The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:00 am

Good Morning!

SPX futures have risen to 6873.20 this morning, as a final probe to the Cycle Top at 6994.65 (7000.00). A reversal from the Cycle Top marks the end of the current uptrend. The Cycles Model suggests the final thrust may be over by mid-week. Should that be so, there may be a dramatic shift in the trend by the weekend. Following that, there may be a seven week decline, similar to the decline ending on April 7. The target of that decline may be the the April 7 low.

The options chain is tightly wound today. Max Pain may be found at 6860.00. Long gamma may prevail above 6880.00 while short gamma becomes prevalent beneath 6850..00.

ZeroHedge reports, “US equity futures are signaling a solid start to November, led by Tech with small caps flat, as traders gauge the durability of a seven-month global equity rally fueled recently by strong tech earnings and easing US–China trade tensions.”

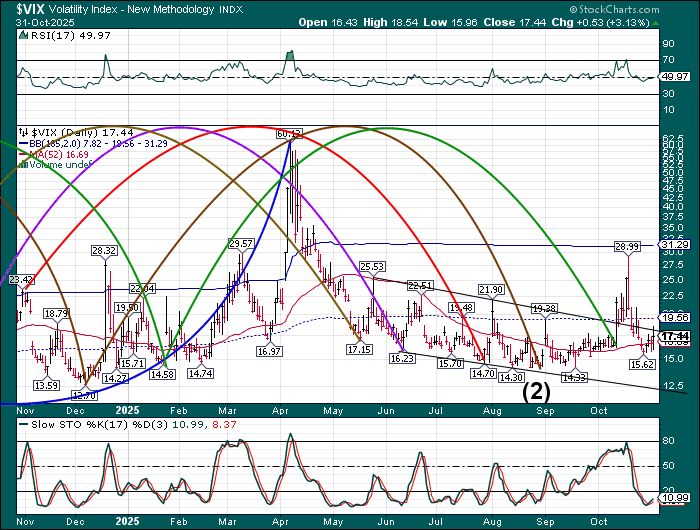

VIX futures continue to consolidate above the 522-day Moving Average showing a buy signal. The descending trendline lies above 18.00, while the mid-Cycle resistance is at 19.56,confirming a possible change in trend. There may be a dramatic shift in velocity starting on Tuesday, with further confirmation in a week. The Cycles Model also infers a possible 7-week rally in the VIX.

The November 5 options chain shows Max Pain at 17.00-18.00. Short gamma resides at 15.00 while long gamma is strong above 20.00.

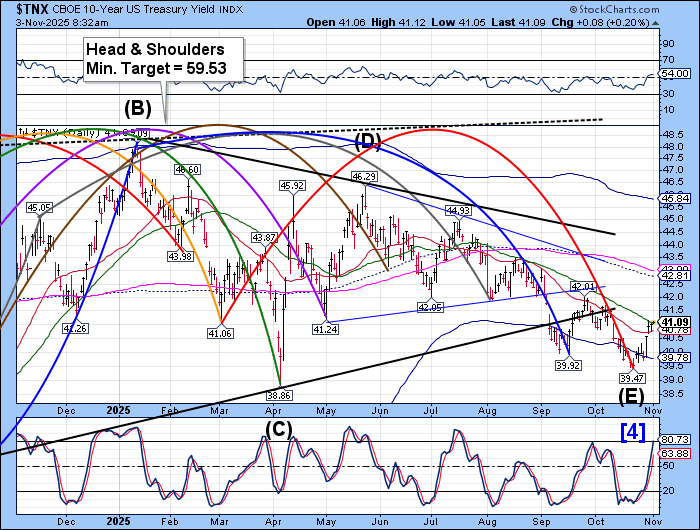

The uo-year Treasury Note index ;has risen above the 52-day Moving Average at 41.05 this morning, confirming the buy signal in yields. The Cycles Model suggests a burst of trending energy by mid-week, with a potential target at mid-Cycle resistance at 42.81.

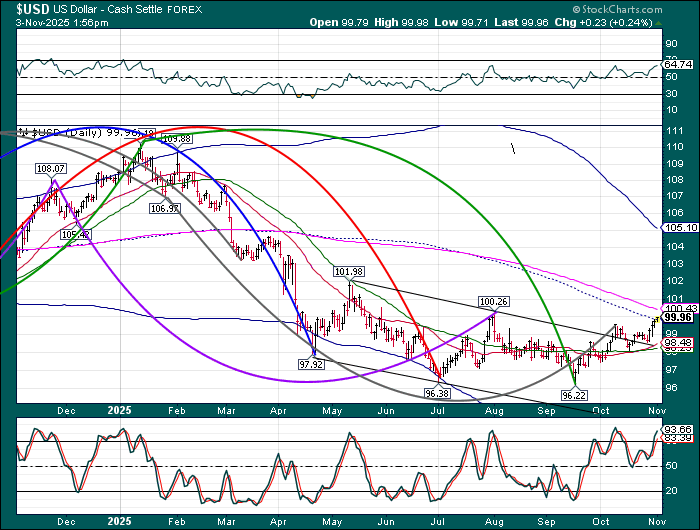

USD futures continue their climb above the mid-Cycle support/resistance at 99.83. The Cycles Model shows USD gaining strength this week. This pattern may persist to the end of November. The decline in the Euro shows possible money flows to the USD.

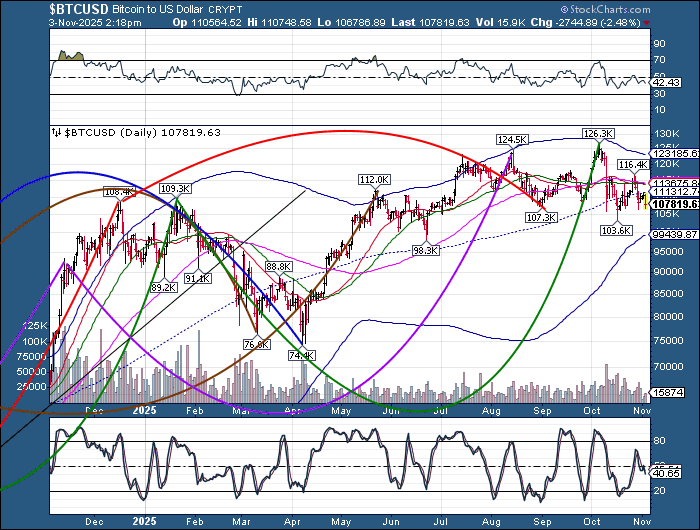

Bitcoin has renewed its decline after being repelled at the mid-Cycle resistance at 111312.00. The Cycles Model indicates a continued decline to the end of November. Narrowing trading bands indicate a strong (panic) move may be developing. Bitcoin has gone nowhere since last December an may be ripe for a fall.

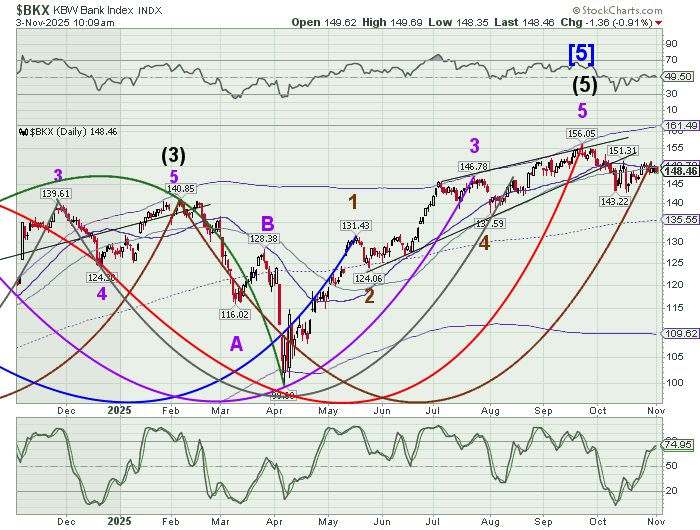

BKX is being held beneath the 52-day Moving Average at 149.70 this morning. The Cycles Model warns that a breakaway decline may develop tomorrow, with multiple surges of potential panic losses through the weekend.

ZeroHedge remarks, “I think I’ve identified the four horsemen of the next stock market apocalypse — each one manageable in isolation, but collectively large enough to reshape a financial system priced for perfection.

Subprime auto, commercial real estate, private credit, and crypto all scratch me where I itch when thinking about precarious pockets of today’s stock market.”

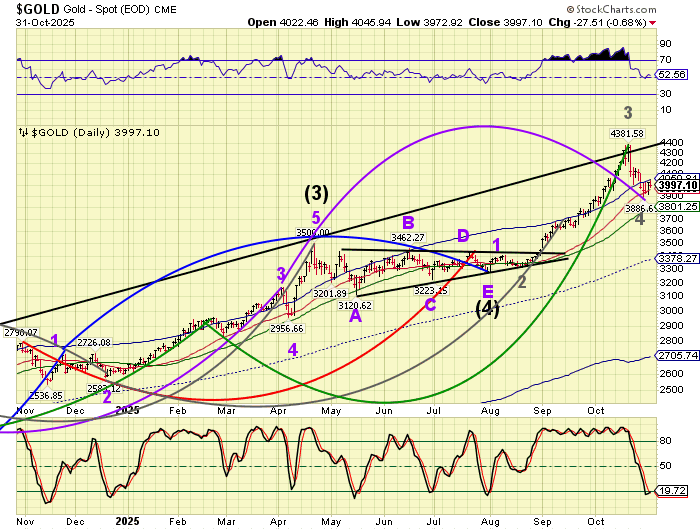

Gold may have made its master Cycle low on October 28. If so, today may reveal the first surge of trending strength to propel it above the Cycle Top at 4050.91 again. Should that be so, gold may rise substantially to mid-December.