The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:15 am

Good Morning!

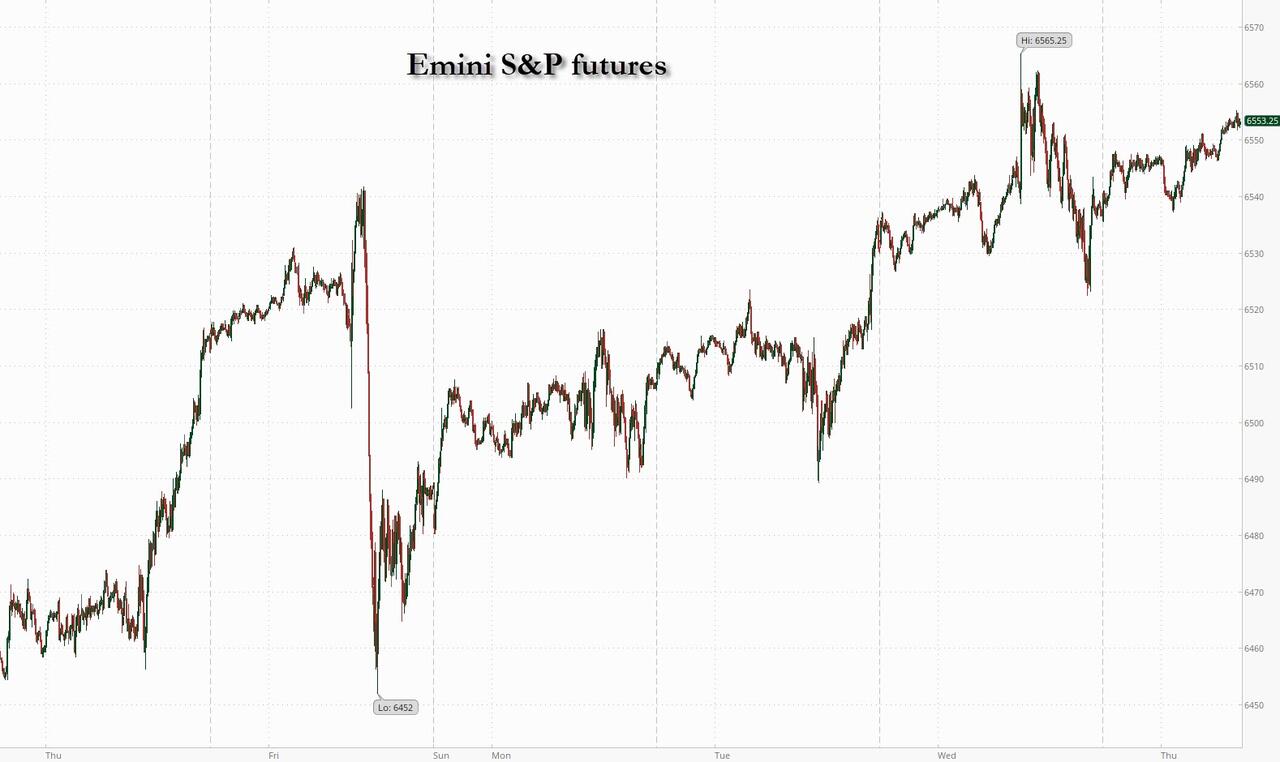

SPX futures rose to 6551.50 and are hovering just beneath yesterday’s all-time high. Trading volume is taking a pause as evaluate where the economy is tracking. Yesterday’s deflationary PPI report cemented the odds of a .25% rate cut while the upcoming CPI report may “lock in” a .50% rate cut. All of this comes to a head next Wednesday at the FOMC decision. The Cycles Model offers no direction until the week after the FOMC, when the market heats up for the end of the quarter rebalancing.

Today’s options chain show Max Pain at 6530.00. Long gamma may begin above 6550.00 while short gamma rules beneath 6475.00.

ZeroHedge reports, “US equity futures have a slight bid into today’s CPI print – the last key macro datapoint ahead of next week’s rate decision – rising to another daily record high, let by Tech. As of 8:10am, S&P futures rise 0.2% after back-to-back all-time highs while Nasdaq 100 futures rise 0.3% with AAPL and AMZN leading the Mag7 higher and ORCL +1.4% after its +36% move yesterday. In a familiar pattern this week, Cyclicals are outperforming Defensives pre-mkt. European stocks also drifted higher while Chinese stocks capped their biggest advance since March, led by companies seen as major beneficiaries of the nation’s push for homegrown technology. Treasuries held steady, with the 10-year yield at 4.05%; the USD is up small as the yen slumps after prominent LDP dove and conservative Sanae Takaichi said she is running for PM; commodities are seeing some profit-taking with both Energy and Metals lower. CPI and Jobless Claims are the focus for today as investors solidify views into next week’s Fed as well as Oct / Dec meetings.”

VIX futures dipped to 14.97 in the overnight market. Yesterday’s low at 14.63 may have given a turning point for the VIX, as the fractal appears complete.

TNX futures hit a new low at 39.91 this morning, but pulled back presumably at the news of the CPI. TNX has about two more weeks to go in the current Master Cycle, giving it the possibility of declining to the April 4 low.

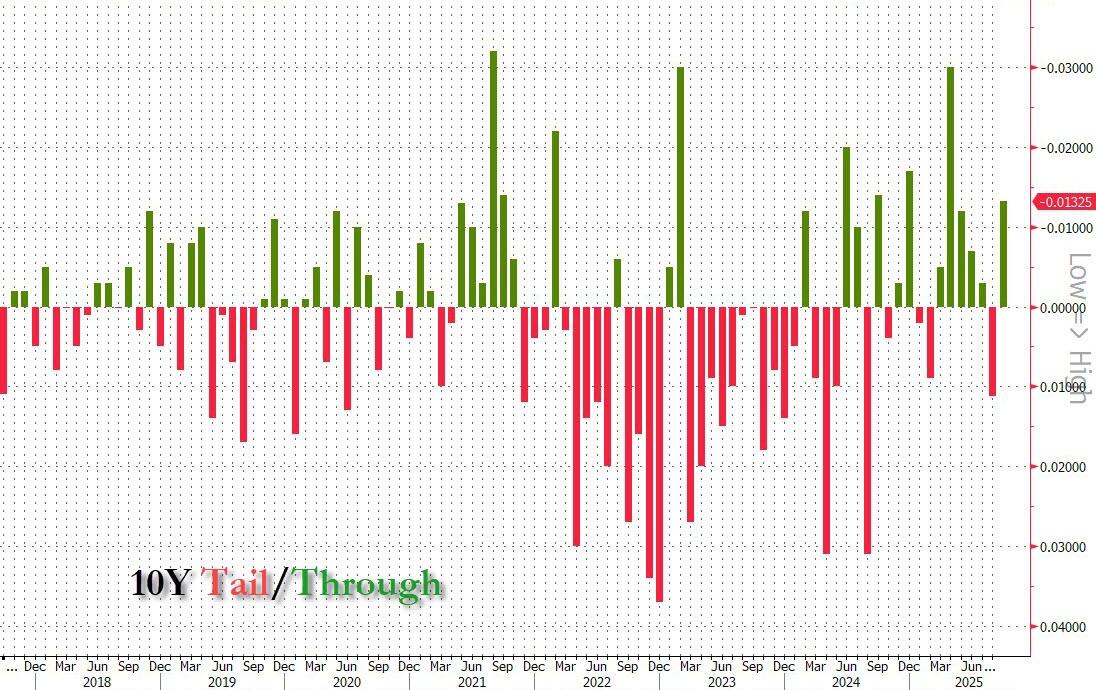

ZeroHedge reports, “After yesterday’s remarkably strong 3Y auction, which in our view was one of the “top 3″ best 3Y sales in history, moments ago the US Treasury sold 10Y paper (in a 9-Year 11-Month reopening) in what may well be one of the “top 3″ 10Y auctions too.

Starting at the top, the auction priced at a high yield of 4.033%, down significantly from 4.255% last month, and the lowest since last September, when the market suffered another growth scare and the Fed ended up cutting by 50bps just a week after a similar 10Y auction priced. And just like the Sept 2024 auction, this one also stopped through the When Issued by a solid 1.3bps: this was the highest stop through since the market chaos in April.”

Bitcoin futures have stopped short of the 50-day Moving Average at 114787.00 this morning. The Cycles Model proposes a possible three more weeks in the currnent Master Cycle which should allow it to exceed the 50-day. However, the prospects of a new all-time high are diminishing.

USD futures are consolidating beneath their 50-day Moving Average at 98.89. The Cycles Model allows another week of decline, which may test the lower trendline near 95.00.

Gold futures made a new all-time high at 3687.42 this morning in Master Cycle overtime, touching the Cycle Top at 3686.84. The Cycles Model suggests this may be the final probe, as it hit its Cyclical target. Caution is advised as