The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:00 am

Good Morning!

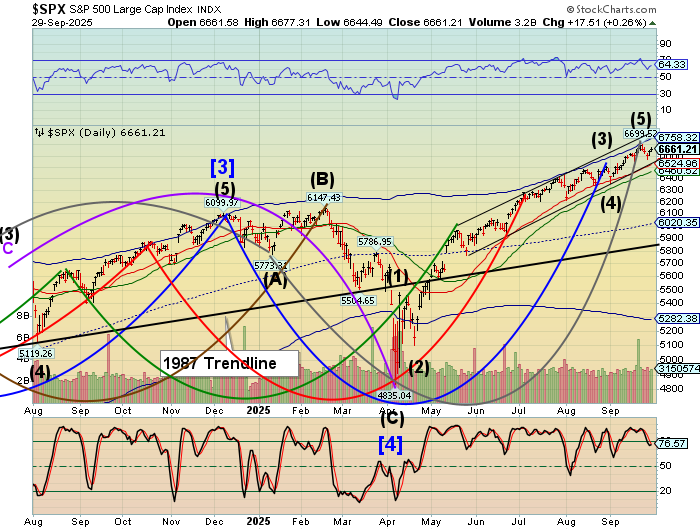

SPX futures reached a low of 6642.40 this morning and is lingering near the low. The Trendline and Intermediate support lie at 6525.00, where a sell signal awaits. While no accepted technical signal is given yet, the Master Cycle has turned. The Cycles Model offers a potential decline that may last until early November, giving it time to potentially match the April 7 low. Traders await updates on the potential government shutdown, looming as early as tomorrow.

Today’s options chain shows a very large contingent of puts and calls at 6650.00. Long gamma gains mastery above 6675 while short gamma dominates beneath 6620.00.

ZeroHedge reports, “Futures are lower as we close out the quarter/month, ahead of what is a most likely (80% odds on Polymarket) government shutdown. As of 8:00am ET, S&P and Nasdaq futures are down 0.2% as sentiment sours after Monday’s optimism. Still, on the final trading day of the month, the S&P 500 is on track for its best September since 2010. ”

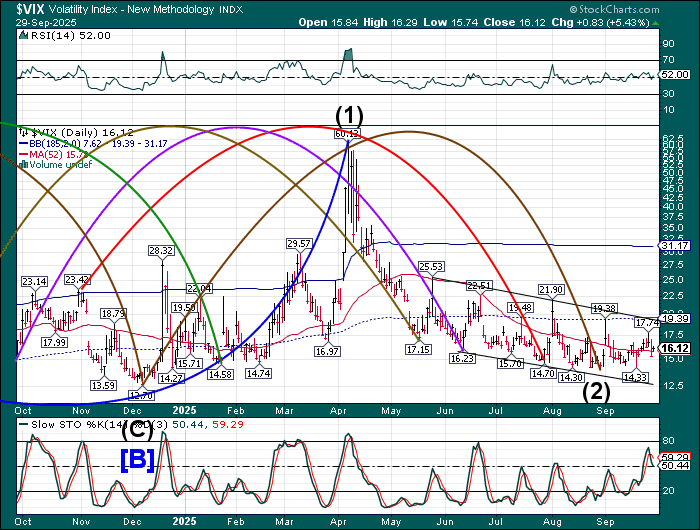

VIX futures rose to 16.70 in the overnight session. It is on a buy signal above 15.73. Overhead resistance lies at the upper trendline and Intermediate resistance at 19.39. The Cycles Model suggests a potential breakout in the next two weeks. The fractal structure suggests the next possible move may be to challenge the impeding trendline. While hedging is yet tentative, the rush to hedging may explode as the trendline is broken.

Tomorrow’s options chain shows short gamma at 15.00-16.00. Long gamma gains dominance at 17.00 and is beginning to fill the space between 20.00 and 25.00.

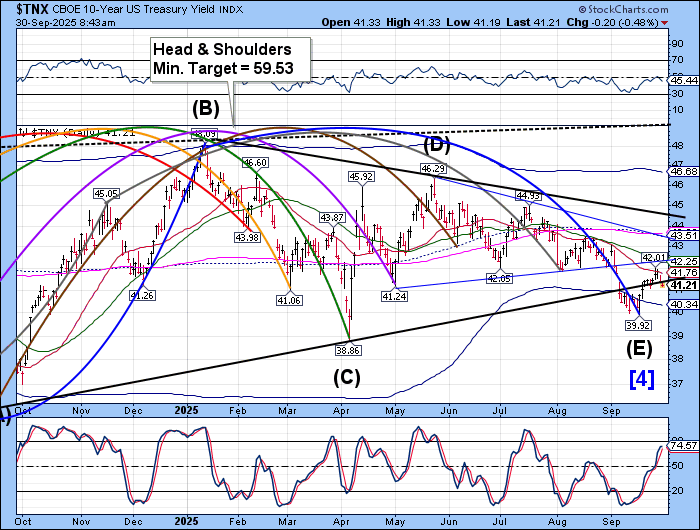

TNX has nudged beneath the trendline, with the next support at 41.00. However, the government shutdown may temporarily strengthen bonds, causing yields to drop to the Cycle Bottom near 40.34. Should that be the case, the current Master Cycle may run to mid-October.

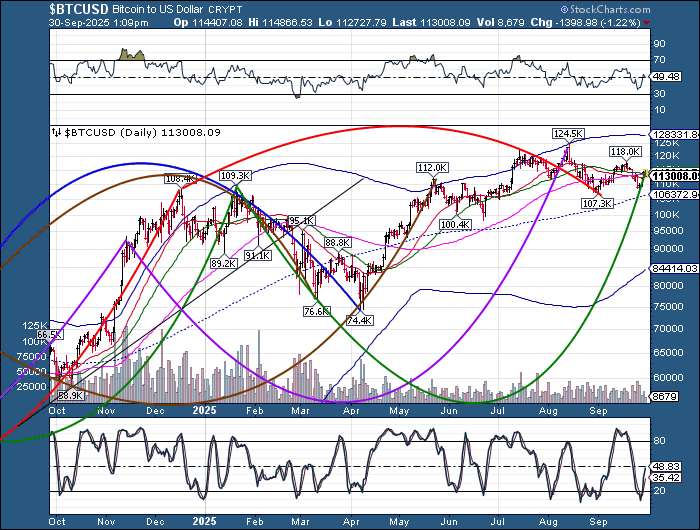

While Bitcoin rose above the 50-day Moving Average at 113815.00 yesterday, it fell beneath it this morning on a potential reversal day in the Master Cycle. It made a 61.8% Fibonacci retracement at 114493.00 yesterday, fulfilling one of the standards for a retracement. That being said, we may wait for further clarity which may arrive in the next few days.

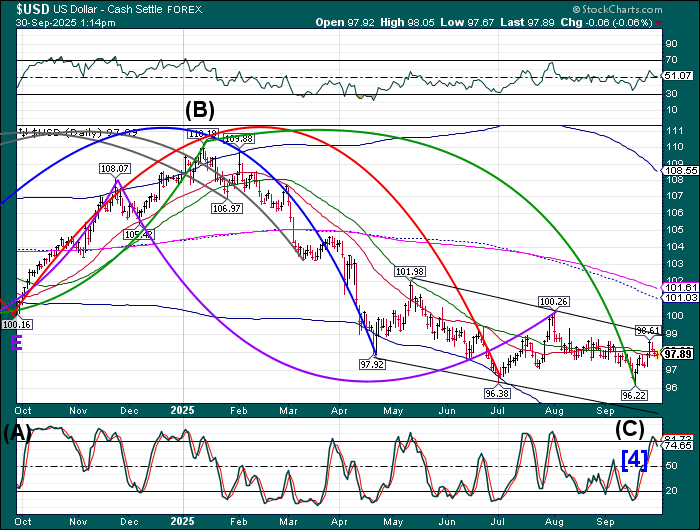

USD futures are consolidating beneath the 50-day Moving Average at 98.03. This suggests a possible decline over the next two weeks to the trendline near 95.00. Should that be so, dollar shorts may get a temporary reprieve from their pain as the bounce may be over.

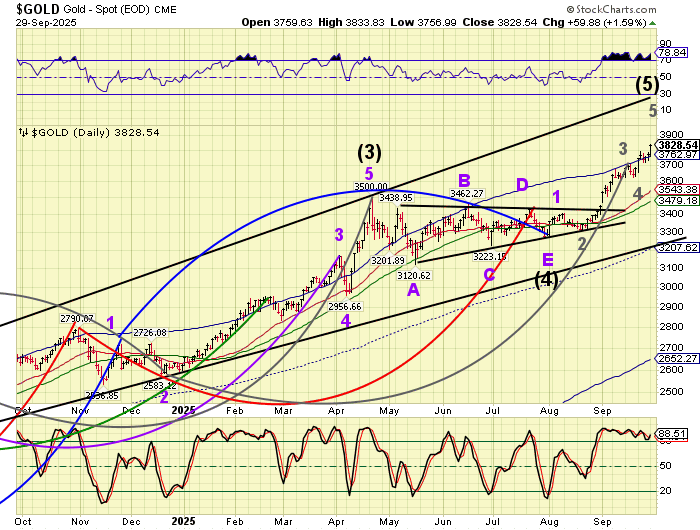

Gold futures made a reversal this morning after having potentially completed its final fractal in the series. Should gold decline beneath its Cycle Top at 3762.97, it may offer an aggressive sell signal. The Model suggests a potential decline may last to mid-November. Calls for higher prices may persist until the 50-day Moving Average at 3479.18 is broken.

ZeroHedge comments, “Gold at $7,000, silver at $100—Frank Holmes isn’t pulling punches. The U.S. Global Investors CEO, who called $4,000 gold back in 2020, warns that the world teeters on the edge of monetary and geopolitical chaos. Exploding global debt, record military spending, and a Fed trapped between inflation and recession are fueling the perfect storm for precious metals.”

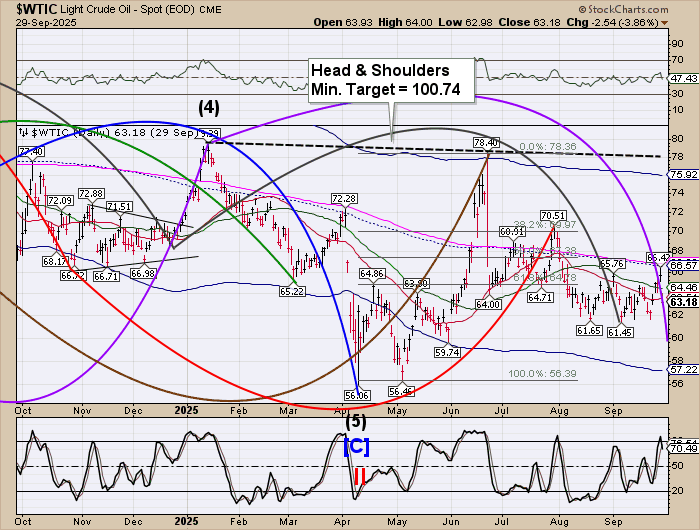

Crude oil has taken a nosedive at the prospect of a government shutdown. After all, the US Government may be the largest customer of oil-based fuels. A Master Cycle low is pending until clarification is made about what is being paid and what is being deferred. The Cycles Model suggests that confusion about the government consumption of oil may be resolved in the next week.