The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

2:57 pm

The SPX bounce may have been repelled by short-term resistance at 6663.40, a 55% retracement. As the market enters its final hour of trading, mutual funds are balancing out the buys and sells. Should there be a a vacuum of buyers, the mutual funds will be sellers in the final half hour of the day. Once beneath Friday’s closing low, the Head & Shoulders formation may be triggered with a possible minimum target at the September 2 low. The August 1 low may also be in play in the next few days.

8:30 am

Good Morning!

SPX futures bounced over the weekend after declining to 6510.00 in the after hours session on Friday(a decline of 3.72% on Friday). The Futures recovered to 6665.10 over the weekend session, but have since eased back down to 6630.00 at this time. The 50-day Moving Average lies at 6522.95, a key support. The declining fractal is incomplete thus far, requiring yet another plunge beneath 6510.00 to establish an impulsive bearish reversal.

Today’s options chain shows Max Pain at 6620.00. Long gamma strengthens above 6640.00 while short gamma begins beneath 6600.00 and has a massive put position at 6550.00.

ZeroHedge reports, “US markets closed last week with the largest one-day loss in six months, with Asian overnight futures pointed to a sharp downdraft on Monday. HSCEI and Hang Seng futures closed down 5% (limit down) on Friday night.

However, on Sunday Trump walked back some of his Friday comments, stating that “November 1 is an eternity” and expressing optimism that “they will be fine with China.””

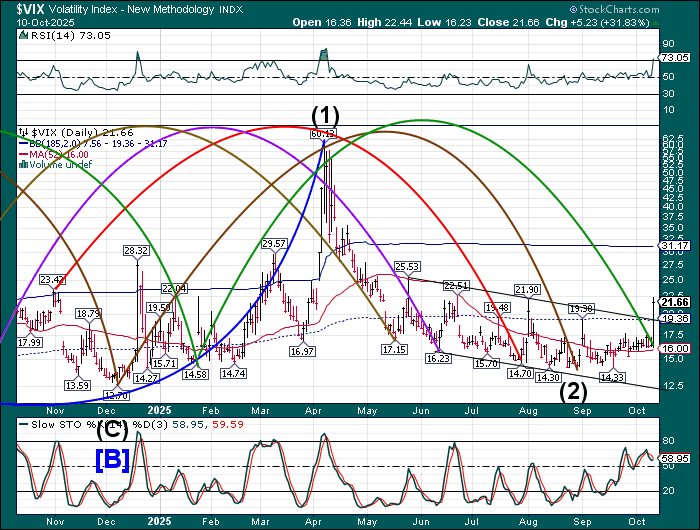

VIX futures have declined to the upper trendline of its 4-month trading channel and the mid-Cycle support at 19.36 this morning. Should support be found there, VIX may resume its upswing, as it may signal a definite change in trend.

Yhr October 125 options chain shows short gamma in the 14.50 to 21.00 range with a large presence in puts at the 21.00 strike. Long gamma begins at 25.00 but tapers off at 30.00. Investors still haven’t caught on that there may be a shift in trend.

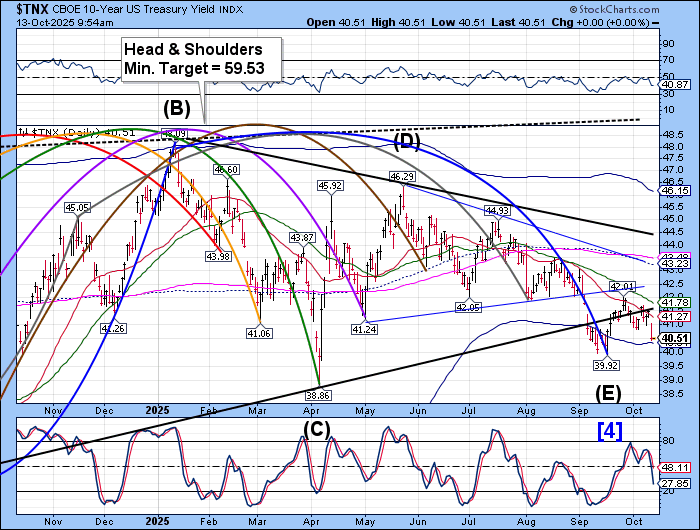

TNX has paused above its Cycle Bottom at 40.31. The Cycles Model shows a possible two-week continuation of the decline, possibly beneath its September 17 low at 39.92, creating a new Master Cycle low.

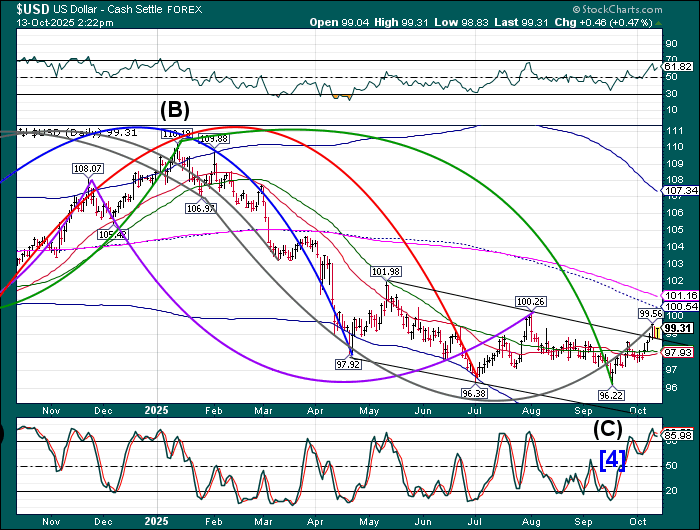

USD futures may have made their Master Cycle high last Thursday at 99.56. Should the USD decline beneath the 50-day Moving Average at 98.06, we may see a decline extend to the end of November. However, a general malaise may be building in the European markets, causing liquidity to flee to the US.

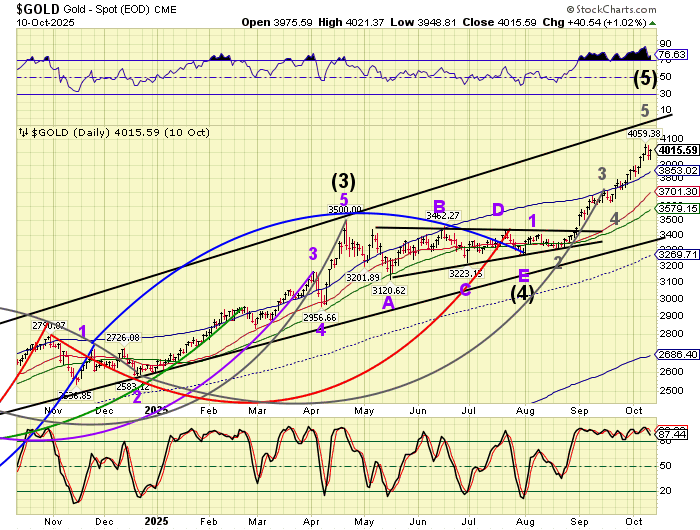

Gold futures may have reached 4100.00 this morning as it extends a possible blow-off phase. The Cycles Model suggests this phase may last into early November. A throw-over above the upper trendline is possible, making it impossible to estimate the final price target.

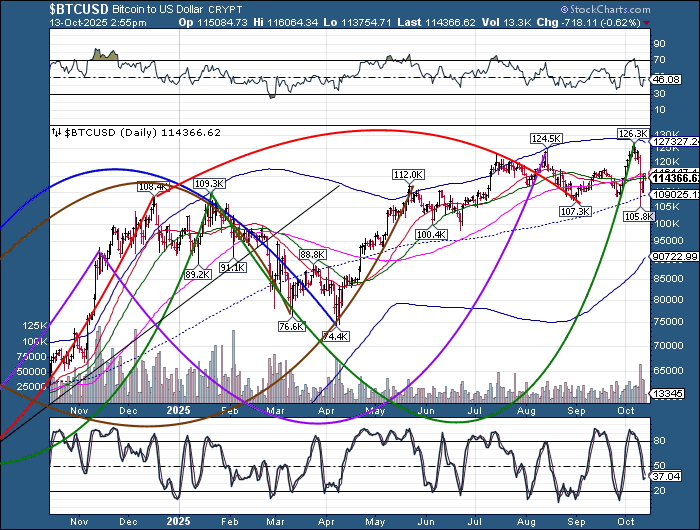

Bitcoin has made an approximate 50% retracement of its weekend decline, an approximate 16.25% decline. The reason for this catastrophic liquidation was overleverage, wiping out virtually all margin accounts. Since then it has declined back beneath its 50-day Moving Average at 1148362.00, renewing a possible sell signal. The next level to watch is round number support at 100000.00. The Cycles Model suggests a continued decline to late November, suggesting the Cycle Bottom at 90722.00 may be challenged. The April low at 74426.00 may also be in play.