The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

1:08 pm

SPX has paused as it reaches for a new all-time high. A potential target may be in the range of 6485.00 – 6500.00. Most strategists were caught by surprise at Powell’s speech. Retail investors are throwing caution to the wind as they speculate whether Powell will make a .25% or .50% rate cut in September.

9:00 am

Good Morning!

SPX futures bounced from Intermediate support at 6340.90 this morning. Investors are waiting for the outcome of Jerome Powell’s speech at 10:00 am. Whether Powel focuses on inflation or employment may give investors the direction of the path forward. The Cycles Model tells us that the current Cycle has either ended on August 15 or may go to a new all-time high in a final flourish of volatility. The aftermath may be a decline to the end of September.

What we have witnessed is a month-long Cycle inversion that may be more of a result of runaway investor expectations than outright attempts at manipulation. Valuations have now exceeded those of the 2000 high. Critical support lies at 6346.06.

Today’s options chain shows Max Pain at 6400.00. Long gamma may begin at 6425.00 while short gamma becomes strong beneath 6375.00.

ZeroHedge reports, “After five days of selling – the longest stretch since Jan 2 – US stock futures halted this week’s run of losses in muted trading ahead of Jerome Powell’s Jackson Hole speech, even as markets scaled back bets on imminent interest rate cuts following very strong economic data on Thursday. As of 8:00am ET, S&P 500 rose 0.2% erasing an earlier decline, while Nasdaq futures rose 0.1% as Nvidia shares fall 1% in premarket after the Information reported the chipmaker had instructed component suppliers to stop production related to the H20 AI chip. European stocks advanced 0.2%, nudging toward an all-time high. US Treasuries held steady after Thursday’s pullback, with the 10-year rate at 4.33%. The dollar was little changed. there are no scheduled events on the US economic data calendar; Fed Chair Powell is set to speak at 10am ET at Jackson Hole with a slew of other central bank comments expected from the event. The Fed speaker slate also includes Boston Fed President Collins at 9am and Cleveland Fed President Hammack at 11:30am; hawkish comments by Hammack on Thursday pushed yields to session highs. Swap contracts linked to future Fed rate decisions fully price in one quarter-point rate cut this year in October and a second one by year-end.”

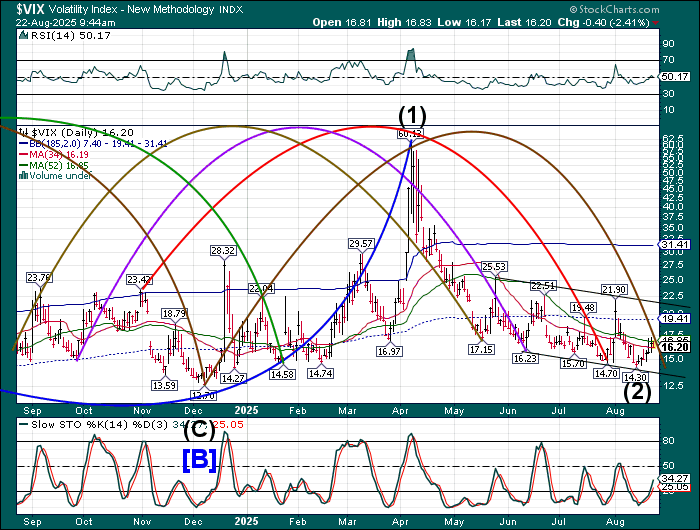

VIX futures are consolidating inside yesterday’s range. It is due for a pullback today. The Cycles Model supports a possible new low in a complex Ending Diagonal Fractal. The chart suggests a target near 14.00.

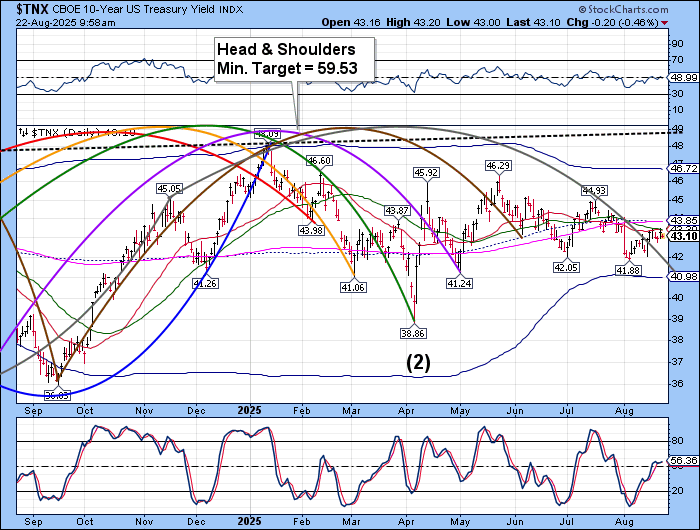

TNX is poised for the delivery of Powell’s speech. Both time and price dictate the final low may arrive today , or early next week.