The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

1:20 pm

SPX has crossed the 6-month trendline at 6725.00, creating a sell signal. There may be a bounce soon that could take SPX back above the trendline, but the sell signal remains. This may be a good opportunity to cut longs and add hedges. Observation: A 50% retracement may allow the SPX to rise to 6813.50. Likewise, a 61.8% Fibonacci retracement may retrace the SPX to 6839.00.

8:00 am

Good Morning!

SPX futures consolidated inside yesterday’s trading range as tensions build toward a possible crescendo this weekend. Should SPX remain beneath 6835.00, the odds are likely of an imminent panic sell-off. Above that level, the situation remains more complex. Smart money is already exiting equities, regardless of a potential new all-time high.

Today’s options chain shows Max Pain at 6805.00. Long gamma may strengthen above 6835.00. Short gamma dominates beneath 6800.00.

ZeroHedge reports, “US equity futures are higher, rebounding from session lows for the second day in a row, amid headlines that layoffs are surging due to AI which in turn is raising odds of a Dec rate cut, with JPM saying that “the market is weighing a weaker labor market and potential spending vs. evidence on the efficacy (and ROI) of AI plus productivity gains.” Challenger job cuts jumped to over 150K in October, nearly triple the year-earlier period and the most in more than two decades.”

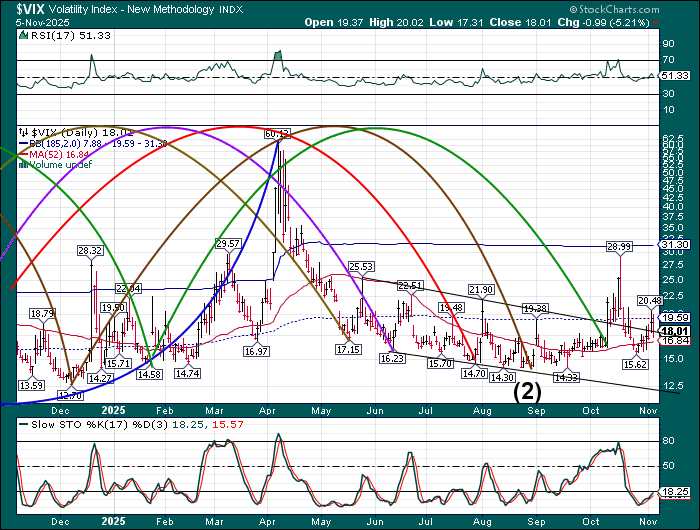

VIX futures are also trading within yesterday’s trading range. It may retest the 50-day Moving Average in the next day or so. However, the Cycles Model calls for a trending surge into the weekend. Should the surge continue, the VIX may continue to rise into mid-December.

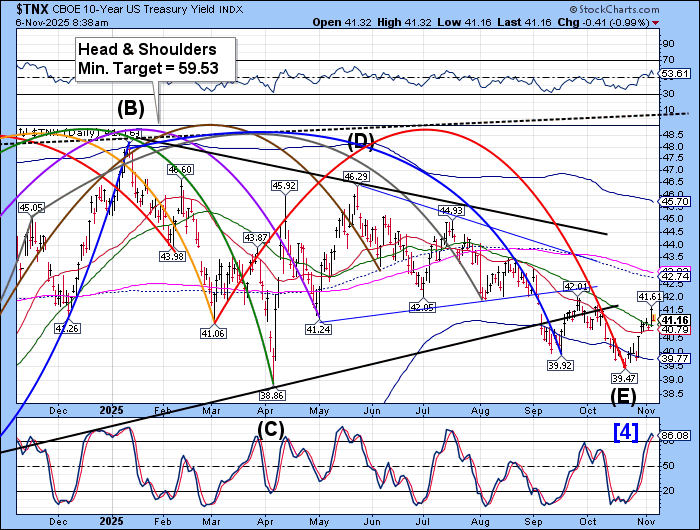

TNX has pulled back from yesterday’s high and may correct over the next week or so. Support may initially be found at the Intermediate level at 40.79, but it may go as low as the Cycle Bottom support at 39.77.

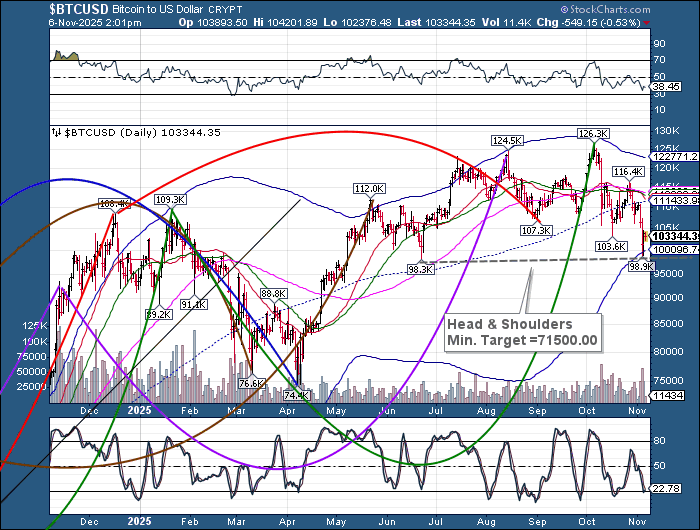

Bitcoin is consolidating this morning, but may be due for a panic washout this weekend. The potential Head & Shoulders formation indicates a possible decline to the April 7 low or beneath it. Bitcoin has been used as a tool for moving money across borders seamlessly. That may be coming to an end as capital controls are being considered in the NATO countries to keep money inside their borders and allow access by authorities that are becoming more tyrannical.

ZeroHedge remarks, “These lessons go for pretty much any asset class, but where I’ve noticed the largest concentration of inane theories, economic non-sequiturs and general outright confusion is among the most hubris-laden speculators in the market, the Bitcoin crowd.”

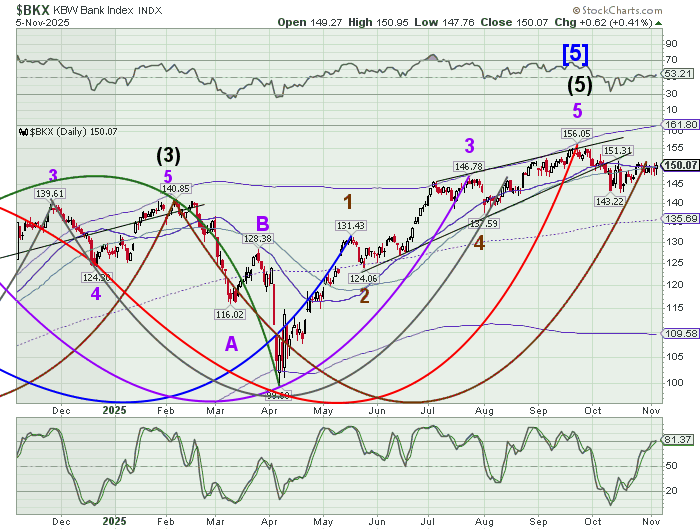

BKX continues to consolidate sideways above the 52-day Moving Average at 149.93. The 52-day may act as a support, but may release it, trap door style, this weekend. Regulators always try to release bad news over the weekend, hoping to escape notice. SOFR spreads have been blowing out, indicating distress in the banking market. The Cycles Model suggests a panic may develop over the weekend, causing a liquidity crunch.