The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

7:50 am

Good Morning!

SPX futures rose to 6745.00 over the weekend, then pulled back, leaving Friday’s high at 6750.87 intact. The Cycles Model suggests that last week’s searing bid for 3 consecutive all-time highs may have been an overtime move to pull in the weakest hands. This has raised confidence so high that analysts are predicting that the earnings bar has been set too low. S&P earnings reports for the 3rd quarter start next Monday, while 68% of all the S&P companies will have reported by the end of October. Consensus estimates show that expected earnings growth may be half the average 30% annualized growth rate. Meanwhile, as money managers predict an inflationary boom, the Cycles Model infers a decline may be forthcoming that may test prior supports.

Today’s options chain shows Max Pain at 6715.00. Long gamma may begin above 6745.00 while short gamma strengthens beneath 6700.00.

ZeroHedge reports, “Stock futures are higher again as traders stay positive on the upcoming US earnings season, ignore the government shutdown (though federal unions are suing to prevent the furloughs from being converted into RIFs) and get a boost from the latest political shock in Japan where pro-stimulus Sanae Takaichi was picked as the next PM (shocking markets and sending the Nikkei soaring and the yen crashing) as well as the latest chip deal out of Nvidia and AMD.”

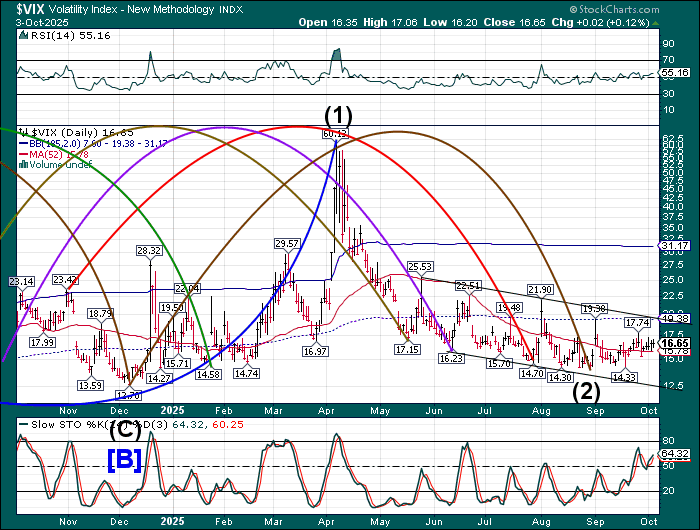

VIX futures consolidated beneath Friday’s high over the weekend, leaving it on a buy signal. Last week’s moves were anomalous, as the VIX rose while the SPX also advanced, being led by call buying by retail investors. This oddity suggests that there may be some very large players that are hedging against a market decline. The Cycles Model suggests a large move in the VIX may take place in the next 1-2 weeks.

The October 8 options chain shows a singular massive put holding at 16.00 while calls are adding large contracts at 17.00 to 30.00.

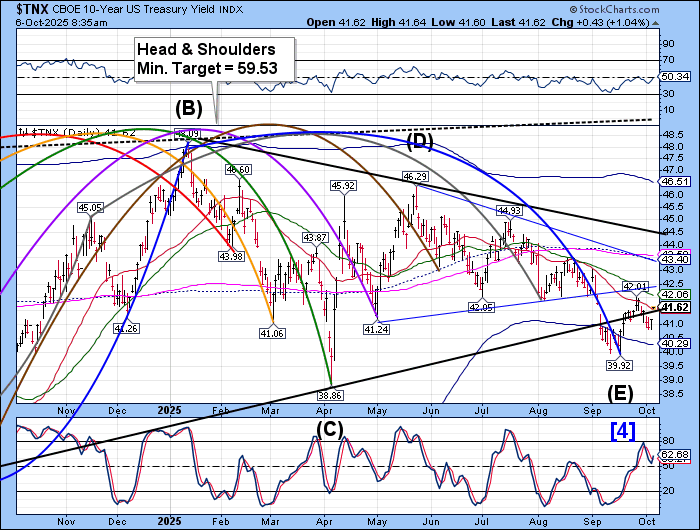

TNX has leaped above Intermediate support/resistance at 41.55, creating a possible buy signal for the 10-year Treasury note. It has also risen above the Triangle trendline, which may offer support in a possible pullback. The Cycles Model suggests a possible rally to the end of October. The Treasury auction schedule starts tomorrow while the Cycles Model shows rising bond volatility starting this week.

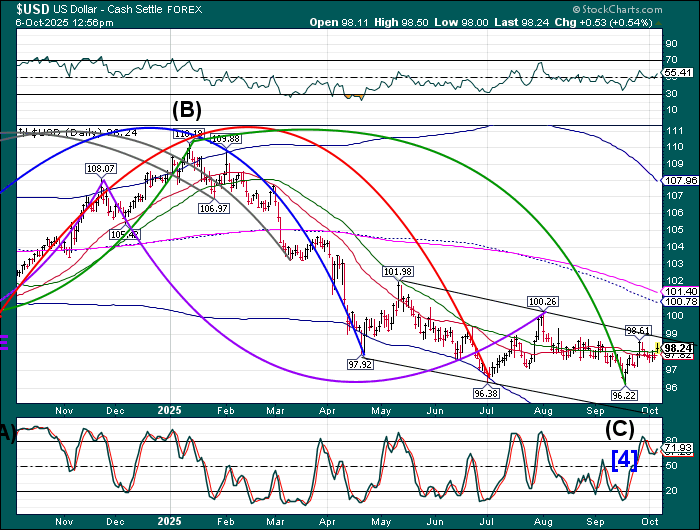

USD futures slipped above the 50-day Moving Average at 98.06 this morning, reinforcing the existing buy signal. A continuation of this move may exceed the trading channel trendline at 98.80, creating discomfort for the dollar shorts. The Cycles Model suggests rising volatility for the next week or so.

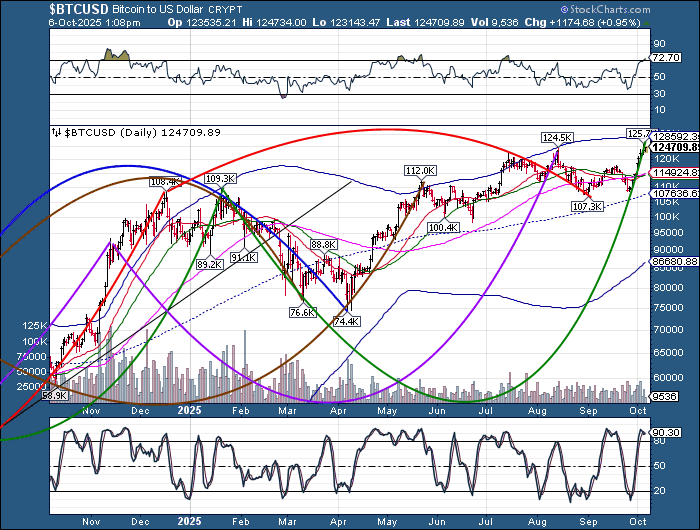

Bitcoin may have made its Master Cycle high at 125710.00 yesterday, spot-on day 258 of its Master Cycle. While the Cycles Model suggests the move may be over, some analysts believe that bitcoin may have gained strength from the shutdown.

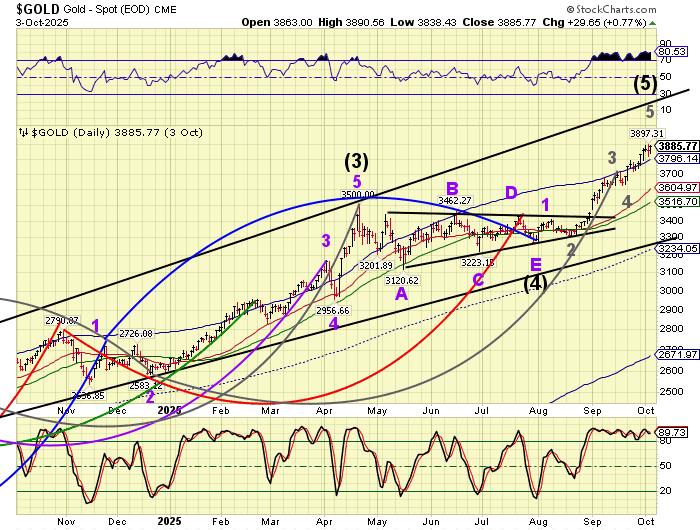

Gold futures rose over the weekend, propelling the CME price well over 3900.00. A fractal structure suggests a potential high near 3933.00. Should that be so, a decline beneath the Cycle Top at 3796.14 may produce a sell signal. There is approximately a #0 point differential between the futures and the Chicago Mercantile Exchange.