The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:10 am

Good Morning!

SPX futures are back beneath the Intermediate support at 6601.00, confirming the sell signal made on Friday. A further decline beneath the 50-day Moving Average at 6526.00 brings on a plethora of sellers as it is universally recognized as a key support. Yesterday afternoon I highlighted a Head & Shoulders formation lurking at Friday’s low that targeted a minimum decline to 6336.00, near the September 2 low. Also in play is the August low at 6212.69 as a short-term goal. Should we see the decline continue, we may see the SPX completely retrace the rally from April 7 over the next month. The SPX went from massively overbought on Thursday to neutral today. However, Investors are unsure of what to do as the old regime seems to have crumbled. Commercials are still very long, but may change on a dime. As a result, retail investors are casting about for investment ideas and the money flows have declined to a trickle.

Today’s options chain shows Max Pain at 6660.00. Long gamma may begin above 6675.00 while short gamma strengthens beneath 6645.00.

ZeroHedge reports, “The market rollercoaster continues: after Monday’s faceripping bounce, US equity futures are lower again led by tech, part of a global risk-off tone as the US/China trade war returned after Beijing vowed to “fight to the end” in the tariff and trade war, while acknowledging that the door for negotiation is open and trade talks between the two countries had resumed yesterday.”

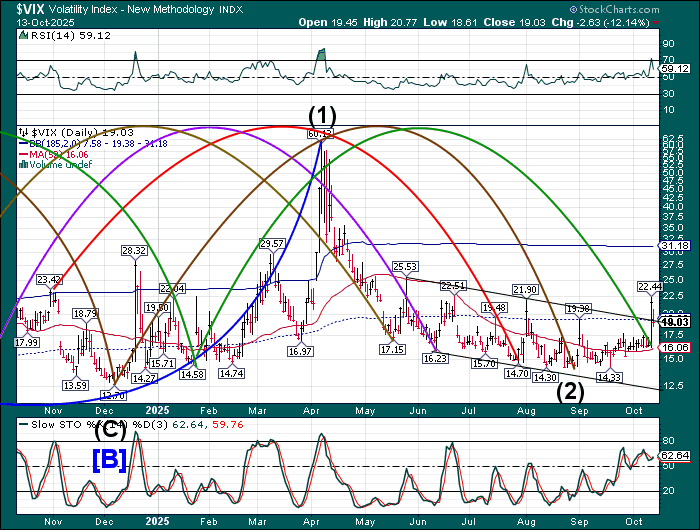

VIX futures may have stressed to a new high in the overnight market, causing the term structure to spike. Friday’s market shock is still on investors’ minds with most still unsure of what to do. Pressure is building for a panic situation that may appear later this week, according to the Cycles Model.

Tomorrow’s options chain shows heavy loads of short gamma from 14.50 to 21.00. Long gamma may begin above 25.00 with some institutional participation to 55.00.

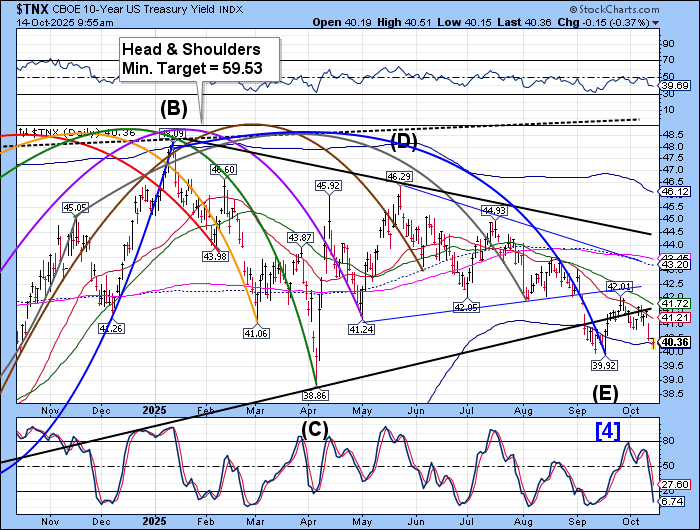

TNX futures declined to 39.99 in the pre-market session, dropping beneath the Cycle Bottom support at 40.28. The Cycles Model indicates 1-2 more weeks of decline with a possible target beneath the September low. This may extend Wave (E), which is not unusual. The sell-off in equities may be a driver for the decline in yields, as investors still believe that treasuries may be a safe haven. However, once the decline is complete, a rally may ensue to mid-December.

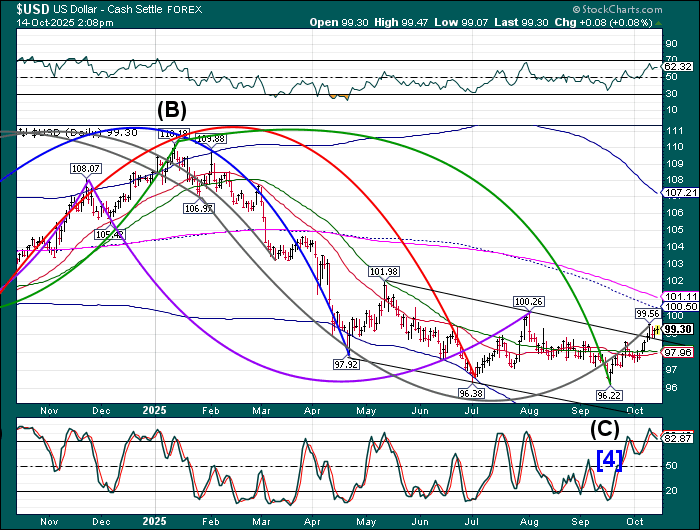

USD is consolidating beneath Thursday’s Master Cycle high as it enters a corrective period that may last to the end of November. Should the USD find support at the 50-dayMoving Average (97.96) in the next two weeks, USD may make a bullish turn.

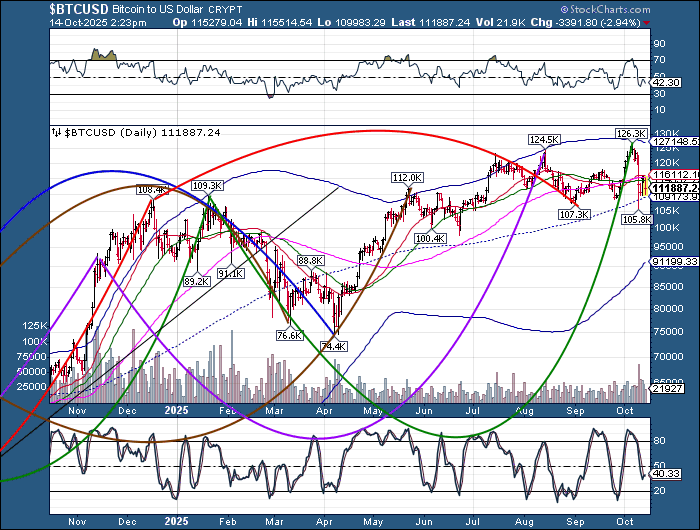

Bitcoin’s bounce was stopped at Intermediate resistance at 116112.00 this morning. It has remained on a sell signal and may challenge the mid-Cycle support at 109123.90 today, as the Cycles Model suggests volatility may increase today. Should Friday’s low be exceeded, the Cycles Model suggests a continuous decline may ensue with multiple panic days by mid-November.

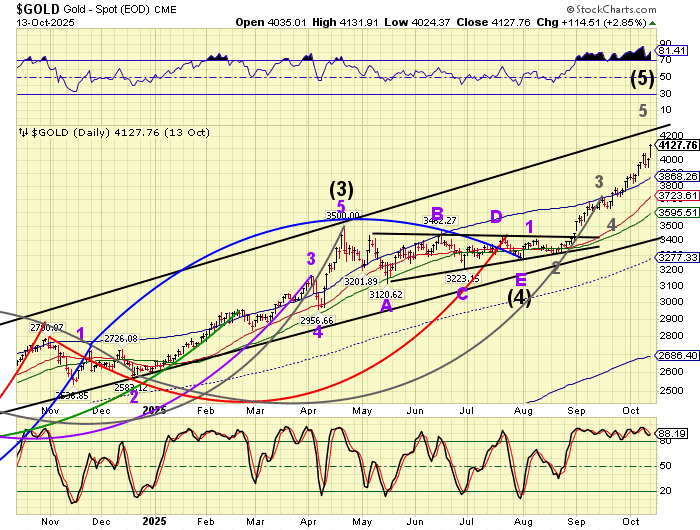

Gold futures continue their climb to the upper trendline, currently just above 4200.00. Another panic upswing may occur this weekend. Should it reach the trendline, it may go into a throw-over panic session toward the end of the month. The rally may still extend to mid-November. 4500 may be possible. This gold rally is overbought, but may get to be even more explosive. No one is selling. There is a concern for capital controls being implemented in Europe, which may be a negative for prices.

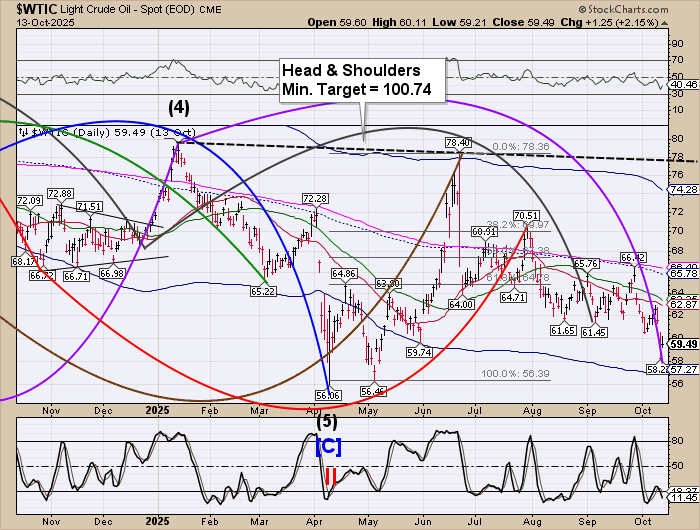

WTI Crude futures may have extended its Master Cycle low to this morning when it declined to 57.34. The Cycle Bottom appears at 57.27, so it appears that there may be a reversal that could develop into a new uptrend. Note the Head & Shoulders formation that has been in play since the beginning of the year.