The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

7:45 am

Good Morning!

SPX futures took a deep dive to test Intermediate support at 6718.46 in the overnight market, then bounced in an attempt to recover its losses. Should the bounce continue, SPX may rally to a new all time high near the Cycle Top at 7014.49. A failure to rally further may propel the SPX to the trendline at 6710.00-6720.00. Beneath that lies the 52-day Moving Average at 6646.52 and a sell signal.

Today’s options chain shows Max Pain near 6800.00. Long gamma rules above 6825.00 while short gamma prevails beneath 6750.00.

ZeroHedge reports, “Welcome to day 36 of the government shutdown which officially makes it the longest shut down in history. Futures are trading moderately lower, following weaker Asian and European sessions, but well off session lows as Japan retraced nearly 50% of its losses during the session.”

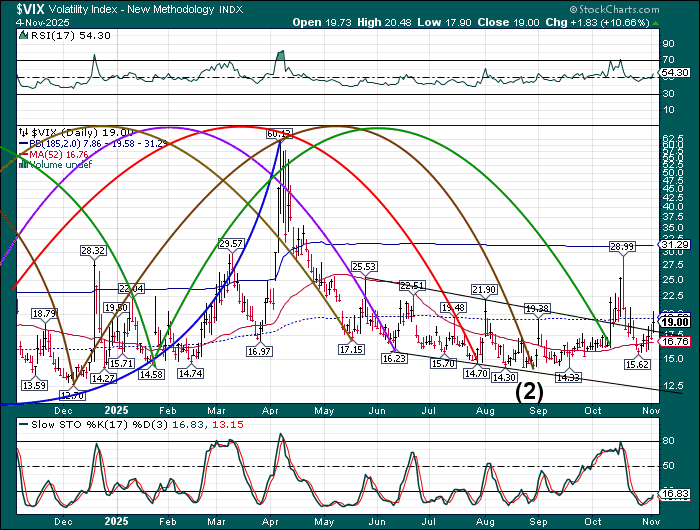

VIX futures rose to 20.02 this morning, surpassing the mid-Cycle resistance at 19.58. While the SPX sell-off continues, the VIX remains quite subdued. That may indicate the SPX has more potential upside this week. Should that happen, VIX may probe back beneath the 52-day Moving Average at 16.76 by the weekend. That scenario may lead to possibly explosive activity early next week.

Today is options expiration and out-of-the-money trades are being closed out. The November 12 options chain shows short gamma ranging between 16.00 and 18.00. Long gamma rules above 20.00.

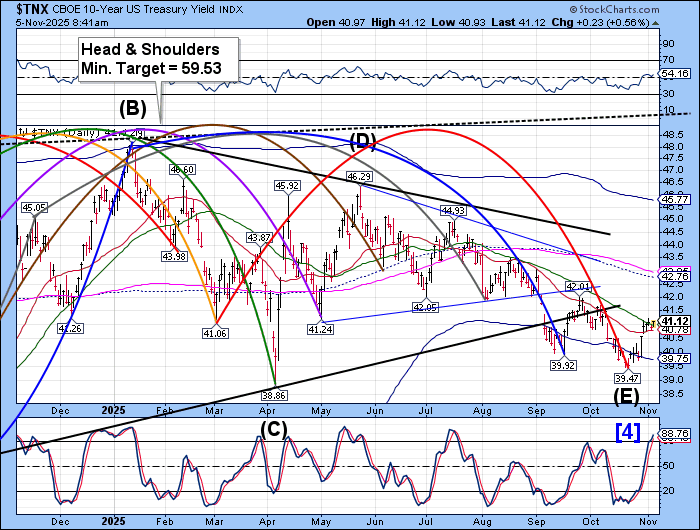

TNX continues to challenge the 52-day Moving Average at 40.98, but hasn’t broken out of its consolidation. The Cycles Model infers today to be a high energy day. Should TNX make a clean break above the 52-day and the consolidation, we may see rising rates through the better part of December. However, a break down may switch to lower rates for the same period.

ZeroHedge latest release, “Superficially, there were no surprises in the quantitative aspects of this morning’s Treasury refunding announcement: as previewed earlier, the Treasury just announced a total quarterly refunding size of $125 billion, just as expected…”

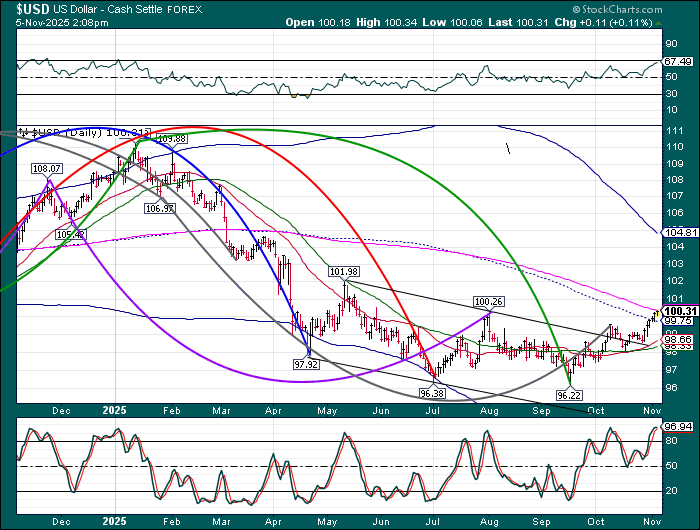

USD futures continue their rally to the 200-day Moving Average at 100.35, where it may meet some resistance. Trending strength is building, however. A show of strength may help the USD move higher through the weekend.

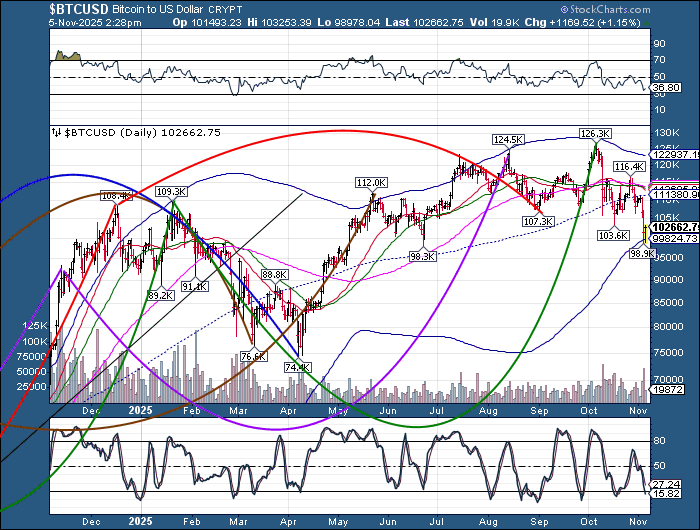

Bitcoin has bounced from the Cycle Bottom at 99824.73 this morning as it consolidates and digests its losses. The Cycles Model notes a buildup of trending strength over the weekend and early next week, possibly indicating further losses. The end of the current Master Cycle may be due in about three weeks.

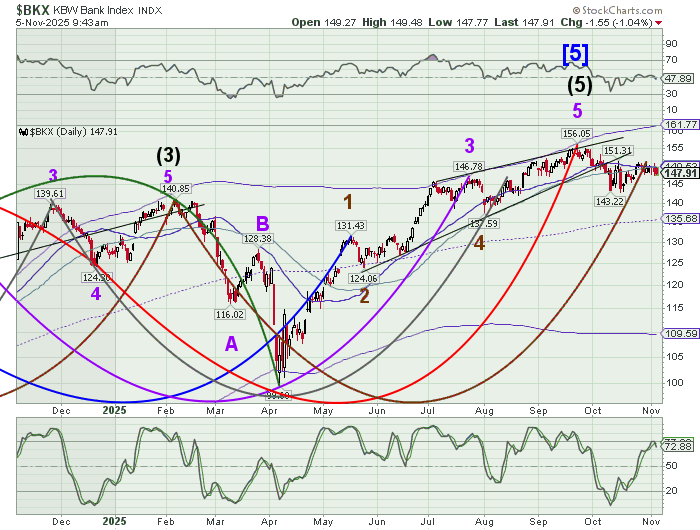

BKX tested the 52-day Moving Average this morning, then sold off. We may anticipate BKX to decline for the next seven weeks with particular strength (possible panic) this weekend. SOFR is soaring above its discount rate. This information is not available in the normal news channels and may not appear until this weekend. Today’s loss of support at the 52-day indicates smart money exiting the banking index. The sideways consolidation after the initial sell signal in October has lulled investors to sleep again.

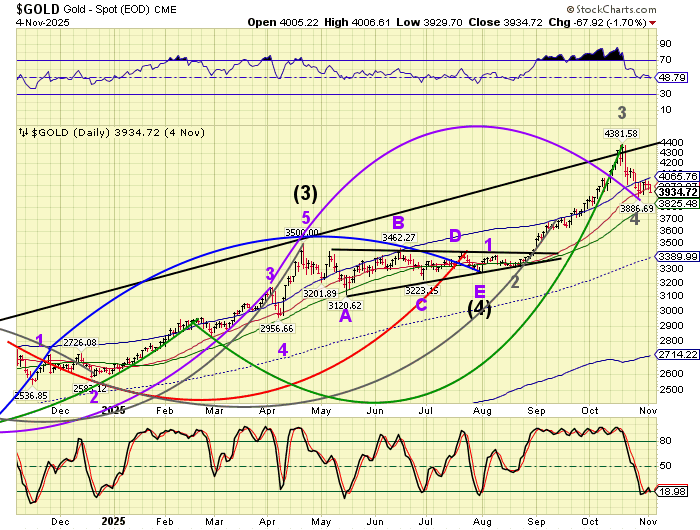

Gold did not make a new low, beneath the October 28 bottom at 3886.69, which completed a Master Cycle. The new Master Cycle is appearing with strength today and may last to mid-December. We may see gold break out above 4000.00 and continue going higher with growing strength toward the end of November and especially in early December.