The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

9:50 am

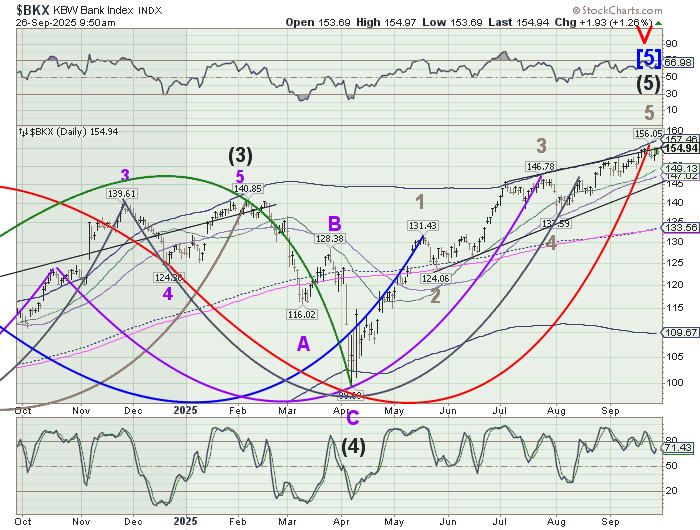

BKX is testing the upper trendline of its Ending Diagonal formation. The Cycles Model anticipates a spike in volatility today and lasting into early next week. A break of the Ending Diagonal is possible. Should that take place, a decline to the April 7 low may be indicated. The collapse of Tricolor and the bankruptcy of First Brands Group have taken the shine off asset-backed securities. Banks are beginning to struggle to assess the impact on their own balance sheets.

8:00 am

Good Morning!

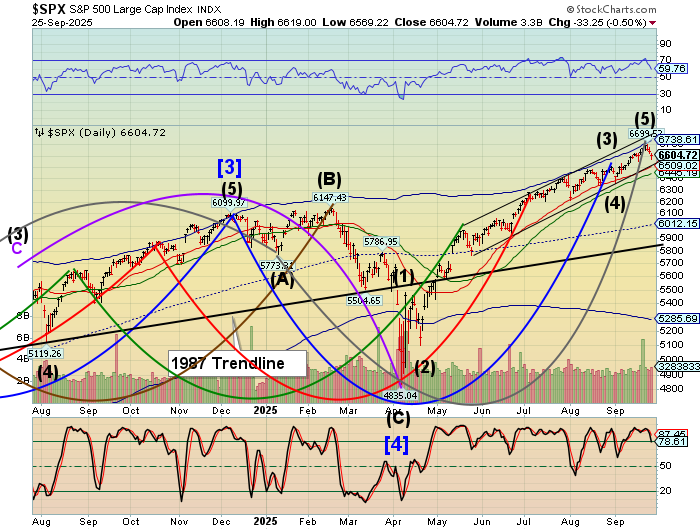

SPX futures made an overnight high at 6620.80 as it attempted to continue the bounce from yesterday’s low. Intermediate support and the 4-month trendline lie at 6609.92, beneath which lurks a sell signal. Further confirmation of the sell signal lies at 6446.79, marking the 50-day Moving Average. The Cycles Model suggests a brief probe higher in an attempt to close the gap at 6635.84. Should it fail, the trendline may be at risk of being broken. Successfully closing the gap may extend the bounce. Once the decision is made, the Cycles Model infers a very strong reaction.

Today’s options chain shows Max Pain at 6610.00. Long gamma may begin at 6620.00. Short gamma offers a put wall of 8,828 contracts at 6600.00, telling a cautionary tale should the SPX decline.

ZeroHedge reports, “US equity futures are flat as the market struggled for traction ahead of today’s core PCE report and as investors ponder the Fed’s next policy move following a raft of much stronger than expected US data.”

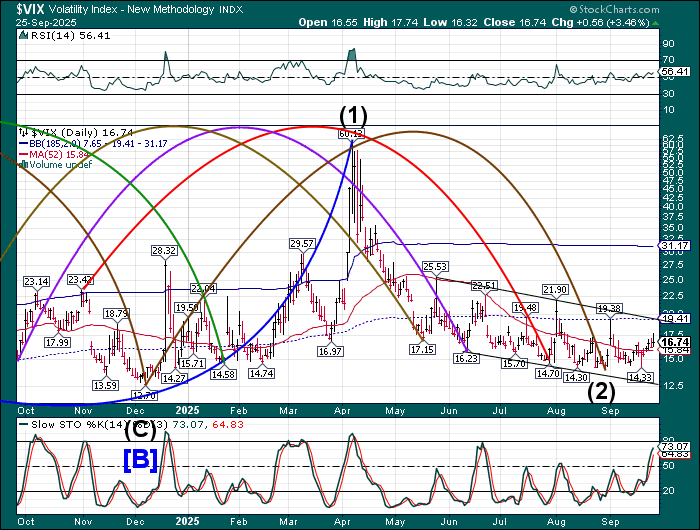

VIX futures are consolidating above the 50-day Moving Average at 15.84. The Cycles Model shows trending strength returning today. A breakout of the mid-Cycle resistance and channel trendline at 19.41 is possible.

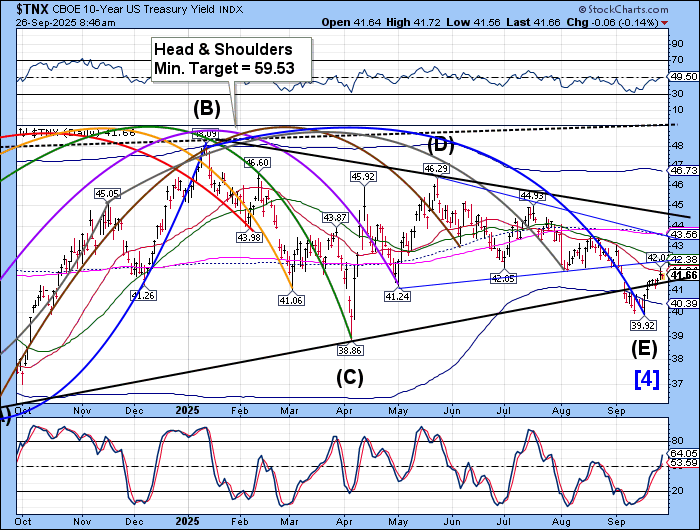

TNX is consolidating between the trendline and Intermediate resistance after having broken through it yesterday. This has further confirmed the buy signal. The Cycles Model suggests another month of rally for TNX.

ZeroHedge reports, “After a poor 2Y auction, a subpar 5Y yesterday, it only makes sense that the week’s final coupon auction – today’s sale of 7Y paper – was the ugliest yet.

Stopping at a high yield of 3.953%, this was a slight pick up from last month’s 3.925%. It also tailed the When Issued 3.947 by 0.6bps, the biggest tail since August 2024.”

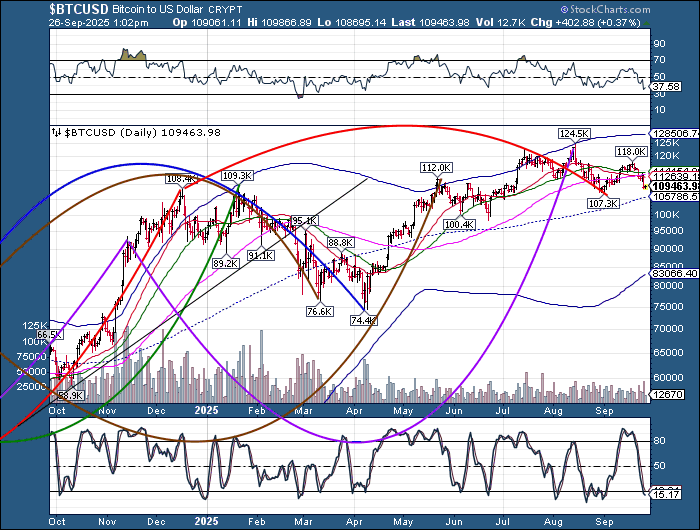

Bitcoin futures are flat after yesterday’s 4.3% rout. The Cycles Model tagged today as a high volatility day, so the questions is, “Did the volatility come early? Or, was yesterday a leading indicator of what is to come?” A partial explanation suggests the latter, as there may be another surge over the weekend and early next week. The final low of the current Master Cycle may not arrive until the week of October 6.

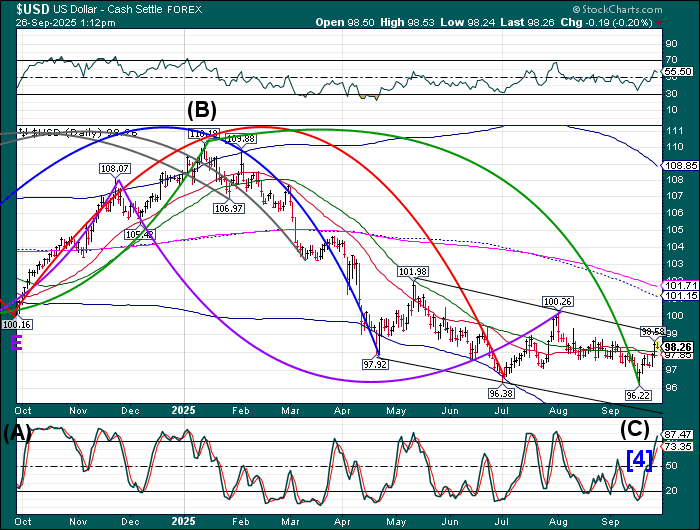

USD futures are pulling back after yesterday’s surge above the 50-day Moving Average, confirming a buy signal. The USD shorts are in pain as I write. The next resistance is the upper channel trendline near 99.00. The Cycles Model suggests the USD may linger beneath the trendline over the next week. Indications are that a breakout may be possible during the week of October 6. Subsequently, a pullback may emerge in mid-October.

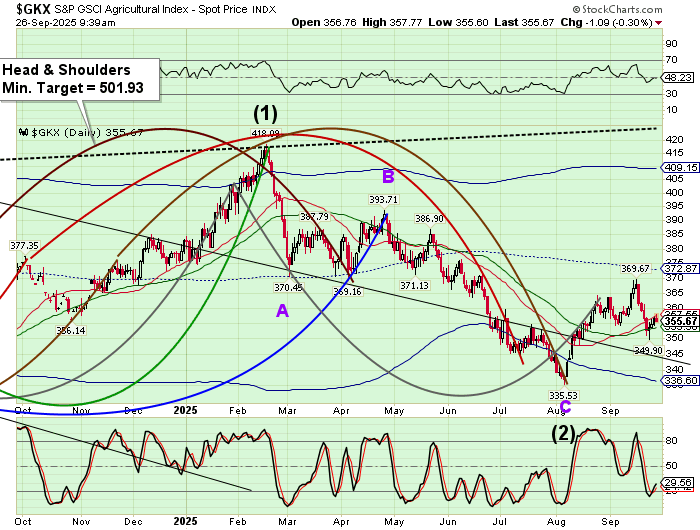

The Ag Index is on a short-term bounce within a decline that may last to mid-October. The target may be the declining trendline near 345.00. Th edecline offers an opportunity to accumulate shares as a substantial rally may be about to resume afterwards.

ZeroHedge remarks, “President Donald Trump on Thursday announced that he would use tariff revenue to provide aid to American farmers until his import levies start to benefit them – which he says is only a matter of time.”