The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

10:09 am

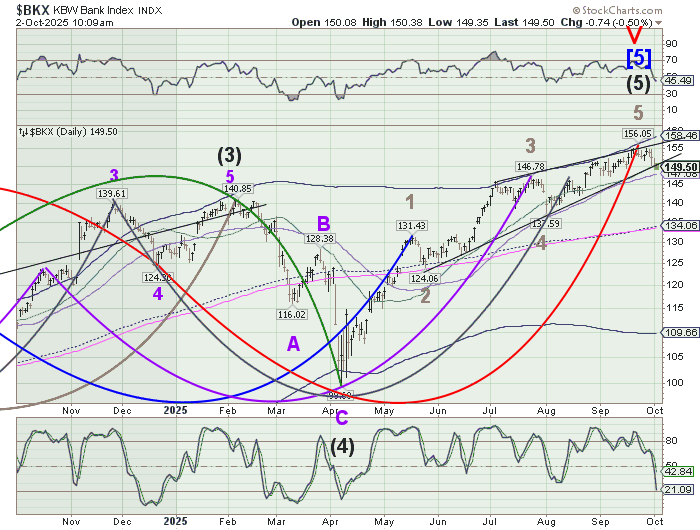

BKX has crossed beneath its Ending Diagonal trendline and Intermediate support/resistance at 150.01. This place BKX on a sell signal. Further confirmation may be made beneath the 50-day Moving Average at 147.68. This may be the canary i the coal mine telling us that liquidity is getting thin at the top. The initial target may be the mid-Cycle support at 134.06. However, should a panic develop, the April 7 low may be noted.

8:30 am

Good Morning!

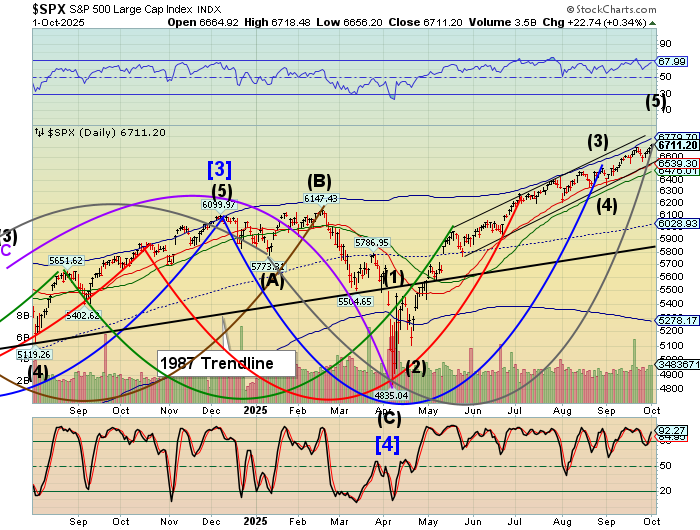

SPX futures rose to a new all-time-high at 6731.40 as it surges to its final destination. There is a high probability that resistance between 6750.00 and the Cycle Top is at 6779.70, the final bastion of resistance in the context of the Master Cycle. There are no assurances that any of the targets may be met.

Today’s options chain shows Max Pain at 6690.00. Long gamma begins at 6700.00 and is especially strong above 6750.00 while short gamma resides beneath 6680.00.

ZeroHedge reports, “US equity futures are higher with tech and small caps both outperforming as the screaming AI euphoria drove global indexes to fresh highs after an OpenAI share sale valued the company at an eye-popping $500 billion, catapulting the firm to become the world’s most valuable startup…”

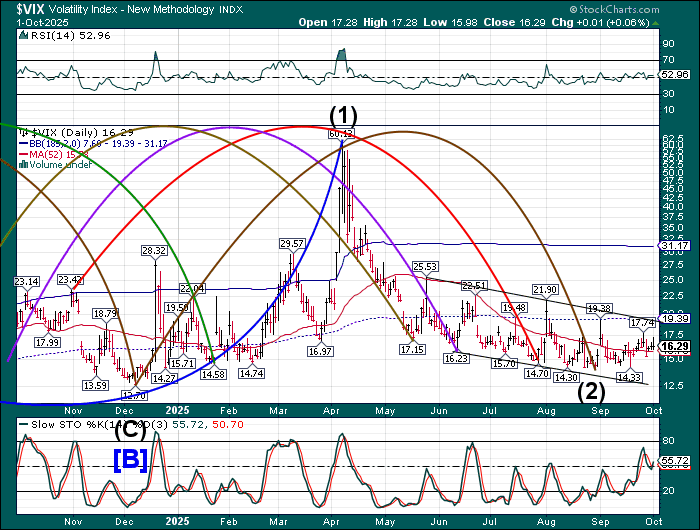

VIX futures have declined to 15.95 this morning, being supported above the 50-day Moving Average at 15.78. Should an effort to suppress the VIX in the next few days, it may produce a Master Cycle low near 12.70. This would give the VIX free rein to rally through late December. There is a mismatch between the SPX and the VIX Cycles, which portends a chaotic market through the end of the year. An alternate view is a possible Cycle Top in the next week or so, as investors panic during the next week or so..

The October 8 options chain shows declining short gamma at 16.00. Long gamma begins at 17.00 and building a presence up to 55.00.

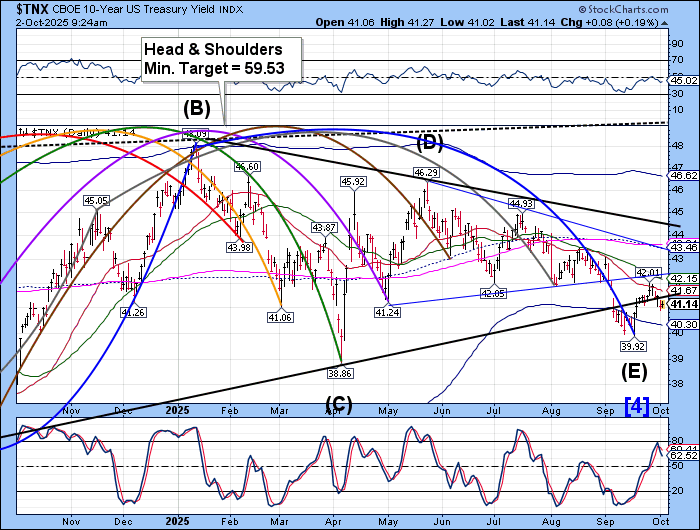

The US Treasury Note Yield is consolidating beneath the trendline. The Cycles Model allows approximately three more weeks of decline with a potential target near the Cycle Bottom support at 40.30.

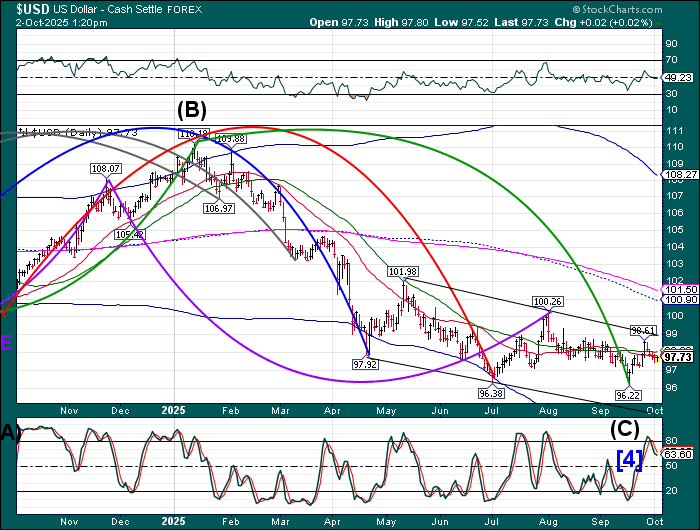

USD futures remain beneath Intermediate resistance at 97.83 this morning. The Cycles Model allows an approximate week of decline with a possible target near 95.00-96.00. USD shorts may note: Once the USD reaches its mark, a possible rally may take the USD higher through early December.

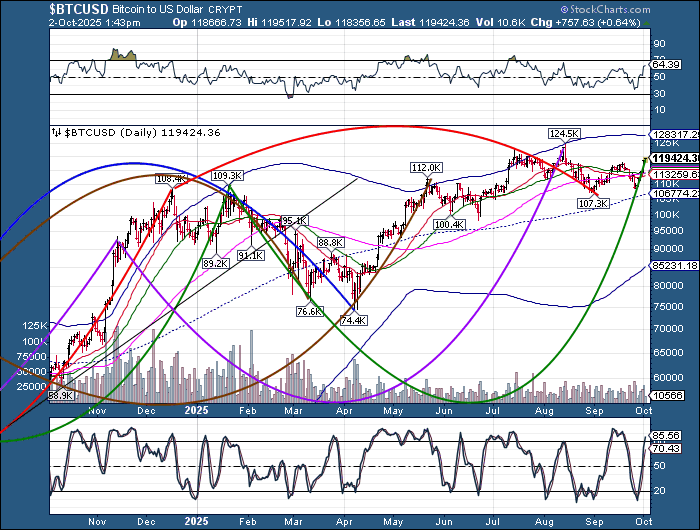

Bitcoin may be in its final surge to its proposed target at 122000.00 today, with the potential of reaching it in the next few days. Should it exceed that reference point, Cycle Top resistance is at 128823.41 in an extended Cycle.

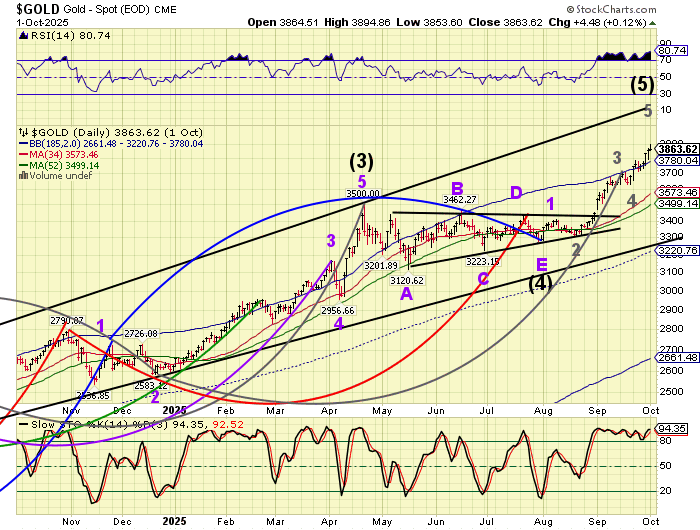

Gold futures rose another 25 points in the after-hours to 3922.80, then made a sudden and sharp reversal. There is an approximate 35 point mismatch between the futures and the CME. Watch for a possible decline beneath the Cycle Top support at 3780.04 (3814.00 in the futures), offering a possible sell signal.