The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:15 am

Good Morning!

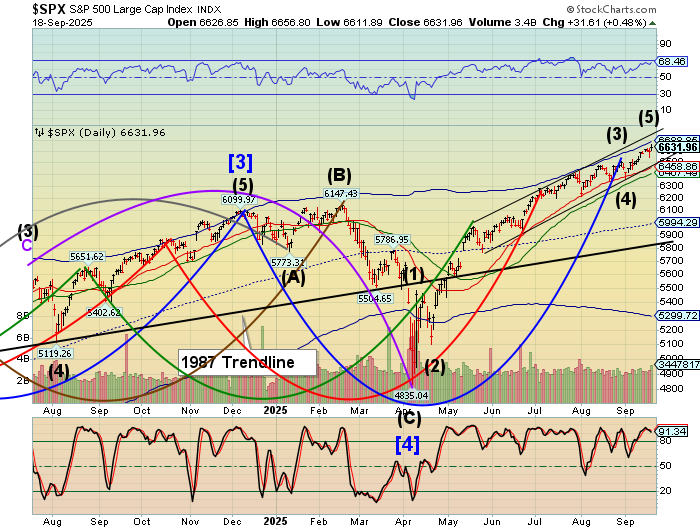

SPX futures are hovering beneath yesterday’s all-time high. On the menu today is the largest position of maturing/expiring call options in history. Should the majority of calls mature above Max Pain, the dealers will be scrambling to fulfill those maturing options, causing a spike higher. The Cycles Model suggests resistance may occur near the Cycle Top at 6688.85. Once expiration is passed, there may be a “let-down” as dealers sell shares held long to fulfill their obligations to the call options holders. There is no free lunch. The Cycles Model shows a possible burst of volatility on Monday following options expiration.

Today’s afternoon expiry shows Max Pain at 6580.00. Long gamma becomes strong above 6600.00.

ZeroHedge reports, “US stocks are set for a quiet finish to a busy week in which the Fed’s first step in what will be a series of rapid interest rate cuts propelled markets to fresh highs. After all four major indexes – DJIA, SPX, Nasdaq and Russel – closed at a record high for the first time since November 2021, futures are flat this morning, with the S&P unchanged and Nasdaq up 0.1%, as Mag 7 stocks are mostly higher led by the +1.1% and +0.7% in TSLA and AAPL. Overnight the BOJ spooked risk assets when it kept rates as expected but surprised markets by announced a 330BN yen annual sale of its massive ETF holdings. The yield on 10-year Treasuries climbed three basis point to 4.13% after yesterday’s sharp move higher, which helped the dollar rise for a third day. Commodities are mixed: oil is lower, while previous metals/ags are both higher this morning. Today sees a much-anticipated call between Xi and Trump at 9am New York, with TikTok and trade likely on the agenda.”

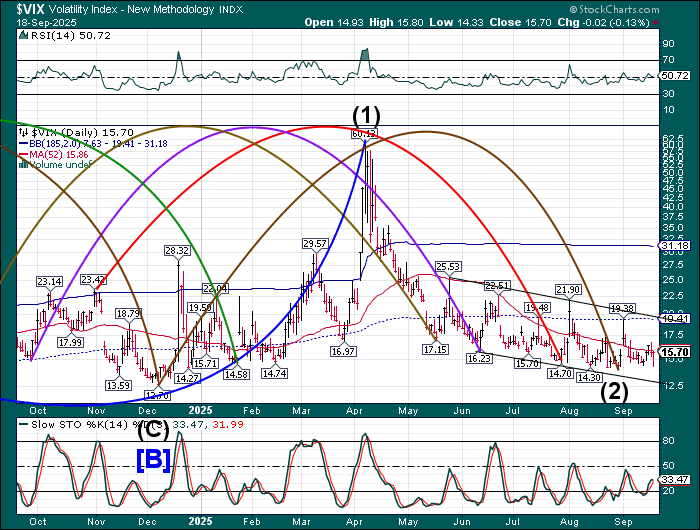

VIX futures may be consolidating beneath the 50-day Moving Average at 15.86 this morning. There may be efforts to suppress the VIX today to keep the markets calm. The Cycles Model shows a possible burst of market strength on Monday following options expiration. The declining trend channel may be broken out.

The September 24 options chain shows Max Pain at 16.00. Short gamma still resides at 14.00-15.00. Long gamma may begin in force above 16.00 and strengthens through 20.00.

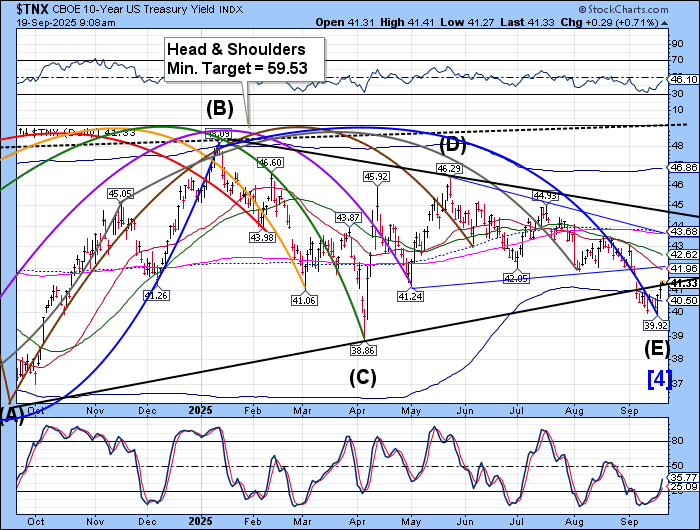

TNX rose to 41.41, rising above the year-long Triangle trendline and offering a possible buy signal. The reversal is about 1 week early, so there may be a back-test of the reversal in the next week. The Bank of Japan and the Bank of England are showing stress, which may strengthen yields in the UST.

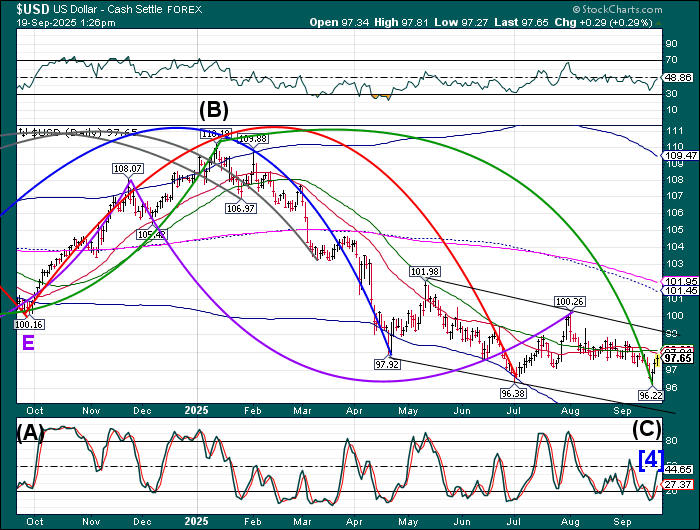

USD futures continue to climb toward the 50-day Moving Average, above which lies a potential buy signal. The Cycles Model shows growing strength in the rally that may continue to mid-October. Further advancement may not only overcome the 50-day, but also break out of the 5-month declining trend channel.

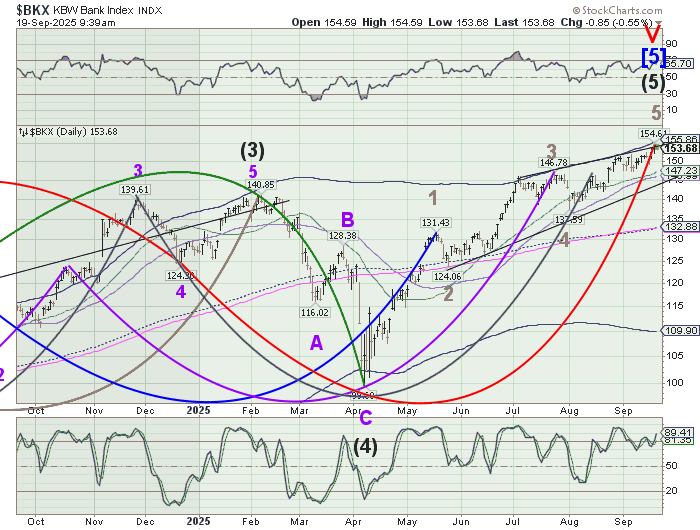

BKX made a new all-time high yesterday and may be pulling back today. The Cycles Model shows the Master Cycle is fully extended and due for a reversal. In addition, volatility may appears on Monday, strengthening the reversal. The Model shows a decline is in the offing that may last to late October.

ZeroHedge observes, “Did a medium-sized canary just croak in the coalmine of consumer credit?

While the world and his pet rabbit was avidly glued to the screens, hanging on every word from Fed Chair Powell, something happened in a name that few have likely heard of that could have a much greater impact on markets.”