The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:00am

Good Morning!

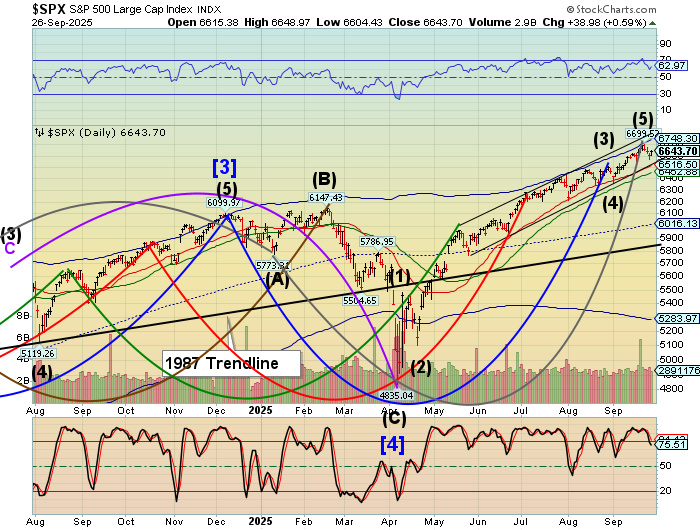

SPX futures rose to 6683.40, taking the high road on Friday to complete its first declining fractal. NDX is leading the decline and may reverse in the first market hour while the SPX may linger another hour or two. No one is particularly alarmed. What few that have recognized the reversal have concluded that the decline may be shallow. They are correct thus far. However, the Cycles Model anticipated 5-6 weeks of decline ahead. While this week’s calendar shows few domestic issues, flight tracking data shows a wave of U.S. tankers being deployed to Europe.

Today’s options chain shows Max Pain at 6640.00. Long gamma may begin above 6670.00 while short gamma becomes very strong beneath 6610.00.

ZeroHedge reports, “Last week’s small market swoon is a distant memory with US equity futures up sharply on Monday, led by tech and small caps as the S&P looks to set a new ATH. As of 8:00am ET, S&P futures are up 0.5% (and off session highs) keeping the benchmark on track for its best September since at least 2013, even as the month is typically difficult for stocks.”

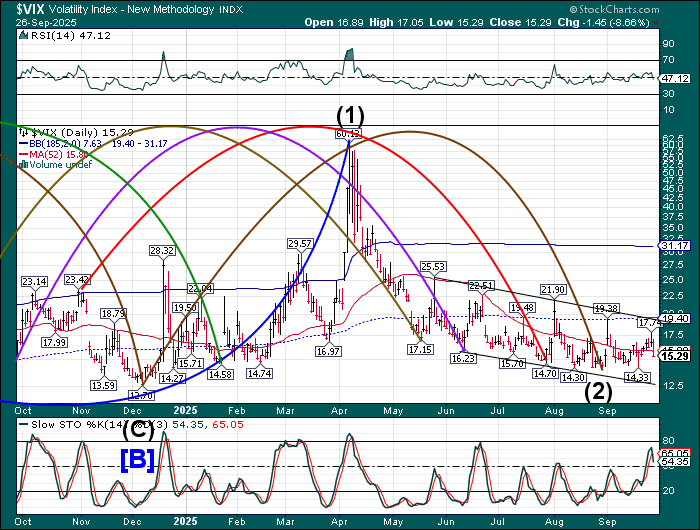

VIX futures rose to 16.00 over the weekend. It is back above the 50-day Moving Average at 15.80. Some of the discounts in the options market have disappeared over the weekend. There is an anomaly in the Cycles Model, showing VIX peaking in about 2 weeks, while the SPX may continue its decline to early November. Making things more interesting, market internals agree with the VIX, giving it credence as a possible leading indicator.

The October 1 options chain shows Max Pain at 17.00. Short gamma still resides at 15.00-16.00. Long gamma becomes very strong above 20.00 with institutional participation every 5 points above 20.00 to 55.00.

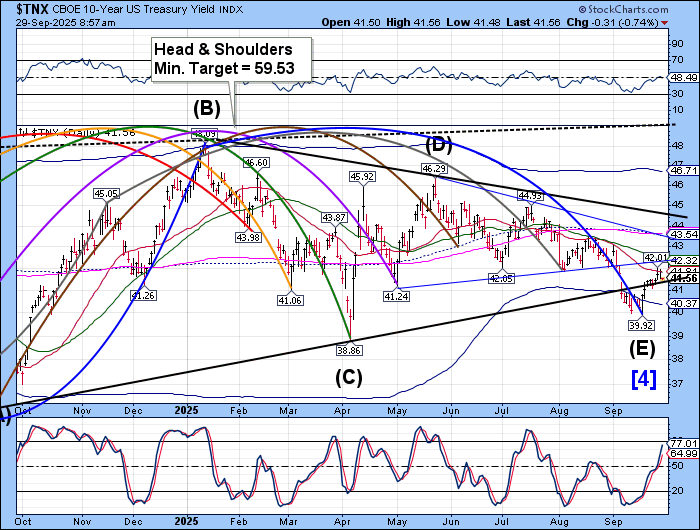

TNX has pulled back over the weekend, consolidating above the trendline. The most likely path may be a test of the 50-day Moving Average at 43.32 as the Cycles Model indicates a further probe higher may be building. Analysts claim that the prospect of a government shutdown on Wednesday may already be figured into their calculations.

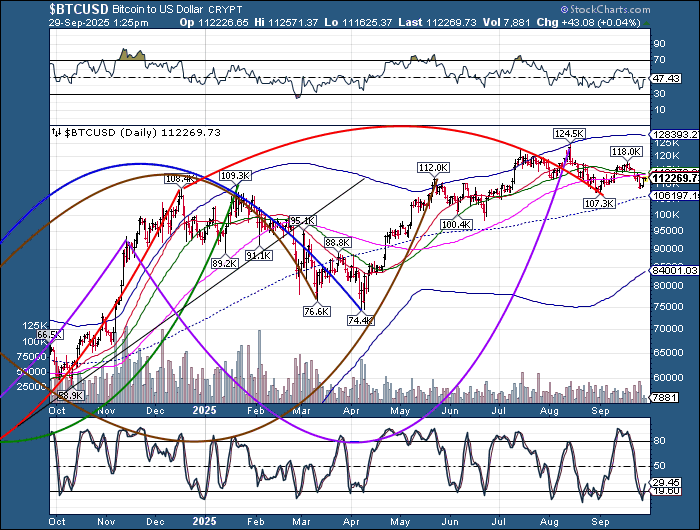

Bitcoin has bounced to test Intermediate resistance at 112.610.00. Should it go higher, a plausible target may be near 122000.00. The Cycles Model may be winding up its final corrective probe higher. The EU is considering capital controls to keep money from fleeing the continent. In that case, bitcoin owned by Europeans may be cashed into US dollars to insulate them from seizure.

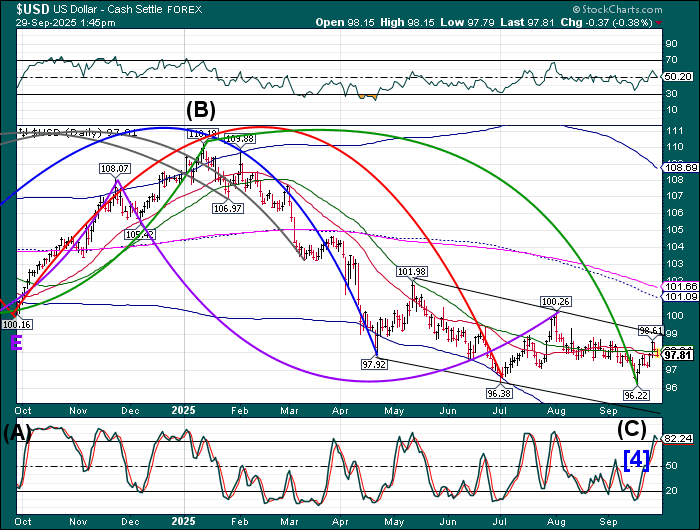

US dollar futures are testing Intermediate support at 97.84. Should it break down, a new low may be made. The Alternate view calls for a possible breakout of the declining trend channel. The answer may reveal itself in the next two weeks. Seasonality experts say that “Now is the time to buy the dollar.”

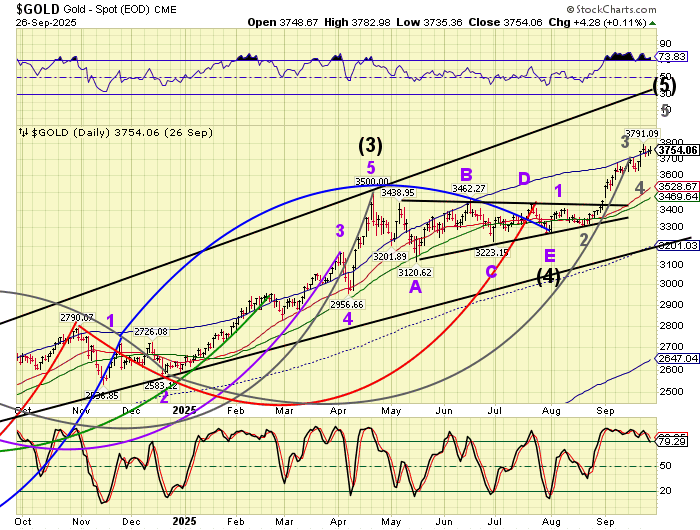

Gold futures are continuing to climb to new heights as it has broken out above the Cycle top at 3755.02. The Cycles Model suggests that gold may continue its uptrend to mid-November.

ZeroHedge notes, “On the back of a 45% surge in the price of gold this year, the US Treasury’s hoard of the barbarous relic has surpassed $1 trillion in value for the first time in history.”