The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

10:20 am

BKX has made its Master Cycle high last Friday and is consolidating beneath it. What is worrisome is that the new Master Cycle decline may extend to the end of October. What is emerging is $1.3 trillion of CRE loans that need refinancing under rugged circumstances. Last year’s $2.5 reverse repo facility is now at zero. Difficult times lie ahead for regional banks.

8:15 am

Good Morning!

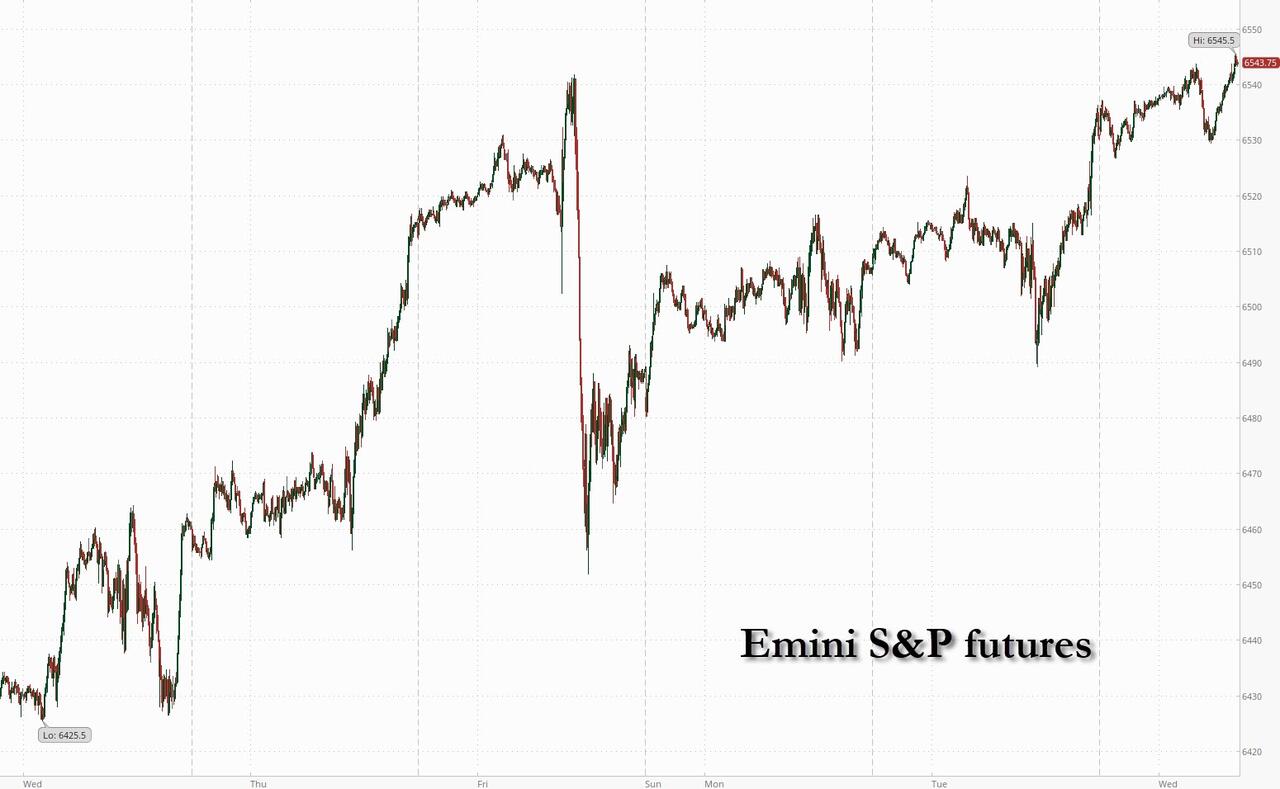

SPX futures made a new all-time high at 6540.10 this morning. It may be in a correction phase which may allow a shallow decline similar to the January correction at any time. While the main support is the 50-day Moving average at 6355.48, it may be possible that the mid-Cycle support at 5972.08 may be tested by the end of the month. Meanwhile, the source of funds seems to be primarily from Europe as the prospects for a hot war are increasing. Analysts are crediting Oracle for the bump in price.

Today’s options chain shows Max Pain at 6505.00. Long gamma becomes strong above 6525.00 while short gamma may begin beneath 6500.00.

ZeroHedge reports, “US stock futures are trading at another record high, with European and Asian also pushing higher after Oracle underpinned the strong sentiment in tech with blowout guidance sending its shares up by 30% in premarket trading, while the market awaits inflation data today and tomorrow. As of 8:15am, S&P futures are 0.3% higher with Nasdaq futures rising 0.4%…”

VIX futures declined to 14.85 this morning, as SPX continues to rally. However, today offers the possibility of a reversal with strength. A bounce above the 50-day Moving Average at 16.04 may begin a sharp rally. Today is options expiration, which may release some of the propensity for decline.

TNX futures are heading lower this morning. The question, “Who benefits?” arises as the US government is the largest borrower in short-term loans. Long term rates may be subject to inflationary pressures as government soaks up even more liquidity.