The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:00 am

Good Morning!

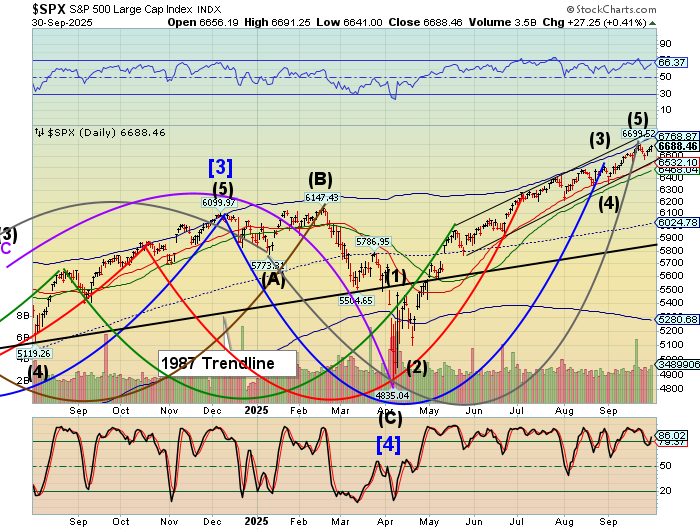

SPX futures declined to 6629.10 this morning as the government shutdown becomes reality. Markets are based on confidence. A shutdown destroys confidence in government, as if it wasn’t already lost. Since government spending affects so much of our economy, confidence declines in the markets’ ability to perform as usual, as well. Critical support lies at the Ending Diagonal trendline and Intermediate support at 6532.10.

This morning’s options chain shows Max Pain at 6665.00. Long gamma rules above 6700.00, while short gamma dominates beneath 6650.00.

ZeroHedge reports, “US stock futures are weaker to start the new quarter but have cut overnight losses by more than a third, as the first US government shutdown in nearly seven years begins. The first shutdown during Trump 1.0 lasted 3 days and the second shutdown 35 days: how long will this one last? As of 8:00am ET, S&P futures are down 0.4%, but well off session lows while Nasdaq futures drop 0.5%.”

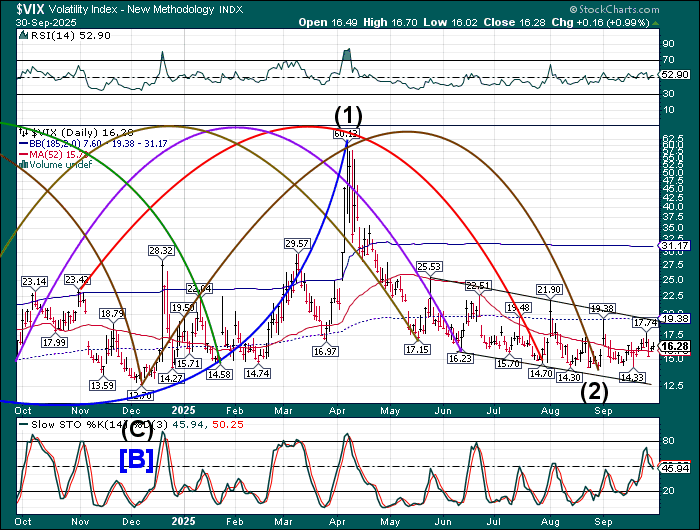

VIX futures rose to 17.28 this morning as instability sets in. The Cycles Model infers a potential spike in volatility during the next two weeks as investors/speculators assess the impact of the shutdown. As the crowd was obliged to follow the market higher, the cost of protection has risen, forcing the dealers to short the downside. Should the market fail, dealer covering could magnify the downside move in equities.

Today’s options expire at the close. The October 8 options chain shows short gamma at 16.00. Long gamma starts at 17.00 and is building to 30.00.

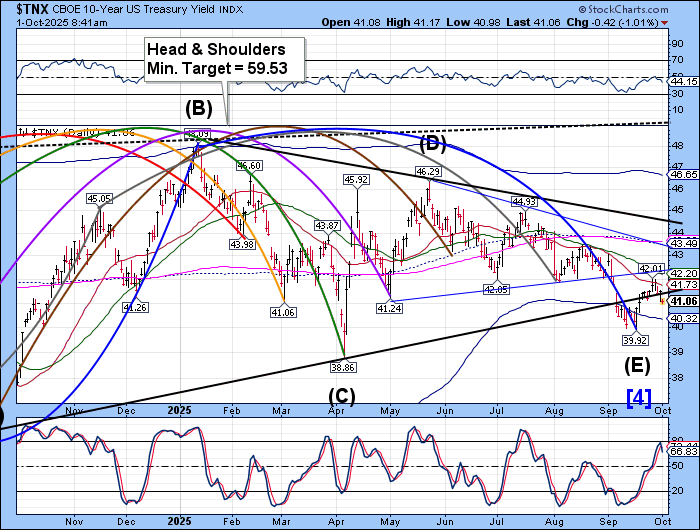

10-year Treasury Note yields declined to a morning low at 40.93 before a minor bounce. It is on a sell signal with a potential target near the Cycle Bottom at 40.32.

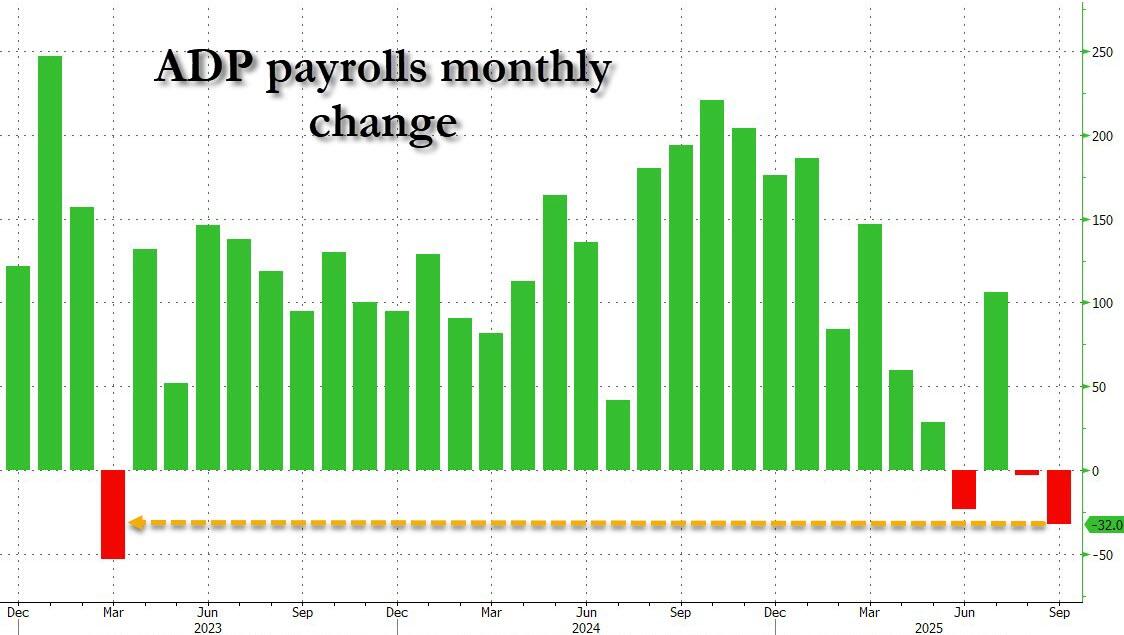

ZeroHedge observes, “Ahead of today’s ADP print we said that traders will be especially focused on the otherwise unreliable number, since the government shutdown which hit at midnight means that this Friday’s payrolls report will likely not happen. Well, if that is the case, the market – and Fed – may well be expecting a jumbo 50bps rate cut again in 3 weeks, because moments ago ADP reported that in September, the US private sector shed 32,000 jobs, the worst print since March 2023…”

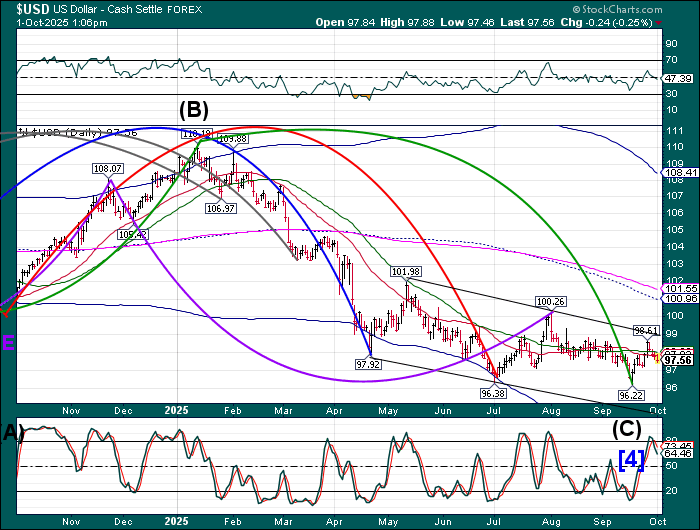

USD futures declined to 97.14 this morning, not yet showing in the forex market. The Cycles Model suggests the USD may go lower over the next two weeks. A potential target may be the lower trendline near 95.00, possibly extending Wave [4] even lower.

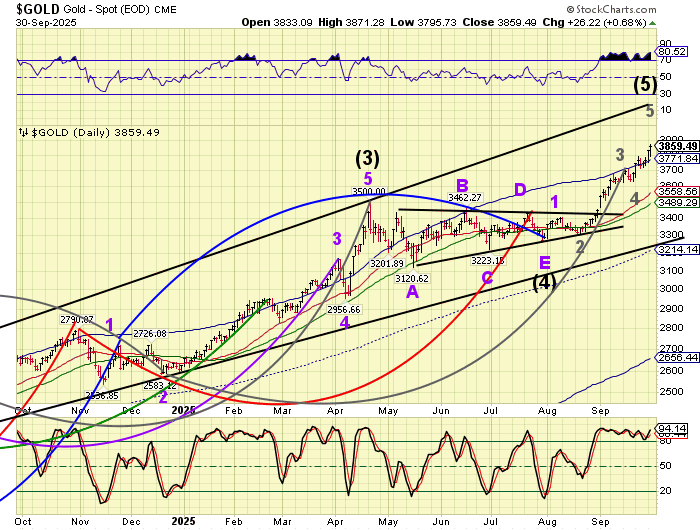

Gold futures rocketed to 3922.10 this morning as government uncertainty incentivizes investors to seek a safe haven. Gold has “thrown over” its Cycle Top at 3771.64, putting it in an unstable position. A reversal beneath the Cycle Top may incur a sell signal.