The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

1:00 pm

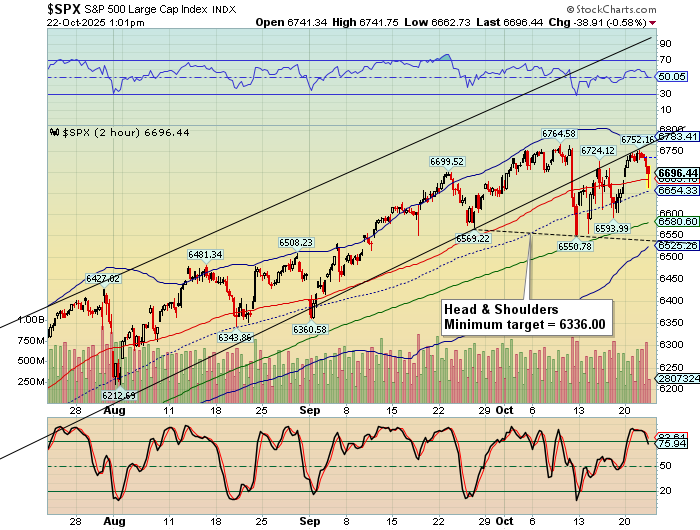

SPX is in the middle of a momentum dump, falling beneath 6700.00 where a wall of puts may cause havoc today. It bounced above Intermediate support at 6654.33 and may be attempting a close at or above 6700.00 to avoid gamma pain mentioned in this morning’s post. Should SPX resume the decline this afternoon, dealers may have to add shorts or sell the index to break even on today’s options market. A decline beneath Short-term support at 6683.00 creates a possible sell signal. Tomorrow may be a bloodbath of selling with the 50-day Moving Average and the Head & Shoulders formation in play. .

ZeroHedge remarks, “As we detailed last night, the market is experiencing a strong degrossing in recent narrative themes, and that is most evident in Goldman’s high-beta momentum basket which is getting slammed again this morning…

It appears that momo meltdown is finally bleeding over into the broad markets…”

8:15 am

Good Morning!

SPX futures traded moderately lower this morning after attempting to make a new all-time high yesterday afternoon. It was repelled by its 5-month trendline underlying its trading channel since early May. The Cycles Model indicates a potential sell-off that may last through the first week of November with increasing downside strength beginning tomorrow. There are increasing chances of limit-down days, especially starting in November.

Today’s options chain shows Max Pain at 6735.00. Long gamma may strengthen above 6750.00 while short gamma is close by at 6730.00. The options chain shows a short trip-lever at 6700.00.

ZeroHedge reports, “US equity futures are flat again, with tech and small caps lagging as traders parsed the latest earnings reports and corporate news amid worries over trade, the US government shutdown and geopolitical risks. Gold and silver extended declines after Tuesday’s slump.”

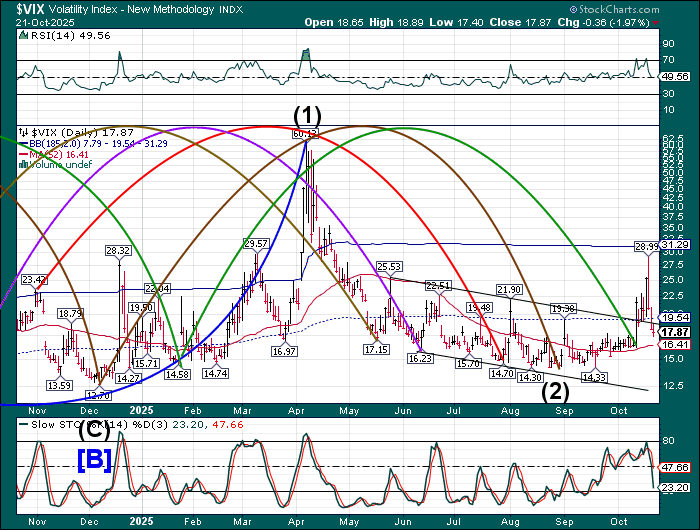

VIX futures rose to 18.28, testing the trendline before easing back. A rise above the trendline and especially the mid-Cycle resistance at 19.54 puts the VIX back on track to rise much higher with the Cycle Top resistance at 31.29 in sight. The Cycles Model suggests today/tomorrow may see a spike in the VIX. There is a mismatch between the VIX Cycle and the SPX Cycles which may foretell another bout of chaos in November. The current VIX Master Cycle may continue its upward path to late December.

Today is weekly options expiration day for the VIX with today’s short VIX options being liquidated, but long VIX options remain.

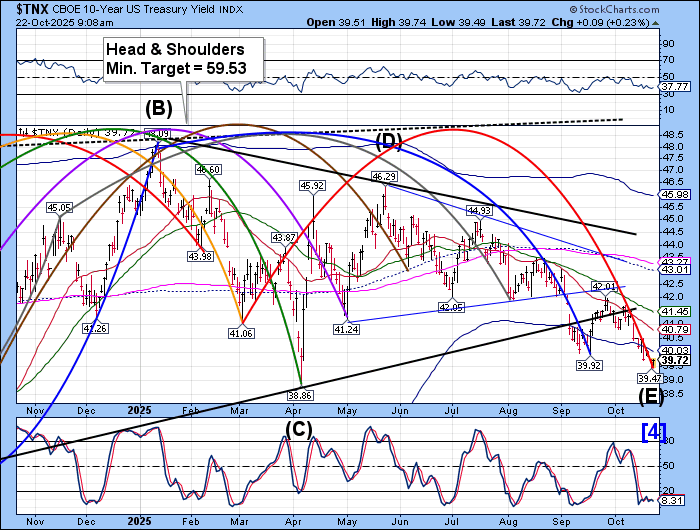

The 10-year Treasury note futures showed an overnight low at 39.37 while the cash low was 39.49. The Master cycle low may have been registered yesterday, October 21. However, the low came early, leaving the possibility of yet a deeper probe sometime this week. Once the reversal is complete, the new Master Cycle may take bond yields higher to late December. The new Master Cycle may start off with a panic rally next week.

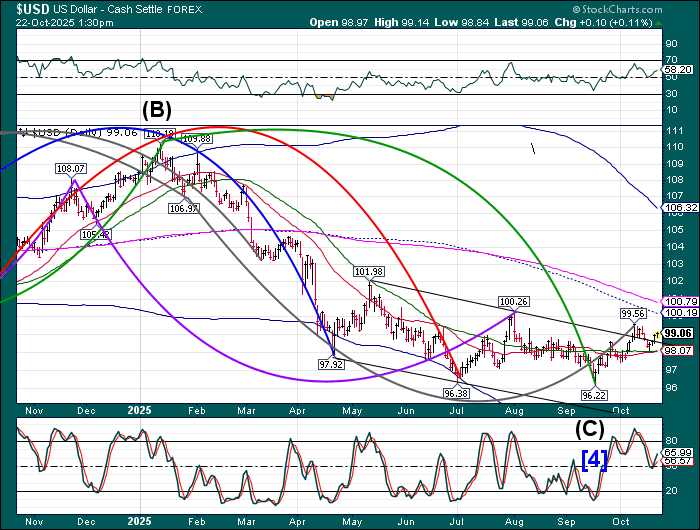

USD futures rose to 99.14 this morning as it continues to gain strength. A move above its Master Cycle high at 99.56 may propel the USD to greater heights, as trending strength may begin this weekend an last through the first week of November. The current Master Cycle may continue on its uptrend through early December and possibly extend through early January. Some writers think that a dramatically rising USD may cause a financial crisis. That puts the cart before the horse since , being the strongest currency, investors would flock to the USD as a safe haven. In other words, it’s the crisis that causes the USD to rise, not the other way around.

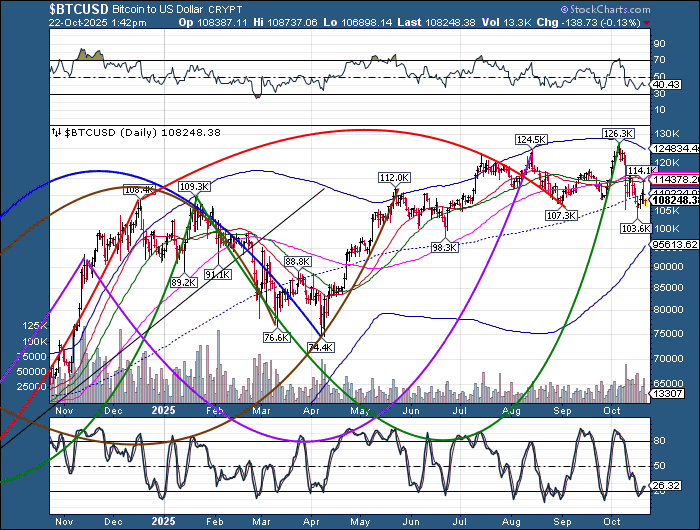

Bitcoin declined to 106930.00 this morning, then bounced. Should it rise above the mid-Cycle resistance at 110223.00, it may test the Intermediate resistance at 114368.00 in the next few days. However, a panic Cycle may appear in early November, sending Bitcoin down beneath its Cycle Bottom currently at 95613.56.

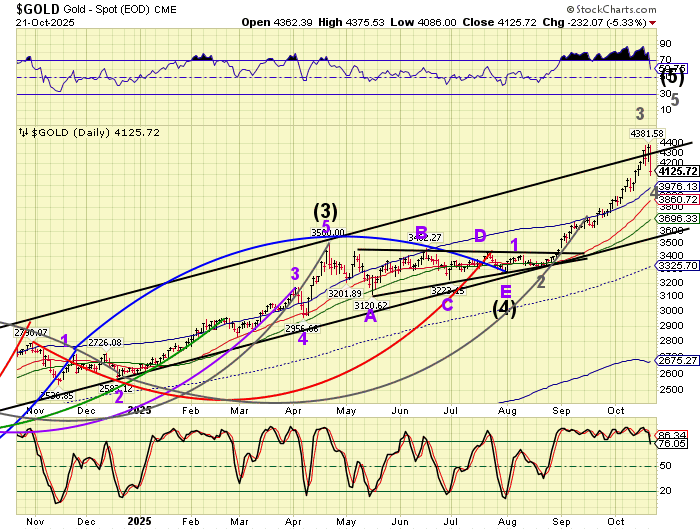

Gold futures suffered a shake-out of weak hands, declining to 4021.91. This elicits a sigh of relief by technicians, staying above round number support at 4000.00. It is also remaining above critical Cycle Top support, suggesting a bounce may be in order. A spike high may develop as investors panic back into gold, driving it to a possible 4475.00 to 4525.00.