The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen

8:00 am

Good Morning!

SPX futures consolidated between 6845.00 an 6889.00 in the overnight session, leaning toward the lower half of the range this morning. Attempts to close above the 52-day Moving Average at 6893.62 have failed thus far. While the past three months have been relatively flat, there are two considerations worth examining: The first is that, while the DJIA made its all-time high on February 11, the NDX and SPX failed to do so.

The SPX ATH was made on January 28 while the NDX ATH was made on October 29. This dispersion begs the question, what’s going on? The NYSE Hi-Lo Index shows 337 new 52-week highs on February 11 vs 288 new 52-week highs on January 28. This denotes a change in leadership, with the Mag 7 companies leading the decline. Second, the rotation into smaller companies could not make up the losses in volume from the 7 giants, despite constant attempts to buy the dips. Finally, the SPX has decisively stayed beneath the 52-day Moving Average for the past two weeks. The Cycles Model anticipates a possible panic decline early next week that may bring the SPX beneath the neckline of the Head & Shoulders formation at 6775.00.

Today’s options chain shows Max Pain at 6865.00. Long gamma takes a decisive lead above 6900.00. Short gamma rules beneath 6825.00.

ZeroHedge reports, “US equity futures are lower, sliding from session highs around the European open to session low just before 8am E as traders assessed the potential market impact of war with Iran, and awaited a firehose of US economic data including GDP and core PCE.”

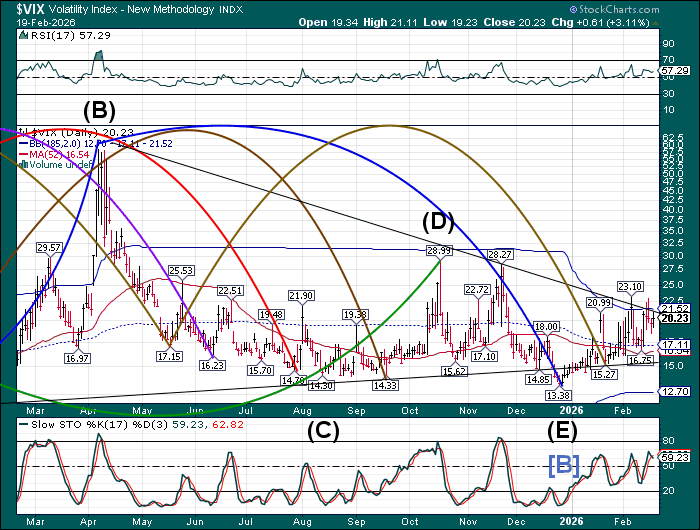

The premarket VIX rose to 20.93 this morning, just beneath the trendline near 20.00 and the Cycle Top at 21.52. A breakout may be anticipated. Despite the “sideways” motions of the SPX in the past two months, VIX has been steadily rising.

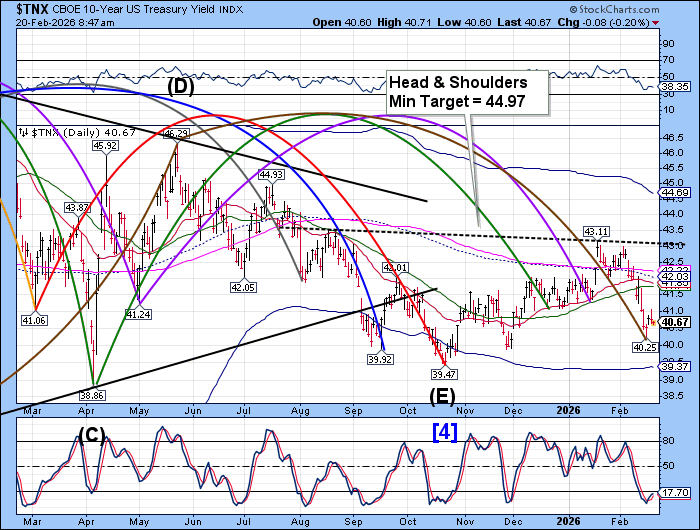

TNX futures dipped to 40.57, while the cash market opened slightly higher. Thi sis an approximate 50% retracement of the initial rise out of the Master Cycle low on February 17. The correctio may not last mush longer as the uptrend may resume shortly. Trending strength shows up by mid-week with a possible breakout above the resistance cluster from 41.74 to 42.22.

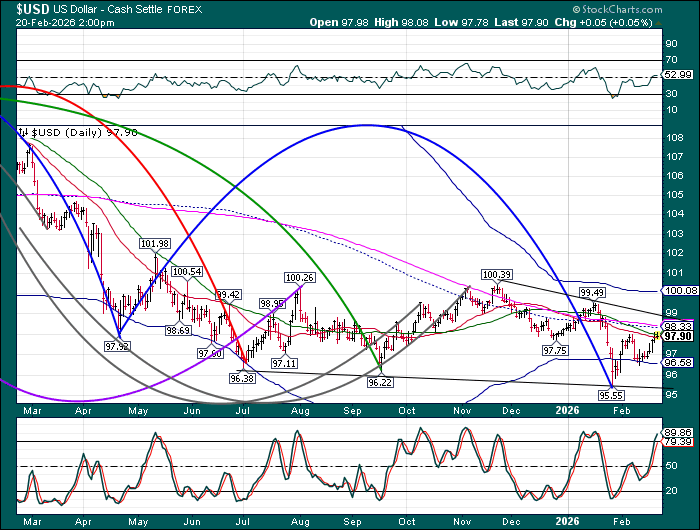

USD may be consolidating between intermediate support and the 52-day resistance. It may be trapped within the resistance cluster for a few days before breaking higher. An alternate view may be a retest of the Cycle Bottom support at 90.58 before a breakout. USD shorts may be nervously watching the 200-day Moving Average at 98.41 and the trendline near 99.00 as a trigger point for covering.

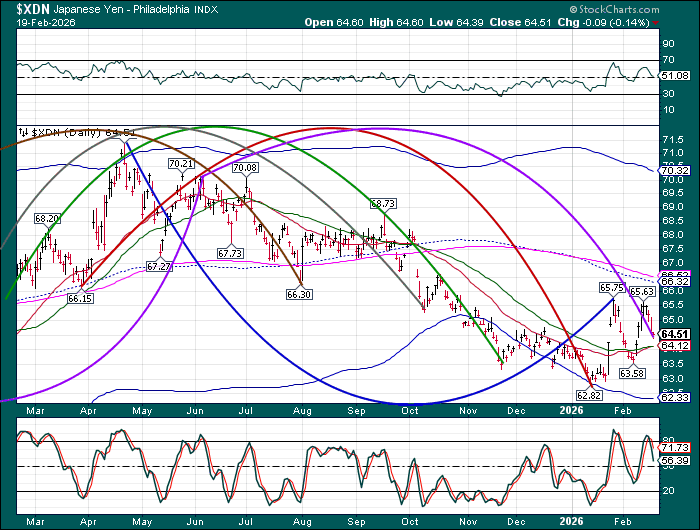

The Japanese Yen may have made its master Cycle low this morning in a complex double reversal pattern. It remains on a buy signal above the 52-day Moving Average at 64.12. The Yen carry trade employs the practice of borrowing in Yen. The process may be viewed as shorting it. The value obtained from the Yen carry trade is that interest rates are extremely low (.75%). But that is about to change, as the Bank of Japan is considering raising the key rate to 1.00%. The Cycles Model suggests that the Yen may appreciate to the Cycle Top near 70.00 or higher in the next six months, adding back over 9% to the payback value of a loan in Yen.

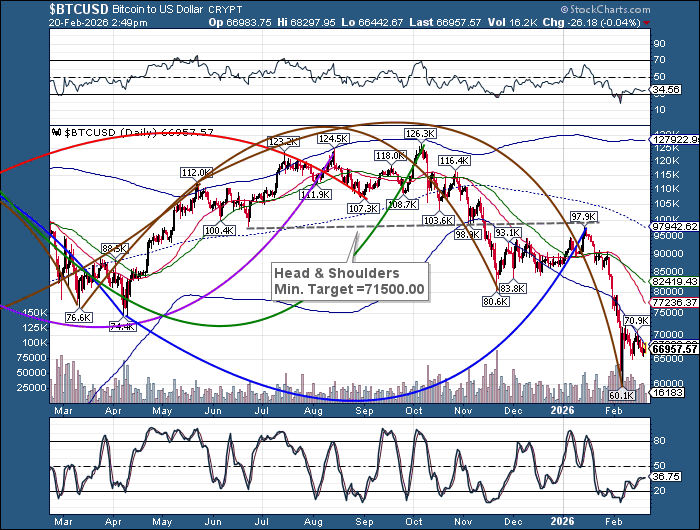

Bitcoin has resumed its decline after testing its Cycle bottom numerous times.