The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:30 am

Good Morning!

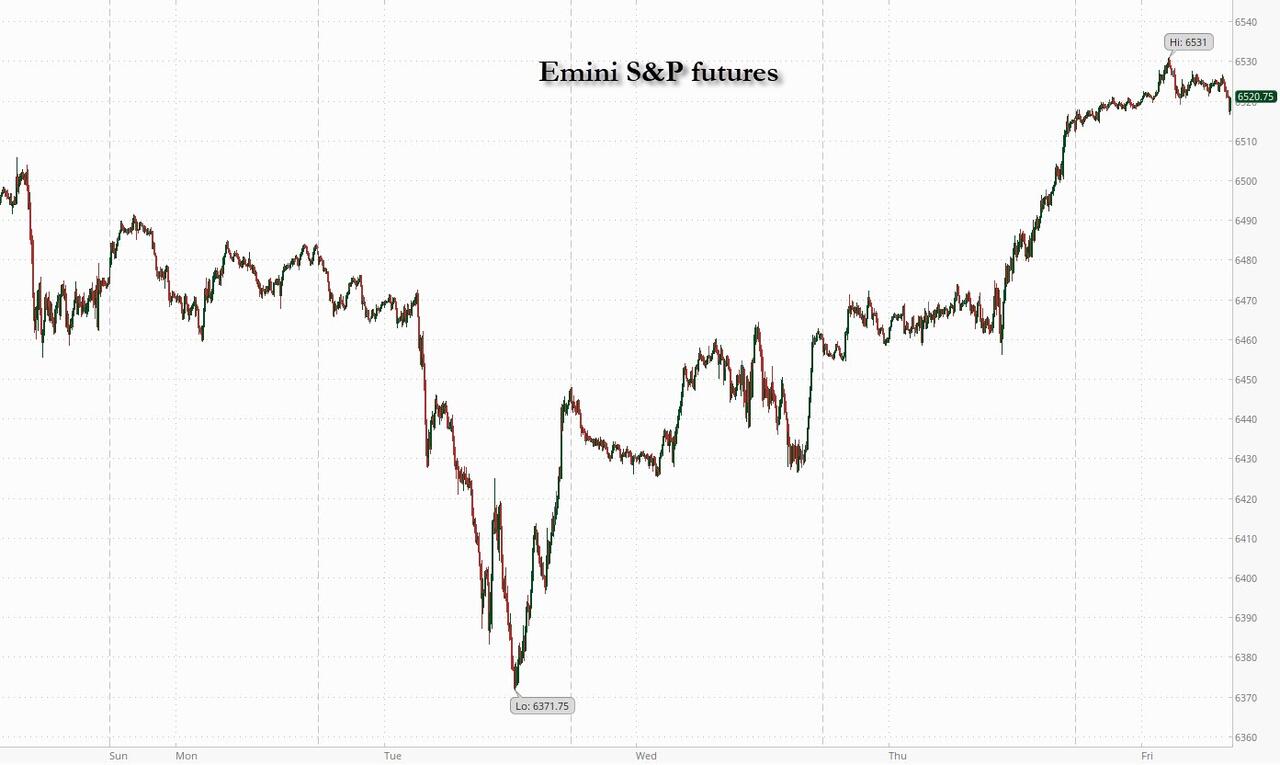

SPX futures are hovering between 6504.00 and 6522.80. The fact that the futures made a new all-time high does not guarantee that the cash market will do the same. There are too many variables that may affect equities. Today’s expectation is a 75,000 print. Anything less may justify lower rates, as the Fed is os inclined. Thus, we wait for the August Payroll report.

ZeroHedge reports, “US equity futures are higher into NFP, rising after strong results from Broadmcom and on optimism that Friday’s jobs report will set the stage for the Fed to resume cutting interest rates this month. At 8:00am, futures for the S&P 500 ticked 0.1% higher – reaching a new record high – but eased off the best levels of the session. Nasdaq contracts advanced 0.5%. In premarket trading, Broadcom rallied more than 9% following its pact with OpenAI to create an artificial-intelligence chip. Tesla rose 2% after the board proposed a potentially $1 trillion pay package for Elon Musk. US Treasuries were little changed, with the two-year yield near the lowest in almost a year. The dollar headed for its weakest showing this week. Commodities are mixed: oil and base metals are lower, while gold and ags are mostly higher.”

8:45 am

Today’s August Payrolls were up 22,000, leaving the unemployment rate unchanged.

ZeroHedge states, “Ahead of today’s jobs report, consensus was that a print between 40K and 100K is largely priced in and greenlighting a 25bps rate cut by the Fed in two weeks, and that we would need a real outlier number for the Fed to either cut 50bps… or not hike. Well, we got a real outlier when moments ago the BLS reported that in August the US added only 22K jobs, a big drop from the upward revised 79K (from 73K previously) but more importantly June was revised from 27K to -13K, ushering in the first negative jobs print since 2020.”

The 10-year Treasury Yield dropped to a morning low at 40.91 thus far this morning. It has declined beneath the Cycle Bottom at 40.98, indicating the possibility of a deeper decline. The Cycles Model suggests the decline may continue through the end of September.