- The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

2:40 pm

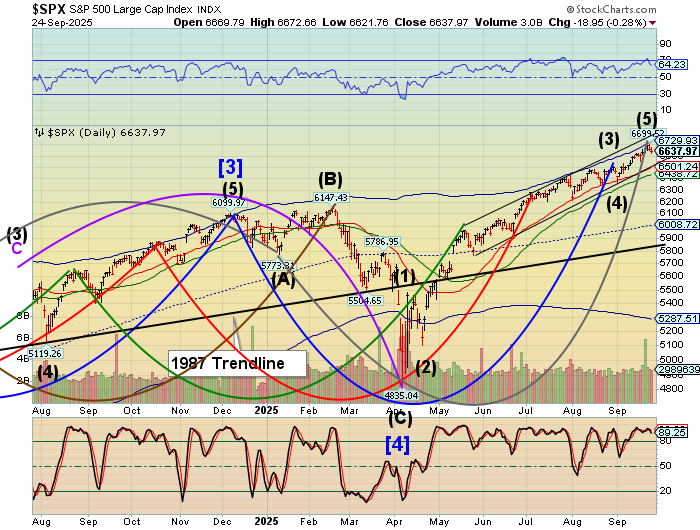

SPX plunged deeper than the morning futures had indicated, changing the conditions for the bounce and subsequent sell-off. Sellers have abandoned the “down” escalator in favor of the elevator as the next decline is about to become steeper and faster. Pensions and institutions had already been primed for an orderly rebalancing, taking profits and reducing risk. However, a certain disorder has been revealed, leading sellers to react sooner and more emphatically. The next support is the trendline at 6511.00. The bottom of this decline may be closer to the 50-day Moving Average at 6451.00.

Good Morning!

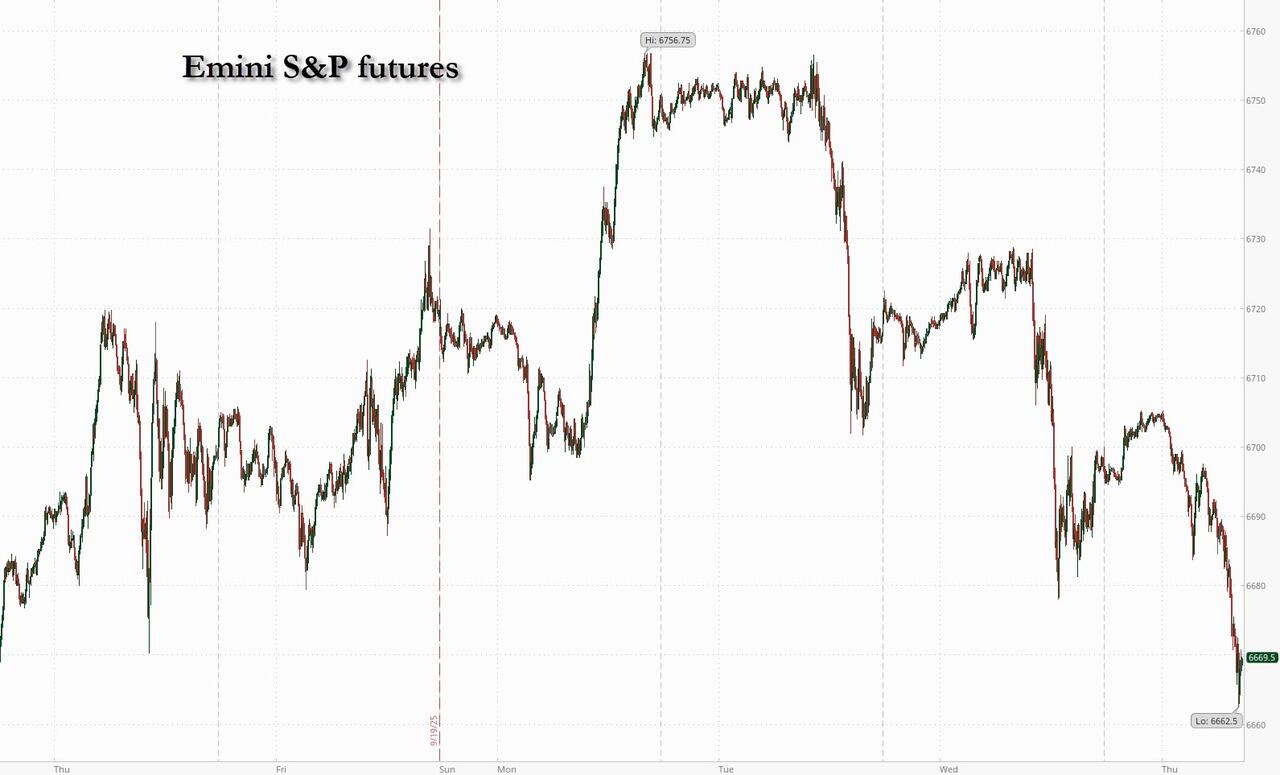

SPX futures declined to 6607.40 and may be due for a bounce. The retracement may reach 6650.00 to 6690.00, depending on current events. Fear of missing out is still strong, despite deteriorating conditions. The Cycles Model suggests a strong bounce today. However, it also infers a possible panic decline starting Friday as quarter-end rebalancing kicks in. Earnings season does not look promising as initial reports may increase downside momentum in October.

Today’s options chain shows Max Pain at 6655.00. Long gamma may strengthen above 6675.00 while short gamma dominates beneath 6625.00.

ZeroHedge reports, “US equity futures are lower after giving up overnight gains with bond yields reversing earlier losses and rising by 1-2bp and the USD is at session highs; yesterday was the best USD performance since Sep 2. As of 8:10am ET, S&P futures are down 0.4% after concerns over stretched valuations and the pace of interest-rate cuts dragged the main gauge back from a record high. Nasdaq futures are down 0.6% with Mag7 and TMT stocks weaker pre-market, with Oracle falling more than 2%. Intel is higher on reports that it is seeking an investment from AAPL. Defensives are leading Cyclicals pre-market. Commodities are mixed with silver +2% and coffee +1.5% the standouts. US launches a Section 232 (sectoral tariffs) probe on Machinery, Med Devices, and Robotics. Today’s macro data focus is on Q2 GDP data, Durable / Cap Goods, Jobless data, Existing Home Sales, Adv. Goods Net-Exports, and Inventories. While none of these macro releases is expected to be market-moving, they may provide a holistic view of a stable / resilient economy that may be inflecting higher.”

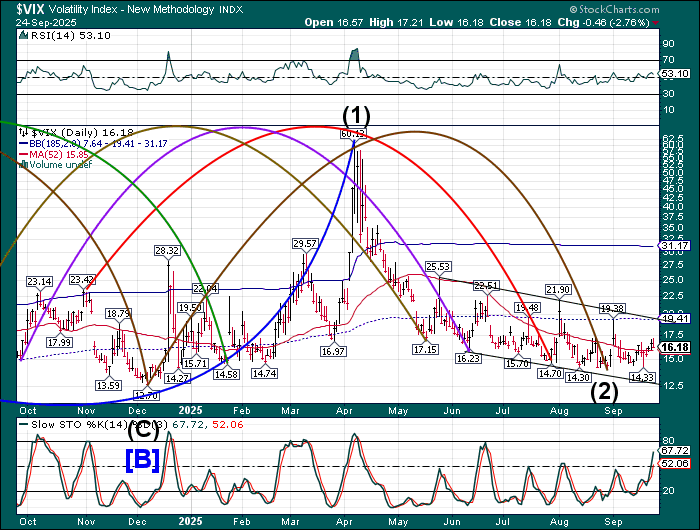

VIX futures rose to 17.44 this morning. It is on a buy signal above the 50-day Moving Average at 15.85, but may come back down to test it in a correction, offering a possible discount on hedges. The Cycles Model suggests a possible rally into early October.

The October 1 weekly options chain shows Max Pain at 17.00. Short gamma resides at 15.00-16.00. Long gamma becomes strong at 20.00 with increasing favor in calls.

ZeroHedge comments, “The White House budget office has instructed federal agencies to prepare to fire a ton of people (aka ‘reduction-in-force’ plans) that could permanently eliminate jobs in the event of a government shutdown – the latest twist in the latest shutdown groundhog day – effectively challenging Democrats to a game of chicken.”

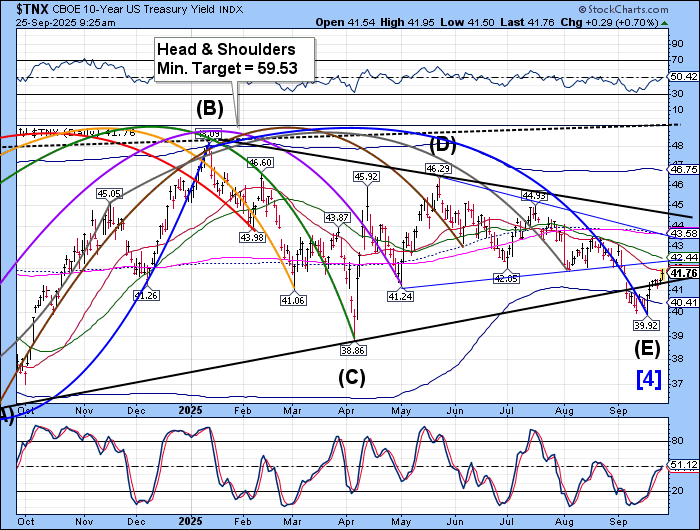

10-Year Treasury Yield futures rose to 41.97 this morning, testing intermediate resistance at 41.88 as TNX probes higher. Resistance at the 50-day Moving Average lies at 42.44. The rally may continue to the week of October 20 with a breakout possible. Q2 GDP has been revised sharply higher to 3.8%, damping the fear of an impending recession.

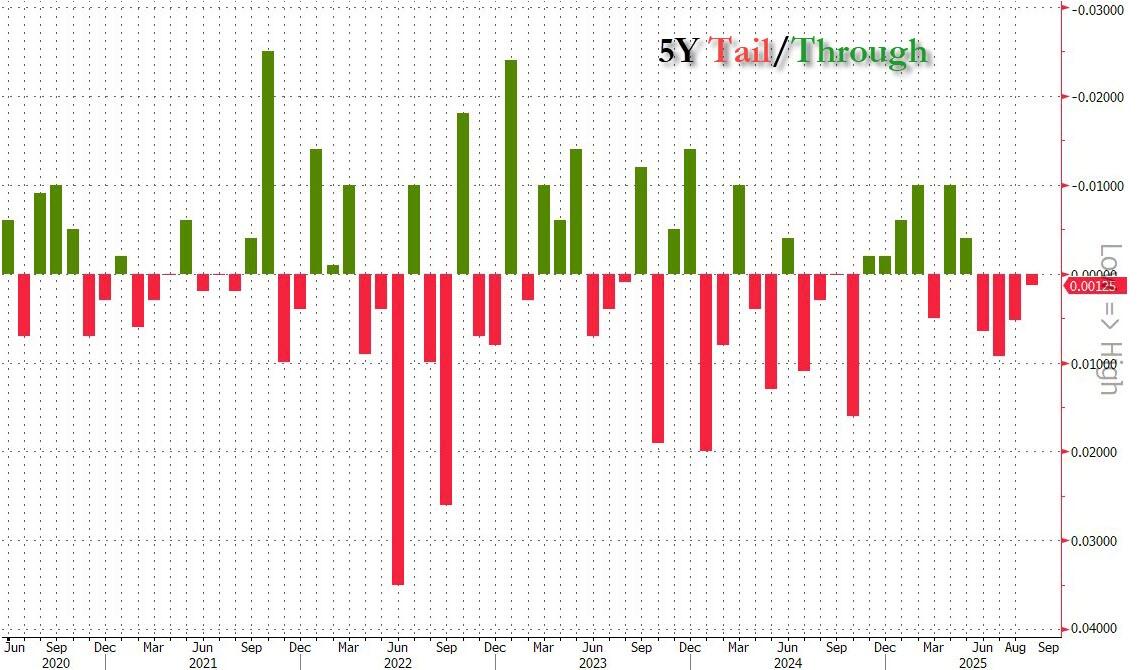

ZeroHedge reports, “After a rather forgettable 2Y auction yesterday, moments ago the Treasury sold $70BN in yet another subpar coupon auction.

The auction stopped at a high yield of 3.710%, down from 3.724% in August and the lowest since last September. It also tailed then When Issued 3.709% by 0.1bps, the 4th consecutive tailing 5Y auction in a row.”

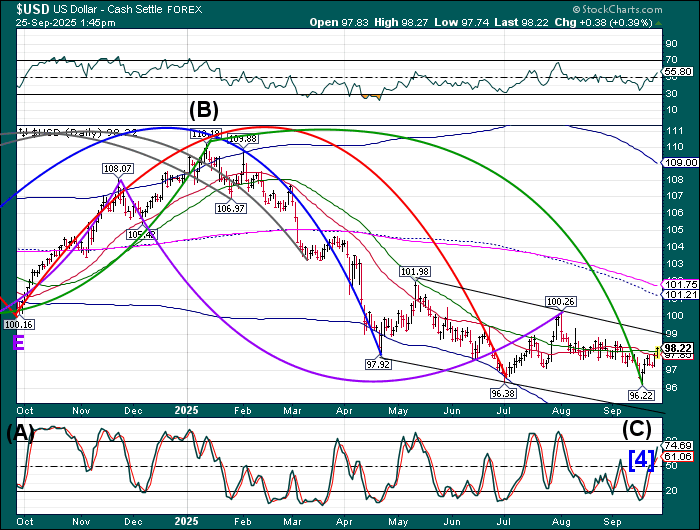

USD futures rose sharply above the 50-day Moving Average, creating a buy signal. Dollar shorts are panicking as the Cycles Model calls for a strong trending day. The trend may continue to mid-October as overseas money, especially from Europe, flees to the US>