The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

9:57 am

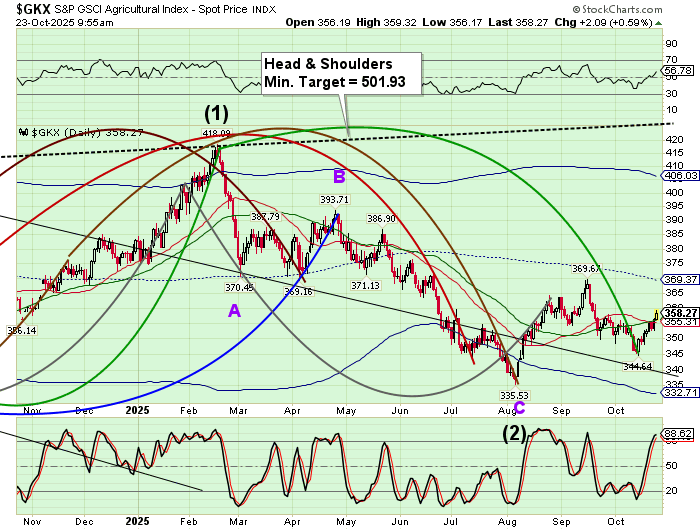

The Agriculture Index has emerged above its 50_ay Moving Average at 356.01, creating a buy signal. It may pull back from here, leaving a possible higher low in the next two weeks. It may resume its rally in early November with a certain amount of fanfare after testing the low. This may present an opportunity to accumulate shares of Agricultural companies and commodities with limited downside risk.

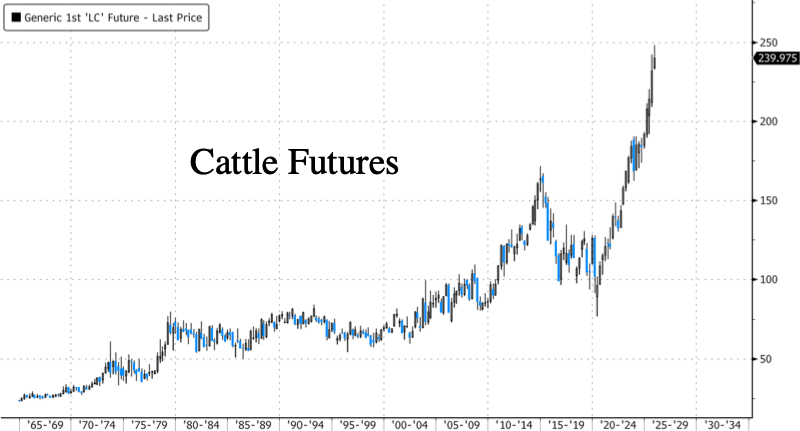

ZeroHedge observes, “U.S. cattle futures are no longer on track for their largest year-to-date gain since 1978. Instead, selling pressure has eroded gains to about 25%, yet it still marks the strongest annual increase since 2010. The pullback comes as President Trump and White House officials confront yet another challenge in the fight against sticky food inflation: a nationwide cattle shortage (years in the making) that has pushed cattle futures to record highs and sent supermarket beef prices to unaffordable levels for working-poor households.”

9:45 am

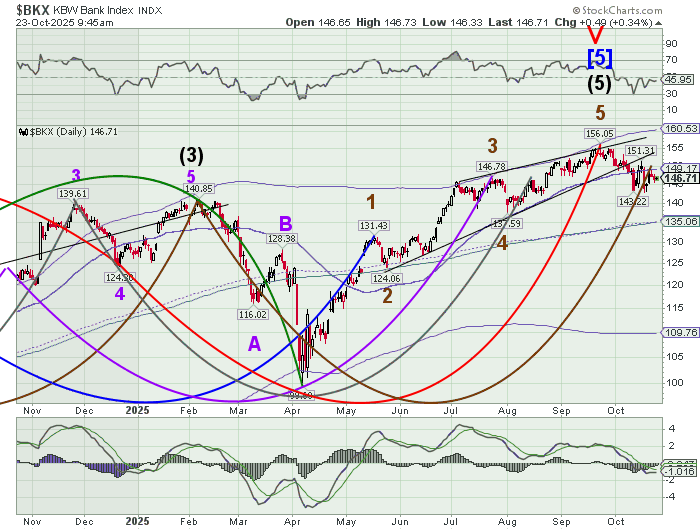

BKX, our liquidity index, remains under its 50-day Moving Average at 149.16 and on a sell signal. The decline is set to resume with a panic phase in early November. It may not recover soon, as the current Master Cycle may continue to late December. The April 7 low may be a likely target for this decline. The weakening liquidity structure may cause dealers to tighten margin requirements.

ZeroHedge comments, “During a conference call with investors last week, JPMorgan CEO Jamie Dimon made a memorable response to a question from Wells Fargo analyst Mike Mayo about the collapse of a subprime auto lender called Tricolor that cost the bank $170 million. Tricolor went bankrupt due to allegations of fraud, including double-pledging of collateral, which led lenders to halt financing.”

7:45 am

Good Morning!

SPX futures consolidates in a range between 6682.00 and 6718.00 in the overnight session. Short term support lies at 6682.00, giving way to an aggressive sell signal. Beneath that, Intermediate support lies at 6646.00, beneath which lies confirmation of the sell. The Cycles Model shows increased volatility today and possibly into the weekend. There may be an outright panic decline in the first week of November.

There is a heavy volume of puts and calls at 6700.00 (Max Pain). Long gamma emerges above 6740.00 while sort gamma rules beneath 6675.00.

ZeroHedge reports, “US equity futures are flat and European stocks headed for a record high as third-quarter earnings continued to flow in. As of 8:20am, S&P and Nasdaq futures are little changed. Pre-market, Mag 7 are mostly flat except for a -3% selloff in TSLA given the underwhelming earnings release last night which saw profits tumble despite record revenues (pulled forward due to expiration of tax credits) on sharply higher costs.”

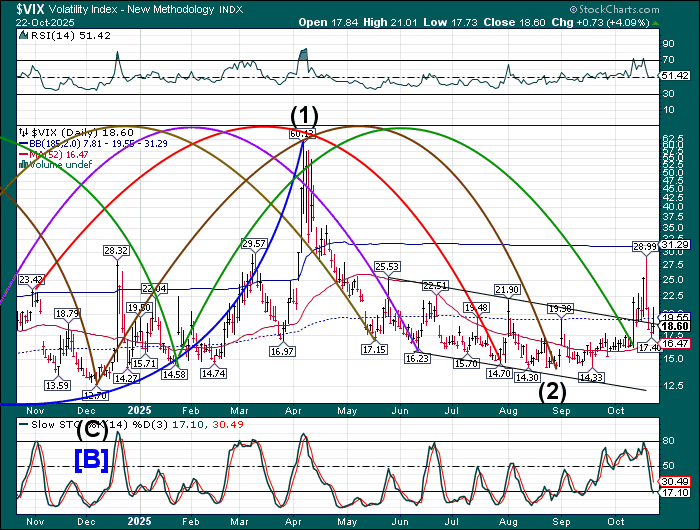

VIX futures are consolidating beneath the mid-Cycle resistance at 19.55 this morning. The Cycles Model shows a potential spike in volatility today with particular strength of trend emerging in the first week of November.

The October 29 options chain shows short gamma ruling from 15.00 to 19.00, while long gamma starts with a bang at 20.00 where speculators have placed 16,773 call contracts.

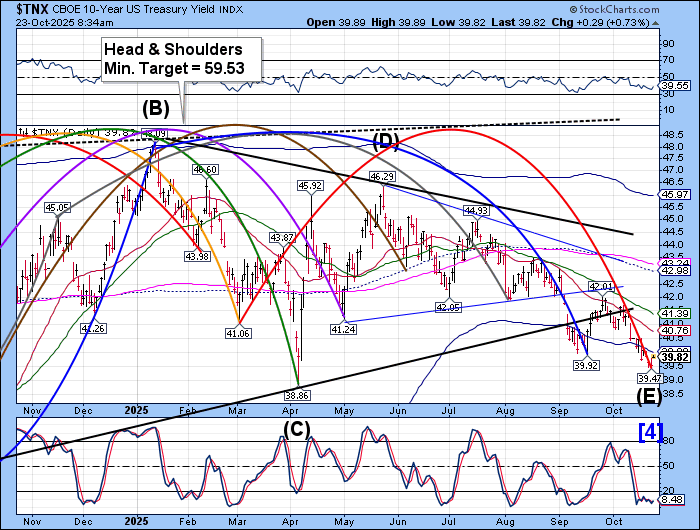

TNX has moved higher, approaching its Cycle Bottom resistance at 39.98. A Master Cycle low may have appeared yesterday, followed by a reversal. However, there is no buy signal until it exceeds its Cycle Bottom where resistance may become support. The Cycles Model suggests a panic buying spree beginning next mid-week, lasting through the first week of November.

ZeroHedge observes, “With market risk mostly off, especially among high beta momentum stocks, bonds have again emerged as a flight to safety and this was certainly on display during today’s auction of 20Y paper.

The reopening of 19 Year, 10 Month paper (cusip UN6) was the week’s only coupon auction, and was issued flawlessly and without a glitch amid solid -mostly foreign – demand; the high yield of 4.506% was up notably from last month’s 3.953% but more importantly, stopped through the When Issued 4.518 by 1.2bps, the first stop since July and followed two weak, tailing auctions.”

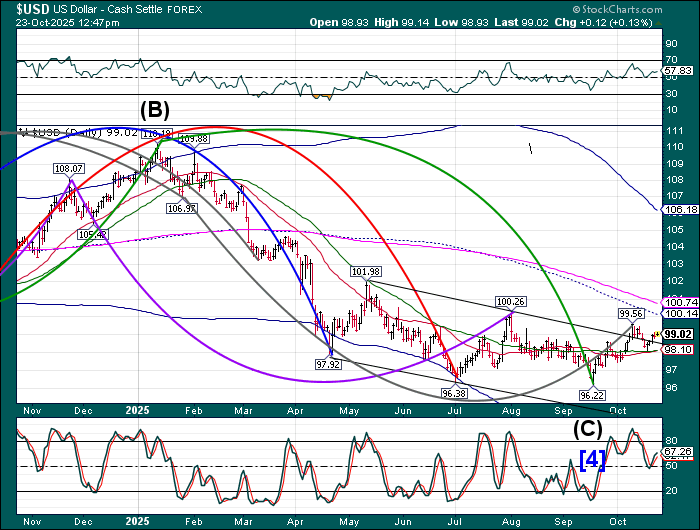

USD futures are hesitating in mid-course and may pull back in the next couple of days. However, the trend is going higher. There may be a boost in strength of the dollar this weekend with more strength resuming in the following two weeks. The Cycles Model infers the USD is likely to rise to the Cycle Top by mid-November.

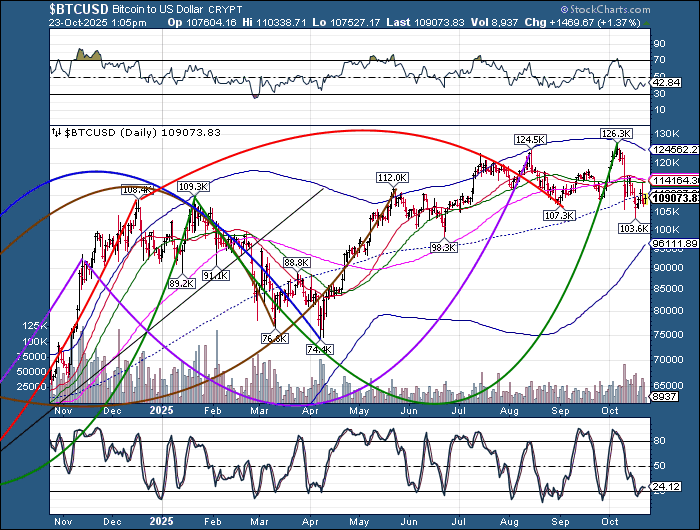

Bitcoin was repelled at the mid-Cycle resistance at 110337.00 this morning. There may yet be an attempt to approach the 50-day Moving Average at 114163.00 before reversing lower. The next lower test of support may be at the Cycle Bottom at 96111.00. The Cycles Model infers that BTC may be in a downtrend to late November.

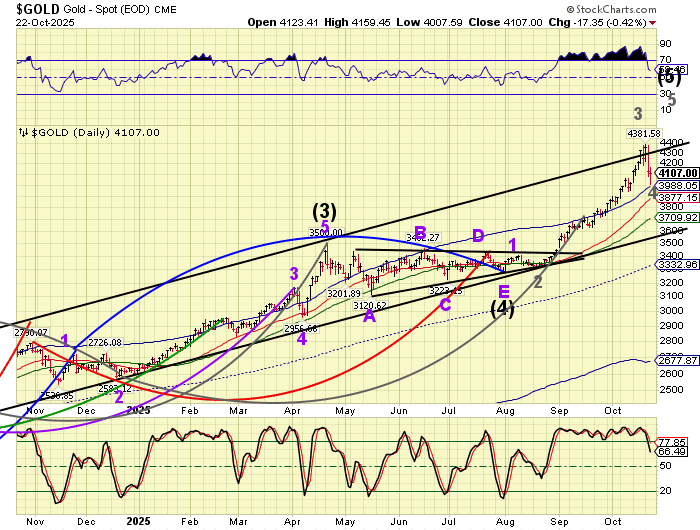

Gold futures rose to 4152.00 this morning as it recovers from its bout of weakness. It bounced off the Cycle Top support at 3988.05 yesterday and may attempt a new high in the next two weeks. Trending strength may return next week with a touch of speculative frenzy thereafter. The Cycles Model suggests that gold may rise above 4500.00 by the end of the current Cycle.

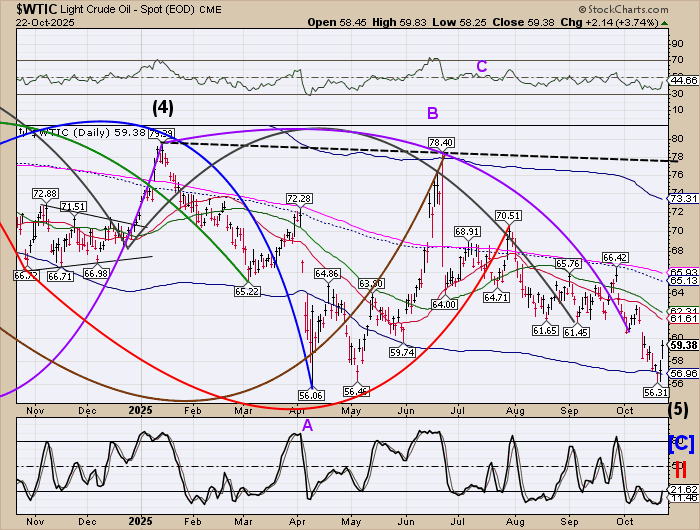

Crude oil futures rose to 61.26 this morning, not testing overhead resistance at 61.61. The Cycles Model suggests a possible imminent resumption of the decline as it may test a 5-year Fibonacci at 52.31 before moving higher. The Cycles Model implies the decline may extend to mid-November.