The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

10:15 am

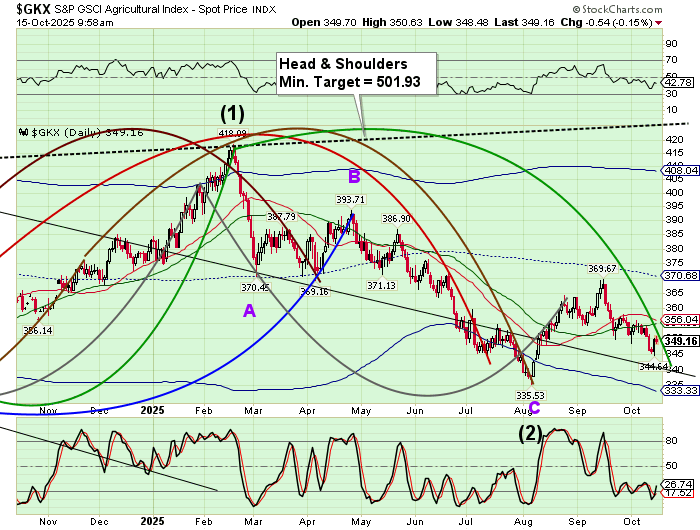

The Ag Index is approaching its Master Cycle low, due in the next week. The intended target may be the lower trendline near 340.00. This is an ideal time to accumulate shares of agricultural companies and commodities.

10:00 am

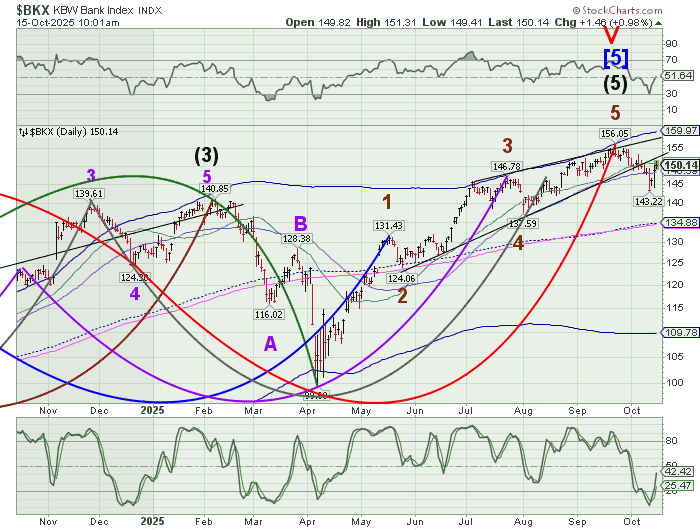

BKX is testing its trendline near 151.50, making a 50% retracement. the 50-day Moving Average is at 148.58, delineating the sell signal. Volatility is rising, suggesting a possible test of the low. However, the current Master Cycle may end next week at the trendline.

ZeroHedge observes, “JPMorgan CEO Jamie Dimon has sparked controversy in banking and finance circles amid a number of high profile (and sudden) bankruptcies, saying during his earnings call yesterday that:

“My antenna goes up when things like that happen. I probably shouldn’t say this but when you see one cockroach there are probably more.””

7:50 am Please note that I will be absent for the next week due to family and business obligations.

Good Morning!

SPX futures have risen to 6691.10 this morning and and appear to be lingering nearby, threatening to rise above 6700.00. Should that take place, the probability of a new high may arise, extending the peak to early November. The rally may have broken out due to a peace agreement in the Middle East, as sentiment continues to run high in this (still) overbought market. Despite the rising risks, investors continue to be afraid of missing out. However, equities are “on the edge” of a downturn. A decline beneath 6550.00 turns the market bearish.

Today’s options chain shows Max Pain at 6650.00. Long gamma begins above 6700.00 wile short gamma strengthens beneath 6625.00.

ZeroHedge reports, “US equity futures are again higher due a combination of softening trade rhetoric, a dovish Powell who reassured markets that another rate cut was coming, and solid results from BofA and Morgan Stanley.”

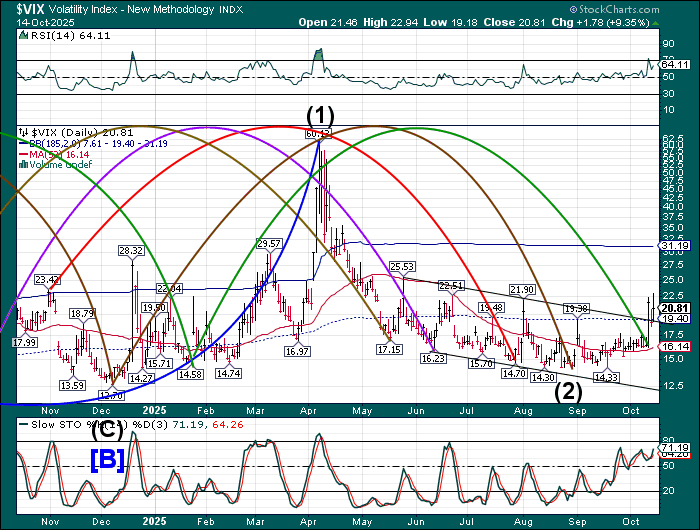

VIX futures have settled back to the trendline and mid-Cycle support at 19.40, maintaining the buy signal. Should equities run bullish, VIX may decline to the 50-day Moving Average at 16.14. Regardless of the short-term moves, the VIX appears to be developing a bullish uptrend. The Cycles Model calls for higher volatility later this week and next week, due to options expiration on Friday.

Today is VIX options expiration day. Activity may be mutes until expiration at the close. Short gamma stretches from 13.50 to 19.00. Long gamma may begin at 20.00 and pulses at 25.00 and 30.00, showing muted institutional presence.

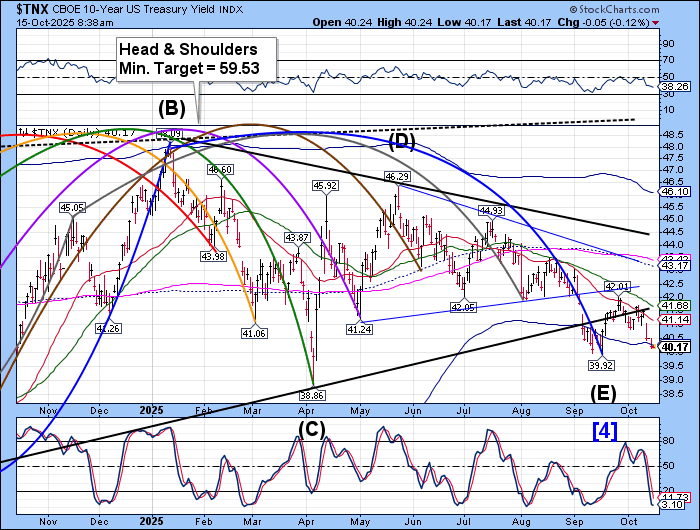

TNX continues its decline this morning with an approximate week left in the Master Cycle. It appears likely that TNX may exceed its September low, extending a roguish Wave (E). Bond volatility is due break out early next week as a precursor to a potential reversal.

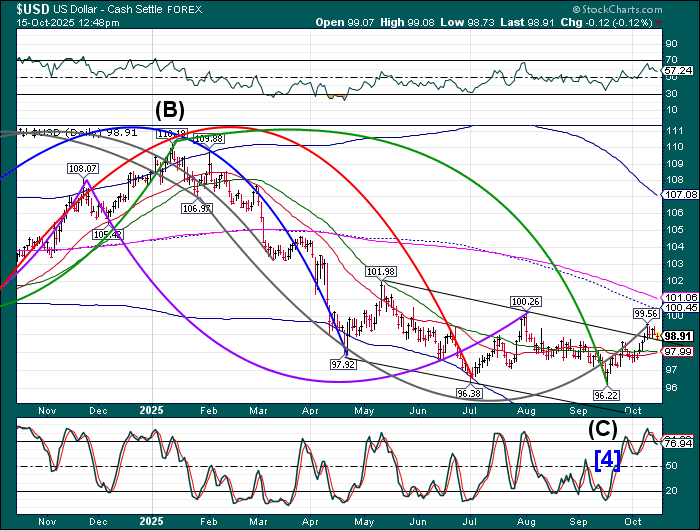

USD is hovering above its declining trendline after making a possible Master Cycle high on October 9. The Master Cycle suggests a potential disturbance in the Cycle this weekend, causing volatility to rise. Should the USD not decline beneath the 50-day Moving Average at 97.99, there may be a possible phase shift in the USD, resuming the rally.

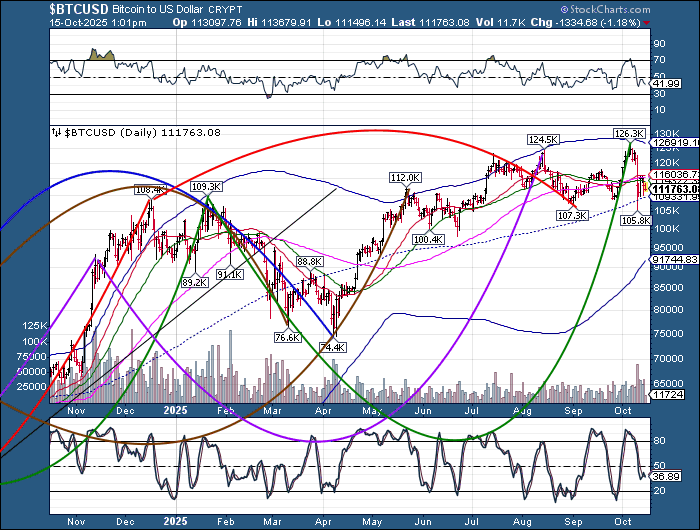

Bitcoin futures declined to 110160.00 as it approaches mid-Cycle support at 109331.00. It has cleanly broken beneath the 50-day Moving Average at 114318.00, confirming the sell signal. The decline may continue with rising volatility through early November, with a possible end to the Master Cycle in late November.

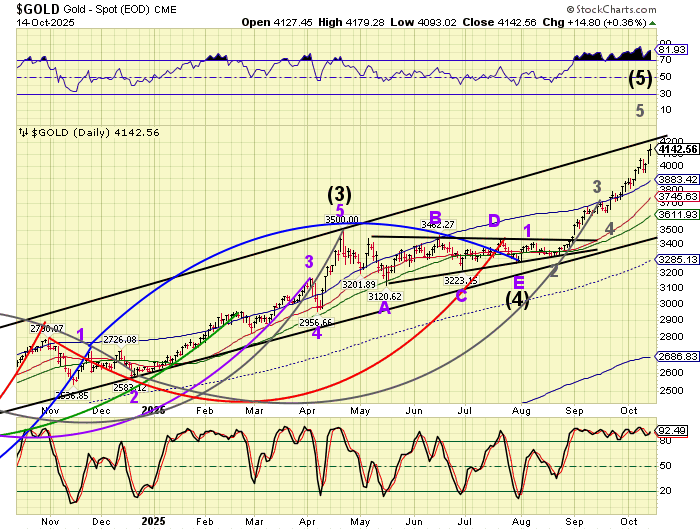

Gold futures have exceeded 4200.00 and may be due for some overbought relief as a short-term pullback is due. However, volatility may be due to return this weekend with panic buying developing in late October and early November. The initial target (above 4200.00) has been met. A throw-over (above the trendline) may develop as early as this weekend. The “gotta have it” speculators may drive the price of gold to 4500.00 or higher.

ZeroHedge remarks, “Fresh from reporting a solid set of numbers for the third quarter, JPMorgan CEO Jamie Dimon said he sees “some logic” in owning gold, while declining to say whether he thinks the precious metal is overvalued after its record run-up (perhaps smart, considering his catastrophic attempts to assign value to bitcoin over the past decade).”

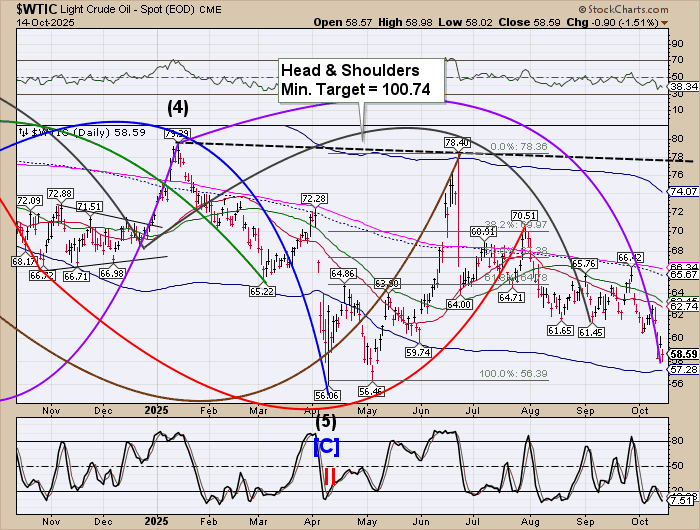

Crude oil futures dropped to 57.99 this morning, nudging the Master Cycle a little lower. Crude may be at the low and ready to begin a serious rally into the month of November. Trending strength appears again this weekend, according to the Cycles Model.