The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

12.28 pm

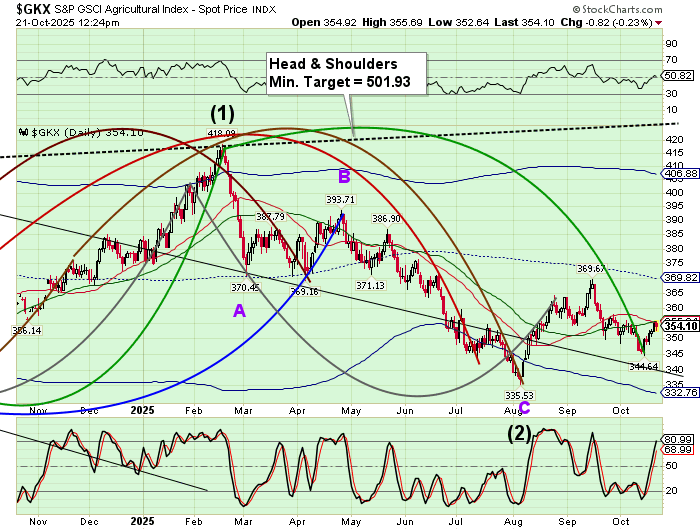

The Ag Index has rallied from its Master Cycle low on October 14. The Cycles Model suggests consolidation for the next week with strength of trend appearing toward the end of the month. Food commodities and industries a in an accumulation phase with emphasis on higher prices around the turn of the month.

12:07 pm

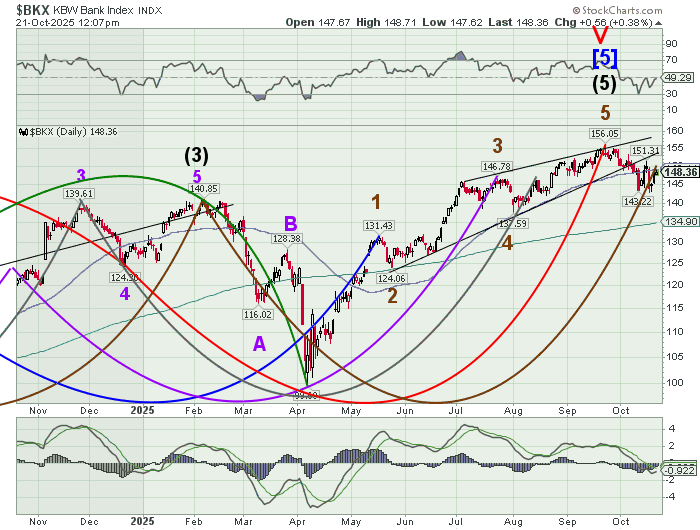

BKX is nearing ita Master Cycle high which may briefly spike above the 50-day Moving Average at 149.11 by the end of the week. There is a possibility of BKX reaching its lower trendline near 155.00. All things considered, the reversal may happen by the end of the week. Investors are buying the dip but don’t have enough strength of purpose to push BKX to a new all-time high.

10:00 am

Good Morning!

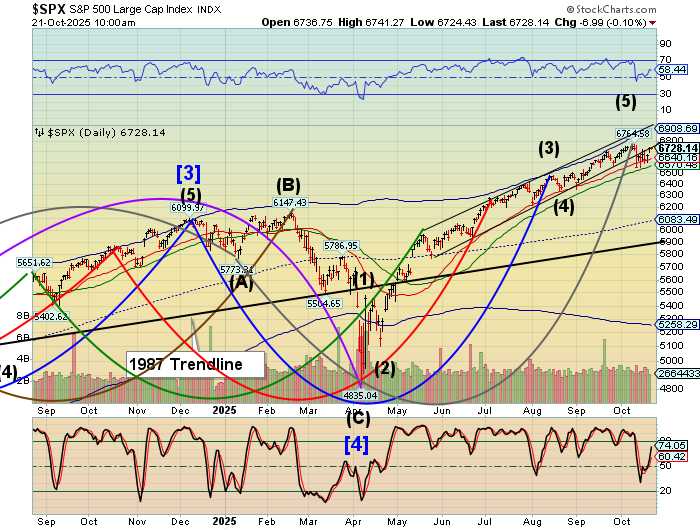

SPX may be in a brief pullback that may lead to another push higher. However, it seems to be tangled with the trendline that offers resistance to any probe higher. Should the trendline resistance keep the SPX from making a new high (ATH) by the end of the day, there is a likelihood of a decline to follow. The current Master Cycle has about two weeks left with no outstanding features, so any decline or rally may be shallow.

ZeroHedge reports, “US equity futures are flat, reversing a small overnight loss, with small caps seeing some underperformance in what looks more like profit-taking than material de-risking. As of 8:00am ET, S&P and Nasdaq futures are unchanged after the S&P 500 notched its best two-day gain since June and the Nasdaq closed at a record high; premarket Mag7 / Semis are mixed but are net weaker with cyclicals underperforming as commodity names are underperforming due to a sharp overnight sell-off in precious metals, among the most notable moves today.”

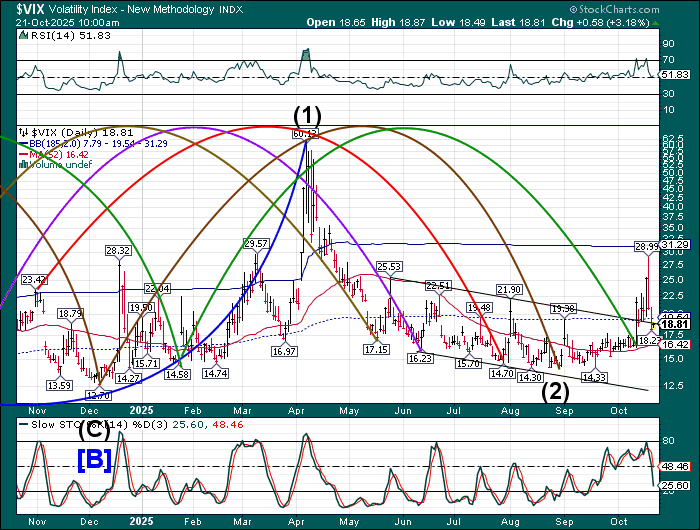

VIX has broken beneath the trendline support at 18.70 and mid-Cycle Support at 19.54, making a 61.8% Fibonacci retracement. The retracement has the potential of dropping to the 50-day Moving Average at 16.42, but may not last. Trending Strength may return on Thursday after the weekly options expiration. There is explosive growth potential during the first week of November.

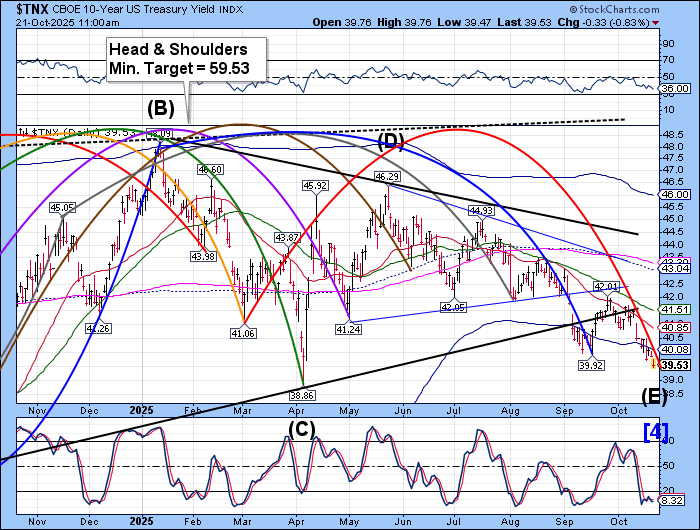

TNX has morning low of 39.45-39.47, extending the decline beneath the September low. The decline may match the April 4 low at 38.86 at completion later this week. Wave (E) is a rogue Wave that may throw off investors, thinking that the lower rates imply the Fed may loosen rates later this year. On the contrary, rates may start climbing at a very fast rate in another week or so.

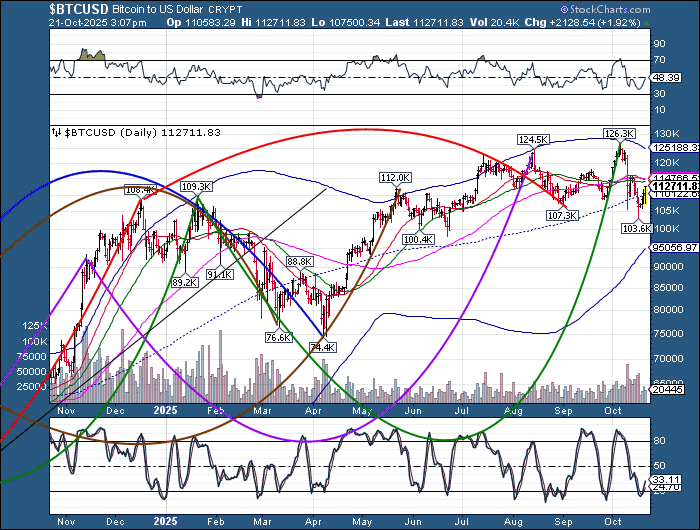

Bitcoin is on a bounce to test the 50-day Moving Average at 114129.00 or Intermediate resistance at 114776.00. The Cycles Model suggests minimal (sideways) activity through the end of October. However, trending strength may reappear in early November, bringing on a possible panic decline through the end of the month.

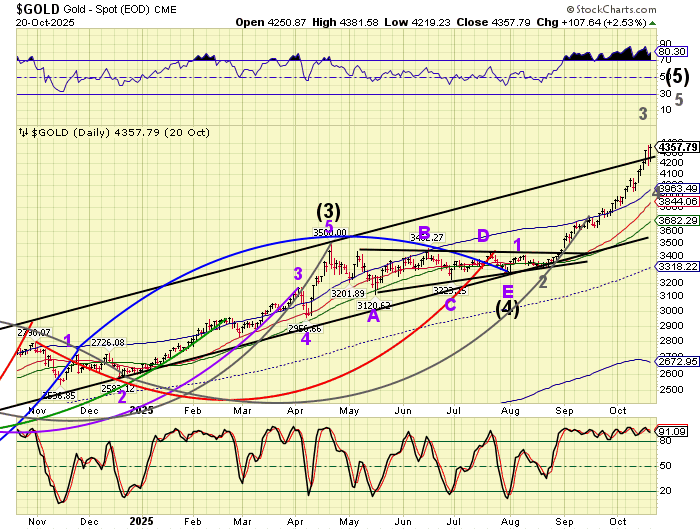

Gold futures are correcting hard, but to be expected after the strong push above the trendline (throw-over). The correction is not expected to last, as volatility settles down later this week. There may be a final probe to a new all-time high starting next week and through the first week of November. We may be witnessing a shake-out of weaker hands as the first bout of profit taking emerges.

ZeroHedge remarks, “Precious metals have been clubbed like a baby seal this morning with Gold down over 5% (biggest drop since Aug 2020)…

Silver is doing even worse, down over 7% (biggest drop since Feb 2021)…”

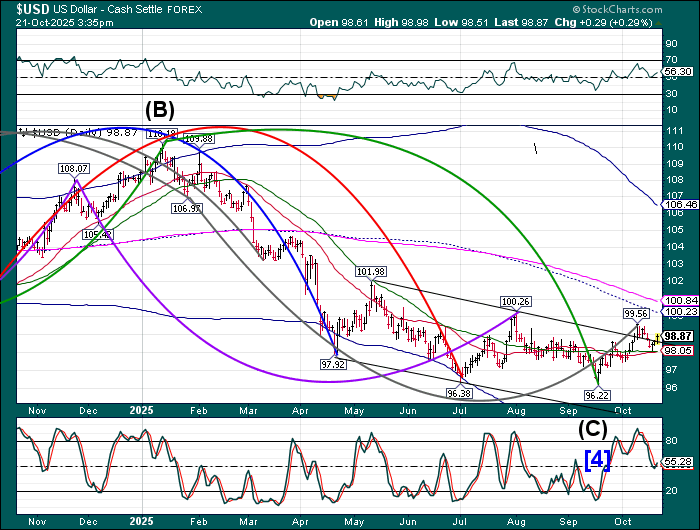

USD has bounced off the 50-day Moving Average at 98.05 and has emerged above the trendline in a very short correction. With the low in TNX coming in this week, I do not anticipate a retest of the 50-day Moving Average. The continued rally may last to the end of November.