The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:15 am

Good Morning!

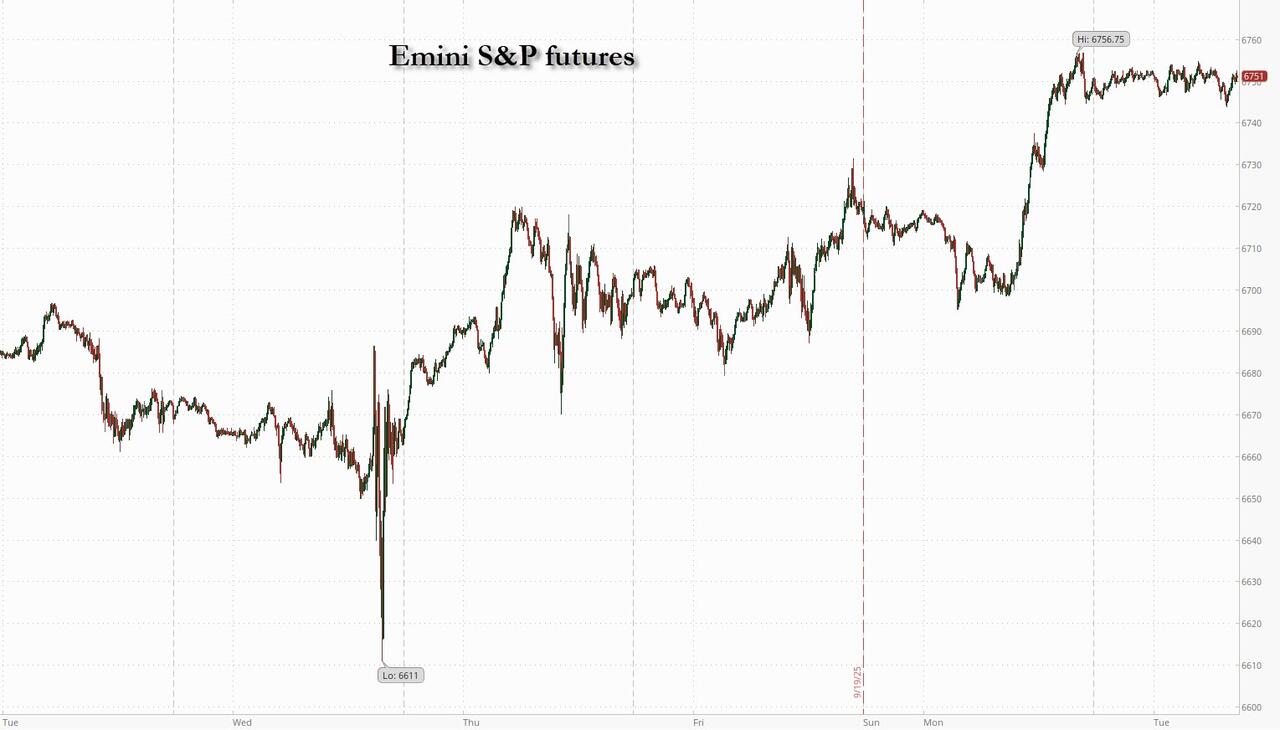

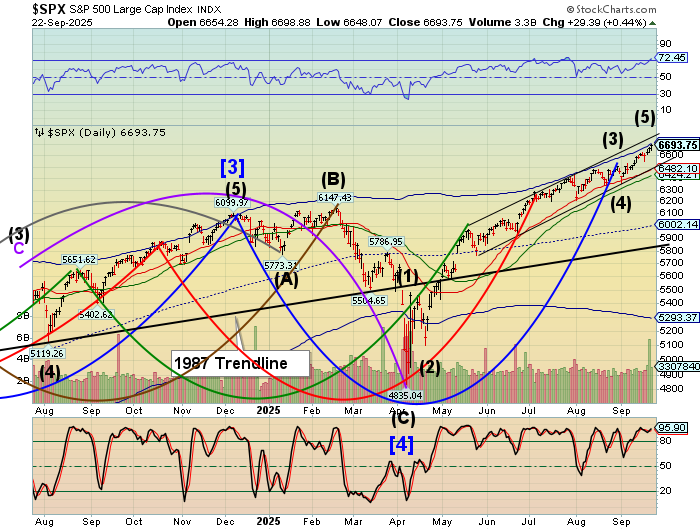

SPX futures reached 6697.80, hovering just beneath yesterday’s high. The Cycles Model infers that, while there may be up to another 2 weeks left to the current Master Cycle, the fractal may be inverted and due for a reversal at any time. In addition, This week offers multiple days of strength that may accentuate a move in either direction. Today is day 253 of an average 258 days in a Master Cycle. Prepare for a reversal.

Today’s options chain shows Max Pain at 6+675.00. Long gamma rules above 6700.00 while short gamma comes into play beneath 6650.00.

ZeroHedge reports, “US equity futures are flat after Monday’s latest dose of AI excitement (where nobody seems to know where the funds will come from, but then again nobody seems to care) drove indexes to fresh highs. S&P futures are unchnaged, with Nasdaq 100 futures fractionally in the red, with Mag7 names mixed in premarket trading as Semis have a slight bid. BA is +2.3% on a potential order stemming from the US/China trade talks. There’s a lot going on – from a looming government shutdown to surging Chinese exports – but no clear way to play it. Bond yields 1-2bps lower as the yield curve shifts lower; USD is flat. Cmdtys are mixed with crude and precious leading; gold +90bp as China moves to custody gold similar to NY Fed. OECD hikes global growth estimate for FY25 from 2.9% to 3.2% with US growth est. moving from 1.6% to 1.8% and 1.5% for FY26. OECD also predicts that the full impacts from tariffs have yet to be felt. The macro data focus is on Flash PMIs and regional Fed activity measures. Today’s main event is Fed Chair Powell’s economic outlook.”

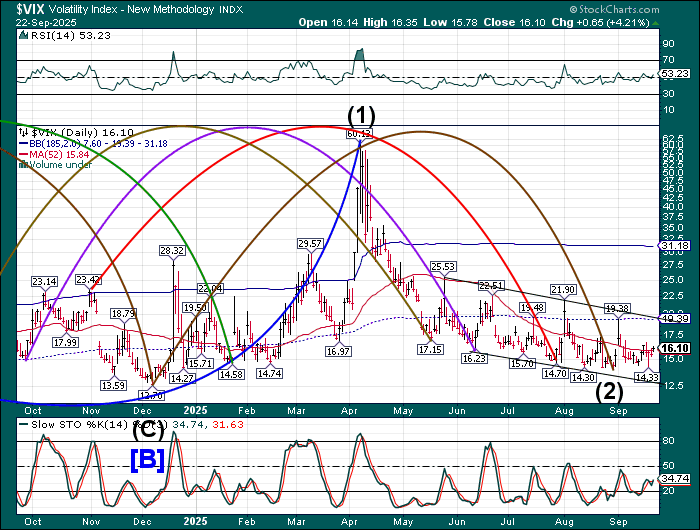

VIX futures are hovering above the 50-day Moving Average and on a buy signal. The next resistance level is the mid-cycle resistance at 19.39. A breakout of that level may be universally recognized as a buy signal and a confirmation of the Cyclical buy signal. The Cycles Model suggests growing strength of trend to the week of September 6.

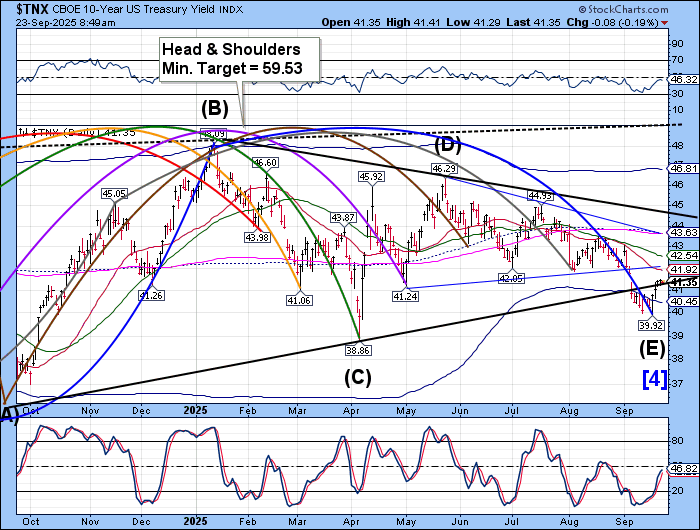

The 10-year treasury yield remains above the lower Triangle trendline. The Cycles Model infers a potentially strong move in the next couple of days that may bring TNX up to the 50-day Moving Average as high as 42.54 before a three week correction.

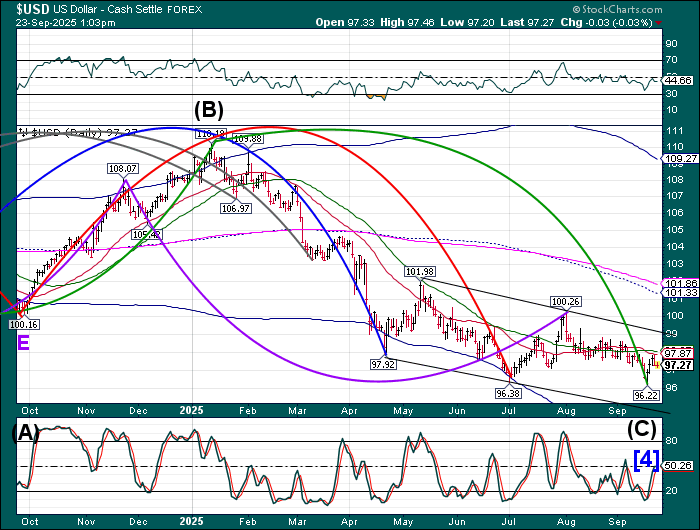

USD futures are consolidating beneath the 50-day Moving Average at 98.07 this morning. While not on a (recognized) buy signal above the 50-day, the Cycles Model infers a rally in progress until mid October. A breakout may not be universally recognized until it overcomes the declining trendline currently at 99.00.

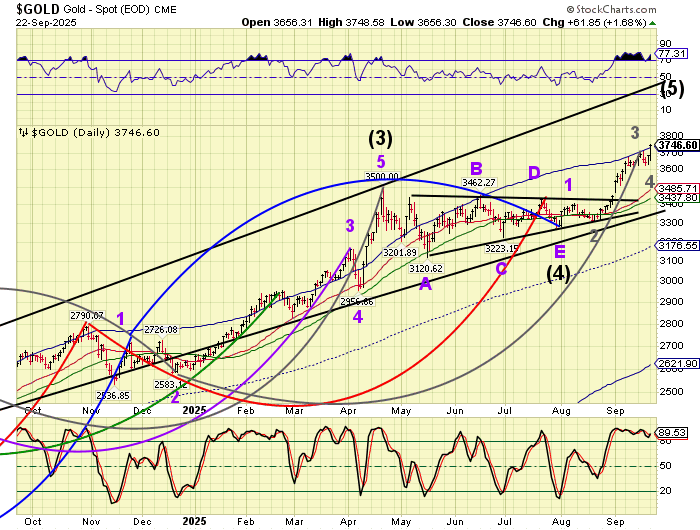

Gold futures are experiencing multiple days of strength this week as it throws over its Cycle Top. This condition may linger to mid-November as the drumbeat of war in Europe and the Middle East grows louder. While most associate the rise in gold to inflation, that is a secondary effect. Historically, it has been shown that war is the primary driver for the price of gold.