The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen

11:44 am

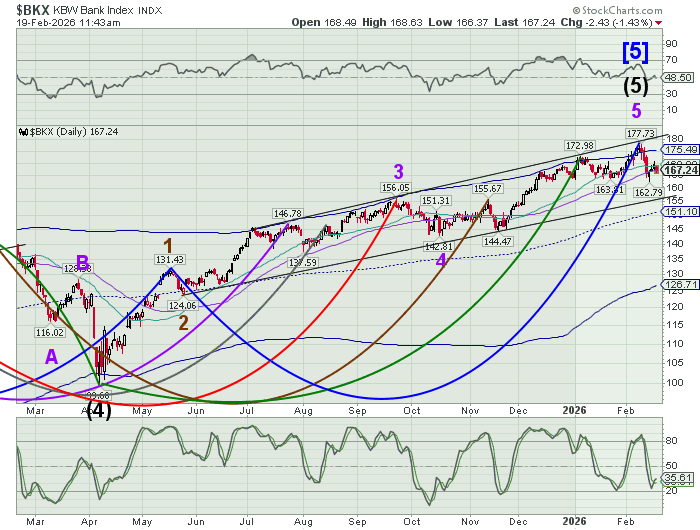

BKX has crossed beneath its 52-Day Moving Average at 167.32 this morning. While still above its trendline at 156.00, a sell signal may be recognized beneath the 52-day,

8:20 am

Good morning!

SPX futures are consolidating inside yesterday’s trading range. It has broken down beneath the 52-day Moving Average at 6893.39 and is on a sell signal. There is a head & Shoulders neckline at 6775.00, beneath which the SPX may decline to its November low. The Cycles Model suggests that the decline may gather enough strength to test the neckline early next week. Analysts consider the sideways consolidation since December to be an indication that the SPX may resume its uptrend. The Cycles disagree, indicating the all-time high may have been put in on January 28. The Industrials have made their all-time high on February 10 at 50512.79. The NDX made its all-time high on October 29 at 26182.10 and a lower high on January 28. This dispersion indicates an ongoing conflict among the markets going forward.

While all the indices are poised for a decline, the Industrials may be the least affected with a shallow correction over the next couple of years with the added bonus of an annual dividend rate of 10.9%.

Today’s options chain shows Max Pain at 6530.00 Long gamma may begin above 6900.00 while short gamma is strongest beneath 6800.00.

ZeroHedge reports, “Equity futures and global markets are lower, ending a modest rebound in US stocks as concerns about a possible war with US (Iran?) and simmering angst over AI dent the fragile optimism seen on Wednesday.”

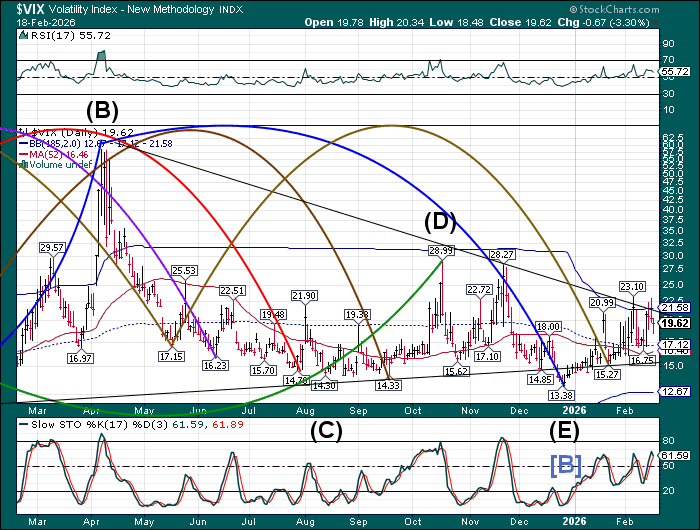

The premarket VIX rose to 20.78 this morning as war and AI disruption anxiety creeps higher. VIX is on a buy signal. The Cycles Model shows an imminent breakout driving the VIX higher. A potential target may be the April 7 high at 60.13.

The February 25 options chain shows Max pain at 19.00. Short gamma rues between 15.00 and 18.00. Long gamma kicks in above 20.00 and maintains strength to 40.00.

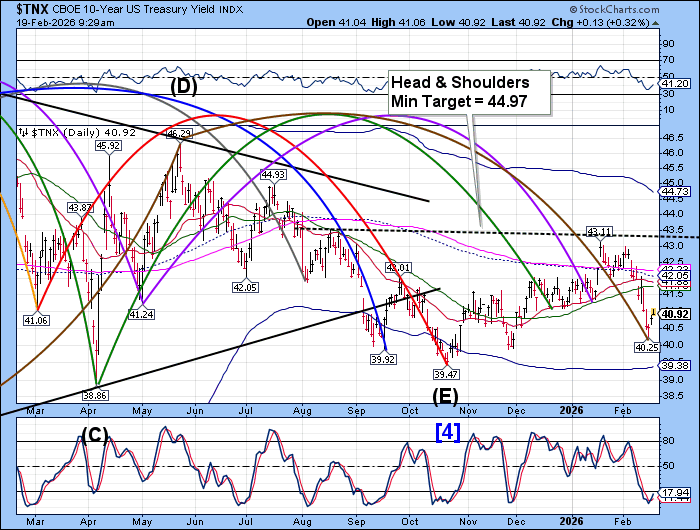

TNX rose to 41.06 this morning before pulling back. It may consolidate a few days to gather strength for the next onslaught, which is the resistance cluster from 41.75 to 42.23. The Cycles Model calls for rising yields to late April.

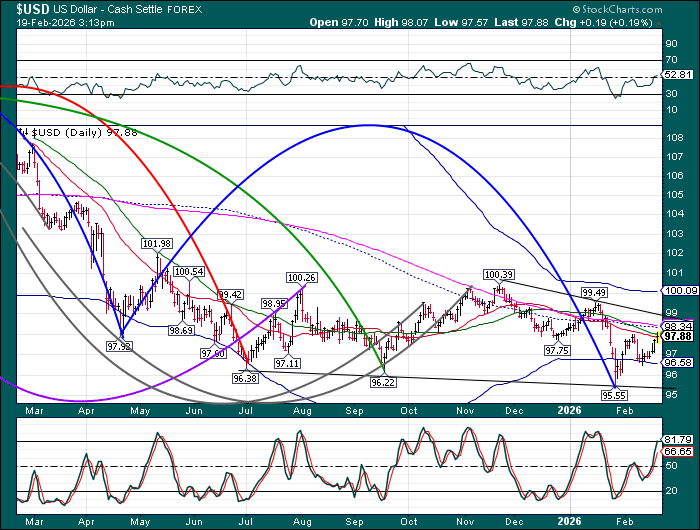

USD has risen above the Intermediate resistance at 97.85 and is challenging the 52-day Moving Average at 98.00. It is on a buy signal, but may encounter further resistance over the next week or so. A possible breakout awaits at the turn of the month that may elevate the USD above the resistance cluster and possibly the trendline as well.

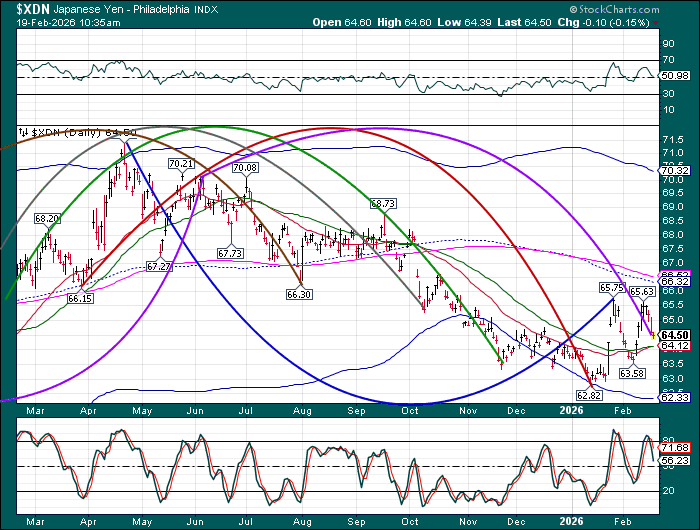

The Japanese Yen is in turmoil, as witnessed by the double directional reversal made this month. Today may be a master Cycle low for the Yen as the long-dated Japanese bond market is near collapse. The Cycles Model suggests a possible rise in the Yen to mid-April.