The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:30 am

Good Morning!

SPX futures reached an overnight high at 6492.80 as it probes toward 6500.00 this morning. Barring any unforeseen circumstances, the probe to a new all-time high may be complete this morning. Nvidia’s earnings announcement failed to impress, leaving investors searching for the next big thing. Unfortunately, not all news will be positive going forward. The Cycles Model is primed for a turn but may remain in neutral over the Labor Day weekend. Awareness of a reversal may not surface until next week.

Today’s options chain reveals Max Pain at 6460.00. Long gamma resides above 6480.00 while short gamma emerges beneath 6450.00. The shorts are gaining courage.

VIX futures revisited the August 22 low, testing trendline support. The Cycles Model may not support a deeper low. An attempt to punch a hole in the “floor” may backfire as support may not only hold, but act as a propellant to the imminent reversal. VIX has completed a near perfect 8.6-month Intermediate Cycle. The new Cycle about to begin may have a peak-to-peak amplitude that may be a multiple of Intermediate Wave (1).

The September 3 options chain shows Short gamma in the range3 of 14.00-15.00. Long gamma may begin at 17.00, but there is not a lot of conviction above 21.00.

TNX is heading lower this morning and may break through the Triangle formation. If so, it may reach the Cycle Bottom at 40.98 in a matter of days. This arrangement could be devastating, as rates may increase while equities fall, leaving one less “safe haven” for investors.

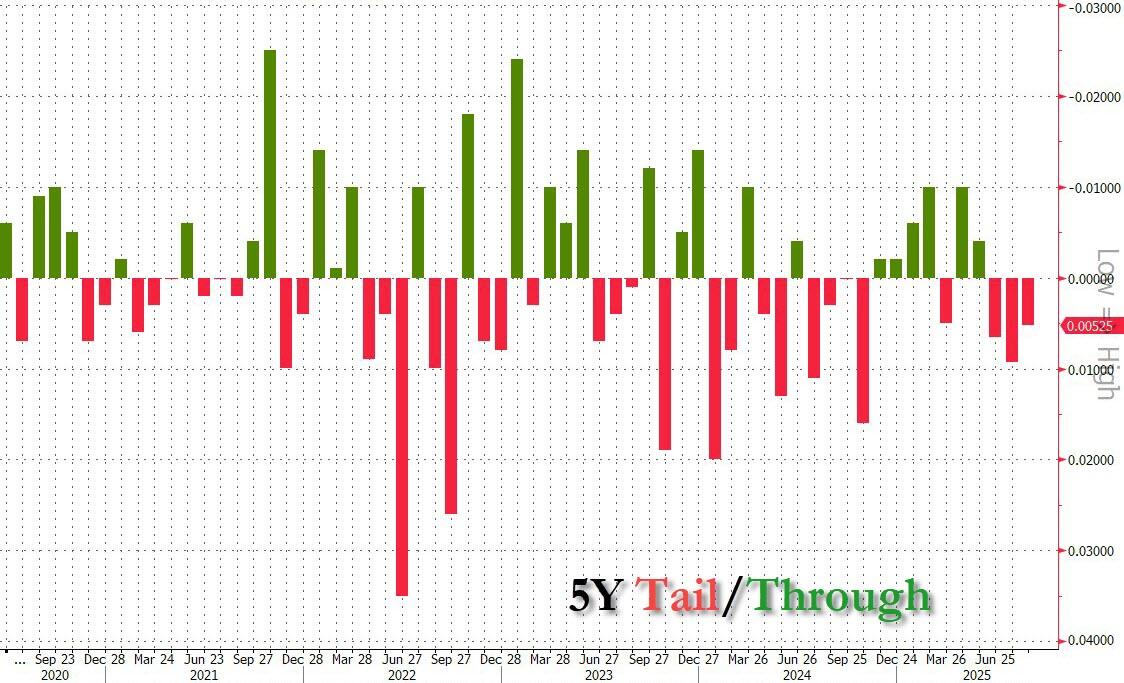

Yesterday ZeroHedge reported, “After yesterday’s stellar, blowout 2Y auction, moments ago the US sold $70 billion in 5Y paper in what was a far weaker auction.

The high yield was 3.724%, down from 3.983% in July and the lowest since last September’s 3.519%; it also tailed the When Issued 3.717% by 0.7bps, the 3rd tail in a row.’