The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:00 am

Good Morning!

SPX futures gapped down to 6757.50 this morning, making the October 29 high as the probable end of the Master Cycle. This morning’s decline tested short-term support at 6748.48 (not shown). Should the SPX bounce from here, the rally may resume to test round number resistance (7000.00) and Cycle Top resistance currently at 7005.60. Should it do so, the Master Cycle may extend to Monday, November 10. Meanwhile, the 6-month trendline lies at 6700.00, beneath which lies a sell signal. Unfortunately, considering the downside is not in fashion. We are now conditioned to believe that the next rate cut or QE may be rewarded with higher values in the market.

Today’s options chain shows Max Pain at 6855.00. Long gamma lies above 6855.00 while short gamma dwells beneath 6800.00.

ZeroHedge reports, “US equity futures are under serious pressure this morning with all 3 indices down more than 1% with Palantir’s strong beat and raise not only failing to spur follow-through buying but sparking what appears to be momentum chasing revulsion. Combined with a pullback in crypto and some hawkish Fed remarks, an unwind in pockets of the hyper-momentum trade is taking hold.”

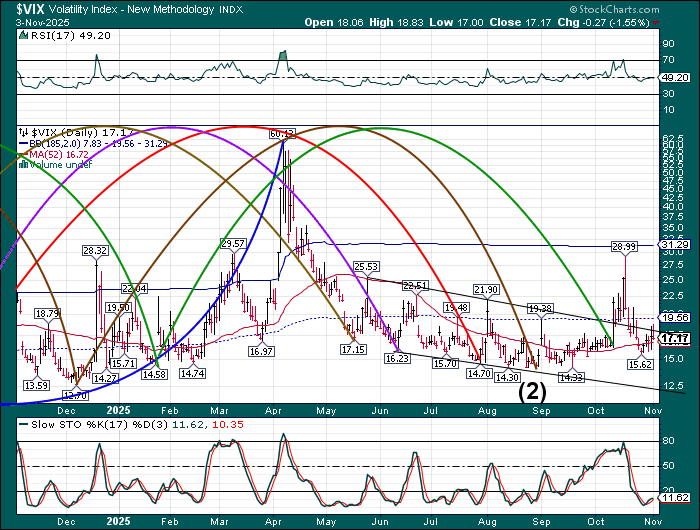

VIX futures rose to 20.48 this morning, soaring above the mid-Cycle support/resistance at 19.56, evidence of today’s forecasted trending strength. It may be due for a pullback to retest the 52-day Moving Average at 16.72 by the weekend.

To0morrow’s options chain shows Max Pain at 17.00. Short gamma has a monster holding at 15.00 while long gamma offers a substantial call wall at 20.00.

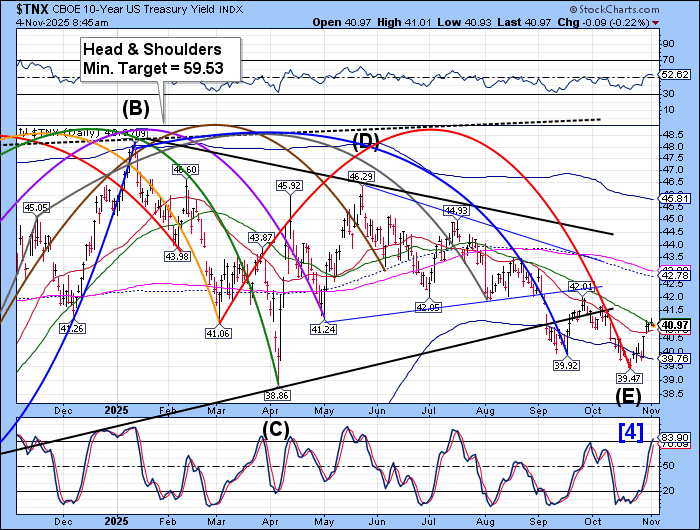

TNX is consolidating around the 53-day Moving Average at 41.01. Tomorrow may exhibit a show of strength in the TNX, completing its first possible bullish fractal and confirming a buy signal for yields. The Alternate view may show a panic decline instead, extending the Master Cycle to the end of the week. Should that be so, the potential target may be in the range of 36.00-38.00.

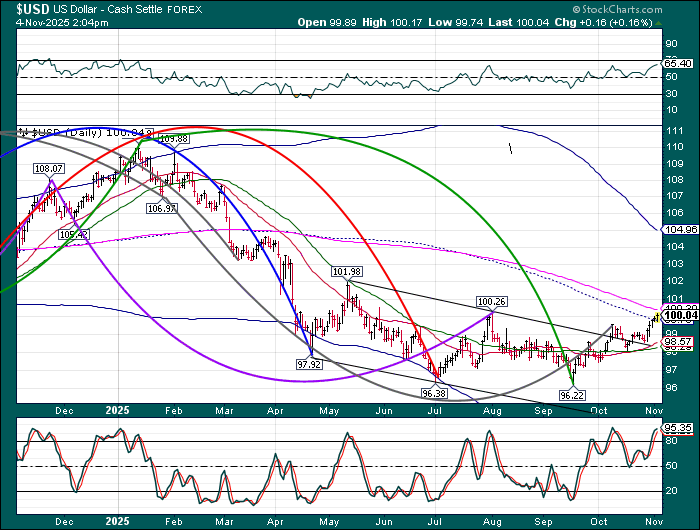

USD futures continue their rally, possibly building strength toward the weekend. The probability of a pullback to the 52-day Moving Average at 98.28 may be rising, but its timing is unclear. The top view reveals fractals may point to an immediate pullback, followed by a panic rally into the weekend.

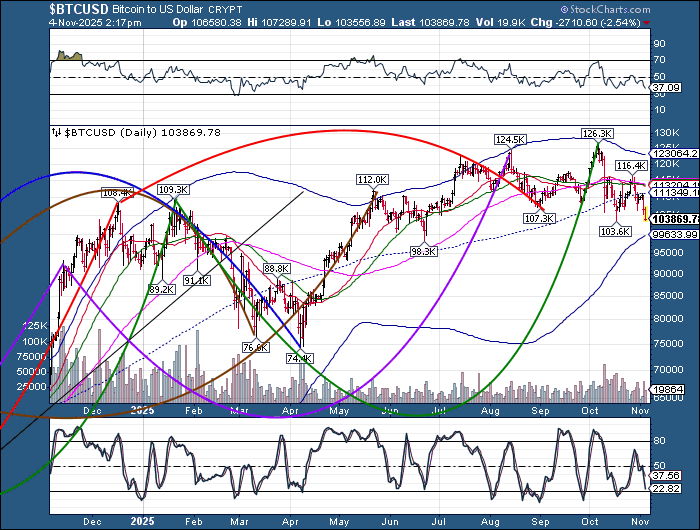

Bitcoin is gaining strength to the downside. Bearish momentum may turn into a panic by the weekend. The Cycle Bottom support at 99633.99 may not hold. The current Master Cycle may come to an end by the end of November.

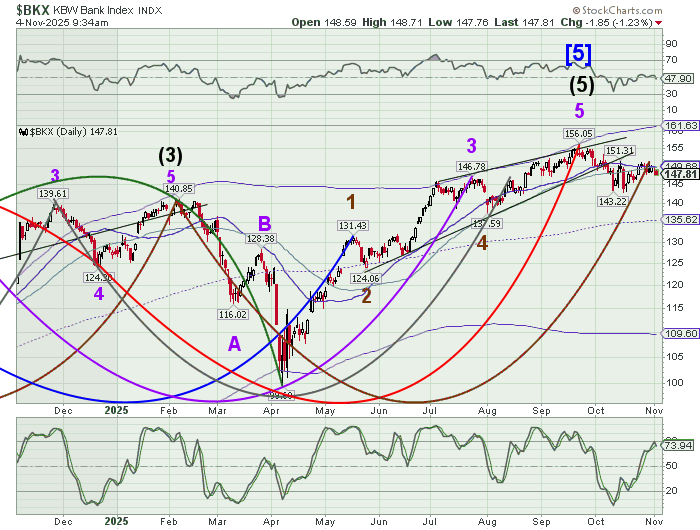

BKX has lost its hold on the 52-day Moving Average, confirming its sell signal. The Cycles Model suggests the next two days may be particularly strong to the downside. This marks the first of seven weeks of potential decline. Ending Diagonals are most likely to completely retrace to their origin, the April 7 low.

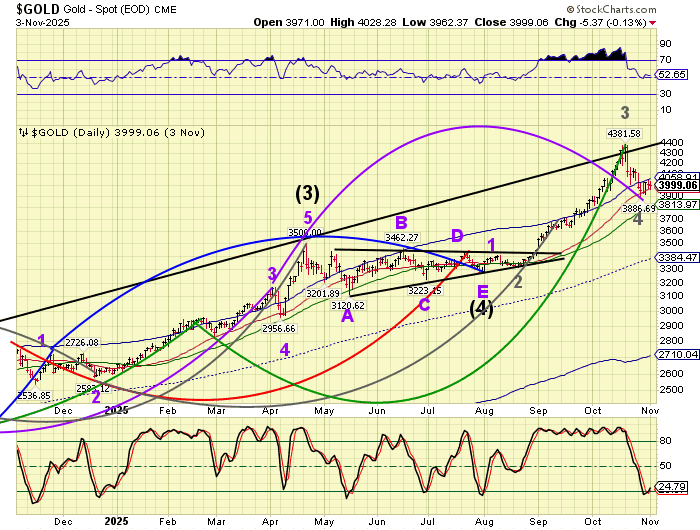

Gold futures made an overnight low at 3937.56, marking a retest of the October 28 Master Cycle low. There may be an immediate surge in trending strength starting tomorrow, resuming the uptrend. Should that be so, gold may resume its rally in a parabolic fashion.