The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

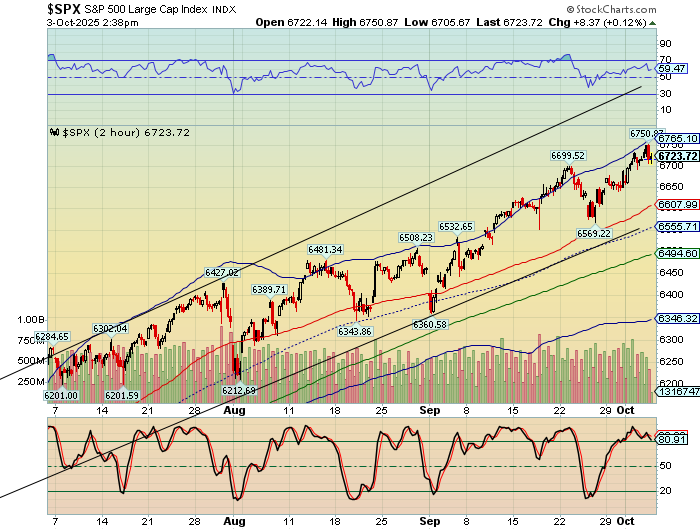

2:38 pm

SPX has declined to 6705.67 after making another all-time high at 6750.00. The final hour of the day will tell us whether the reversal today is the one. A Key Reversal may be made by declining and closing beneath 6693.00. While not a guarantee, Key Reversals have a high propensity to signal a change in trend. Good luck and good trading!

8:00 am

Good Morning!

SPX futures are hovering beneath yesterday’s high. AI fever is jumping off the charts as shutdown fears and overbought conditions are being overridden by the Fear of Missing Out. There is no NFP report today, leaving the state of the economy in a fog. The current Master Cycle has extended about a week and is due for a reversal. Fractal resistance lies at 6750.00 while the Cycle Top has risen to 6790.37. There is no assurance that either possible target may be met. The trendline and Intermediate support lie at 6648.55 where a possible sell signal may be obtained.

Today’s options chain shows a heavy population of puts and calls at 6700.00. Long gamma may dominate above 6725.00 while short gamma strengthens beneath 6675.00.

ZeroHedge reports, “US equity futures are heading into Day 3 of the US government shutdown on pace for what is now another daily all time high. S&P 500 and Nasdaq 100 futures rose 0.1% as of 8:15 am in New York, on course for the longest winning streak since July.”

VIX futures declined beneath the 50-day Moving Average to 16.43 this morning. Should the downtrend continue, there is a possibility of a further decline to the lower trendline near 12.50 in the next week. Caution is being tossed to the wind as hedges may be abandoned.

The October 8 options chain shows speculators are playing cards close to the vest as the largest number of put contracts is at 16.00 and the largest call swarm is at 17.00.

The 10-year Treasury yield is hovering near yesterday’s close as investors await further developments. The Cycles Model suggests steady-to-lower rates over the next several weeks. The downside target may be the Cycle Bottom, currently at 40.28.

Bitcoin has pulled back from yesterday’s high at 121187.00, making a Master Cycle high or very nearly so. The fractal target for this probe is near 122000.00, so we remain neutral on BTC.

USD continues to hover beneath the 50-day Moving Average at 98.05.. The Cycles Model shows weakness for the next week or so, suggesting the USD may decline to the lower trendline near 95.00.