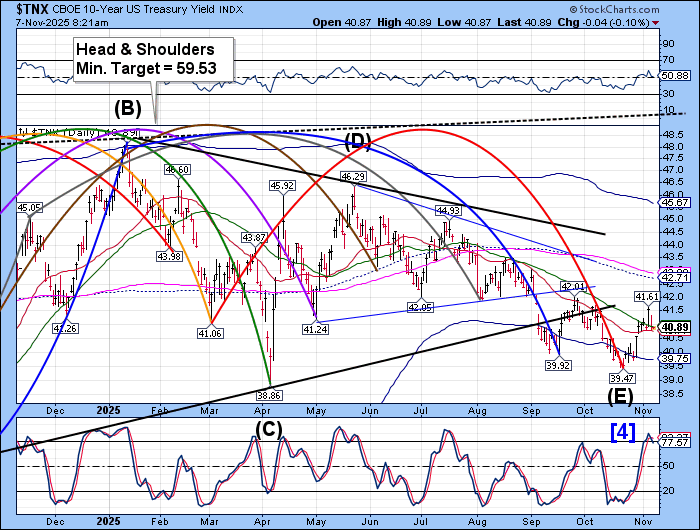

TNX is lingering above the 52-day Moving Average at 40.32 this morning. A breakdown may allow TNX to decline as far as the Cycle Bottom in the next week. Keep in mind, however, that the trend in the TNX is now positive with a buy signal, suggesting that investors may buy the dip in TNX.

ZeroHedge remarks, “One month ago, when the market was freaking out by the lack of official government data (it has since realized again, that whether the government is open or closed, or what the jobs number is – certainly not until it is revised 3 or 4 times, does not matter), everyone scrambled to find private sources of economic data.”

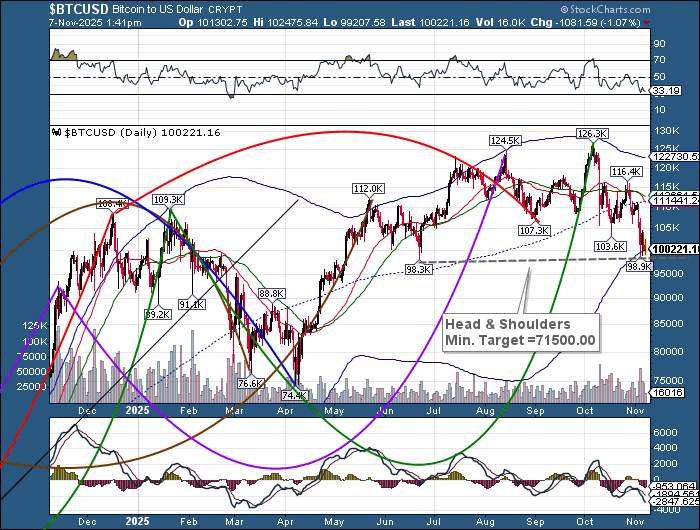

Bitcoin is declining to test the Head & Shoulders neckline at 98932.00, where a bounce is possible. A breakthrough triggers the formation with a subsequent panic decline. The Cycles Model suggests a disturbance beginning during the weekend with a panic decline developing into next week.