The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

9:44 am

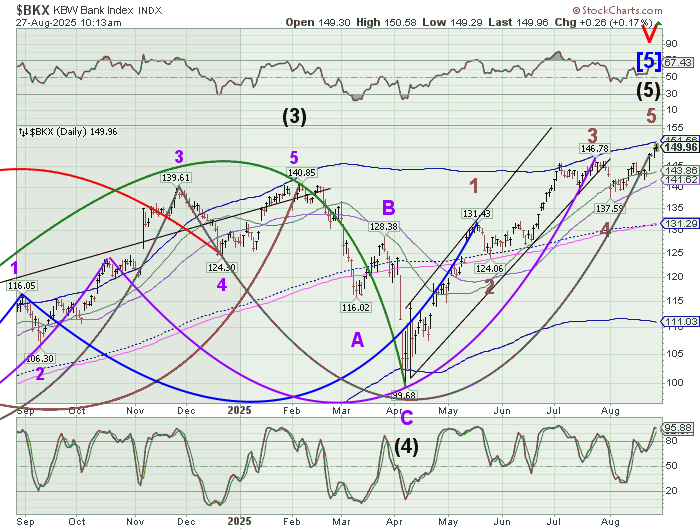

The Banking Index may be making its final probe toward the Cycle Top at 151.56 this morning, making a new all-time high for the BKX. The prior high was 148.96 made on January 10, 2022. This may be the completion of the Cycle Trend (at 4 degrees). The ensuing decline may take the BKX to its April 7 low

7:45 am

Good Morning!

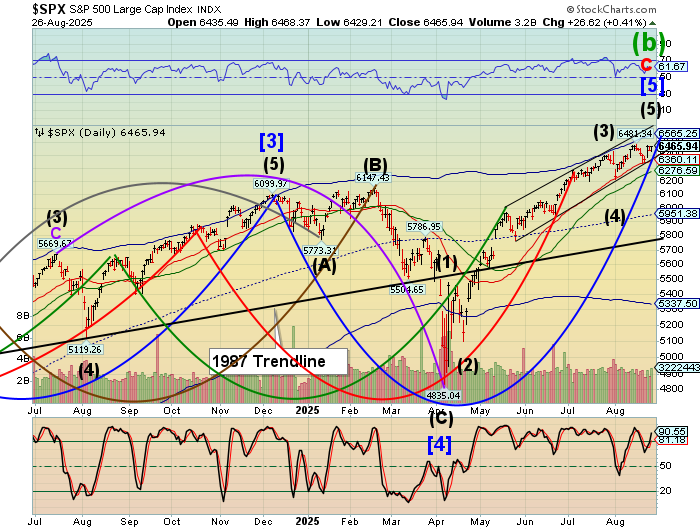

SPX futures reached an overnight high at 6474.10 as it approaches its target range of 6500.00 to 6565.00. NVDA earnings are on deck today and could spark a volatile reaction. Nvidia accounts for 8% of the SPX, so it has the ability to influence the markets. At the same time, the current Master Cycle has run its course and is in overtime. This may be the last week to finish the course before negative seasonality appears. The Cycles Model infers that September may be a seriously negative month, especially after the inversion in August.

Today’s options chain shows Max Pain at a hotly contested 6450.00. Long gamma appears above 64750.00 while short gamma dominates beneath 6430.00.

ZeroHedge reports, “Futures are flat with all eyes on NVDA – the largest S&P component by far accounting for a record 8% of the S&P – set to report after the bell. As of 8:00am, S&P futures are just barely in the green recovering from a modest loss earlier, while Nasdaq futures gain 0.1%, with NVDA up +54bps premarket, tracking most of the Mag7 higher and Semis also bid. Cyclicals are mixed (Industrials up, Fins down) with Defensives mostly higher. The yield curve is twisting steeper but with a lesser magnitude to yesterday: bonds steadied after long-dated debt from the US to France and the UK retreated Tuesday, with the yield on 10-year Treasuries little changed at 4.27%. $70 billion of 5Y notes will be auctioned at 1pm ET; yesterday’s 2Y auction saw strong demand closing 1.5bp through. The USD jumps to the highest since Friday’s Jackson Hole dovish pivot, with the Euro sliding to a 3 week low as attention turns to the political mess in Europe, and gold continues to trade rangebound. The market’s focus is on NVDA today (our preview is here).”

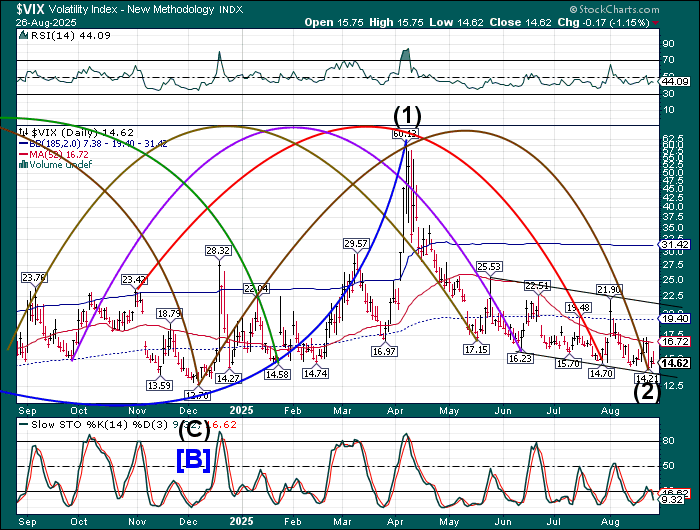

VIX futures are trading in a narrow range near yesterday’s close. The current fractal allows a final probe t lower. The Cycles Model suggests today may be the low, as the Cycles Model suggests a burst of strength to complete the declining fractal. VIX seasonality turns positive in September.

Today’s monthly options expiration is loaded with short gamma which may influence the outcome at the close. The September 3 options chain shows short gamma beneath 15.00 and long gamma gaining dominance above 20.00.

Morningstar observes, “September typically is a loser. August’s return depends on the index you track.

Bulls and the bears each claim August as one of their own. They’re both wrong.

When taking all available historical data into account, August is an average month. There is no statistically significant difference between the month’s average return and that of all other months. Your best guess for how the stock market will perform during August is that it will be no better or worse than the long-term average for all months – which is a dividend-adjusted gain of 0.70%.”

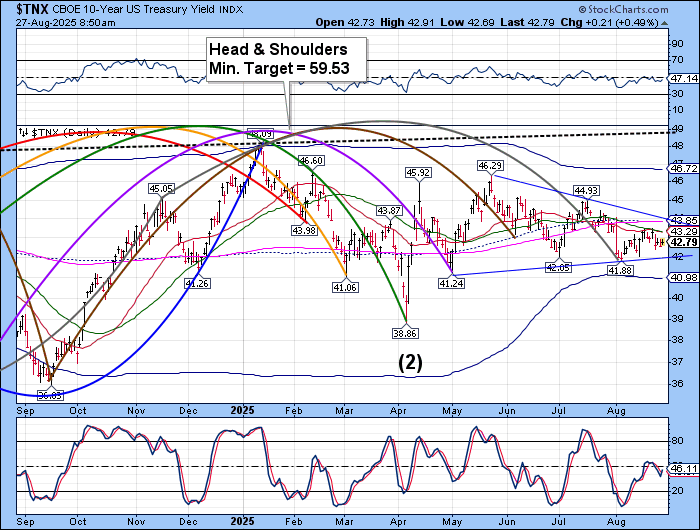

TNX continues to consolidate within a possible Triangle formation. There is a possibility of a breakout above the formation tis week. However, if this analysis is correct, it may be a false move. The Cycles Model suggests that TNX may decline during the month of September, as investors seek a safe haven from a stock market decline.

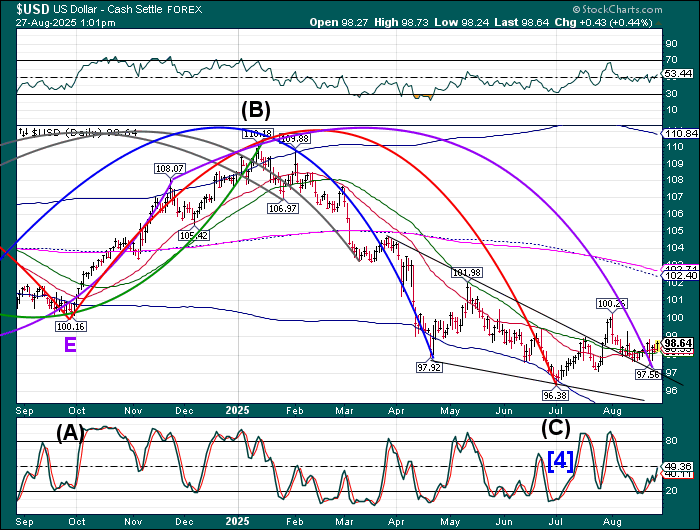

USD futures rose above the 50-day Moving Average at 98.11 this morning, confirming a buy signal. The Cycles Model suggests growing strength in the uptrend as we approach this weekend. The next few weeks may be notably strong.

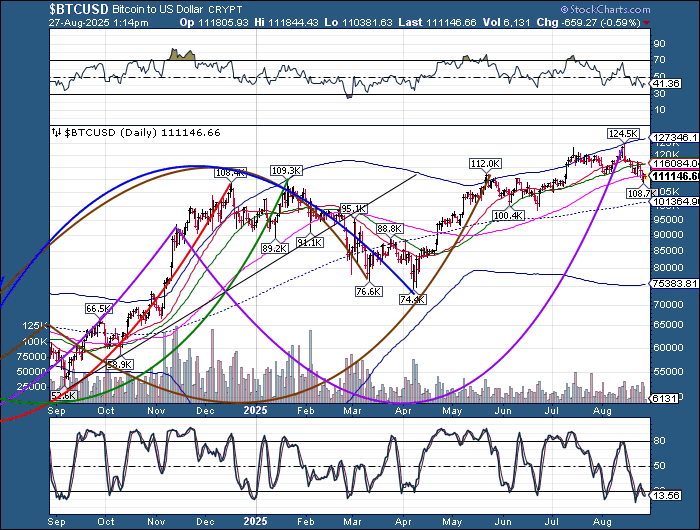

Bitcoin may be continuing its decline to Labor Day. A likely target for the decline may be the mid-Cycle support at 101364.90. It appears that Bitcoin may be viewed as a safe haven during the stock market decline.