The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:30 am

Good Morning!

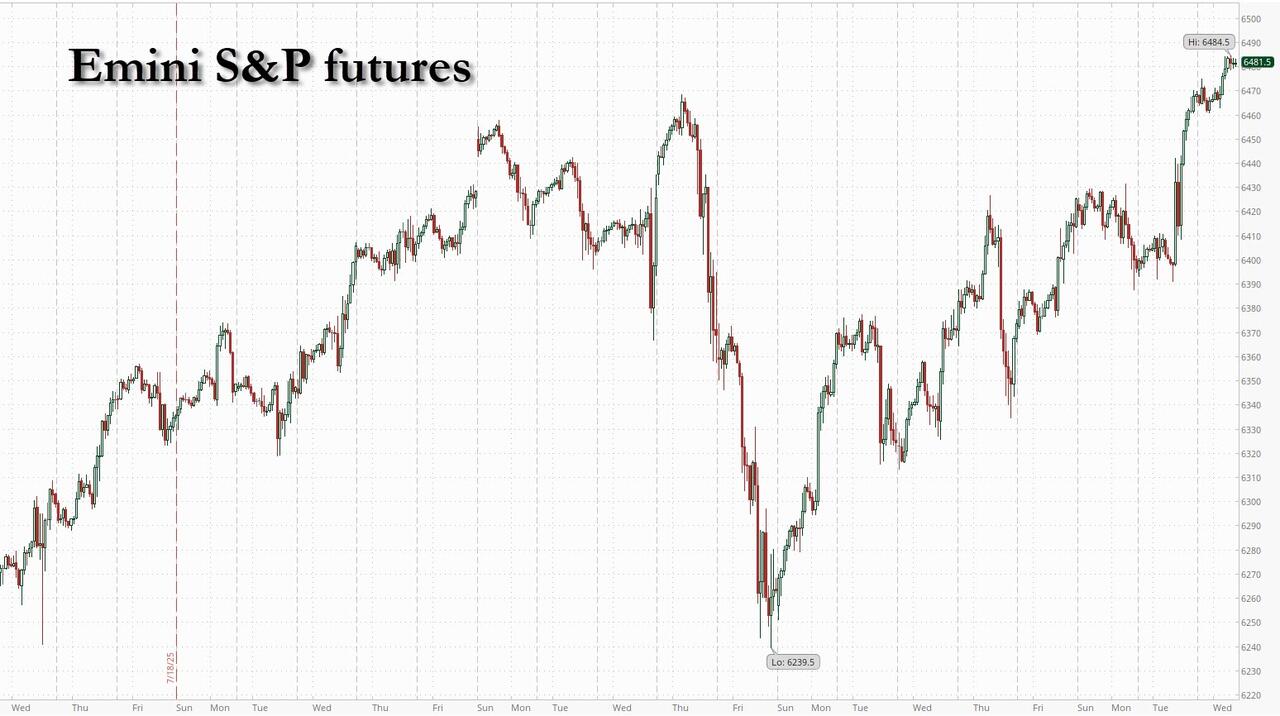

SPX futures reached an overnight high at 6462.50, possibly on its way to 6500.00, near the Cycle Top. The Cycles Model suggests more strength in the rally, at least to the end of the week. However, this Master Cycle is running out of time as today is day 250. In addition, the Cycle Top is at 6493.00 today, suggesting resistance at 6500.00.

ZeroHedge reports, “US equity futures are higher led by small caps (again) as the CPI print induces further short covering ahead of a now certain September rate cut, and a beta chase. As of 8:15am, S&P 500 and Nasdaq 100 futures were 0.2% higher after both indexes closed at fresh record highs on Tuesday, but were comfortably outpaced by the Russell 2000 index, as smaller companies were lifted by a largely benign inflation reading. Pre-mkt, Mag7 and semis are higher with Cyclicals outperforming Defensives, ex-Energy. Bond yields are lower as the curve bull flattens and USD weakens; the market strengthens its view on rate cuts in Sep, Oct, and Dec. Bessent calls for a 50bp cut in Sep. Today’s macro data focus is on mtge apps ahead of tmrw’s PPI which should help solidify PCE views.”

The Question is, where is the money flow coming from? The answer may be Europe. Note that any analysis of the market omits the influence of the turmoil in Europe.

The EuroStoxx 50 rose in sync with the SPX from the April 7 low to the July 8 high. Then the Stoxx reversed, making a bearish low on August 1. Smart money is leaving European stocks and coming to the US. Not only is the European economy in shambles, but NATO is preparing for war. US stocks are considered a safe haven because of the strong US economy and the distance from the war zone.

VIX futures made a new low at 14.36, extending Wave (2). This action may also bring in the terminus of the current Master Cycle by the end of the week.

TNX futures declined to 42.44 this morning, while the Cycles Model considers a further decline to the Cycle Bottom at 41.04, extending the Master Cycle. The bounce in Federal revenue may have been too little, too late as spending in July increased by almost 10%. So, while the thought of further rate cuts offer encouragement to the markets, increased spending and the threat of war in Europe are moving things in the opposite direction. The realization may soon catch up to reality.

Bitcoin continues its march higher, with the Cycle Top at 124811.00 a possible target. In fact, it may touch 125000.00 briefly this week.